Pula 2 Na

Written by Nick Ackerman and co-produced by Stanford University chemists.

We reported last time abrdn Global Income Fund (NYSE: FCO) last July; in that article we highlighted the potential opportunity to convert to Brandywine GLOBAL – Global Revenue Opportunity Fund (biological working group). The overall premise is simple. FCO’s extended premium makes BWG’s heavily discounted valuation look even more attractive.

Generally speaking, we regularly highlight “exchange” opportunities such as these. Part of our strategy is to let valuation guide your investing. We don’t worry about timing the market; we worry about timing the market. We let the market provide opportunities and make the most of those rotations. We want to build an all-weather portfolio and then let valuation differences between closed-end funds guide us in deploying or redeploying capital through swaps.

When “redeploying” funds Through swap transactions, we can find two or more funds that have a high historical correlation and invest in similar industries. Since two different funds hold two different portfolios, they will never be exactly the same. Therefore, divergences may arise, which is always the main risk of this strategy.

There are many examples of how this has worked for us, FCO to BWG is another example. In this case, however, I think there’s more to do, as FCO remains significantly overvalued. Sometimes it takes weeks or even years for these moves to work in our favor. The timing is never consistent, so overall this strategy requires some patience.

exchange updates

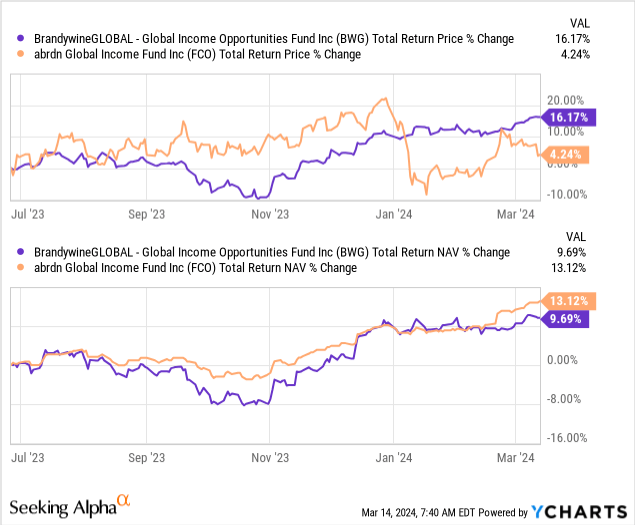

We can see that BWG’s total share price has outperformed the market since original publication on June 26, 2023. However, as mentioned above, these swap ideas may take some time to develop. It wasn’t until the sharp sell-off in early 2024 that performance really turned around. Then, more recently, the performance of these two funds actually picked up and then dispersed again, with BWG leading higher and FCO heading lower.

Y chart

While FCO’s total NAV returns have performed better during this period, swaps have continued in the direction we expected. FCO’s premium has indeed declined, but this outperformance comes more from the narrowing of BWG’s discount. FCO premiums actually fell only slightly. In fact, after our initial launch, it hit over 60% at one point. That’s why the fund initially started outperforming BWG significantly. This is despite the fact that the net asset value of both funds fell during the market decline last October.

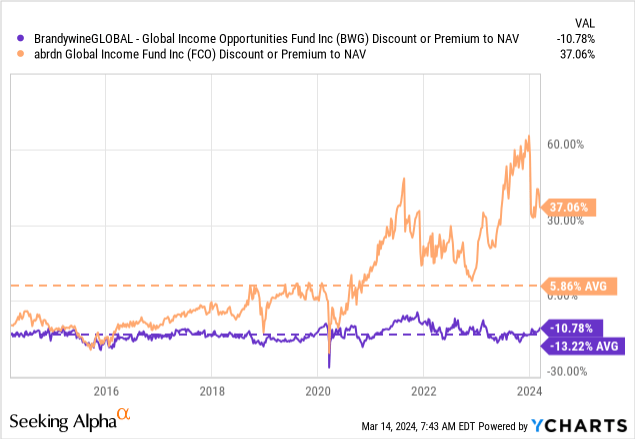

Today, premiums still look richly valued as overall premiums have not fallen significantly since our initial reporting. Therefore, I’d suggest this deal has more to go and BWG looks to be the better bet overall. I believe this will be the case even if BWG actually starts trading slightly above its historical average. In our previous report, the fund’s discount was approximately 15%, while FCO’s discount was approximately 38%.

