eternal creativity

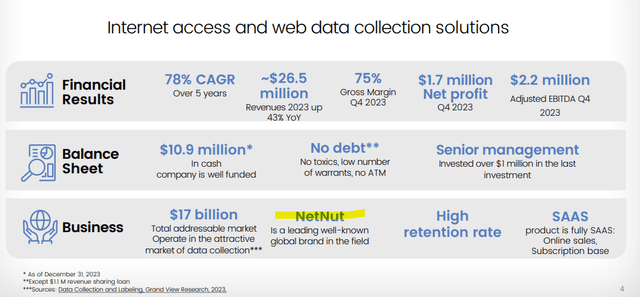

Wing Technology Corporation (NASDAQ: Alar) announced its latest quarterly results, capping a transformative year for the Israeli software company.Decided to withdraw from the network security business and other non-core businesses in 2023 to focus on its “NetNut” network data collection Significant increases in sales and profitability are proof that the platform is paying off. The launch of new tools based on artificial intelligence represents a new driver of growth.

With a market cap of just $120 million, the company is still small, but its impressive operating trends and solid fundamentals prove it has some real value. ALAR’s shares are up more than 1,100% in the past year, and it’s worth keeping a close eye on.

ALAR Financial Review

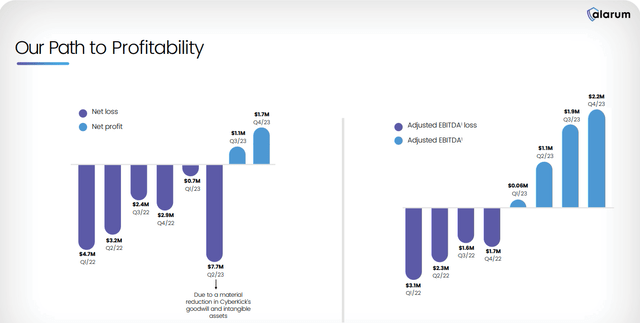

alar report Fourth quarter net profit 1.7 million US dollars, reversing the loss of -2.9 million US dollars in the same period last year.Revenue was US$7.1 million, an increase of 38% annually and a quarterly increase of $6.75 million for the third season. Full-year revenue was US$26.5 million, an increase of 43% year-on-year.

Source: Company IR

This is the second consecutive quarter of profitability, with net profit climbing to $1.7 million from $1.3 million in the third quarter. For the full year, results were weighed down by large write-offs related to the CyberKicks divestiture and goodwill accounting charges in the second quarter. Nonetheless, 2023 adjusted EBITDA of $5.2 million has climbed sequentially over the past four quarters, including $3.2 million in the fourth quarter, highlighting underlying earnings momentum.

Source: Company IR

We mentioned the strong growth story. NetNut’s full-year revenue was US$21.3 million, accounting for 80% of the overall business, an increase of 150% over the same period last year. By this metric, the underlying trend is even stronger than the overall metric, considering NetNut is the main focus right now.

NetNut’s surge has been driven in part by the launch of new products, including the SERP Scraper API, while winning new customers in the fintech market. Management noted that the response to the AI capabilities has been positive.

The standout metric is net retention rate for the quarter, which reached 153%, up from 144% in the third quarter. The explanation here is that existing customers are spending more on the various tools on offer, far beyond the impact of regular customer churn.

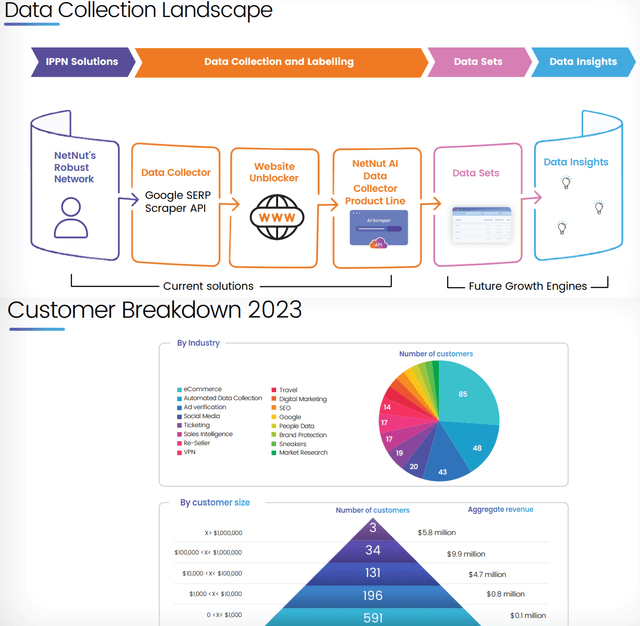

For context, Alarum’s target market is web-based businesses that need to collect traffic trends or customer insights. In terms of use cases, the types of tools offered include ad verification, brand protection, search engine optimization (SEO) monitoring and web data extraction.

