Minal Pal

ICICI Bank, India’s second largest diversified banking group (NYSE:IBN), has made great progress since its establishment Governance failure Under former CEO Chanda Kochhar.Current CEO Sandeep Bakshi is not only scandal-free (so far) but has all the rights checked Basic box.bank most recent quarter is a case in point – compared to major peer HDFC Bank (HDB), saw Erode everything On the P&L front, ICICI Bank has shown better resilience and charted a clear path to defend margins going forward. To be clear, the road ahead will not be smooth as India’s system liquidity remains very tight even after the recent infusion of funds; therefore, competition for low-cost deposits will continue to be fierce in the coming months.

Bloomberg

Regardless, ICICI Bank’s structurally low funding costs stand out and should help Underwriting continued credit and earnings growth throughout the cycle. It’s also worth keeping the bigger picture in mind; after all, nominal GDP growth in the low teens is the norm in the countries where the group operates, and as the latest monthly credit data shows, there’s still plenty of demand for loans.

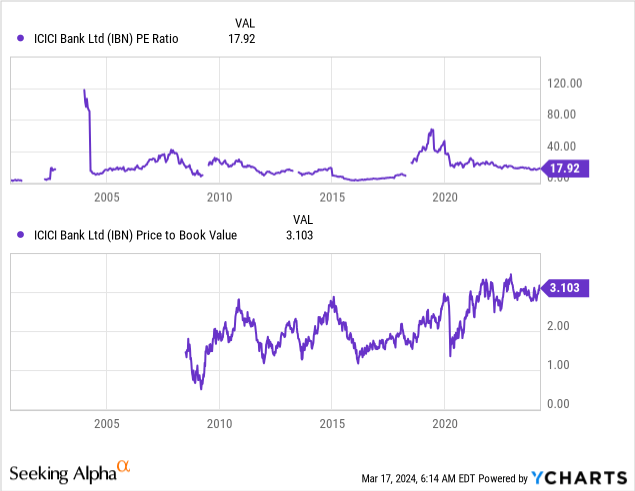

The problem is, at its current high double-digit forward P/E ratio (about 3 times book value), this isn’t a traditionally cheap bank stock. However, the multiple is below historical levels and, more importantly, is supported by a consistently high 1% ROE and a 20-30% earnings growth runway. I don’t usually like to own banks entering rate cut cycles, but ICICI Bank is a rare exception given its stellar fundamentals.

Resilience shines against a difficult backdrop

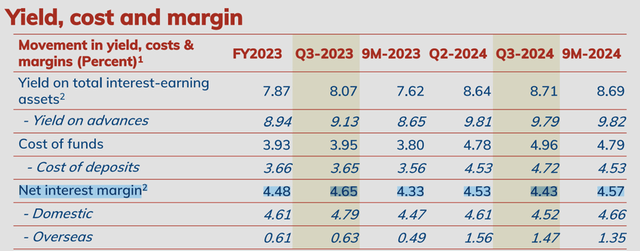

Not surprisingly, ICICI Bank has been facing some net interest margin (NIM) pressure in recent quarters. The latest report for the third quarter of fiscal 2024 showed more of the same, with net interest margin falling about 10 basis points sequentially to 4.4%. Nonetheless, management provided some good news in its latest guidance, calling for deposit repricing pressures to largely end over the next quarter or two. This is partly supported by deposit trends in the third quarter – up 19% year-on-year. The bank is fully capable of meeting loan demand, and its loan-to-deposit ratio of 87% is also very attractive in the Indian private banking sector. Essentially, ICICI Bank’s net interest margin is likely to have bottomed out at around 4.4-4.5% – an impressive result given the ongoing funding cost pressure across the industry.