Y chart

One of FCO’s main attractions relative to BWG is clearly the distribution yield. FCO pays a rate of 15.5%, while BWG pays a rate of 11.15%. However, FCO’s distribution ratio is over 21% on a NAV basis. This is the income the underlying portfolio must earn to cover its expenses, and then operating expenses are added on top. For BWG, the NAV rate is 9.95% due to the fund’s discount.

We noticed before that neither of these two funds actually received allocations.According to the British Foreign Office Last annual report, the fund earned a net investment income of $0.19, equivalent to NII coverage of 23%. BWG looks pretty strong, as NII has been trending higher year over year (without much loss due to artificially high allocation rates), with NII coverage around 84%.

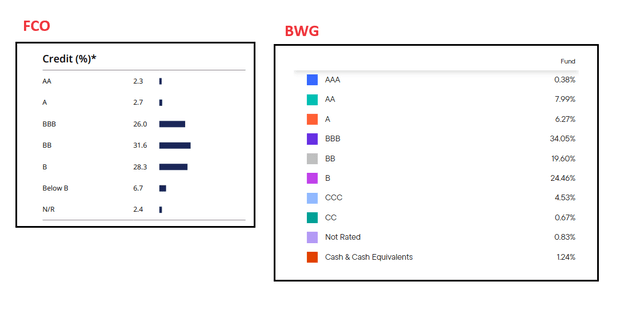

Remember, a closed-end fund can pay whatever it wants, but ultimately, total returns will tell us what the fund really “pays.” In this case, this is one of the reasons why these funds make great swap pairs. They both invest in global bonds, which actually includes a fairly similar split between investment grade and below-investment grade exposures. Recently, FCOs appear to have shifted their portfolios towards lower credit quality risks. In our previous update, the FCO allocated 44.4% to BBB, up from 31% now. BWG has 44.7% allocated to BBB and above, with the allocation increasing to 48.69%.

FCO comparison. BWG Portfolio Credit Quality (Fund Materials)

Even with these similarities, they don’t always translate into similar performance, as the underlying portfolios can still be significantly different and cause total returns to vary. The latest changes in credit allocations could mean divergence is more likely.

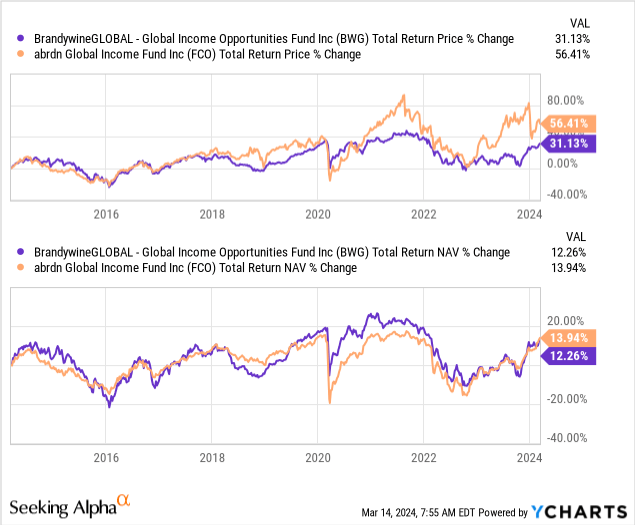

That is, in this case, over the past decade, BWG and FCO’s total NAV returns (which reflect the performance of the actual underlying portfolio) have shown a high correlation and nearly identical results. There was definitely a period of divergence between the two, but to have such similar results in a decade is pretty impressive.

