white pointer

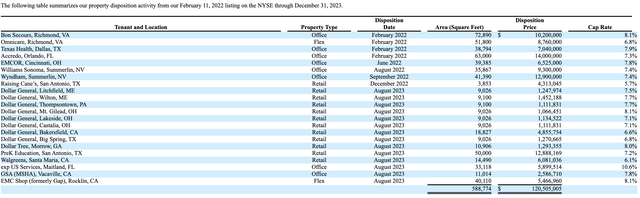

Modif Industries (NYSE: MDV) is probably one of the most unique equity REITs I’ve come across.This internally managed small-cap REIT focuses on acquiring single-tenant net lease industrial manufacturing properties in the United States, with a portfolio that includes 44 characteristic At the end of the most recent fourth quarter of fiscal 2023. MDV has since disposed of two non-core assets held for sale and has now completed a more than two-year strategic shift away from an initial portfolio focused on retail and office properties. Since the REIT listed on the New York Stock Exchange in February 2022, it has made $121 million worth of dispositions.

Modiv Industrial Fourth Quarter Fiscal Year 2023 Supplemental Data

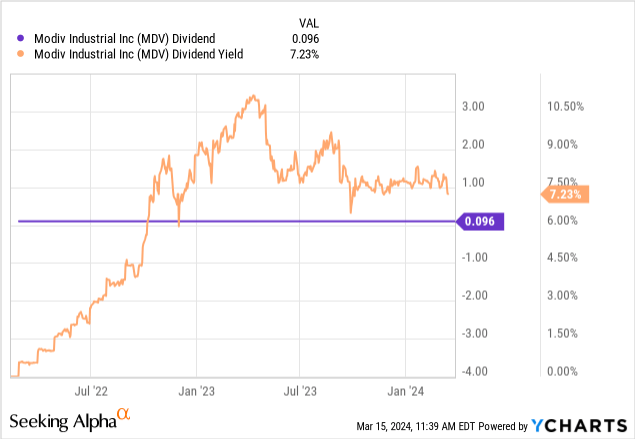

MDV last announced a quarterly cash dividend of $0.0958 per share, unchanged from the previous month, with an annualized dividend rate of $1.1496 per share and a dividend yield of 7.2%. REIT with market capitalization of US$160 million AFFO’s monthly payout has remained steady in Q4 since it went public $0.40 per sharebeating consensus estimates by 5 cents but missing FFO $0.68 per share a year ago. The decline in yields comes as the stock has gained 54% in the past year due to rating upgrades.

Direct year-over-year comparisons are difficult because MDV’s portfolio has undergone dramatic changes during this period. The REIT is currently changing hands at about 10x fourth-quarter annualized AFFO, and its dividend yield is above the average net lease REIT, but this reflects the somewhat strengthened risk profile of small-cap single-tenant owners operating in domestic manufacturing. A niche that has been characterized by austerity for a decade. The listing of REITs comes amid the most disruptive period for REITs in a generation, as the Federal Reserve’s battle with inflation drives up REITs’ capital costs and curtails growth.

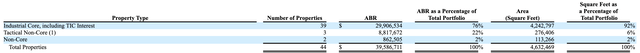

Modiv Industrial Fourth Quarter Fiscal Year 2023 Supplemental Data

Liquidity, Debt and AFFO Growth

MDV’s 42-property portfolio currently generates $44 million in annual net operating income, with annual rent escalation of 2.5% and a weighted average lease term of 14 years. The real estate investment trust’s fourth-quarter revenue was $12.29 million, down 11% from the same period last year. However, the year-ago comparison includes $3.8 million in early termination fees paid to tenants, which would have seen revenue rise 23% annually. Crucially, MDV’s industrial acquisitions drove growth but were offset by its non-core assets.

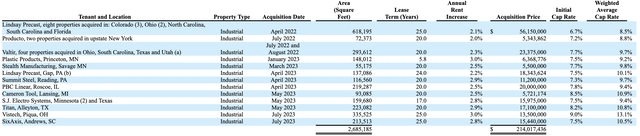

Modiv Industrial Fourth Quarter Fiscal Year 2023 Supplemental Data

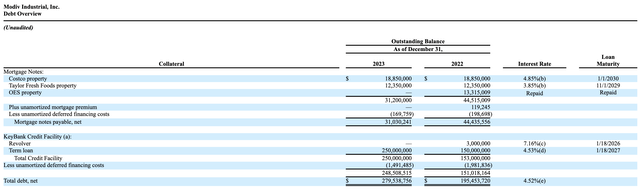

The real estate investment trust has spent $214 million on acquisitions since going public, but there have been no new acquisitions in the fourth quarter and so far this year. Fourth-quarter AFFO increased 41% compared with the same period last year (excluding 2022 lease termination charges). Total debt at the end of the fourth quarter was also very reasonable, with no maturities until 2027. The REIT held a cash balance of $17.9 million at the time of the earnings call, as well as an undrawn $150 million revolving credit facility.

Modiv Industrial Fourth Quarter Fiscal Year 2023 Supplemental Data

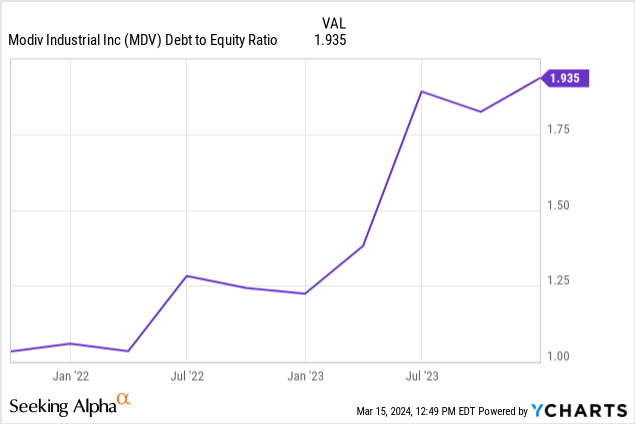

The real estate investment trust has also been selling shares to raise capital, selling 162,063 shares between November 15, 2023 and January 29, 2024, at an average price of $15.22 per share, for proceeds of $2.47 million. However, the risks here are also prominent. Leverage is high, with MDV’s debt-to-equity ratio at about 1.94 times as of the end of the fourth quarter, the highest level since the REIT went public. There are no recent debt maturities, and the Federal Reserve is about to cut interest rates to reduce the risk of rising leverage.The real estate investment trust also owns A series Outstanding Preferred Stock (NYSE:MDV.PR.A) The current cost yield is 7.6%.

MDV has a clear investment strategy centered around acquiring key industrial manufacturing properties with long-term leases. This focus on single-tenant net lease industrial manufacturers means significant exposure to a single industry. Russia’s invasion of Ukraine triggered a wave of inflation but also triggered a major shift in global supply chains. Chinese foreign direct investment has fallen to its lowest level in decades, and U.S. trade policy has seen a major shift toward more protectionism. The Inflation Reduction Act of 2022 and the CHIPS and Science Act both have serious domestic biases and both promote a domestic manufacturing boom. As a result, MDV is operating in an attractive space that is likely to see the emergence of a new, more growth-oriented zeitgeist than in past decades.I think MDV makes sense as an investment, especially in response to Fed’s comments, Powell said The process of cutting interest rates”can and will start“During 2024. I’ll probably take a small position at some point this month as AFFO covers a dividend yield of about 140%.