A smiling man holding a 100 dollar bill. Deagreez/iStock via Getty Images

To me, there is nothing better than cold, hard, consistent and growing passive income. As a dividend growth investor, this is the name of the game for me and my primary investment goal.

The idea is that when a company’s dividend grows steadily over time, it also becomes more valuable. Over the long term, this helps drive market-beating total returns.

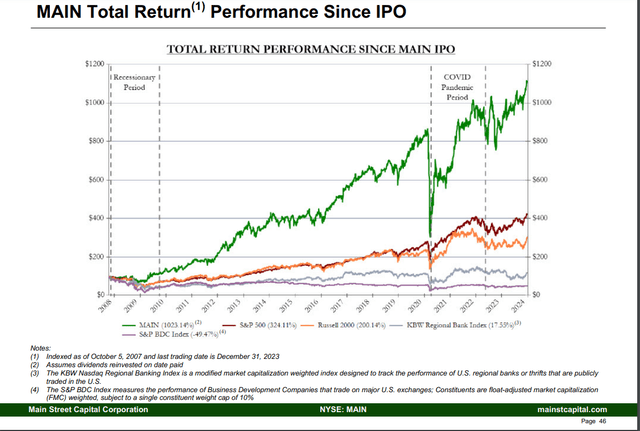

Main Street Capital Q4 2023 Investor Presentation

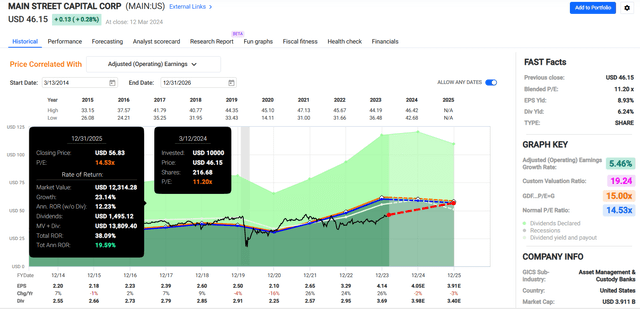

One of my favorite companies in my portfolio is Main Street Capital (NYSE: Main). Since its initial public offering in October 2007, BDC has proven itself to be an outstanding compounder. A $10,000 investment in the company at the time of its October 2007 IPO will grow to more than $110,000 with dividends passed December 2023. For context, that’s almost 3 times the same $42,000 investment in the S&P 500 (SP500) will grow into during that time. This is also well ahead of the December 2023 halving of a $10,000 investment in the S&P BDC Index (if dividends are reinvested).

This stellar track record of making shareholders rich is why I initiated coverage with a Buy rating in September 2023 and reiterated a Buy rating in December 2023. Since I last covered MAIN, the company late last month shared consensus-beating financial results for its fourth quarter, which ended December 31.

Today, I’ll take a fresh look at BDC’s fundamentals and valuation to explain why I’m once again maintaining a Buy rating.

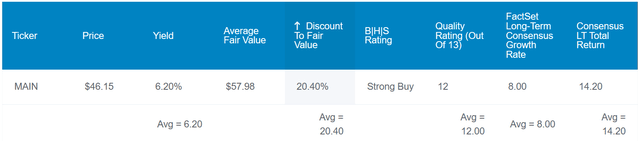

Dividend Wang Zen Research Terminal

MAIN’s 6.2% dividend yield (excluding special dividends) is about 200 basis points higher than the 4.2% yield on the 10-year Treasury note. This investment spread is narrower than the 280 basis points spread the last time I covered the stock, but is still attractive. That’s well above the financials industry’s average yield of 3.5%, which is why Seeking Alpha’s quantitative system gave MAIN an A grade for its dividend yield.

MAIN’s dividend also appears to be relatively safe for a BDC. The company’s 90% payout ratio is better than the 95% payout ratio that rating agencies consider safe for BDC. Note that this payout ratio also includes the company’s generous special dividend.

MAIN’s financials are also respectable. The company’s debt-to-capital ratio of 44% is below the 50% that ratings agencies want BDC to see. That’s why BDC has a Standard & Poor’s investment grade BBB- credit rating with a stable outlook. This suggests that there is an 11% chance that MAIN will fail within the next 30 years.

