Photofex/iStock Editorial via Getty Images

Dear readers/followers,

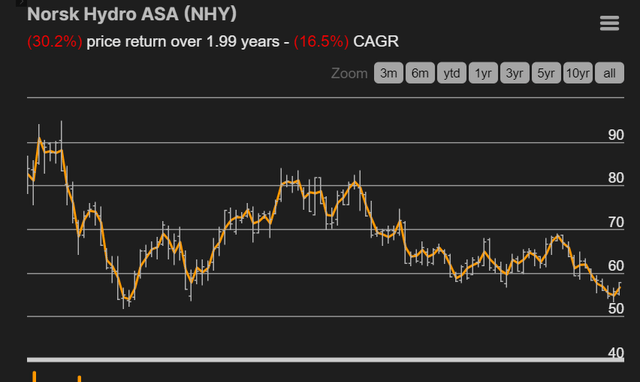

Norsk Hydro (OTCQX: NHYDY ) is a company I’ve reviewed several times over the past few years.I have a very attractive position with the company I purchased below At NOK 30 per share, it sold for more than NOK 60, a triple-digit return. The company didn’t decline again as quickly as I expected, but the fundamental appeal of the business has increased significantly due to the changing nature of the aluminum industry.

In this article, we digest the company’s full-year results and take a look at what we can expect for the year ahead. Norsk Hydro announced its fourth-quarter financial results in mid-February. Compared with the same period last year, the company’s overall performance fell sharply from the previous year.

I think this company is A company that must be bought at a price – it is a quality business that is heavily owned by the Norwegian government, which is a good allocator of capital and has one of the largest sovereign wealth funds in the world.

Despite this, Hydro has been trading at highs for a long time. I’ve been hoping for a significant decline for some time, and I believe 2024 could provide us with an attractive entry point.

Norsk Hydro – Challenging Q4 2023 and FY2023, with challenges ahead for 2024

Therefore, 2024 is problematic for the company. Volatile market and commodity trends contributed to the decline, but the company managed to free up some cash and ride out the ups and downs of volatile markets. However, the company’s EBITDA fell significantly as it fell by approximately 50%. (source: Norwegian Hydro Q4’23)

The company also set improvement and efficiency targets for the year – and they were exceeded.

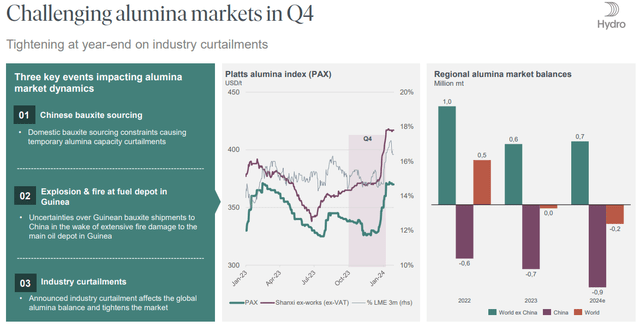

A rosy picture of a challenging market is as follows – As you can see, PAX is already online in early 2024.

Norsk Hydro Infrared (Norwegian Hydro IR)

Demand remains down – inventory balances are not good in 2023, but are expected to improve in 2024, and we are already seeing early signs of those improvements. (Source: Norwegian Hydro Q4 2023)

But 2023 is the year we’re focused on, and it’s not a “good” year for the company in terms of net profit. There are typical margin pressures, and falling demand continues to challenge profitability, which has declined from its peak in 2021 to 2022. We’re not down to 2020 levels yet, but we’re getting there. (Source: Norsk Hydro IR/S&P Global)

We see this in the company’s KPIs. The company’s capacity utilization rate has dropped below 60%, and scrap steel prices have also declined. This allows the company to free up some cash by releasing NOK7B in 2023 via NOC. Beyond this, the company is taking clear direction across various divisions, including aluminum capacity reductions, production shifts, margin management and resiliency for short-term recyclers.

On the positive side, the company has Overall improvement targets exceeded. More than NOK 1 billion in efficiencies were ensured through operational efficiencies, digitalization, fixed cost improvements and procurement savings within the company’s operating framework. The company also managed several new business initiatives, including energy improvements, green energy premiums, market share growth (impressive considering the company’s already strong position), and a better mix.

Norsk Hydro isn’t done yet. The company is also counting on further benefits from green premiums, new products and margin improvements to drive improvements in 2024.

