JHVEPhoto/iStock Editorial via Getty Images

introduce

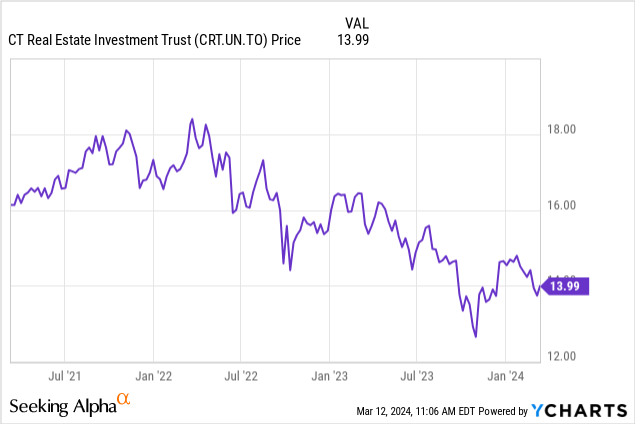

I have a sizable long position in CT Real Estate Investment Trust (TSX:CRT.UN:CA) (OTC:CTRRF) Because I Like Canadian REIT’s Investment in Canadian Tire (CTC.A:CA) (OTCPK:CDNAF)) (OTCPK:CDNTF) This is where CT REIT was spun off. Canadian Tire remains REIT’s largest tenant, accounting for approximately 91% of rental income (including all related brands). For some investors, this is a “no-no,” but I see it as a positive. Canadian Tire has a vested interest in maintaining a strong relationship with CP REIT as it is CP REIT’s largest shareholder and tenant.

2023 is a satisfying year for CP REIT

Thanks to its good relationship with its largest tenant, CP REIT has very high occupancy rates, which stood at 99.1% as of the end of 2023.This obviously happened immediately Positive impact on REIT’s NOI and AFFO performance.

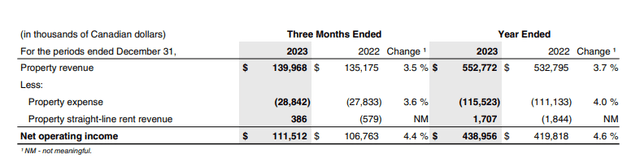

As shown in the chart below, the REIT’s net operating income totaled C$111.5 million in the final quarter of the year, with a theoretical run rate of approximately C$445 million per year, up from C$439 million in 2017. Report NOI.

CP REIT Investor Relations

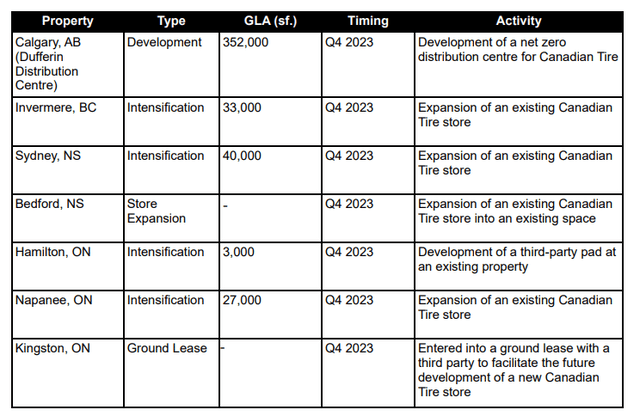

It’s just a REIT theory Completed multiple development projects We won’t see the full impact of these expansion efforts in 2024 until the fourth quarter.

CP REIT Investor Relations

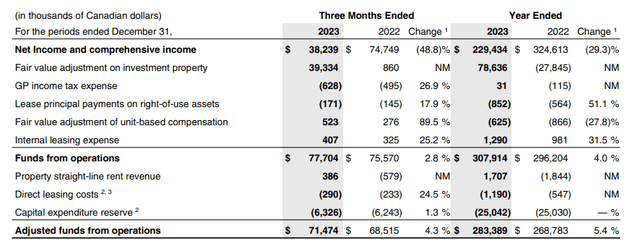

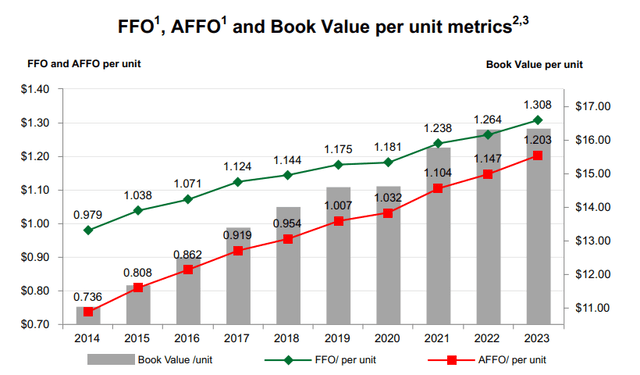

While the development of net operating income is positive, I also want to make sure that we see significant improvement in FFO and AFFO performance. This is where most REITs are struggling right now, as rising interest rates in financial markets are impacting performance. Fortunately, that’s not the case with CT REIT.As shown below, fourth-quarter FFO grew approximately 2.8% to CA$77.7 million, while Full-year FFO growth was 4%.

CP REIT Investor Relations

Additionally, adjusted funds from operations (AFFO) increased 4.3% in the final quarter of the year and 5.4% for the full fiscal year 2023. As you notice in the chart above, AFFO includes reserves for capital expenditures. The capital expenditure reserve is management’s estimate of the normalized capital expenditures required to maintain properties in good condition. For CP REIT, this amount is estimated at C$25 million per year, or almost 0.4% of the asset’s book value.