Due to its sustainable payout ratio and solid corporate financials, MAIN’s odds of a dividend cut in the next average recession are estimated at 0.5%. The probability of the next severe recession is still only 2%. For perspective, these values are the lowest possible in a Zen research terminal.

Dividend Wang Zen Research Terminal

Even though the S&P is up 9% since my last article, MAIN’s stock is up 7% and looks at least somewhat undervalued. The current annual P/E valuation multiple of 11.2 is well below the 10-year normal valuation multiple of 14.5, which suggests a fair value of $58 per share. Since MAIN’s fundamentals appear to be intact based on recent operating results, I believe a return to a P/E ratio close to 10-year normal levels is largely justified.

My analysis of MAIN using the dividend discount model also shows the stock to be discounted: To be conservative, I will use an annualized dividend of $2.88 per share (the current monthly regular dividend amount is $0.24 annualized). I also assume a 10% discount rate and a 4% annual dividend growth rate. This gives me a fair value estimate of $48 per share.

Finally, the P/B ratio is currently close to 1.6, while the median P/B ratio in the Financials industry is just over 1, according to Seeking Alpha. However, the company’s quality has always commanded a high premium. MAIN’s share price is about 1% undervalued relative to its five-year average, which would value it at $47 per share.

Averaging these fair values, BDC’s fair value is approximately $51 per share. Compared to the current share price of $46 (as of March 13, 2024), this represents a 10% discount to fair value.

If MAIN returns to fair value and grows as expected, here are the possible total returns over the next 10 years:

- 6.2% Yield + 8% FactSet Research Annual Growth Consensus + 1% Annual Valuation Multiple Expansion = 15.2% Annual Total Return Potential or a 10-Year Cumulative Total Return Potential of 312% vs. the S&P’s 10% Annual Total Return Potential or 159% 10-year cumulative total return

Another quarter of strong results

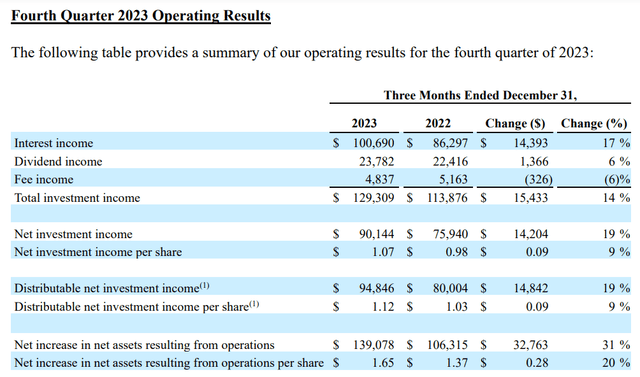

Main Street Capital Fourth Quarter 2023 Earnings Press Release

MAIN opened one clinic in the fourth quarter ended Dec. 31. The company’s total investment income for the quarter increased 13.6% year over year to $129.3 million. The figure was $1.8 million ahead of analyst consensus, according to Seeking Alpha.

MAIN’s business model benefited from significant upside in the fourth quarter. The vast majority (66%) of the company’s debt investments bear interest at floating rates. In an environment of rising/high and stable interest rates for two consecutive years, this drove interest income to increase by 16.7% year-over-year to US$100.7 million in the quarter.

Ahead of the eventual rate-cutting cycle, it’s worth noting that MAIN’s floating-rate investment exposure is down from 70% when I last covered the company. This suggests that BDCs are taking action to protect themselves from the adverse effects of the coming rate drop.

As a BDC, MAIN periodically issues shares to fund additional investments in its $5.5 billion internally managed portfolio. A major advantage of the company is that it issues shares well above book value. As a result, the company’s share count rose 8.5% year over year to 84.4 million shares in the fourth quarter.

That also helps explain why distributable net investment income per share rose 8.7% to $1.12 in the fourth quarter. That was $0.05 above analysts’ consensus, according to Seeking Alpha data.

MAIN’s net investment earnings per share are likely to decline slightly over the next few years at least. According to FAST Graphs analyst consensus, NII per share will fall from $4.14 in 2023 to $4.05 in 2024 and to $3.91 in 2025.

