Maxim Rabkowski

Global PMI rises for fourth consecutive month, hitting eight-month high

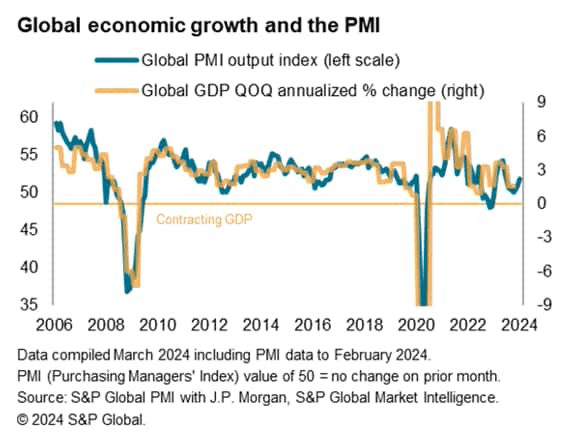

The S&P Global PMI survey showed that the global economy gained further momentum in February. The overall PMI covering manufacturing rose to an eight-month high of 52.1 from 51.8 in January. The services sector in more than 40 economies has now grown for four consecutive months. While the PMI remains below the survey’s long-term average of 53.2, the overall improvement bodes well for an encouraging start to the year.

India leads global expansion, but developed world renaissance gathers pace

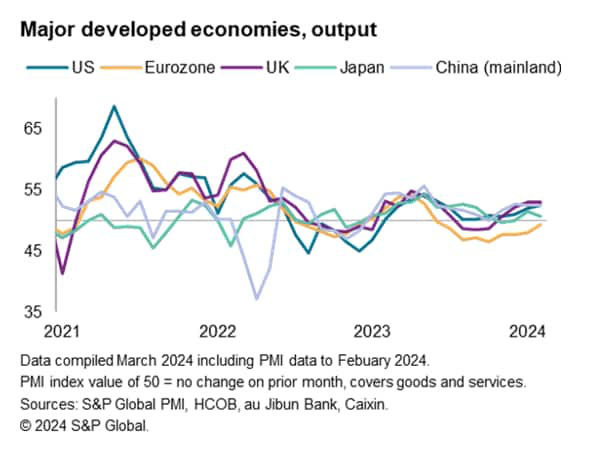

Business activity in developed countries rose at the fastest pace in eight months, rising for the second month in a row after five months of declines. Although growth slowed in Japan, growth resumed in Australia and expansion rates hit nine-month and eight-month highs in the United Kingdom and the United States respectively.At the same time, the economic recession in the euro area and Canada has eased. PMIs were at eight-month and five-month highs respectively.

Meanwhile, growth in emerging markets fell only slightly, recording the second-fastest expansion in the past eight months. India continued to record the strongest growth by some margin, with growth in Brazil accelerating sharply to a 19-month high. Mainland China also posted steady but weak growth, but Russia’s expansion slowed to its slowest in 13 months.

All major industries report global output growth for first time since July 2022

By industry, all eight major subsectors tracked by the PMI expanded globally for the first time since July 2022, signaling an increasingly broad-based economic recovery.

A return to growth among basic materials producers, linked in part to reduced destocking by customers, helped the broader manufacturing economy report its fastest global output growth in nine months and one of the strongest growth rates in the past two years. Still, the services sector continued to lead the economic recovery, expanding at its fastest pace in seven months. Growth in the global consumer and financial services industries has been particularly strong.

PMI signal shows stubborn global price inflation

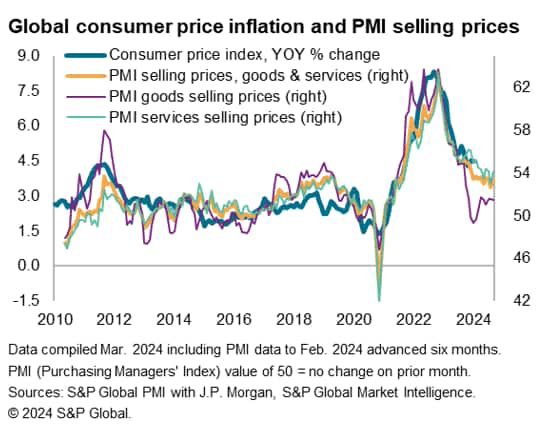

Although the survey also showed that global sales price inflation edged higher, the growth rate is still at the lowest level since mid-2021 and is well below the strong growth rates in 2022 and early 2023. Still, inflation has remained broadly stable since the end of last year, with inflation continuing to rise relative to the average for the decade before the pandemic.

Global services sales price inflation remains particularly high, accelerating slightly in February, with manufacturers’ sales prices rising for a seventh consecutive month. However, the impact of shipping disruptions eased in February after disruptions in the Red Sea in January caused supply delays, suggesting that vessel diversions across Africa have so far had little impact on global supply chains and prices.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.