On a per-share basis, AFFO earnings per share in 2023 will be C$1.205 per share, compared to C$1.149 per share in 2022, an increase of 4.9%. The chart below shows earnings per share of CA$1.203, but this is based on diluted share count rather than effective share count.

CP REIT Investor Relations

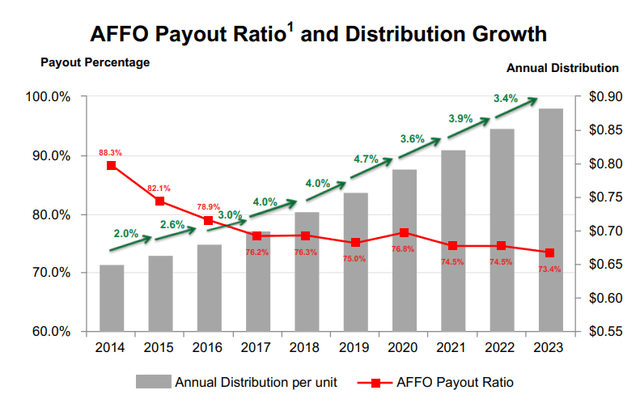

Total dividends paid in 2023 will be C$0.883 per share, giving a payout ratio of just over 73% (see below), meaning the REIT will be able to retain

CP REIT Investor Relations

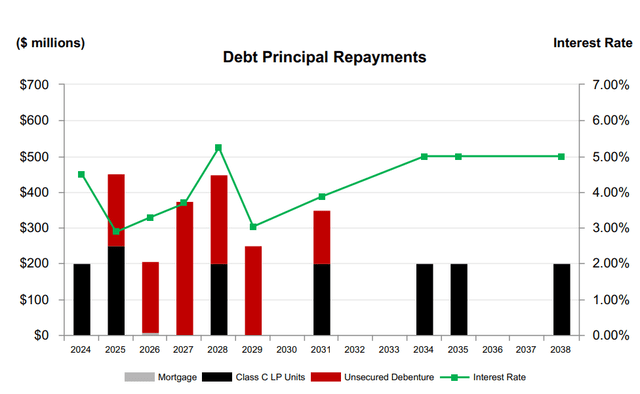

AFFO’s growth is indeed quite impressive considering the current state of the financial markets. CT REIT’s average cost of debt has also increased, with the REIT now paying about 50 basis points more than it paid two years ago. The average cost of debt is currently about 4.1%, and CP REIT’s maturities are staggered, which means the average cost of debt will only gradually rise.

CP REIT Investor Relations

The most recent debt issuance was priced at around 5.8%, but I expect future refinancing rates to be lower as interest rates in financial markets will undoubtedly fall over the 2024-2026 period, and the 5.8% bond (maturity 2028) is Unsecured Bond.If borrowing costs become too high, CP REIT can relatively easily market secured debt This will have a lower interest rate.

Let’s also not forget that the lease with Canadian Tire includes 1.5% annual rent increases that cover anticipated annual interest expense increases. Annualized escalator-based rent increases of C$6 million per year will compensate for the 150 basis point cost of the C$400 million debt increase in the annual refinancing. With average refinancing requirements only CA$1.2B between 2024 and 2027, or just CA$300M per year, I expect the rental escalator to fully cover rate increases.

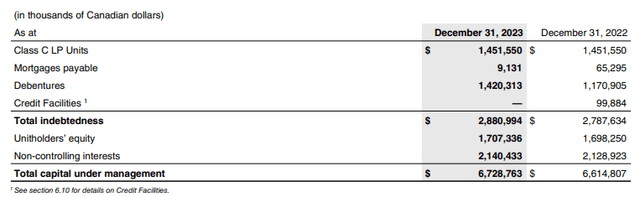

The debt ratio also remains at a low level. As of the end of 2023, the debt on the balance sheet of CP Trust was approximately CAD 2.9B, cash was approximately CAD 21 million, and the net debt position was CAD 2.86B.

CP REIT Investor Relations

The property’s total book value is estimated at C$6.94B, resulting in an LTV ratio of approximately 41%. Not only is this very manageable, but the properties have a final capitalization rate of 6.71% and a discount rate of 7.20%. At the end of 2023, NOI divided by the book value of assets was 6.4%.

CP REIT Investor Relations

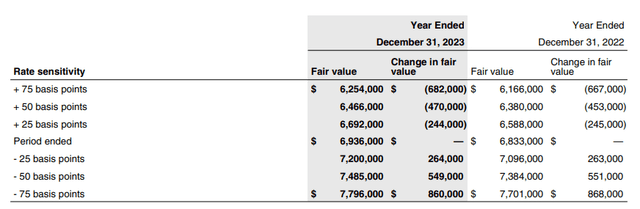

As you can see above, even a 75% increase in the BP cap rate would reduce the fair value of the property by $682 million (excluding the impact of rent increases and approximately $70 million of hoarding in AFFO annually, which are not will be distributed to shareholders). Even in this case, the LTV ratio is only 46%, and the NAV per share is still about C$13.5.

investment thesis

This is why I continue to overweight CP REIT. I don’t view dependence on anchor tenants as a weakness, but rather a strength, and despite Canadian Tire’s recent disappointing financial performance, the company isn’t going out of business anytime soon. The stock currently trades at a 15% discount to current book value and just 11.5x 2023 AFFO (including ongoing capex distributions).

At the same time, the distribution is C$0.898 per share per year (paid in monthly installments), the dividend yield is approximately 6.4%. CT REIT typically raises its dividend in June, and I’m looking for another annual dividend increase of C$0.02-0.025, which would bring the annualized distribution to C$0.92 per share, a yield of nearly 6.6% based on a stock price of around C$14.

I have a long position in CP Real Estate Investment Trust and have continued to add to that position on weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.