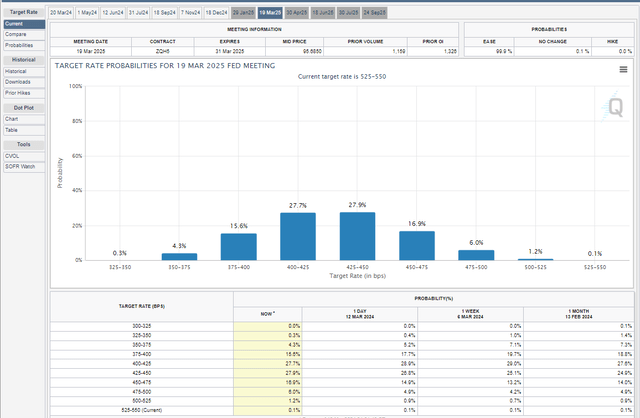

CME Group Fed Watch Tool

Keep in mind that MAIN expects every 100 basis point decrease in the federal funds rate to decrease NII by $0.18 per share. Between now and next March, 30-day federal funds futures data show an 88.1% chance that interest rates will be 75 to 150 basis points below the current target rate of 5.25% to 5.50%. This would be a headwind of $0.135 to $0.27 per share.

This will put pressure on company performance as MAIN adjusts to falling interest rates and works to restore investment spreads once interest rates stabilize. Fortunately, MAIN’s incremental investments in opportunities it believes are attractive will help partially offset these headwinds in the coming quarters. This is evidenced by the fact that the company closed private loan portfolio investments totaling $160.4 million in the fourth quarter.These investments carry spreads of 400 to 425 basis points, which should increase net investment income (unless otherwise noted or hyperlinked, all details from MAIN 2023 Fourth Quarter Earnings Press Release and MAIN Q4 2023 Investor Presentation).

Financially, MAIN is also on solid footing. The company’s regulatory debt-to-equity leverage ratio was 0.59, according to Chief Financial Officer and Chief Operating Officer Jesse Morris’ opening remarks on the fourth-quarter 2023 earnings call. Morris went on to note that this is below the long-term target range of 0.8x to 0.9x. This further supports the argument that MAIN is a well-capitalized business.

More dividend growth is likely in the future

Over the past five years, MAIN Regular monthly dividend per share The current interest rate is $0.24, with a cumulative compound interest rate of 23.1%. This represents a compound annual growth rate of nearly 4.3%.

Assuming the monthly dividend per share remains at $0.24, MAIN’s regular dividend payout in 2024 will be $2.88 per share. Analyst consensus sees net investment income per share of $4.05 in 2024, with a payout ratio of 71.1%. This shows how much flexibility the company has to increase its regular monthly dividend slightly per share and/or continue to pay a generous special dividend.

Risks to consider

MAIN is a high-quality BDC, but the investment thesis carries risks like all businesses.

The impact of the rate cut was slightly muted due to the company’s previously mentioned hedging (down $0.18 per 100 basis points versus $0.19 per 100 basis points previously). However, the risk of a sharp rate cut remains a concern.

Another risk for MAIN is the possible failure of its information systems. If this happens, the company’s operations (including accounting and data processing) may be in trouble. This could harm MAIN’s operating fundamentals and investment philosophy. If such failures were the result of a cyberattack, the BDC could be subject to lawsuits and damage to its reputation.

Summary: I may be buying more core holdings soon

Quick charts, fact sets

MAIN is a well-run BDC with management aligned with shareholders (management owned $152 million worth of common stock as of December 31). If that’s not enough, the balance sheet is also future-ready and investment grade.

Shares are cheaper than normal over the past decade, cementing the case for buying. Skeptics might point out that high interest rates artificially inflate profitability. Even adjusting for the impact of a 200 basis point decline in interest rates or net investment income of $0.36 per share in 2023, the company’s valuation multiple would remain at 12.2. MAIN is already the 27th largest holding in my portfolio, accounting for 1.2% of my portfolio. However, I am considering adding more to my portfolio in the coming days/weeks.