Brandon Bell/Getty Images News

Last June, I published Valero: U.S. Gasoline Prices Will Soar This Decade as More Refineries Close, in which I explained my bullish outlook for Valero (NYSE:VLO).I believe the value of VLO will increase at that time because The “crack spread,” or the difference between gasoline and oil prices, has increased over time. My long-term view is that the price differential between refined products (gasoline) and crude oil will remain elevated as refining capacity is generally lower than U.S. demand. This gap stems from decades of underinvestment in capital and labor.

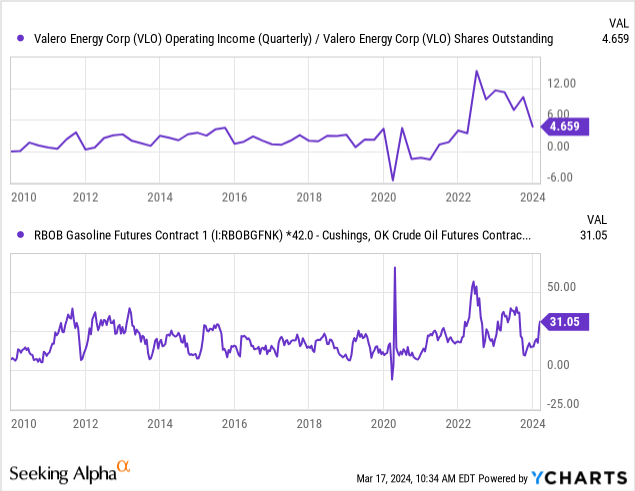

Since then, VLO has posted a total return of 50%, beating the S&P 500 by a wide margin. Oil prices fell slightly, while gasoline prices barely rose. That said, the crack spread between the two increased, causing Valero’s core profit driver to rise again. See below:

Going forward, we need to consider whether the recent rally in the crack spread is sustainable, which could push VLO’s OI per share back into the $10-12 range. As VLO’s revenue outlook improves again, rising crack spreads have been a significant driver of VLO’s recent gains. That is, higher income is good for stock investors only if the stock trades at a reasonable valuation. In my opinion, VLO’s discount isn’t as big as it was when I last reported.

The golden age of refineries will continue to grow and end

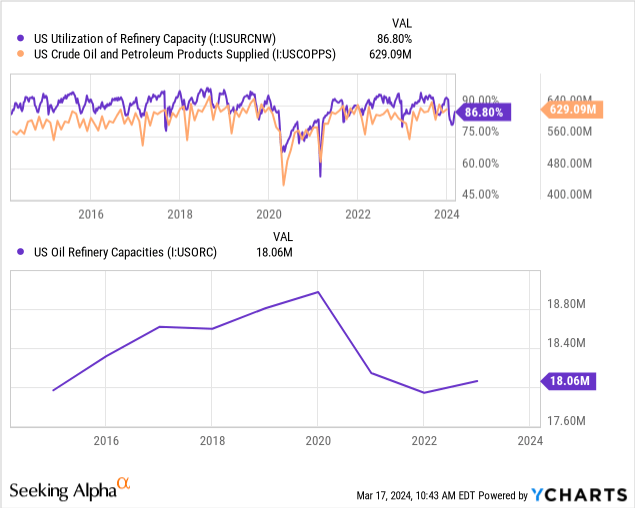

Refinery capacity remains significantly lower than 2020 levels, largely due to labor Shortages worsen in 2020. Today, demand for petroleum products is high, as shown in the Product Supply data. However, capacity utilization also dropped to 86.8%, showing a negative growth trend, indicating that U.S. gasoline supply continues to decrease. See below:

Existing refineries benefit from a lack of competition due to a shortage of skilled workers in the refineries and energy industry. Even a 1% gap between gasoline supply and demand could be enough to cause refiners like Valero to see a significant increase in profits because the energy market demand curve is so steep. Most consumers of gasoline and other energy products are unable to significantly reduce demand if prices rise, meaning refiners can benefit from potential oligopoly pricing power despite large barriers to entry.

These barriers include increased energy regulation, disinvestment in the fossil fuel energy industry, high capital costs (physical and monetary), and a lack of skilled labor for refinery capacity expansion. In my opinion, this latter point has not been discussed enough, but is very important as we look to the future. aging energy sector The workforce is not being replaced by younger generations.There is some logic to this, as it may be unwise to pursue a career in an industry that may not exist twenty years from now, and should be downsized Within ten.Also, building a new refinery is not a great business decision because that won’t change Profit for ten years or moreby which time U.S. natural gas demand should decline.

I don’t think America will ever give up on gasoline, as some people think. Electric vehicle sales remain is growing rapidly while traditional car sales are slowing. The price of electric cars is getting closer to that of traditional cars.This transition may take longer than expected, but new technologies, e.g. solid state battery Demand for electric vehicles is also likely to accelerate as range and cost issues are resolved. Therefore, I only expect Valero to make significant profits over the next year or two, with significant improvements in EV technology carrying huge risks. Thereafter, the refinery can only be used for chemical production, which means >90% overall sales decrease.

So for Valero to be a Buy today, we would have to expect positive discounted cash flows from today to that time commensurate with its valuation. I think Valero and its peers will benefit greatly from the natural shortage of refining capacity due to poor long-term demand prospects. That said, since VLO’s earnings per share should decline over the long term, VLO’s current valuation must be relatively low to be justified.

