chengwaidefeng

Vista Energy, SAB de CV (NYSE: VIST) looks promising in 2024 as the company trades at a lower valuation and has strong double-digit revenue and earnings growth consensus estimate.Crude oil price expected to be stable Oil production in 2024 and 2025 should help the company maintain high profitability metrics.

company background

Vista Energy is a $3.76 billion oil and natural gas producer headquartered in Mexico. VIST’s main assets are located in Vaca Muerta, Argentina’s Neuquina Basin. The company also has assets in Mexico’s Marcus Pana Basin. Vista’s total proven and probable reserves are 318.5 MMboe.

Vaca Muerta is what the company considers Key Value Drivers. The reason is that Vista has 1,150 sites under development in Vaca Muerta, including 99 wells that have been drilled.this As of the end of 2023, the company’s proven reserves at Vaca Muerta were 308.4 MMboe. The Vaca Muerta well’s productivity is considered the best in the basin.

Vista has proven reserves of 10.1MMboe in the Macuspana Basin in Mexico. The company believes future growth in the basin will come from infrastructure upgrades, field development and exploration of untested deeper formations.

growth catalyst

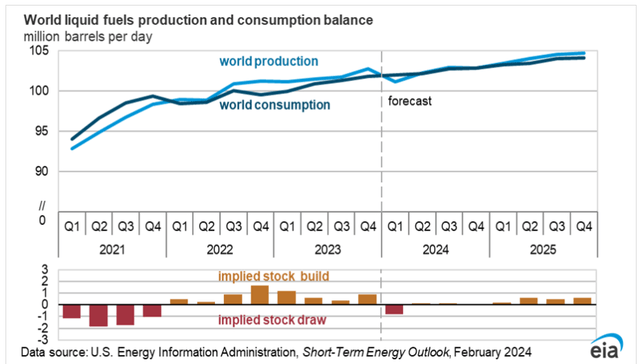

Vista Energy has a number of positive catalysts that could drive growth in 2024 and beyond. At the macro level, oil prices are expected to remain stable according to forecasts from Eia.gov. EIA expects Brent crude oil prices to average about $82 per barrel in 2024 and $79 in 2025. For context, Brent crude oil prices will average around $82 per barrel in 2023. WTI crude oil is still expected to be a few dollars a barrel cheaper than Brent crude oil. Therefore, conditions favorable to Vista in terms of oil prices in 2023 should continue into 2024.

The expected stable price of crude oil is due to the balance between supply and demand of crude oil. Oil production is expected to roughly match demand (consumption) over the forecast period, as shown in the chart below.

EIA.gov

If oil prices do remain stable in 2024, Vista Energy will be able to maintain strong profitability metrics. VIST has delivered high double-digit margins and returns over the past 12 months. VIST’s gross profit margin (GM) is 74%, EBITDA margin is 80%, ROIC is 24%, ROE is 38%, and ROA is 15%.

For context, I’ll provide metrics for Vista competitors. northern oil and gas (NOG)’s GM is 80%, EBITDA margin is 93%, ROIC is 23%, ROE is 66%, and ROA is 21%. enaplas corp. (ERF)’s GM is 65%, EBIDTA margin is 63%, ROIC is 26%, ROE is 40%, and ROA is 22%. Notably, Enerplus is being acquired by: chord energy (CHRD). The acquisition should improve Chord’s profitability, as Enerplus has higher margins and returns. Chord Energy’s GM is 56%, EBITDA margin is 54%, ROIC is 16%, ROE is 21%, and ROA is 15%.

All three companies are top performers in the industry. They all benefit from stable oil prices as they increase production through increased drilling capacity and utilization rates. Vista Energy expects production to increase from 68,000 barrels of oil equivalent per day to 70,000 barrels of oil equivalent per day by 2024. Vista expects this to result in an increase in EBITDA of $1 billion to $1.5 billion based on oil prices of $65 to $70 per barrel. Vista aims to double production to 100,000 barrels of oil equivalent per day by 2026. This gives Vista a positive long-term outlook as oil prices are expected to remain stable.

Northern Oil & Gas expects the company’s daily production to reach 115,000 to 120,000 barrels of oil equivalent by 2024, compared with the company’s fourth quarter 2023 production of 114,000 barrels of oil equivalent. In addition to existing organic growth, Northern Oil and Gas has an acquisition strategy for continued growth. assets.

Enerplus expects total production in 2024 to average 99,000 barrels of oil equivalent per day, which will be lower than the average of 100,015 barrels of oil equivalent per day achieved in 2023. Of course, this estimate could change based on the completion of the Chord Energy merger, which is expected to close. Mid-2024.

Chord Energy believes the combined company will have the best inventory in the Bakken. Chord also expects to benefit from significant synergies from the acquisition. These capital, management and operating synergies are expected to amount to $150 million annually. The total value of synergies is expected to exceed $750 million.

I think both Vista and its competitors are likely to do well in 2024. Stabilizing oil prices and efforts by these companies to increase production should help drive revenue and earnings growth this year.

What I like about Vista is Expected strong revenue growth of 49% According to consensus forecasts, earnings will grow 51% in 2024.Nog is Revenue growth is expected to be less than 1% Earnings are expected to fall 24% in 2024. Expected Enerplus Revenue fell 2%, but profits grew strongly by 51%. Chord Energy Estimated Revenue grew by 1.5% and profit by 7.5%. Of course, the merger between Chord and Enerplus could change those expectations. Overall, Vista has the highest combination of revenue and earnings growth expectations, allowing the stock to outperform other stocks. If these expectations are met or exceeded, this could serve as a powerful catalyst for the stock.

Valuation

I use the forward EV/EBITDA ratio to compare Vista to its competitors because it is a standard valuation metric for oil and gas companies. The EV/EBITDA ratio values a company based on earnings before interest, taxes, depreciation, and amortization (while eliminating debt). The EV/EBITDA ratio is important for valuing oil companies because they tend to carry large amounts of debt, and EV includes the cost of servicing that debt.

I also use the EV/2P ratio, which values a company based on its total proven and probable reserves. The importance of the EV/2P ratio is in determining how to value a company based on its potential growth, as reserves may be clawed back over time. Here’s how these companies compare:

| shown | However | ERF | CHRD | |

| Forward EV/EBITDA | 3.6 | 3.7 | 4.2 | 3.12 |

| Electric vehicle/2P | 1.27 | 1.35 | 2.9 | 0.82 |

Source: Seeking Alpha and SEC filings

EV/2P is calculated as follows:

Vista: EV is US$4.22 billion/2P is US$3.3 billion; NOG: EV is US$5.61 billion/2P is US$4.156 billion; ERF: EV is US$3.85 billion/2P is US$1.321; CHRD: EV is US$7.02 billion/8.53 Dollar

The 2P value is taken from each company’s SEC filings through the end of 2023. These values are calculated in accordance with US SEC standards.

Based on these metrics, Chord Energy has the most attractive valuation. Vista ranks second, and its valuation is relatively close to Chord. Frankly speaking, all four companies have EV/EBITDA ratios below 5 and EV/2P ratios below 3, and their valuations are all attractive. Generally, an EV/EBITDA ratio below 10 is considered healthy for oil and gas companies.For context, the global EV/EBITDA ratio The energy industry in 2023 is 12.5. I can’t find sector or industry averages for the EV/2P ratio. However, we can see that VIST’s EV/2P ratio is attractive among its competitors.

technical perspective

Weekly Chart of Vista Energy (VIST) and RSI (Trading View)

Vista stock has had strong positive momentum over the past three years. The stock has been trading in and out of overbought territory on the weekly chart for the past few years. The stock recently re-entered overbought levels. Therefore, investors may want to wait for a pullback before entering the market. The stock tends to experience retracements of 10% to 40% while rising in long-term uptrends. The stock’s attractive valuation and strong growth will likely keep the stock on a positive upward trajectory.

Vista Energy’s Long-Term Outlook

Vista’s total proven and probable reserves are 318.5 MMboe, which could last more than a decade (approximately 12.5 years) if the company produces 70,000 barrels per day or 25.55 million barrels per year. Of course, the company’s reserves can grow over time through continued exploration and acquisitions.

The company’s low valuation leaves the stock with room to grow. Vista’s strong double-digit revenue and earnings growth should drive the company’s stock price higher as the company ramps up production. Stable oil prices could help Vista meet its revenue and profit expectations.

Vista’s biggest risk is an unexpected sharp drop in oil prices, which could have a negative impact on revenue and earnings. Another risk is an economic recession, which could reduce demand for Vista’s oil and gas. Potential investors should also be aware that the stock may experience frequent and sharp retracements. Therefore, they may need to have some tolerance for high volatility in stocks.

If things remain favorable for Vista (stable oil prices and a strong economy), there’s a good chance the stock will outperform. The stock’s above-average gains could be due to Vista’s above-average growth and lower valuation.