Andrei Rostek

when i first saw AdCom Briefing Document for Legend Biotechnology (NASDAQ: LEGN) and Johnson & Johnson (JNJ) Carvykti, I think the stock is definitely going to plummet.but it is not the truth It fell only slightly before recovering to recent highs.

I have previously been bullish on the growth prospects of Legend and Carvykti, with the stock up approximately 40% since my first article in October 2022 and approximately 40% since my last update in August 2023. In it I highlighted Carvykti’s commercial progress and the problematic supply issues the company and partner Johnson & Johnson are working to solve.

The AdCom meeting taking place today (March 15) will discuss Legend and J&J’s use of CARTITUDE-4 data to support an sBLA application to expand the use of Carvykti, and given the stock, I don’t think it will go smoothly. Contents of the document, FDA’s concerns, and commercial implications.

The FDA’s concerns about rising early mortality rates and detailed data on early-stage treatment lines for patients with multiple myeloma make me less optimistic about Carvykti’s long-term growth prospects, and I no longer foresee significant use in early-stage treatment lines. Much of the stock’s upside will come from. While I agree that Carvykti can still do well and hit impressive volumes, I no longer see significant upside from current levels as Legend is already a $12 billion+ company and it has a strong partnership with partner Johnson & Johnson ( J&J) shares profits. Therefore, I downgrade Legend to Neutral/Hold.

Increased early mortality in CARTITUDE-4 may reduce use of Carvykti in later stages of multiple myeloma

One of the concerns raised by the FDA in the AdCom briefing document was that early mortality was increased in patients with second-line+ multiple myeloma in Carvykti’s CARTITUDE-4 trial compared with the control group, and “the overall benefit is unclear at this time.” Will it increase?” – The risk assessment is good; specifically, whether additional data are needed to support such an assessment. “

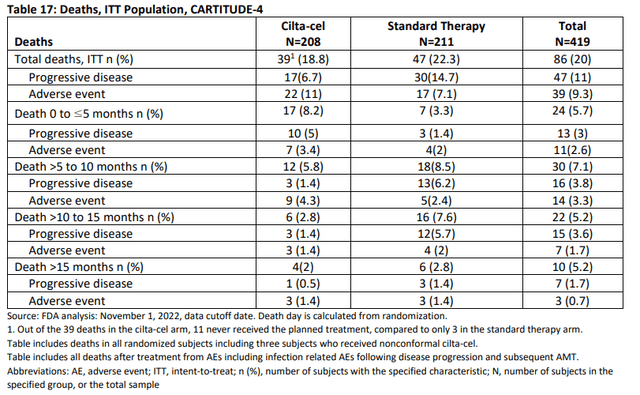

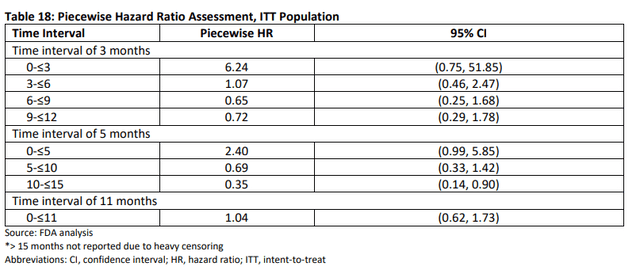

This concern is shown in the table below, where hazard ratios (“HR”) above 1.0 show an increased risk of death with Carvykti compared with the control group in the study.

FDA AdCom Briefing Paper FDA AdCom Briefing Paper

The dosing process for Carvykti is more cumbersome than the control group because patients need to undergo lymphocyte-depleting chemotherapy before receiving Carvykti. This process kills the patient’s remaining T cells to make room for the engineered T cells in Carvykti, and increases safety risks and can lead to side effects.

Whatever the reason for the increased early death in patients receiving Carvykti, it is a concern even for patients treated with Carvykti later in life and may have implications for the product’s growth trajectory in existing approved indications Negative impact.

Data from early-stage multiple myeloma cell lines suggest early-stage multiple myeloma cell lines have much lower potential

One of the important long-term growth drivers for Carvykti is its potential expansion into earlier treatment areas, including first-line use. Based on the FDA data from the CARTITUDE-4 trial in the early-stage multiple myeloma series, and the aforementioned increase in early-stage mortality with Carvykti, I believe the potential for early-stage series use of Carvykti has been significantly reduced.

