Igor

Automotive Industry Real Estate Investment Trust (OTC: APPTF) (TSX: April. United Nations:CA) is a Vancouver-based Canadian automotive real estate investment trust with 77 revenue-generating automotive dealerships in urban centers across Canada (as of December 31, 2023).

Recently, the REIT has added a number of new properties to its portfolio that played a role in promoting its growth. I’m bullish on the prospects for auto real estate REITs as they continue to grow through acquisitions and joint ventures.

Automotive industry REIT financial position remains strong

The company has been operating steadily for the past 9 years since the REIT’s IPO. Its sales and total assets have continued to grow over the years, while gross profit margins have remained in the 85% range. This is not surprising since all of its tenants are triple net, with tenants paying real estate taxes, building insurance and maintenance.

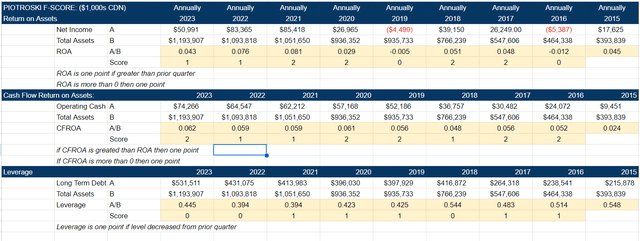

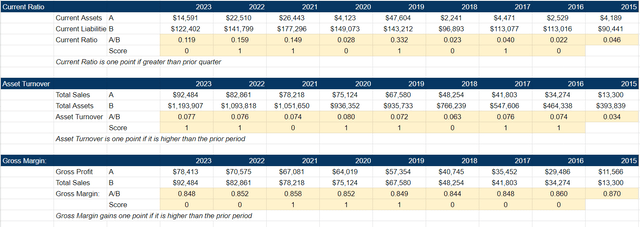

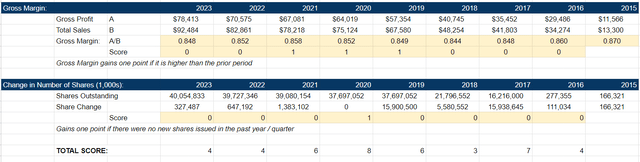

Evaluate a REIT’s financial health through F-scores In terms of health, a score of 9 indicates a company’s financial health is good, a score of 1 indicates a company’s financial health is poor, and Automotive Real Estate REIT’s score has been declining to 4. The REIT has dropped from its peak score of 8 points in 2020. The pandemic has likely had an impact on their finances. But even so, the company’s financials remain healthy. The decline in the F-Score is due to higher cash outlays and higher leverage required to purchase 7 properties in late 2023 (more on this later).

F Rating Auto Real Estate REIT (Auto Real Estate REIT Financial) F Score – Auto Real Estate REIT Financials (Auto Real Estate REIT Financials) F Score – Auto Real Estate REIT Financials (Auto Real Estate REIT Financials)

Comparing the 2023 annual data to 2015, the year of the REIT’s first IPO, there are many improvements. The current ratio has improved from 0.046 in 2015 to over 0.10 in 2021. Although the ratio may seem low, remember that the REIT does not have any direct liabilities because the tenants are responsible for its repairs and maintenance.

Its profit matrix also shows that the company is very cautious about its acquisitions. Management has been very careful to ensure that acquisitions do not negatively impact profits. We see this because, as mentioned earlier, gross margin continues to be in the 85% range.

Its long-term liabilities have continued to trend downward over the years, from 54.8% in 2015 to approximately 45% in 2023. Leverage has been below 40% in 2021 and 2022, with the recent increase due to acquisitions made in previous years.

Overall, management knows what it’s doing, and despite lower F scores in 2022 and 2023, the financials are improved from 9 years ago.

Acquisitions in early 2023 boost auto real estate REIT’s profits

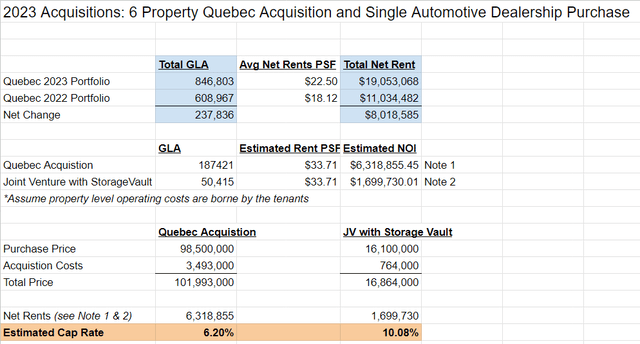

In January 2023, Automotive Properties REIT acquired a portfolio of six properties in Quebec for C$98.5 million. In June 2023, a joint venture with StorageVault Canada made another acquisition, purchasing another automotive dealership for $16.1 million.

Based on information provided in annual financial statements. Net rents for the 6-property portfolio acquisition are estimated to be approximately $6.3 million per year, and net rents for the single properties are approximately $1.7 million per year:

Acquisition Analysis (Automotive Real Estate REIT Annual Report)

Based on the above net rents, the cap rates for the 6-property portfolio and single acquisition are approximately 6.20% and 10.08% respectively. These are earnings numbers, as management also disclosed that the weighted average interest rate to fund these acquisitions was between 4% and 5%.

It’s also worth highlighting that acquiring a property with a cap rate of over 10% is impressive. This shows the degree of fragmentation of the automobile dealership industry.

Risk: Niche market

Canada is a relatively small automotive market with a population of approximately 39 million people. Automotive Real Estate REITs operate exclusively in suburban centers across Canada. Dealers in more rural areas are likely not to be financially viable due to smaller population sizes. Given Canada’s small population and the fact that auto real estate REITs operate only in urban centers, the acquisition pipeline is likely to be quite small.

Another risk factor to consider is that car dealerships are a very niche business within the overall retail landscape. Kudos to the management team for being able to secure a 10 year lease from the tenant. However, if there is a possibility that the tenant decides to terminate the lease and vacate, the REIT will have a difficult time finding a new replacement auto tenant, which could result in a longer lease term.

The risk of the tenant terminating the lease is fairly low. Even if properties do sit vacant due to vacancies, there are plenty of opportunities for REITs to transform. One approach is for REITs to rezone vacant properties into residential lots and sell them to residential developers.There is one shortage Housing and repurposing vacant properties in Canada does have its benefits.

Conclusion: Auto Real Estate REITs Are Safe Bet

The stock price has been on a downward trend since its peak at $14.95 in December 2021. It is currently trading around $10.40. I believe this could be a buying opportunity for investors looking for safe dividend-producing stocks. Even if a car dealer is having trouble selling cars, I believe the dealer will still pay rent or risk being shut down by the landlord. This makes Auto Real Estate REIT a very resilient company. REITs have never missed a dividend payment during the pandemic.

Auto real estate REITs can only grow through acquisitions, so this explains why they have never raised their dividend in the past 9 years. Investors should keep this in mind because the REIT is focused on expansion, so it’s unlikely to see any growth in dividend income.

Beyond that, Auto Real Estate REIT is well-managed and a dividend income-generating machine. Investors looking for a safe stock should consider this stock. I like Auto Real Estate REITs as dividend income stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.