akiyoko/iStock via Getty Images

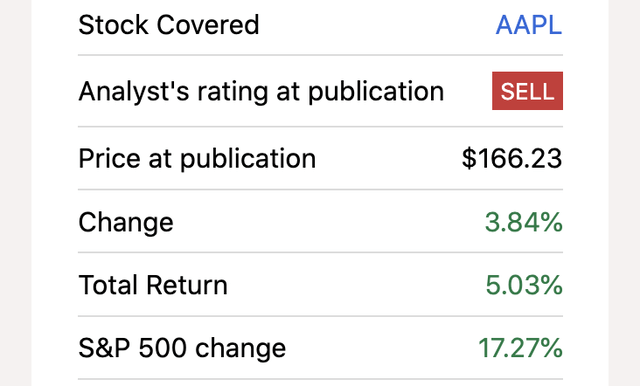

Just over two years ago, Stone Fox Capital warned investors: apple (NASDAQ:AAPL) is dead money for up to 4 years.The tech giant’s stock is going to be in trouble Strong new product development was needed to warrant then-current prices, let alone higher prices over the years.mine investment thesis Still extremely bearish on the stock, its valuation remains irrelevant to a lack of growth.

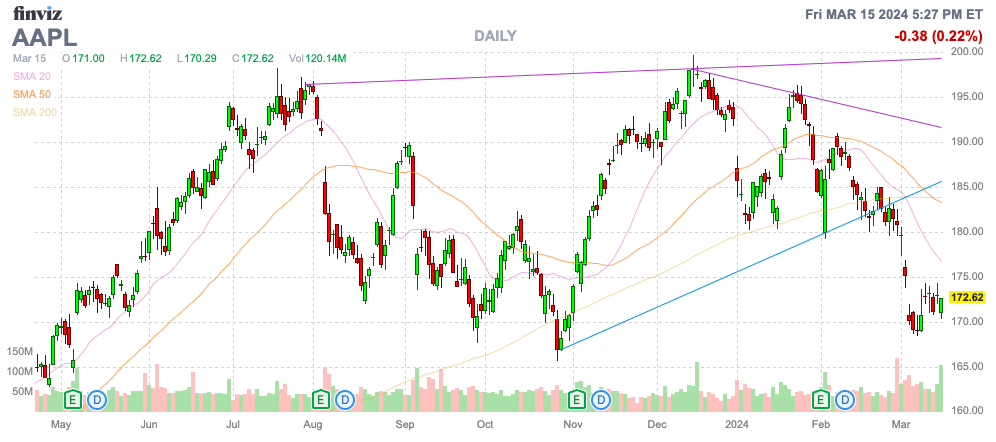

Source: Finviz

Problems encountered in product development

As early as March 2022, analysts predicted that Apple would reach minimal growth over the next 4 years, and the stock has already priced in significant growth. The main question is whether the tech giant can achieve such growth rates.

Apple does need new products such as AR/VR devices and self-driving electric vehicles to grow The interest rate required to guarantee the stock’s trading price to rise to $166. On that front, the Vision Pro recently posted low revenue forecasts due to production constraints, and the long-touted Apple Car program was discontinued.

The company enters the middle of fiscal 2024, and neither product is expected to bring material revenue to Apple in the next few years, and these products are the future growth drivers of the investment theme in fiscal 2022. The Vision Pro certainly got some positive feedback when it launched, but the $3,500 price tag and the complexity of making an AR/VR device limited supply and demand. Not to mention, Apple has yet to announce any roadmap for AR/VR devices, similar to how the iPhone releases new products every year.

Top analysts including Dan Ives of Wedbush Securities and Wamsi Mohan of BofA Securities predict Vision Pro will 400K to 600K range. At $3,500 per unit, revenue would only reach $1.4 to $2.1 billion in 2024, which would likely include the December quarter counting into fiscal 2025 sales.

Influential Apple analyst Ming-Chi Kuo even said sales have declined Significant slowdown The rush among early adopters has led to concerns about the strength of demand. Analysts said the MR device product roadmap has limited visibility, with cheaper versions expected to be launched in the first quarter of 2026, followed by new models with advanced technology in 2027.

Mohan expects sales of low-end models to reach 4 million units in fiscal 2026. At a cost of $2,000, the Vision Pro line could only generate $8 billion in sales, given the sharp slowdown in the demand equation for initial devices, and given the sharp slowdown in the demand equation for AR/VR devices in 2000 The dollar is still extremely expensive for consumer adoption, making this number somewhat high.

