Microcap Center

Looking at the weekly closing price of the 10-year U.S. Treasury yield, the final yield this week was 4.30%, which was the highest weekly closing yield since the closing price of 4.47% in late November 2023.

Last Friday, 03/08/24, 10 Year Treasury Bill The yield closed at 4.09%, so if the S&P 500 is a little choppy here, you’ll understand why.

Thanks in part to yields, the U.S. dollar has had a strong week as measured by UUP, rising 0.75% over the past five trading days.

Interestingly, the Nasdaq has yet to break above its November 21 all-time high of 16,212 and remains above that key level. It closed above this key level multiple times in Mar’24, but has since fallen back below the Nov’21 high.

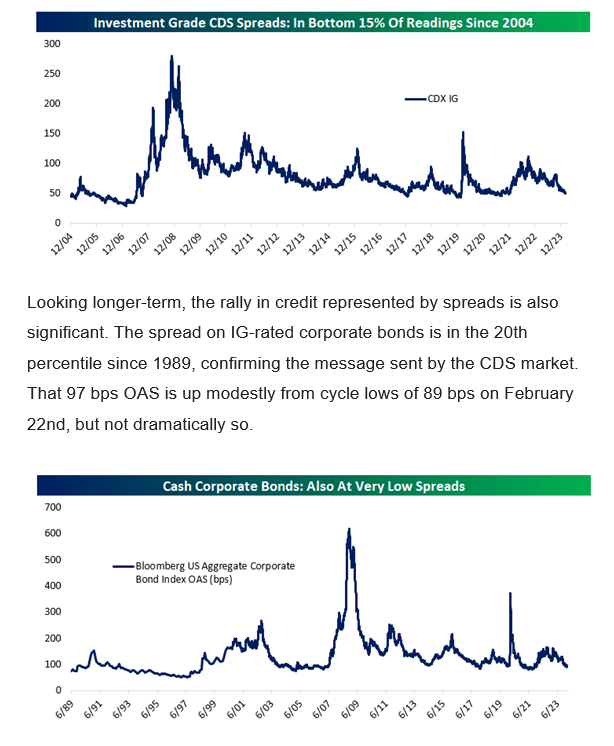

First, a little introduction credit spread:

![]()

The spreadsheet above shows Since the S&P 500 bottomed in early November 2023, credit spreads have continued to progress.

What surprised me last week was that high yield credit spreads have tightened another 12 basis points in the last 5 days alone.

This customized note dated March 7, 2024, with graphic support, notes improvements in credit spreads.

While credit spreads don’t always immediately correlate with rising stock prices, it’s always a good thing when credit spreads tighten and vice versa.

This blog sold some corporate high yield bonds last week, selling the PIMCO High Yield Fund (which is generally the higher quality of the various high yield mutual funds in the junk bond space) and swapping it into LQD or iShares investment grade ETFs .

The swap sacrifices a bit of yield while adding a bit of duration or total return (if the Fed lowers the federal funds rate) and protects customer accounts from a credit quality perspective.

The client still holds long positions in SHYG, HYG and Pimco HYS, so the client still holds approximately 95% of the high yield exposure held over the past 3 years.

S&P 500 Index Data:

- This week’s forward fourth quarter estimate (FFQE) improved to $243.31 from $243.29 last week, marking the fifth consecutive week of improvement in FFQE.

- This week’s expected price-to-earnings ratio is 21 times, compared with 21 times last week.

- The S&P 500 earnings yield rose to 4.76% from 4.75% last week, marking the first consecutive improvement since mid-February 2024.

- Next week’s report points out that three companies this blog will be interested in are Micron Technology (MU), Nike (NKE) and FedEx (FDX). Micron Technology will report after the close on Wednesday, March 20, while Nike and FedEx will report after the close on Thursday, March 21, 2024.

There are only two weeks left before the S&P 500 Index earnings in the fourth quarter of 2023, and there is almost no change in performance expectations for the next two weeks. Therefore, except for the above company reports, the S&P 500 Index earnings have entered a quiet period or a dead zone.

The positive noted last week is that 2024 S&P 500 EPS estimates have been little changed over the past 12-14 weeks, considering investors and analysts have already seen the upside in the January and February 2024 earnings releases. 2024 guidance, that’s a positive.

Corporate guidance remains cautious, which is usually a plus.

Summary/Conclusion: S&P 500 earnings remain in good shape, and the upward shift in forward forecasts and some annual S&P 500 EPS forecasts is positive, as this is typically the time of the quarter when analysts get nervous and slowly reduce numbers.

Nike and FedEx are both American brands with considerable global influence. As The Wall Street Journal noted this week, it will be interesting to see whether FedEx is affected by Boeing’s (BA) issues.

None of this is advice or recommendations. Past performance is no guarantee of future results. Even in the short term, investing can result in a loss of principal. Readers should gauge their own comfort level with portfolio volatility and adjust accordingly. All S&P 500 EPS and revenue forecasts come from LSEG or the London Stock Exchange Group.

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.