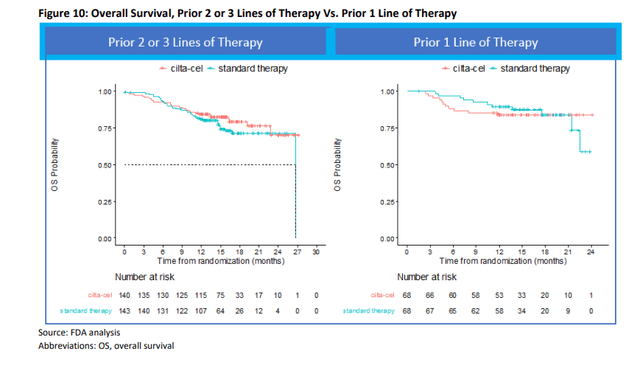

The FDA’s post hoc analysis showed overlapping overall survival curves for patients with multiple myeloma who had received two or three prior therapies within the first 12 months (left side of the chart below), followed by an advantage for Carvykti. Overall survival curves for Carvykti were mostly poor compared with patients who had received one prior treatment (right graph below). These data provide a negative interpretation of Carvykti’s overall survival data in early-stage multiple myeloma cell lines.

FDA AdCom Briefing Paper

Another risk with Carvykti and CAR-T cell therapy in general is the development of secondary malignancies, which the FDA recently highlighted and included in the labeling of all CAR-T cell therapies.

Revenue growth remains constrained by supply issues

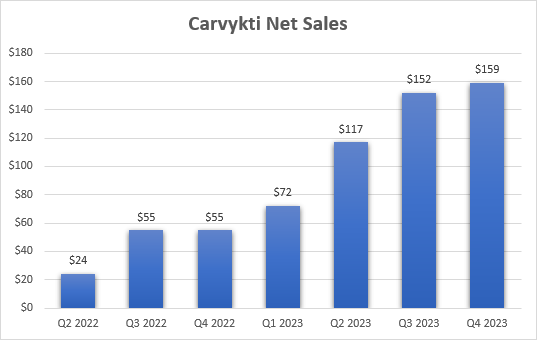

Lenovo missed fourth-quarter 2023 earnings per share and revenue estimates, but analysts’ consensus likely includes revenue from the partnership in addition to profit sharing with Johnson & Johnson. In addition, there were no major surprises in the financial report. Carvykti net sales increased slightly from the previous quarter to $159 million as Legend and J&J continued to work through supply constraints.

Legend Bio Financial Report

The companies expect to increase production capacity to support up to 10,000 doses of Carvykti by the end of 2025, or revenue capacity of approximately $4 billion based on Carvykti’s estimated net price per patient of approximately $400,000.

The company had $1.3 billion in cash and equivalents at the end of 2023, which is estimated to be enough to fund the company through the end of 2025, and we expect at least one more capital raise before the company reaches cash flow breakeven.

Potential upside drivers beyond Carvykti

Legend also has an early-stage R&D pipeline outside of Carvykti that could fuel the stock’s long-term upside. The two early projects are LB1908 for CLDN18.2 and LB2101 for DLL-3. These two targets are among the most pursued in the industry today, and it is too early to understand their clinical and commercial potential.

Current valuation calls for strong execution and growth

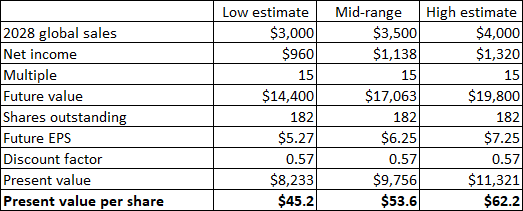

Lenovo’s $12 billion market capitalization requires Carvykti’s strong growth and billions of dollars in annual sales, considering its profit and loss split with Johnson & Johnson (50:50 outside China and 70:30 for Lenovo in China) ). I previously expected global peak sales of Carvykti to exceed $5 billion, and now I expect its best-case scenario to hit $4 billion, based primarily on use in late-stage multiple myeloma series. Applying the revenue range of $3 billion (base case) to $4 billion (call case) to my standard earnings-based valuation model yields a valuation range of $45 to $62 per share.

Author’s estimate

Additional upside may come from the rest of the pipeline, but it’s not yet proven and it’s too early to assign a value to these candidates.

in conclusion

The FDA AdCom filing negatively impacted the data generated by Carvykti in the CARTITUDE-4 trial, and I expect the product will face a more difficult road in early-stage treatment of multiple myeloma. While I still believe Carvykti could become a blockbuster drug, I no longer think Legend Biotech is attractive at its current level.