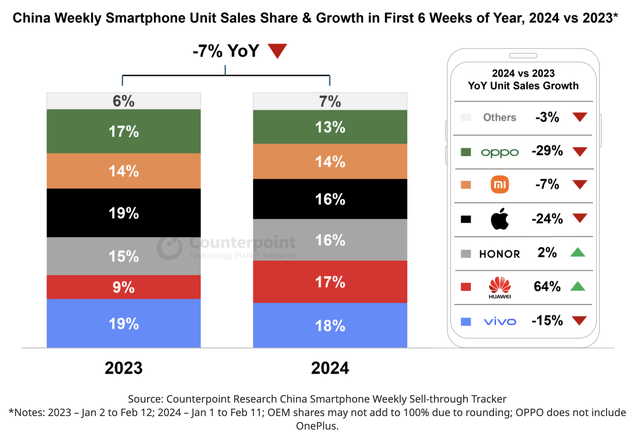

At the same time, Apple faces an existential threat in China as iPhone sales plummet. Counterpoint Research records show that despite restrictions on U.S. chips, Huawei surprised the market with competitive smartphones, with iPhone sales in China falling 24% in the first six weeks of 2024.

Source: Counterpoint Studies

At the beginning of 2024, Huawei’s sales increased by 64% year-on-year, while sales of other smartphone manufacturers declined. China’s total sales fell by 7% year-on-year, causing Apple to weaken significantly. On the basis of weak sales levels, its market share dropped by 3 percentage points to 16%.

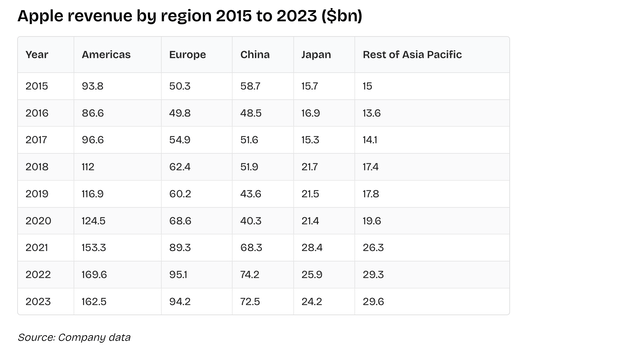

China is a big issue for Apple, accounting for 19% of total revenue in FY23. With annual sales of $73 billion, the country is the tech giant’s second-largest region, behind Europe as a whole with $94 billion.

Source: Applied Commerce

In fact, unless the iPhone 16 sees additional demand from its artificial intelligence focus, Apple has no bright spots on its product development roadmap. The iPhone 15 faced problems from the start, with no major upgrades, leading to indifference to upgrading a $1,000+ phone.

iPhone generates now $200 billion Annual sales and weakness in the Chinese market are a major concern. Even with the early rollout of 5G iPhones and the Covid pandemic, iPhone sales are still only slightly above the $166 billion level in fiscal 2018, given demand issues. Apple’s iPhone sales are still roughly the same as in fiscal 2015, when sales exceeded 230 million units for the first time, with all revenue growth coming from higher average selling prices.

Stock weakness should persist

The original “dead money theory” was written back in March 2022, with Apple up just 4% during that period, while the S&P 500 rose more than 17%. During that time, the stock rose to highs of nearly $200, and investors were warned of the possibility of an irrational rally as high as $250.

Source: Seeking Alpha

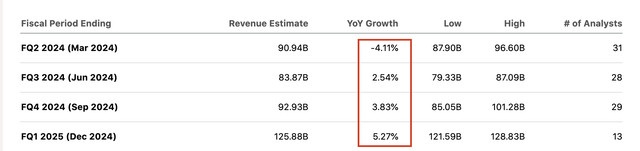

The key here is that Apple has now had five consecutive quarters of minimal or negative growth, and future forecasts aren’t particularly impressive. The company expects sales in the first quarter of 2024 to be down $5 billion, or 4%, from sales in the second quarter of 2023. Analysts’ growth forecasts for the next three quarters appear particularly aggressive given iPhone sales problems in China and the lack of new product innovation to boost revenue.