RBOB crack spread rebounds again

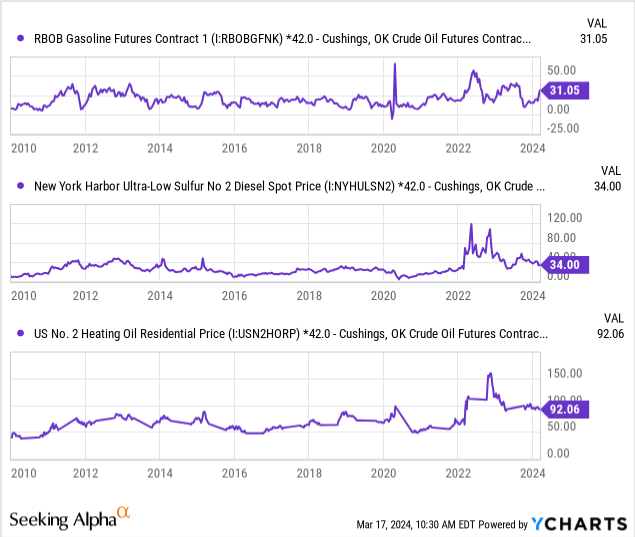

VLO grew slightly in the second half of 2023 and accelerated significantly in 2024, growing by 26%. Most of the gains occurred in the past month, with VLO growing 16% month-on-month. The recent peak may have been driven by a significant increase in the RBOB crack spread. Meanwhile, diesel spreads have declined, while heating oil spreads remain good. See below:

The core reason for the rise in RBOB crack spreads (most important for VLO) is the sharp decline in U.S. refinery capacity utilization due to reduced plant operations globally. us.maintenance and weather is the primary reason; however, these short-term pressures reflect long-term refinery issues that appear to be causing permanent difficulties for refineries seeking to maintain utilization. As we saw in 2020, these short-term stresses expose and (often) exacerbate long-term structural problems, leading to reduced supply.

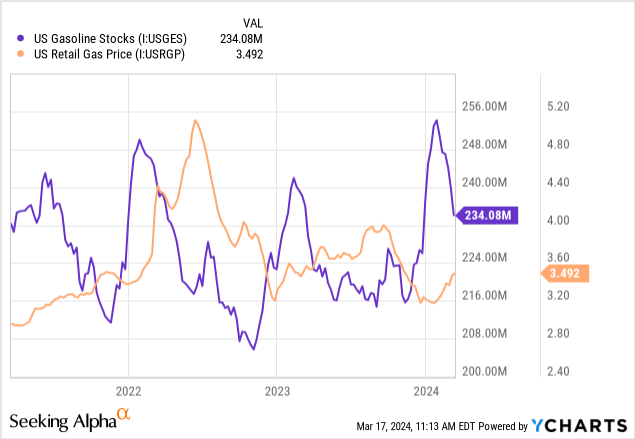

Gasoline storage has fallen sharply, causing retail gasoline prices to rise. See below:

Over the next month, I expect retail gasoline prices to rise closer to $4 as natural gas storage continues to shrink due to reduced supply. Much of this change has been reflected in the futures curve, as shown by the jump in the crack spread.

Of course, this temporary situation is driven by short-term factors at the refinery level. Therefore, I do not expect the crack spread to remain high above $30. Nonetheless, with each decline in refinery utilization, we see the RBOB crack spread creeping closer to the $30-40 range. In the new era, it seems unlikely that we will see the spread return below $20 long-term, as there is no reason to believe that widespread refinery shortages will permanently end anytime soon.

With this in mind, I expect VLO’s annual earnings per share to be close to $20 in 2024, and given the lack of a significant decline in U.S. gasoline demand, could remain close to or even above that level over the next five years. Analysts expect VLO to earn closer to $15-$16 per share, but that doesn’t take into account the recent increase in crack spreads. Additionally, I disagree with the analyst consensus that VLO’s earnings per share will remain stable at $8 per year, as its margins should remain relatively low over the long term due to long-term refinery issues until EV technology and adoption rates are high enough. high level.

bottom line

By my estimation, VLO’s forward “P/E” ratio is close to 8x, which could be as low as 5-6x if we assume a long-term increase in crack spreads, but could also be around 10-12x if spreads recover quickly reduce. For investors in less cyclical or faster-growing industries, a “P/E ratio” of 8x may seem very low. However, 8x is not necessarily low if we believe its EPS should fall to zero or even lower by 2040.

Yes, this is a long period, but there is a risk that it will be shortened.Ideally, Valero will play some role in the future of electric vehicles as it markets itself through a slew of products ESG-oriented values, but the vast majority of its assets today are old fossil fuel capital projects and they will lose value. So if VLO has a clean energy future, it will need to reinvest a significant amount of its earnings, which could potentially be better spent and returned to shareholders via dividends.

Overall, I think VLO’s current valuation is quite reasonable. I wouldn’t invest in it with the expectation of significant positive returns, nor would I short it. I think VLO could continue to rise in the coming weeks and months as speculative enthusiasm surrounding the refinery sector appears to be building, as is seen across much of the stock universe today. However, even if this makes me look wrong, I am by no means one to follow a speculative rally without fundamental support. At current prices, VLO appears to be supported by fundamentals, but if it trades just 10% higher than it does now, I’d be bearish on the outlook.