Angelo D’Amico/iStock via Getty Images

Pfizer (NYSE:PFE) had a tough couple of quarters.

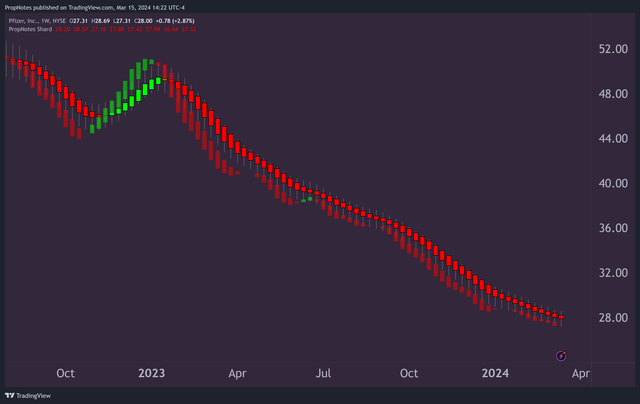

The company’s well-known Covid products, including the vaccine (Comirnaty) and Paxlovid, led directly to huge revenue and profit growth, and then the stock price plummeted, as Pandemics as a global threat have broadly receded:

trading view

However, as Covid-based revenue and profits have shifted from a large portion of PFE’s revenue to a relatively smaller piece, PFE’s stock has once again become a question of balancing the company’s expiring patents against its new pipeline. It’s what we ultimately like.

Additionally, with shares trading at multi-year lows and valuations moving into attractive territory, PFE stock is starting to look quite attractive as a potential investment, both for value seekers and for yield. investor.

Today, we’ll take a closer look at PFE’s outlook, valuation, and momentum to explain why we rate the stock a Strong Buy. sounds good?

Let’s take a closer look.

finance

As we just mentioned, PFE’s financials have been suffering of late, largely due to post-pandemic declines in key coronavirus-related products.

Comirnaty and Paxlovid had previously acted as a sugar rush to PFE’s top and bottom-line results, but it’s now clear that the company is coming off those highs.

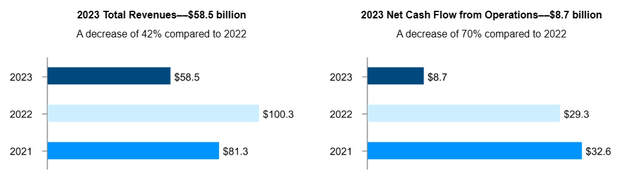

Revenue and cash flow decline 42% and 70%, respectively, from 2022 to 2023, largely due to the negative impact of Covid-related products:

10-K 10-K

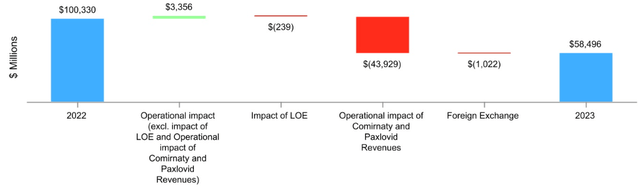

However, excluding the impact of COVID-19, PFE’s other income was Actually up 7%which may surprise some readers:

Excluding the contributions of Comirnaty and Paxlovid, Total operating income increased 7%reflecting increases in Nurtec ODT/Vydura and Oxbryta revenue; Abrysvo revenue primarily driven by the launch of a geriatric indication in the U.S.; and continued growth in the Vyndaqel family and Eliquis; partially offset by declines in Ibrance.

This is actually quite optimistic, as it proves that PFE’s “core” non-COVID products have held their own, while pandemic-related products have come full circle. Considering that these other drugs and therapies should drive the vast majority of PFE outcomes moving forward, it makes sense to start looking here.

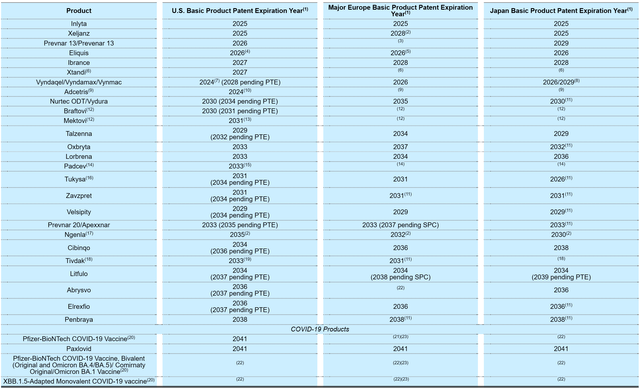

Recently, many people have paid much attention to the “patent cliff” of PFE. Indeed, many of PFE’s drug patents will expire in the next few years. This includes many important medications, including Eliquis, Prevnar 13, and Ibrance:

10-K

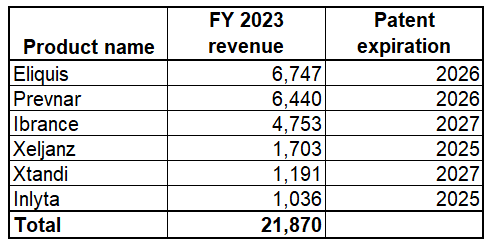

In a recent article, SA analyst KM Capital calculated the impact on PFE’s revenue over the next three years, and it’s significant:

Kaimei Capital

Fortunately, not all of the Prevnar series patents are about to expire, so the total value is just under $21.8 billion per year.