Y chart

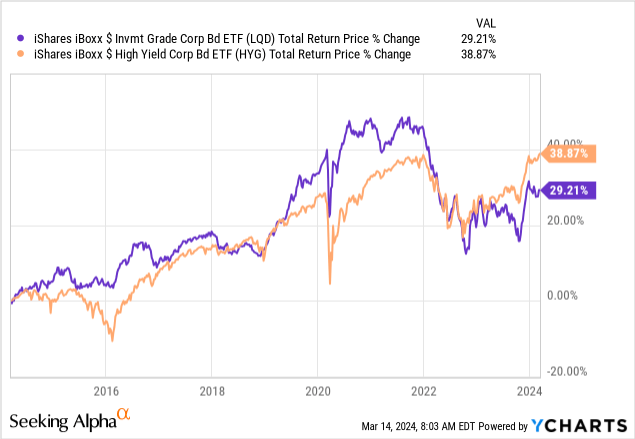

Now, by the way, have the performance of these funds been impressive? Absolutely not. Over a decade, their total returns eked out 12% and 14%. That said, for some perspective, keep in mind that both funds have some exposure to investment grade debt.

Although the relative risk is low, this has actually caused huge harm to the fund’s performance because interest rates have risen significantly over the past few years. This resulted in a significant decline in the total return performance of investment grade bonds.

Y chart

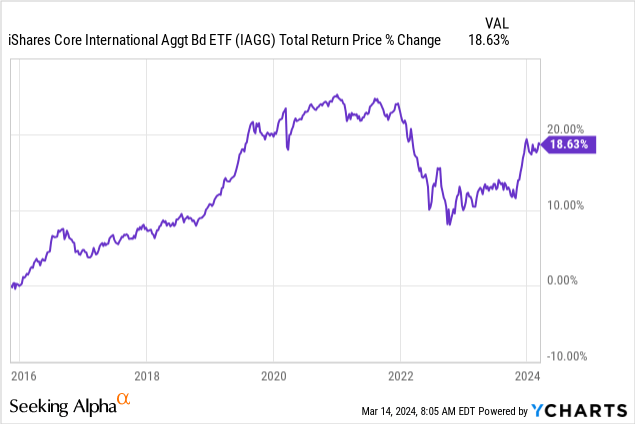

BWG and FCO are also global funds that have performed poorly relative to their U.S. peers over the past decade.

Y chart

The iShares Core International Aggregate Bond ETF (IAGG) may not be a good proxy for BWG and FCO because the fund invests overwhelmingly in debt rated A or above, accounting for more than three-quarters of the fund’s allocation. Still, it gives us an idea of how weak IAGG’s performance is relative to its U.S.-based twin, the iShares iBoxx Investment Grade Corporate Bond Fund (AGG).

So we’ve seen poor performance, but that’s more because fixed income isn’t a very attractive place to invest overall and global investing has historically been worse. That, coupled with higher expense ratios and leverage, then makes the situation worse and amplifies the downward trend these two companies have seen over the past few years.

in conclusion

Overall, FCO may not be a bad fund, but it’s certainly priced high, which is a concern since it appears to be driven solely by “yield.” One benefit of the high premium is that they can issue shares through market issuance. This increases the NAV because it is done at a premium, and the higher the premium, the better. For example, in fiscal 2023, the fund received $0.17 in NAV from the issuance of shares.

Still, even taking that into account, there’s still a huge gap between the fund’s profits and the amount paid out to shareholders. Anything above a 20% distribution rate on an NAV basis will eventually need to be adjusted. They really have to do this or the fund will eventually go to zero.

When such cuts occur, the damage can be quite severe in terms of the reaction to stock prices. Therefore, if you are looking for global debt exposure, a swap with BWG appears to be a solid option. This measure has already had some effect, but I suspect there will be more to come.

Editor’s note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks.