pixdeluxe/E+ via Getty Images

Introduction and investment papers

I initiated a Hold rating on GitLab (NASDAQ:GTLB) on January 22, 2024.My holding thesis is based on my belief that despite growing revenue, the company’s valuation looks fully priced in, especially after corporate customers and expand profits. I also highlighted that macroeconomic risks remain a concern with the possibility of an extended sales cycle, which would hurt GitLab’s top line, as well as competition from larger players like Microsoft (NASDAQ:Microsoft Corporation) This could further weaken GitLab’s growth prospects.

The company recently announced its Financial Report for the Fourth Quarter of Fiscal Year 2024, revenue continues to grow steadily, and customer spend continues to grow with annual recurring revenue (ARR) reaching $100,000. At the same time, profit margins continued to improve as the company remained committed to streamlining operating expenses.At the same time, the company also announced multiple product versions in the security and compliance, artificial intelligence and enterprise areas Planning solution areas. While macroeconomic and competitive risks remain concerning, I believe the post-earnings sell-off creates an excellent buying opportunity for long-term investors, with potential upside of 35% from current levels.

GitLab Quick Start

GitLab is a DevSecOps platform that helps customers bring development, operations, IT, security and business teams together to deliver business needs on a single application by reducing software development cycle time from weeks to minutes results, thereby increasing overall productivity.

In terms of business model, the company has a three-tier subscription pricing structure. These include a free tier and two paid tiers: Premium and Ultimate.period Earnings Conference Callthe company announced the release of GitLab Duo Pro, a $19 per user per month paid add-on for Premium and Ultimate subscribers that will allow developers to code more efficiently with features like code suggestions and chat .

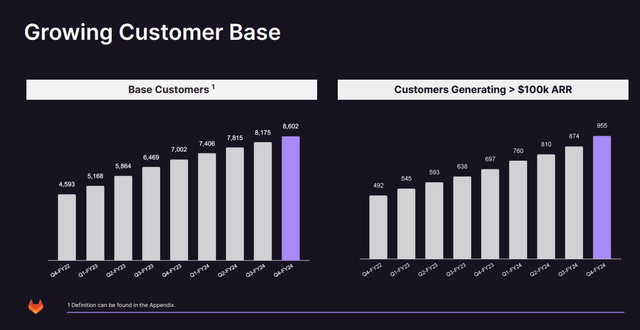

End of FY24, the GitLab platform has more than 30 million registered users, and more than 50% of Fortune 100 companies are customers. According to their latest earnings report, they have 8,602 customers with ARR of at least $5 million, up 22% year over year, and accounting for 95% of total ARR.

Benefits: Strong revenue growth, strong product innovation and expanding profits

GitLab’s fourth-quarter revenue increased 33% year-on-year to $163 million, exceeding expectations by 3%. At the same time, full-year revenue for fiscal year 2024 was US$580 million, an increase of 37% over the same period last year. The growth in revenue was driven by customer contributions of $100,000 in ARR, which increased 37% year-over-year in the fourth quarter. At the same time, the number of customers contributing $1 million in ARR also increased 52% year-over-year in the fourth quarter, indicating that the company’s strong product innovation and its successful go-to-market strategy are driving adoption, and the net retention rate (NRR) increased 130% year-over-year and compared with fiscal 2024. The third quarter of the year improved compared to the previous quarter. At the same time, Chief Financial Officer Brian Robins also mentioned on the earnings call that their Ultimate Tier currently accounts for more than 50% of ARR bookings, which was also the case last quarter.

Q4 FY24 Earnings Slideshow: GitLab’s Growing Enterprise Division

I believe one of the main reasons the company has been successful in acquiring and adopting its solutions in a relatively tough macroeconomic environment is its commitment to driving strong innovation. The company estimates its total addressable market (TAM) at $40B and it believes that by 2027, 75% of organizations will move from multi-point solutions to DevOps platforms to streamline application delivery. To ensure that it captures more and more market share, I personally like how the company is leading its solutions in security and compliance, artificial intelligence, and enterprise planning.

In the fourth quarter, the company launched remote development workspaces that will create secure and replicable environments for developers. At the same time, the company also launched GitLab Duo Pro, a paid add-on service for Premium and Ultimate subscription levels for $19 per user per month, which allows teams to work efficiently with AI-driven code suggestions and chat features. Write code and fix bugs. Function.