It’s important for me to say that the level of profits and performance we see in 2021-2022 is Non-repetitive, like fertilizer. I don’t see this happening again in the near future, in fact it hasn’t even happened yet, nor do most other analysts for the company (Source: S&P Global, FactSet).

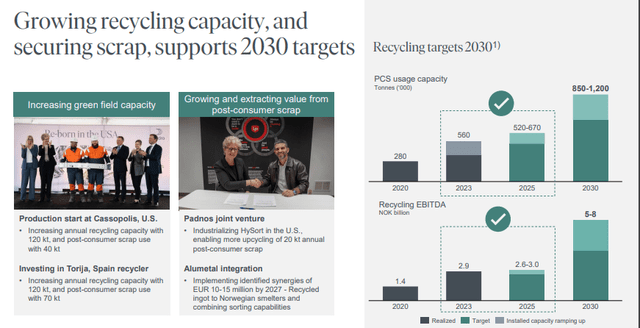

Norsk Hydro continues to predict its upside green aluminum, There are clear priorities for the next 5-6 years to 2030. The company will increase investments in recycling and extrusion as it attempts to seize market opportunities arising from this transition as well as decarbonization-related businesses. In fact, Norwegian Hydro was one of the early adopters of recycling technology in its business model. (Source: Norwegian Hydro Q4 2023)

Norsk Hydro Infrared (Norwegian Hydro IR)

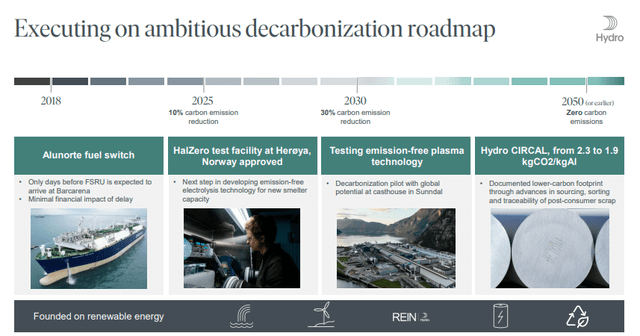

Much of the work the company is looking to do across its business over the next few years is related to decarbonization. In fact, I’d go so far as to say that if you’re not interested in owning a “green” aluminum producer, you probably shouldn’t invest in this company at all.

Norsk Hydro Infrared (Norwegian Hydro IR)

Therefore, the main reason for the decline in the company’s performance is the low level of upstream pricing. While the situation is expected to normalize this year, a large-scale reversal is unlikely as destocking continues. The company’s segments performed poorly compared to the same period last year due to low prices. The benefits of lower raw material costs were not fully offset by the negative impact, with demand for the company’s key products and services declining significantly. Furthermore, it seems unlikely that these trends will improve significantly this year, with squeeze market growth expected to be exactly flat and slightly negative this year and quarterly (Source: Norsk Hydro IR).

One of the reasons I like Norsk Hydro as a green metals company is the company’s existing strengths in its own energy sector. While this energy segment is down this year due to falling energy prices, the company is a company that has the ability to produce its own electricity, which is very reliable when you’re producing aluminum, one of the most energy-intensive metals on the planet. Safety and security.

Me too like In fact, Hydro went on to sell a double-digit percentage stake in Alunorte, one of the more problematic assets the company owned. Norsk Hydro is still the majority shareholder at 62%, but I think this is a risk-off move, albeit with lower returns, which reminds me that my article on this investment mainly touched on the level of problems caused by environmental concerns. assets.

Partnering with Glencore is never a bad thing either, so this is a further positive and adds to Norsk Hydro’s appeal in my opinion.

Furthermore, while this dividend hasn’t been impressive over the past few years, as the fertilizer industry has seen considerable upside in payouts, this dividend is actually higher than the company’s original guidance. Norsk Hydro’s current local share price is close to NOK 60 per share. This means that the company’s current yield is NOK 2.5 per share, or about 4.1%. That’s not a terrible yield, but it’s not an impressive one either. When you look at what Hydro has done over the past few years, the company has been able to drive growth through better fundamentals, although it’s provided somewhat negative returns. I selected “Hold” in May 2022 and was able to buy the company at a long-term attractive price of just under 56-58 NOK/share.

Norwegian Hydro Valuation (TIKR.com)

Norsk Hydro Valuation – There’s a lot to like, assuming you’re investing for the long term until 2030.