Source: Seeking Alpha

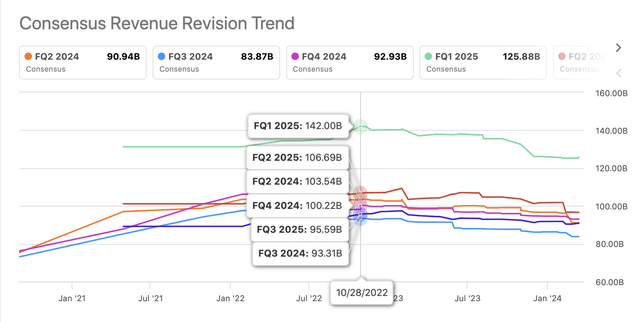

A classic example of analyst forecasts being too aggressive for a period of time is revenue targets for 1Q25. The consensus target for October 2022 was $142 billion, and the number has now fallen below $126 billion, growing only 5% year-over-year.

Source: Seeking Alpha

As we’ve highlighted in our research over the past two years, Apple has historically been largely in line with analyst targets for the coming quarters. The tech giant will beat expectations slightly and see limited growth. Only during the COVID-19 pandemic did sales growth accelerate and the company began beating analysts’ expectations, but excess growth during that period may be part of the reason for the current weakness.

The original Dead Money article even predicted what FY25 earnings per share estimates would look like if Apple beat analyst estimates by 5% per year. In the bullish cash case, the EPS target remains just $8.82, while analyst consensus now expects earnings of just $7.16 per share.

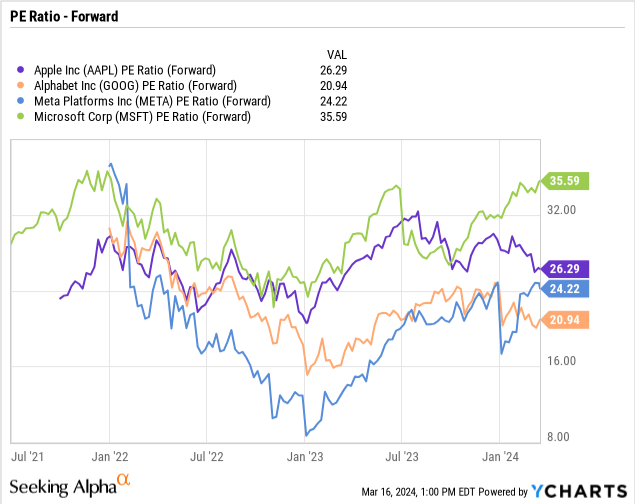

Even in a best-case scenario where Apple achieves 6% annual growth and beats analysts’ earnings-per-share targets, the stock still doesn’t justify the $166 price. Now, Apple’s stock price is still 26 times the lowered earnings per share target, which is obviously unreasonable.

The stock’s price-to-earnings ratio remains higher than meta platform (yuan) and Google (GOOG) This comes despite the fact that these companies are heavily involved in artificial intelligence and have reported strong growth. Microsoft (MSFT) trades in a different mood at nearly 36 times forward EPS target.

While the market has favored these seven Magnificent stocks over the past two years, there are still several stocks that have significantly lagged the market during difficult times. One has to really question why Apple’s valuation is so favorable, with even a 20x P/E yielding a stock price of only $143.

Likewise, the market may actively predict Apple’s earnings per share growth rate of 7% to 10% over the next three years. Even if the company achieves these goals, Apple should be lucky to trade at a P/E ratio of 15x without any clear new products providing a path to real growth from a revenue base approaching $400 billion.

The Vision Pro is the only product to generate consumer interest, but the general consensus is that sales will only be in the billions over the next few years, and the product will age rapidly entering fiscal 2026. So far, Apple hasn’t shown any signs of updating its products.

take away

The main takeaway for investors is that warning investors that Apple should be dead money within four years is actually overly optimistic about the results. The stock should see a sizable decline due to weak results and continued product development failures. Chief Executive Officer Cook, who turns 64 this year, may be starting to feel pressure to retire after another year of lackluster growth and weak product development that led to a weak stock price.

Investors should view shares still trading above $170 as a gift. In a normal market, Apple would be lucky to be trading at 15x its EPS target, resulting in a stock price of just $107. The stock is vulnerable to more than two years of consistent dead money, and the real risk is that investors face negative returns during that period while watching years of gains disappear.