Chip Somodevilla/Getty Images News

Last week’s inflation data certainly shocked markets, with interest rates heading sharply higher and indexes falling for a second straight week.But more importantly, this has led to a repricing of market views on rate cuts The Fed may make good on its promise in 2024.

It sets up a key Fed meeting that is not expected to change interest rates but could change the number of rate cuts the Fed believes are likely in 2024 and the long-term neutral rate. As such, investors will be watching the Summary of Economic Projections (SEP), the “dot plot,” Fed governor and board member projects and their expected path of inflation.

Cuts to be reduced in 2024

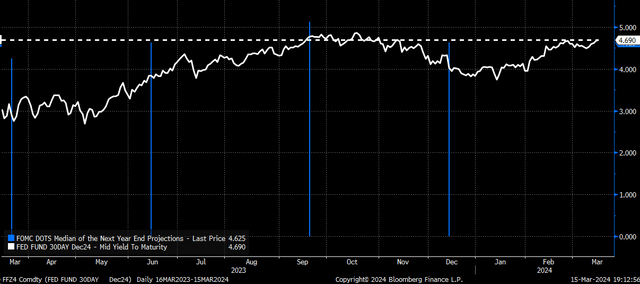

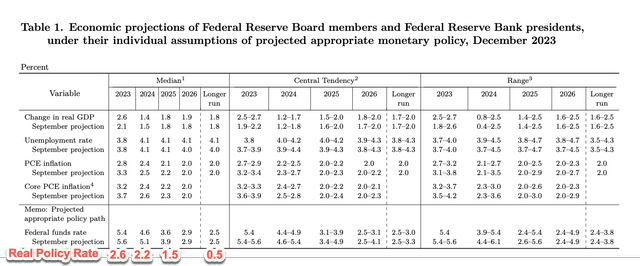

What is clear is that the market is now skeptical about the number of rate cuts expected by the Federal Reserve at its December FOMC meeting Meeting. At that time, the SEP predicted that the median interest rate in 2024 would be 4.6%, indicating that the Federal Reserve would cut interest rates three times in the market. However, this week’s better-than-expected CPI, PPI and import price reports have led the market to expect no more than three interest rate cuts this year.

Fed funds futures currently forecast interest rates to be near 4.7% by the end of 2024, up from 4.5% last week. In fact, federal funds futures fell as low as 3.75% in January. That’All that was thrown out the window, given the hot inflation numbers for several months and expectations for March’s numbers.

Bloomberg

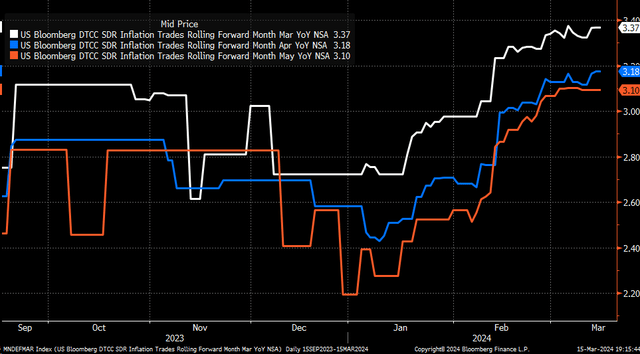

CPI inflation swaps in March are now 3.37% and 3.18% in April, which is higher than before the release of CPI in February. At the same time, May is still expected to be around 3.1%. Inflation expectations have been revived since mid-February, when markets were surprised by the popularity of the January CPI report.

Bloomberg

The deflation narrative is in serious trouble

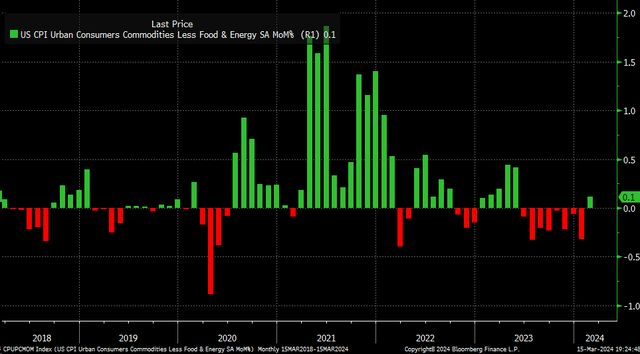

To make matters worse for the Fed, the Consumer Price Index (CPI) excluding food and energy rose 0.1% on a seasonally adjusted basis in February. This was the first time since June that “goods prices” were deflationary. If the good deflation process stalls, or worse is reversed, in the second half of 2023, it means that the overall deflation process will face major obstacles in 2024.

Bloomberg

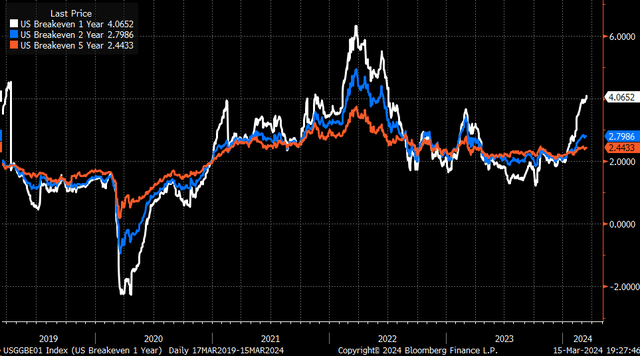

Commodity prices, gasoline, oil and copper, are rising steadily, further exacerbating problems for claims of deflation. Rising commodity prices, a key input to manufacturing, appear to be affecting and pushing up inflation expectations for 1-, 2- and 5-year breakeven points.

Bloomberg

Policy restrictions are not enough

Given the number of steps being taken and the potential risks to the deflationary process, the Fed may be wise to follow the lead of federal funds futures and remove one or even two rate cuts from its 2024 forecast. This will resolve some of the confusion. The Federal Reserve announced three interest rate cuts in December in 2024, easing financial conditions.

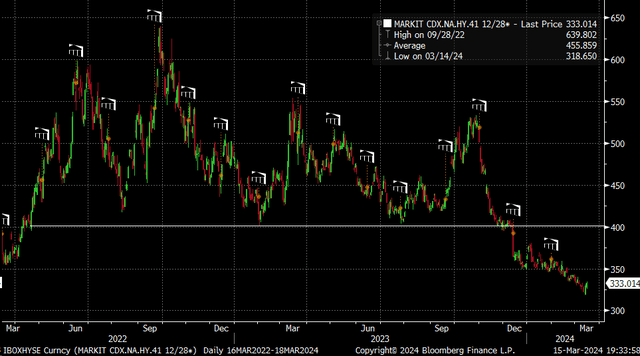

Credit spreads plummeted after the December FOMC meeting, causing the CDX High Yield Index to fall below 400 for the first time since spring 2022. The November Fed meeting also didn’t help, with credit spreads plummeting after the meeting. But at least in November, an unexpectedly dovish U.S. Treasury quarterly refund announcement and a dovish-than-expected Bank of Japan policy announcement also shouldered some of the blame.

Bloomberg

Still, financial conditions have eased significantly in just a few months, so it’s no surprise that risk assets are surging. That’s why now is the time for the Fed to rule the market and regain control of the narrative, otherwise market forecasts for inflation may only go higher because commodities, oil, gasoline and copper are risky assets in their own right. If stocks move higher, it only makes sense that commodity prices will move higher as well.

Since the Fed has now canceled its plan to raise interest rates, the only tool the Fed has to tighten financial conditions is to cancel interest rate cuts. Not only do they have to cut interest rates, they also need to raise long-term interest rates from the current 2.5% to 2.75% to 3%, which indicates that the economy is operating at a higher neutral rate and requires higher interest rates. Real interest rates keep inflation at target.

They could achieve the same effect by keeping their 2024 PCE and core PCE targets unchanged but removing one or two rate cuts from the forecast. This would signal a rise in real interest rates to ensure that policy remains sufficiently restrictive to reduce inflation. For example, the Fed stated that the federal funds rate will be 4.6% and the PCE rate will be 2.4% in 2025, which means the effective interest rate will be 2.2%. The Fed is likely to keep its PCE forecast at 2.4%, but raise the federal funds rate to 4.9% and imply an actual interest rate of 2.5%, which would be more in line with the Fed’s 2023 actual interest rate of 2.6%. The Fed acknowledged that the policy was not restrictive enough.

Federal Open Market Committee

The Fed must do this to tighten financial conditions again and keep the deflationary process on track. If the SEP guidance doesn’t work, the only option left is to threaten further rate hikes, which would have to come in the form of communications before the June meeting, a step the Fed doesn’t want to take without first trying to use the guidance.

Of course, the Fed could choose to do nothing, ignore the SEP, leave the three interest rates on the table for 2024, or even lower the PCE forecast. This would be a risk signal for markets and commodities. By then, financial conditions are likely to ease further and all bets on returning inflation to target appear to be off.