shih-wei

Written by Nick Ackerman and co-produced by Stanford University chemists.

Eaton Vance Tax Management Buy Sell Opportunities Fund (NYSE:ETV) delivered some solid returns in 2023 and strong returns in 2024 as well.Of course, this is thanks to the fund Heavy allocation to large-cap tech stocks. 2024 no longer looks like the era of Magnificent 7; it’s more just NVIDIA (NVDA) and meta-platform (Mehta) has definitely done all the heavy lifting and has been rewarded handsomely year-to-date. Both names made it into ETV’s top ten.

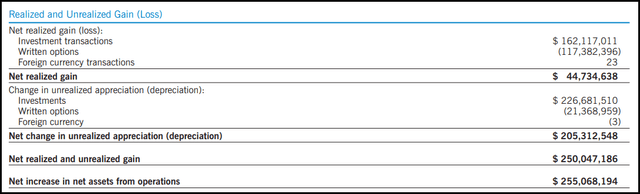

The fund also uses a call strategy; it uses an overlay strategy to target nearly 100% of its portfolio. This effectively limits the fund’s upside potential and drags down relative performance. From the latest annual report, we see that the strategy’s losses have been quite significant.At the same time, the income gained The underlying portfolio is more than sufficient to offset the losses incurred.

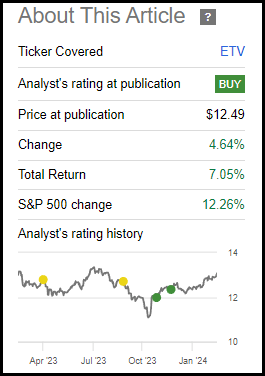

The fund has delivered some solid total returns since our last update. It also continues to trade at an attractive discount, potentially offering more potential upside in the future if we reach higher historical levels.

ETV’s performance since last update (Seeking Alpha)

Educational Television Basics

- 1 year Z score: -1.01

- Discount: -6.89%

- Distribution yield: 8.83%

- Expense ratio: 1.08%

- Leverage: N/A

- Assets under management: $1.5 billion

- Structure: permanent

educational television investment objectives It is “to provide current income and gains, with the secondary objective of capital appreciation.” To achieve this goal, the Fund will invest “a diversified portfolio of common stocks and write call options on one or more U.S. indexes for a significant portion of the value of its common stock portfolio, seeking to generate from option premiums Current earnings.”

Performance – still attractive discount

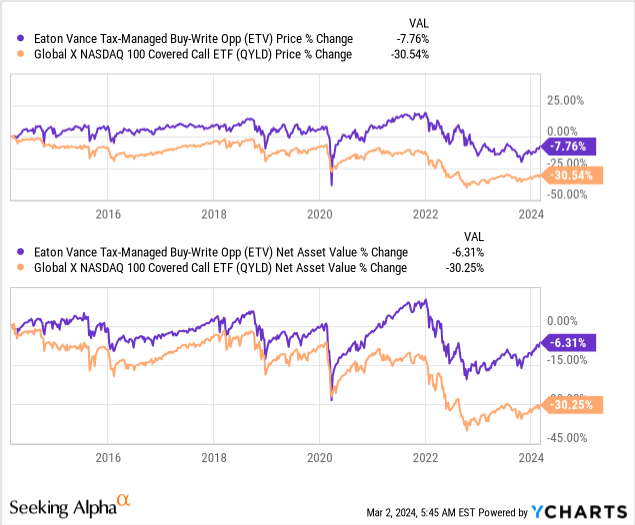

During our last update, we also took a look at the Global X NASDAQ 100 Covered Call ETF (QYLD), as this is another option-selling fund focused on generating high monthly distributions for investors. Although QYLD has fallen significantly in price compared to ETV, both funds have performed solidly in this regard. ETV remained stable for most of the past decade until a decline in 2022.

In the chart below, we are only looking at price and equity changes, which means we are not taking distribution into account.

Y chart

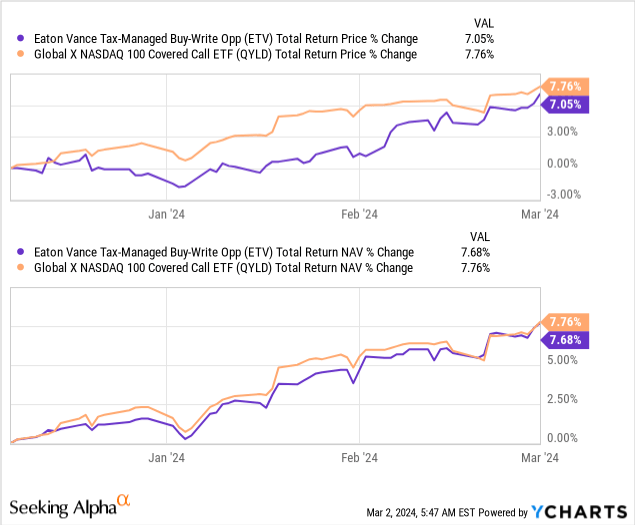

Now looking at the total returns for each stock price and NAV results since our last update, we can see that these funds have performed almost identically on a total NAV return basis. Total share price returns are also pretty close, although QYLD has a slight edge over ETV in this regard. This was more pronounced at certain times throughout the period (mainly January and February 2024).

Y chart

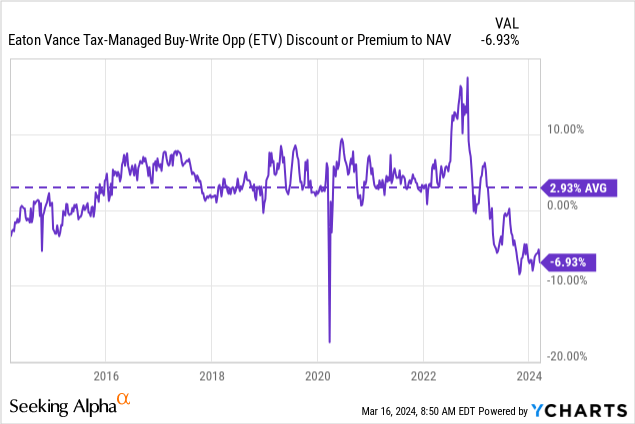

Since ETVs are able to trade at meaningful discounts/premiums, I believe the closed-end fund structure could provide some opportunities to take advantage. Discount/premium is generally not a significant consideration for ETFs because they have a creation/redemption mechanism that usually keeps their share price in line with the NAV price.

For ETV, after cutting allocations in 2022, the fund continues to linger in discount territory. The fund’s decline was quite dramatic given that it fell from a historically high premium to a discount level rarely seen since 2012/2013.

Today, the fund’s discount still looks like an opportunity. The risk, of course, is that this doesn’t mean this new discount can’t become the new “normal,” or that discounts can’t be expanded. This is always a risk when looking for a mean reversion strategy based on historical valuations.

Assignment – Monthly Salary

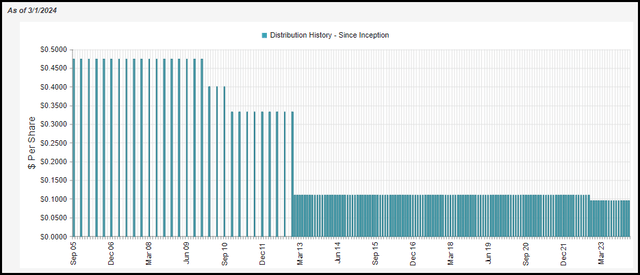

The fund maintained its distribution for several years before cutting it in 2022. The last time the fund cut its allocation was shortly after the global financial crisis. In 2013, they started paying monthly instead of quarterly, but kept the same equivalent amount.

ETV Distribution History (CEFConnect)

The annual interest rate is $1.1388 and the monthly amount is $0.0949. This calculates the fund’s distribution rate to 8.83%; based on net asset value, the interest rate is 8.22%. The difference here reflects the fund’s discount.

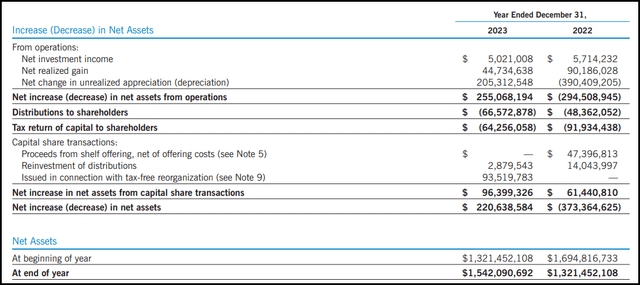

Funding this allocation will require capital gains from the underlying portfolio or its option sales strategy. The fund’s holdings of large-cap technology stocks pay dividends at a different level than the fund hopes to pay out to investors on distributions. This is normal for equity CEFs.

Furthermore, it is normal for a technology-focused CEF like ETV to generate only a fairly small amount of net investment income. In 2023, NII coverage is only 3.84%. When ETV trades at a premium, the fund is also able to take advantage of selling new shares through a market offering or creating new shares through a dividend reinvestment plan. Now, at a discount, it’s a perk they no longer enjoy.

ETV Annual Report (Eaton Vance)

META is now paying dividends, but of course, there’s no way that’s going to make up the difference. This way, capital gains can be used to pay monthly distributions to investors.

Given that the fund sells call options against the index, they cannot directly own the fund. This creates a situation where the options are settled in cash, which could mean they take a loss when rolling the options each month. This would represent a gain if the premium they receive is less than the cost of the rolling option next month. Throughout 2023, we know the market has performed quite well, meaning ETV’s option selling strategy has generated realized losses throughout the year.

ETV realized/unrealized gains and losses (Eaton Vance)

While the fund cannot own the index directly, it can do so indirectly. This is where the fundamental portfolio comes in. Despite all the losses incurred from selling the call options, the fund’s underlying portfolio performed extremely well. Well, enough is enough, any losses realized by the options strategy are more than offset by gains realized by the portfolio. The portfolio’s unrealized appreciation was also large last year.

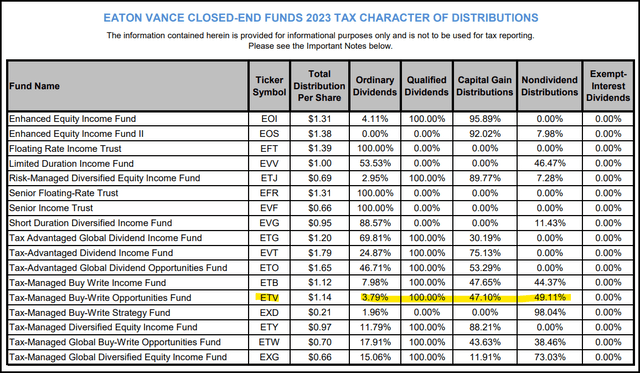

This strategy employed by the fund also goes back to why the fund enjoys tax benefits, as its name suggests. This is because the fund can typically generate distributions known as capital returns. This is a topic we’ve discussed many times in the past.

for 2023, ETV is once again offering investors a large ROC allocation. The remaining classifications are long-term capital gains or qualified dividend income, which have their own tax benefits. This is why ETVs are a relatively good choice for taxable accounts.

ETV Distribution Tax Details (Eaton Vance (Author’s Highlights))

ETV’s product portfolio

The fund’s portfolio turnover rate is quite low, at just 8% last year. Although 2022 is 19%, this is more of an outlier since in the two years prior to that, turnover was 9%, similar to 2023.

As a result, its product portfolio typically doesn’t change in many meaningful ways between updates.

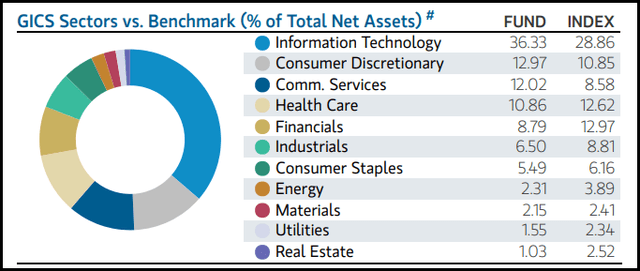

ETV Industry Weighted (Eaton Vance)

The fund continues to favor the information technology sector heavily as its options strategy is to buy call options on the Nasdaq 100 and S&P 500. Both indexes are listed as the fund’s equity benchmarks.

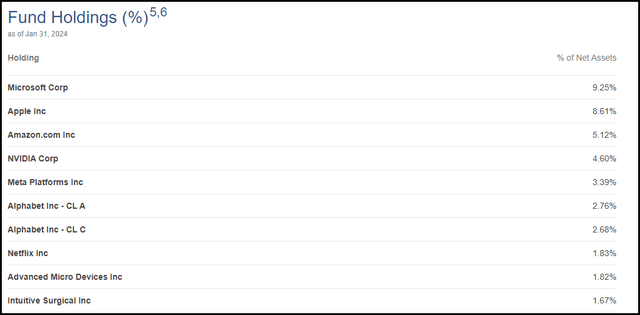

We also see this reflected in the fund’s top 10 holdings, through its weighting in such technology stocks and its call options on the index. Large-cap technology stocks account for 38.24% of the portfolio. Here are 8 of the top 10 names. Previously, the weighting of these large-cap stocks was 39.41%.

ETV Top 10 Holdings (Eaton Vance)

Advanced Micro Devices (AMD) shares also rose sharply. It’s not quite in the same league as other names in terms of market capitalization. At the same time, it has now pushed itself into “mega-cap” status as its market capitalization exceeded $327.42 billion, while a mega-cap stock is defined as more than $200 billion. However, in some cases, META is valued at $1.28 trillion, NVDA is valued at over $2 trillion, and Microsoft (MSFT) is valued at over $3 trillion.

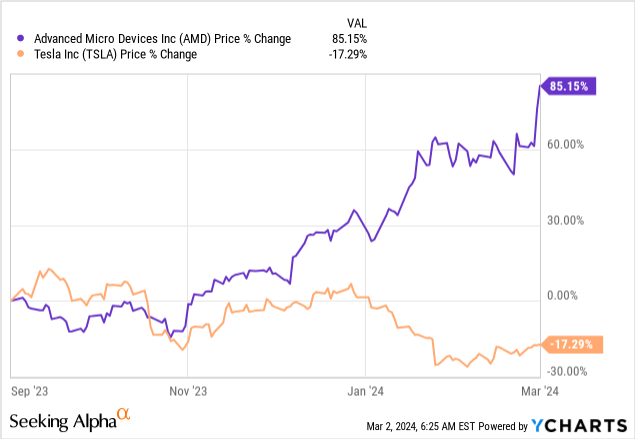

That said, AMD is particularly noteworthy here as it entered ETV’s top 10, but Tesla (TSLA) has been dropped from the top 10 since our last update. TSLA remains a position for the fund, but its ranking has slipped to No. 11 due to weak price performance. This is one of the reasons why there don’t seem to be any Mag 7 clubs anymore.

Looking at AMD and TSLA’s performance over the past six months really helps illustrate how dramatic the performance difference is. So that’s why sometimes ETV’s top ten can be rotated very meaningfully without management even having to do anything.

Y chart

in conclusion

ETV offers investors attractive monthly distributions. From an absolute perspective, it’s not as deep as some other options on the market, but from a relative historical perspective, the level is quite attractive. The fund invests heavily in large-cap stocks that dominate market performance. This makes sense given the fund’s strategy.

The fund’s option selling strategy requires the fund to be “hedged.” Indexes cannot be owned directly, so by writing options against the index, you are essentially writing naked calls. You gain this protection indirectly by having an underlying portfolio that largely reflects the index being targeted. As these companies continue to dominate in terms of performance, they will naturally become an increasing weight in the index, so ETV’s own portfolio will need to reflect this.