That said, with potential $19-20 billion in annual revenue largely due over the next few years, these expirations could have a significant impact on PFE’s stock.

About $32 billion of PFE’s $58.8 billion in annual sales could be at risk in the coming years amid the impact of the patent cliff and the likely continued decline of Covid products:

Now, this isn’t all bad news for investors.

While PFE’s patent issues and COVID-19 hangover appear to be serious, PFE’s pipeline is also strong and further strengthened by the recent SGEN acquisition that closed in December.

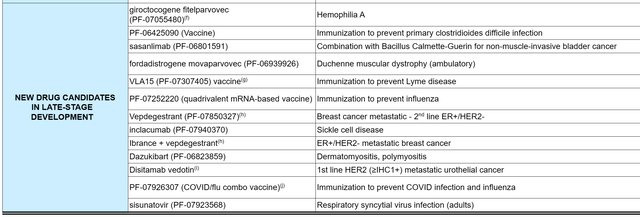

From an organic perspective, the number of new drugs in late-stage development continues to grow:

10-K

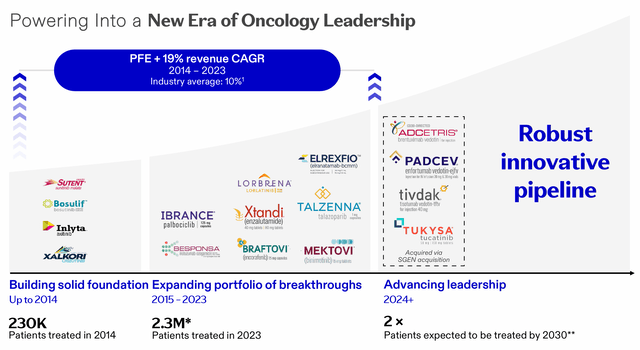

In addition, through the acquisition of SGEN, PFE’s focus on oncology (cancer) products may also lead to some potential blockbuster results in the future:

Investor introduction

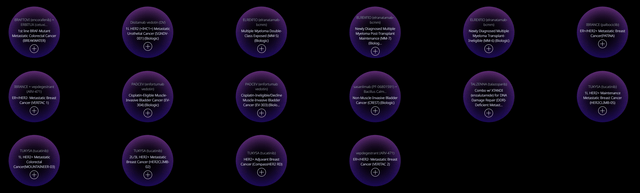

Overall, there are 31 Phase 3 projects in the PFE pipeline, many of which have a good chance of developing into products that can shoulder the revenue burden of products with expiring patents, and potentially even increase cash flow further.

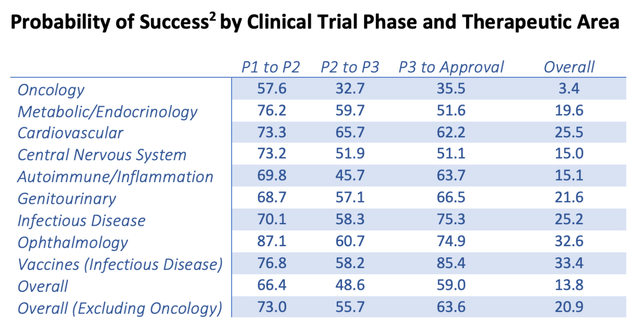

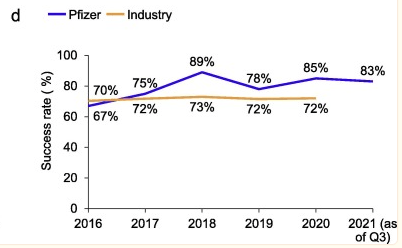

Statistical data shows that quite a few P3 drugs are approved along the way, with an average between 60%-70%:

Yaksh

Expectations should be somewhat tempered as 16 of PFE’s 31 P3 projects are in oncology, an area with lower historical approval rates:

Pfizer

That said, with less competition in oncology, the chances of a drug becoming a blockbuster are higher if it gets approved.

Alternatively, use PFE better than average P3 success rate, we see huge potential here:

american institutes of health

Overall, we are excited about the prospects for this pipeline.

There is also evidence that this strategy is working.

Recently, SGEN’s newly acquired project Adcetris completed its primary endpoint trial, laying the foundation for monetization and productization:

Pfizer (NYSE: PFE ) on Tuesday announced positive results from a Phase 3 trial of Adcetris, its antibody-drug conjugate developed with Takeda (NYSE: TAK ), in a new lymphoma condition, potentially supporting future regulatory filings.