I set the bar quite high for Norsk Hydro in my last article, pricing the share price at NOK 68 per share. Many articles clarify this in the long run. The truth is, if you had held on around 68 or lower before buying, you would have made pretty good returns up until the start of the year, but the company’s valuation has declined due to annual results.

Norsk Hydro’s advantages are long-term. It is currently expected that 2025 will be the first year in which revenue exceeds NOK 200, with this target to be achieved again in 2027-2028. (Source: S&P Global) The future until 2030 is cyclical, but this is positive for this company, which seems likely to continue paying a progressive dividend of at least 4% or more given this share price .

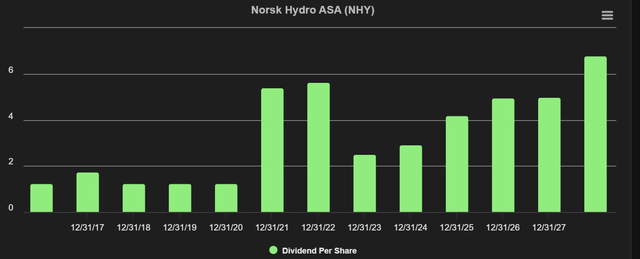

What’s more, as you can see here, basic knowledge The company’s scale and operating efficiency have improved, risks have decreased, and it is estimated that the company can Normalize dividend levels for 2021-2022 at some point.

Norwegian Hydro Dividend Forecast (TIkr.com/S&P Global)

If this turns out to be accurate and the company revise it upward, you can expect the company’s share price to yield a return of NOK 57/share It will grow by 7-9% in the next few years. Combined with the operational strengths, this is the main reason why I continue to view Norsk Hydro as a very attractive investment, despite the cyclical risks we see here.

That’s why – although a downturn this year may be justified due to ongoing destocking and demand issues – I won’t lower my PT on Norsk Hydro.

In my opinion this is this Aluminum companies ready for Europe’s future. As commodity aluminum is a core component of ESG/EV and the “green switch” future, I believe the company will remain the best positioned company in the entire industry in Europe.

This, dear reader, is most likely worth the investment.The truth is, I wish the company could manage Annualized profits will achieve double-digit growth over the next few years.

I expect 2023 to be the trough, and 2024 to rise at least 10-11% (source: author’s calculations) depending on demand recovery, especially towards the end of the year.I also predict that 2025 will be full HP resurrectionWith earnings per share normalizing around NOK 6-7, earnings growth of over 25% is followed by a further increase in demand for green aluminum, which should hold up well thanks to EU tariffs. Hydro still maintains a BBB rating despite being more cyclical, but I’m willing to “jump on the bandwagon” here and expect the company to go higher over time.

I won’t adjust my targets here, the estimates I mentioned to you actually don’t change when looking at other analysts’ forecasts for Hydro (source: S&P Global, FactSet) and the 3-year annualized growth rate of 15-17% A fairly conservative EPS growth rate is not unrealistic, making NOK 68/share a fairly conservative target.

Is this risky? Delays in recovery, delays in demand normalization, mixed results from the whole “green aluminum” push. Beyond that, most other risks are “noise” in my opinion.

This brings me to the following paper.

paper

- Norsk Hydro’s current valuation is attractive relative to normalized future earnings and my newly raised price target for Q1 2024.

- The potential returns at current levels are acceptable compared to other investment options on the market. I think the company is more attractive now than when I wrote my last article, which you can find here .

- At current valuations, Norsk Hydro has a Buy rating and I think the upside is quite attractive. The target price is NOK 68.

Remember, my whole purpose is to:

- Buying undervalued companies at a discount—even if the undervaluation is only slight and not by much—allows them to normalize over time while reaping capital gains and dividends.

- If the company moves well beyond normalization levels and into overvaluation, I would reap the gains and move the position to other undervalued stocks, repeating #1.

- If the company does not enter an overvalued state, but instead hovers within fair value range, or returns to an undervalued state, I will buy more shares as time permits.

- I reinvest earnings from dividends, work savings, or other cash inflows specified in #1.

Here are my standards and how companies achieve them (italics).

- The overall quality of this company is high.

- This company is basically safe/conservative and well-run.

- The company pays a generous dividend.

- Prices from this company are very cheap at the moment.

- The company has realistic upside based on earnings growth or multiple expansions/returns.

I wouldn’t call the Hydro “cheap,” but I’d call it “attractive” here, even if it’s down slightly since my last post.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.