Source: Company IR

An example of explaining the value proposition considers how websites often need to present different landing pages and even pricing options based on the user’s geographic location. NetNuts’ Internet Protocol Peer-to-Peer Networking (IPPN) tool can simulate users browsing the Internet, which is an important aspect of competitor analysis.

We found that Alarum’s industry diversification is relatively high, covering e-commerce customers, social media websites and ticketing platforms. While most clients contribute less than $1,000 in annual revenue, 37 clients have annual sales in excess of $100,000, with three clients having liquidations in excess of $1 million.

Finally, we note that ALAR ended the year with US$11.0m in cash and zero debt. We believe the balance sheet is a bright spot in the company’s investment profile. While no official financial guidance was provided for 2024, comments on the earnings call indicated optimism that this trend will continue in the year ahead.

What’s next for ALAR?

With a current market cap of about $110 million, Alarum Technologies falls into the micro-cap category, but the company is an outlier compared to any negative connotations that come with classifying it based on recent trends. The appeal here is that when we put the numbers together, it’s clear that ALAR isn’t just a speculative “penny stock” or simply climbing due to artificial intelligence hype.

Annualizing fourth-quarter earnings to $6.8 million, or an adjusted EBITDA run rate of $8.8 billion, ALAR’s implied forward P/E ratio is about 17x or 12x as an EV for the forward EBITDA multiple. We believe these multiples are very attractive for a company that just achieved 43% revenue growth last year. The benchmark here is that the company can grow sales by at least 20% by 2024.

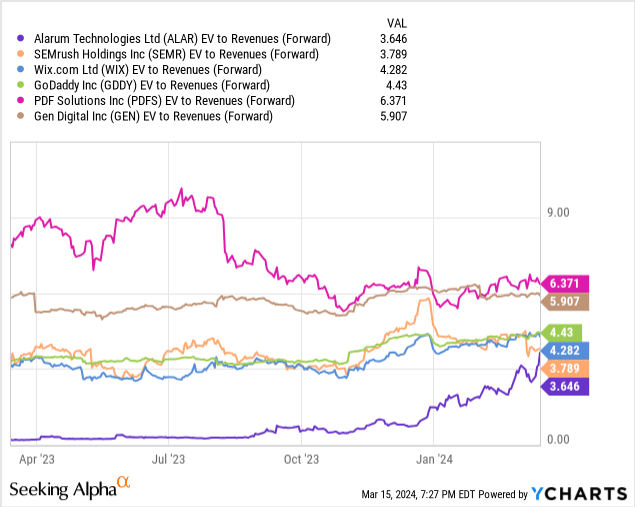

It is worth noting that ALAR’s EV revenue multiple of 3.6x is still lower than what we consider to be comparable network access and network data service providers, including SEMrush Holdings Inc (SEMR), Wix.com Ltd (Wix. com Ltd )) is close to 5x the average. WIX), GoDaddy Inc (GDDY), PDF Solutions Inc (PDFS) and Gen Digital Inc (GEN).

Of course, the much smaller Alarum deserves some degree of small-company discount, but we’ve seen no sign at all that the stock is significantly overvalued or in a “bubble,” even with a 140% year-to-date gain.

On the other hand, we need to be wary that online tools aimed at online website developers may be vulnerable to a competitive environment.

Management commented on the earnings call that the company’s patents in the field and established relationships posed barriers to entry. Switching costs are also high for customers trying to switch to a different product.

Nonetheless, for a company of this size, this is an aspect that needs to be considered in the context of risk. With a critical eye, we would also view the limited number of large customers with over $1 million in annual revenue as a weakness, which would have a huge impact on quarterly results if Alarum loses contracts for any number of reasons.

final thoughts

We rate ALAR a Buy, feeling the stock remains under the radar and has room to expand its valuation multiple as the next few quarters confirm financial momentum. Monitoring points through 2024 include trends in gross margin, reported net customer retention, cash flow and adjusted EBITDA.

We’ve already covered some of the risks to consider, but we’ll add that we expect the share price to remain volatile and sensitive to changes in growth expectations. A broader market sell-off or weakness in the tech sector could push the stock price lower.