According to the company, its ongoing ECHELON-3 trial showed Adcetris as a combination therapy to achieve a statistically significant and clinically meaningful improvement in overall survival, the trial’s primary endpoint.

The nominal revenue that such a product could generate for PFE is modest, but it’s a step in the right direction and proves that PFE’s consolidated pipeline still has some upside.

Overall, we believe PFE’s robust pipeline and oncology-focused growth strategy should more than offset the COVID-19 pandemic and falling patent cliff. Management may have to take steps as revenue drivers decline, but managing these risks is something the company is good at now given its long track record of success.

value

But how much is this company worth?

Analysts expect that PFE’s earnings per share will actually grow in the coming years as management balances patent consumption with new products and the company’s recently announced cost-cutting plan significantly improves OM% and net profit margins:

quick chart

Earnings per share are expected to grow to around $2 by the end of 2025, which seems reasonable to us.

The key here is how PFE’s valuation is reflected.

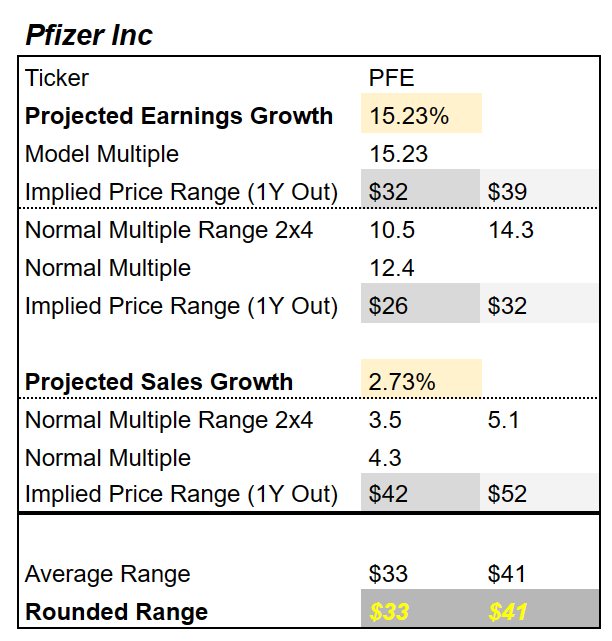

Currently, we currently peg PFE’s “fair value” range at $33 to $41, which is significantly higher than where the stock is currently trading:

www.propnotes.co

By averaging model and historical multiples, we believe PFE has ~18% upside potential from its “fair value” area.

In this model, we use 12.4x EPS and 4.3x sales as a baseline for “historical” multiples, since that’s the rough blended average of the stock over the past 5 years.

In addition, the expected EPS growth rate is 15.23%. We apply PEG as 1, showing PE=G, which is a highly acceptable model for companies with a growth rate higher than 15%.

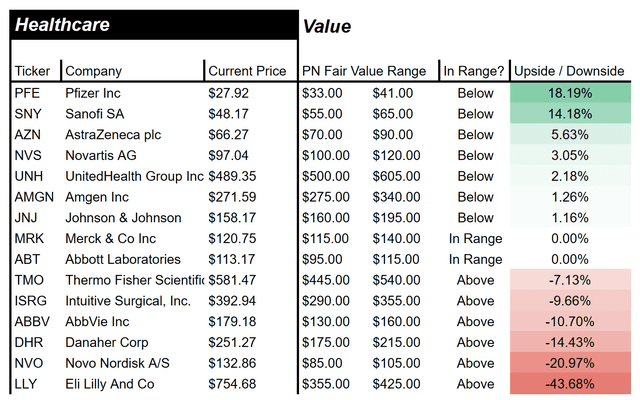

That makes it the most discounted healthcare company we currently cover:

www.propnotes.co

All in all, with a strong pipeline and an attractive valuation, including potential upside where investors can fully participate in the company’s growth, PFE appears to be an attractive investment candidate at this time.

Plus, with a generous 6% dividend, you’ll be paid handsomely while you wait for your paper to be published.

risk

That said, there are some risks.

First, as is the case with nearly every major pharmaceutical company, the pipeline is a key risk. Revenue streams almost always disappear, so the strength of your pipeline is critical.

Currently, there are 31 projects in the pipeline, and we believe management is very likely to produce more blockbuster products that will improve people’s lives and improve health. However, as the focus on oncology increases, and historically only 35% of P3 oncology drugs/therapeutics have received industry-wide approval, the risk in this regard increases.

Additionally, PFE stock momentum is terrible:

trading view

Shares have been plummeting since their peak during the pandemic, and no one seems willing to buy.

We think the value is compelling now, but it may take some time for the market to agree, so it may be too early to buy now and investors may suffer losses on the momentum factor for a period of time, even if things fundamentally improve.

This is a risk worth considering.

generalize

But overall, PFE looks like a “Strong Buy.”

Shares look historically cheap, the pipeline looks healthy, and although issues like COVID-19 and the patent cliff have shaken investor confidence, we ultimately believe risks are now tilted to the upside.

Good luck!