pavren

Investors have been waiting for the rally to extend even longer than they have been digesting (and then digesting) a rate cut, but while the magnitude may still be relatively small, there has been a lot of rotation recently.

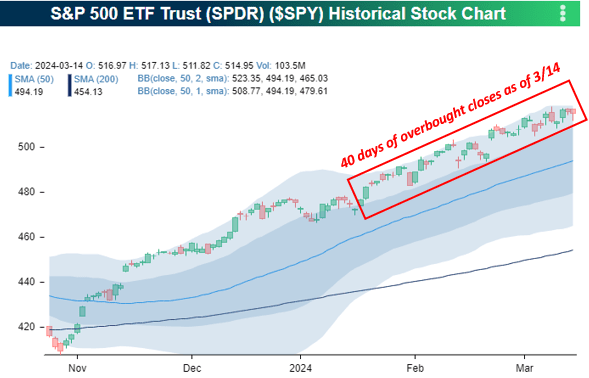

Let’s start with today’s market conditions. We measure overbought and oversold levels as closing prices one or more standard deviations above (below) the 50-day moving average (DMA).

By this standard, as of the close on March 14, the S&P 500 had closed at overbought levels for 40 consecutive days.

While this may sound extreme, we note that during the period ending August 1 last year, the S&P 500 closed at overbought levels for 45 consecutive days, known as the “overbought summer.”

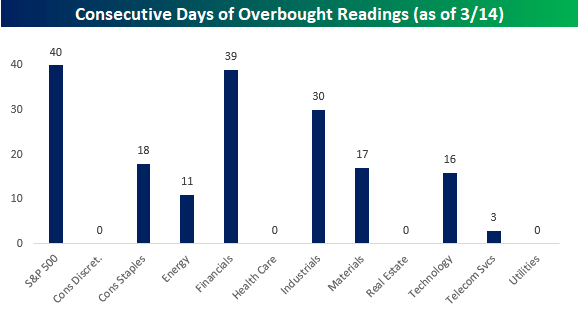

Now let’s get into about turn around. Although the S&P 500 has been overbought for the past 40 trading days, no sector has closed at overbought levels for multiple days in a row.

As shown in the chart below, the financial sector’s consecutive rising days are close to 39 days, followed by the industrial sector’s consecutive rising days of 30 days. After these two sectors, no other sector has closed at overbought levels for longer than half the time the S&P 500 has.

To put it in perspective, since daily industry price data began in late 1989, there have been 11 other periods in which the S&P 500 closed at overbought levels for at least 40 trading days, and only one of those periods (2012) did not include a single sector Consecutive closing prices at or above 40 points on the same day as the S&P 500 hits 40 points.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.