Looking forward, GitLab aims to increase revenue by approximately 25% annually in fiscal 2025, reaching $725-735 million. While this is a slower growth rate than previous years, I believe management will be cautious in setting expectations, especially as the company enters its third year as a public company. I believe the company should be able to achieve this as it continues to drive superior innovation, driving deeper adoption that increases spend per customer and allows them to gain economies of scale. At the same time, management also increased the price of the premium subscription tier, which is expected to generate $1-20 million in incremental revenue in fiscal 2025. Additionally, management remains confident they will be able to drive monetization with GitLab Duo Pro, an extension of artificial intelligence capabilities, which should help boost revenue.

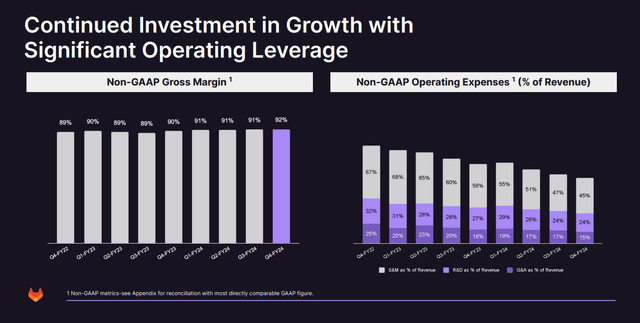

Turning to profitability, GitLab generated a non-GAAP operating loss of $1.4 million in fiscal 2024, an improvement of 98% from the same period last year. This represents a margin of -0.24%, narrowing from the -30% non-GAAP operating margin in fiscal 2023. As management focuses on growing responsibly and ensuring improving unit economics, GitLab streamlined its operating expenses, which continued to improve both sequentially and year-over-year, as shown below. Going forward, the company is targeting $5-10 million in non-GAAP operating income in fiscal 2025, which would imply a margin of 1-1.4%.

Fourth quarter fiscal year 2024 financial report: GitLab continues to improve operational efficiency

The Bad: Macroeconomic uncertainty and competitive threats could dampen growth

While management mentioned that buyer behavior improved across all customer sizes during the quarter and customer churn and shrinkage decreased, the overall spending environment remains cautious, especially among small and mid-sized businesses.along with Fed to keep interest rates longer as Inflation remains stubbornly above targett, we are likely to see an increase in debt defaults, which disproportionately hurts small and medium-sized businesses. This could lead to a slowdown in GitLab’s growth forecast, especially as prices rise for its premium subscription tiers and monetization for GitLab Duo Pro is suppressed.

At the same time, the competitive landscape in the DevOps industry remains fierce. In my previous article, I mentioned that one of GitLab’s biggest competitors is GitHubacquired by Microsoft in 2018, bringing Microsoft’s own development tools to market. With deep-pocketed players in the space, GitLab needs to continually invest in R&D to build compelling solutions, which could negatively impact profitability if the overall macroeconomic environment worsens from its current state.

Putting it all together: GitLab has 35% upside potential from current levels.

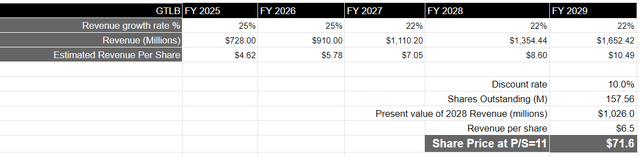

Since the company has yet to provide a long-term financial or operating model, and given that its non-GAAP operating income is just beginning to turn positive, I will value GitLab based on my forecast for revenue growth over the next 5 years. I believe the company’s revenue should be able to grow in the mid-twenties range. Continued product innovation will drive this as the company continues to gain market share in the DevOps space in the coming years, especially as enterprise customers increasingly adopt its Ultimate tier and monetize solutions like GitLab Duo Pro. A trend. This means that by fiscal 2029, the company should generate approximately $1.65B in revenue.

At a 10% discount, this translates into a present value of $1.026B in revenue.take S&P 500 Index as proxy, its companies have average revenue growth of 4.8% and a price-to-sales ratio of 2.19, which means GitLab should trade at about 5 times the forward price-to-sales ratio of the S&P 500 Index. The price target of $71 represents a 35% upside from current levels, creating an attractive entry point for long-term investors.

Author’s valuation model

in conclusion

I believe the company’s post-earnings sell-off creates an attractive opportunity for long-term investors, as the stock should generate solid returns of close to 35% over a 5-year investment horizon. I remain optimistic about the innovation pipeline and management’s commitment to driving growth while ensuring improved profitability. Therefore, I currently rate this stock a Buy.