ICICI Bank of India

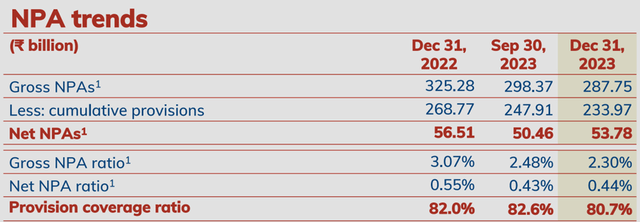

Equally critical is that the bank has achieved this resilience while maintaining discipline on its lending front. Note that the bank indexes higher yield/higher risk unsecured lending – an area that has come under increasing regulatory scrutiny in recent months. This discipline is also reflected in its capital buffers, with ICICI Bank’s provision coverage ratio remaining among the highest in the industry. However, despite the one-off impact of weather on agriculture, the asset quality environment in India is quite benign, so I feel very comfortable with underwriting well-managed credit cost results for banks.

ICICI Bank of India

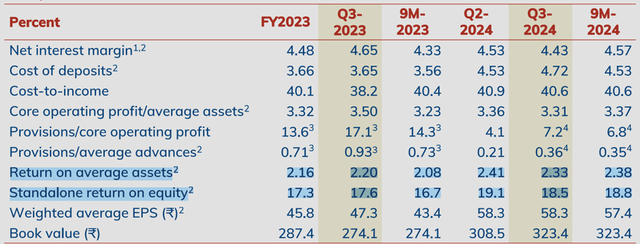

Earnings were also boosted by improved fee income from non-bank businesses such as investment banking, insurance and asset management. On the cost front, management has guided for a slowdown in headcount additions, which bodes well for operating leverage (i.e. cost growth is lower than revenue growth). So, net interest margin pressure aside, there is enough leverage here to offset any headwinds and maintain the bank’s financial targets going forward (ROA >2%). Unlike other private banking peers, it’s no surprise that ICICI Bank share price continued to rise after the earnings release.

ICICI Bank of India

Increases and decreases in monthly data; near-term upside potential

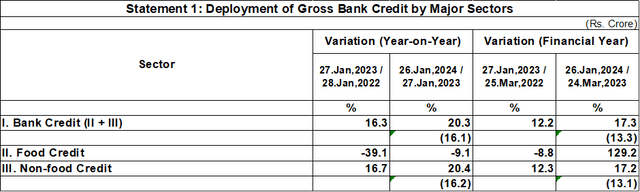

The outlook is bright for ICICI Bank heading into the next quarter.Monthly subscription credit growthAccording to data from the Reserve Bank of India (RBI), the index remained strong, growing 16% from the same period last year.For context, this overall figure comes despite a number of headwinds, most notably the Reserve Bank of India’s implementation of higher risk weight these segments in the second half of last year. This was followed by a slowdown in deposit growth in the banking system (low double-digit annual growth, compared with high double-digit annual loan growth) – a result of tight liquidity conditions in the system. Regardless, ICICI Bank’s loan growth has been outpacing the system and should continue to do so as it is not dependent on high-yielding unsecured loans. Instead, much of its growth has been built on retail and small and medium-sized business lending – two areas that have led the growth of system credit in recent months.

reserve bank of india

Currently, management remains Guidance is fairly easy to manage Heading into fourth quarter/full year results. Yes, people expect credit to grow more, but most importantly, at a slower pace. Likewise, in riskier non-bank financing, the central bank has adopted a more stringent and therefore slower-growing approach. The key to beating the raise, though, may be the deposit. With system credit growth still significantly ahead of deposit growth, ICICI Bank’s ability to secure “stickier” and lower-cost retail deposits stands out and should be able to meet the loan growth challenges of other banks in the sector.

final thoughts

ICICI Bank has outperformed major banking peer HDFC Bank in recent months, and for good reason. Although the two entities now look more similar after the latter’s mega-merger, ICICI Bank’s complete funding cost advantage makes it stand out amid the challenging liquidity backdrop. Ahead of the RBI’s easing cycle, ICICI Bank’s low-cost funding base is expected to shine, allowing it to sustain best-in-class loan growth and returns without taking on balance sheet risk.

Regardless, the bank is still in the early stages of its long-term growth story, so even if we do see some near-term margin pressure, there’s plenty of room for earnings to compound significantly higher over time. Yes, the stock is up as well, although most of the upside comes from earnings growth (currently 20-30%) rather than multiple expansions. At the current high double-digit forward price-to-earnings ratio (which is attractive relative to historical trading levels and the bank’s fundamentals), valuation is not as demanding as it initially appears.