Sutiphon Chandon

investment thesis

I last covered this stock in November 2022, and wow, it’s down 82%.

Looking at the past few quarters’ earnings calls and Q10, aside from the macro impact on device sales, it seems To me, most of the reasons for the poor performance are due to management’s lack of execution, some are not, including – undermining ST’s growth, losing its largest customer – T-Mobile impacting its ODS revenue, and migrating to a new ad tech platform Its AGP unit suffered a short-term revenue decline due to the loss of lower-margin customers.

While APPS trades at a discount to its peers, I think it would be prudent for investors to wait for clearer signs of improvement and continue to monitor its growth.

About digital turbines

Digital Turbine Corporation (NASDAQ: APPS) yes A mobile ad technology platform that provides publishers with unique access to the home screens of over 800 million devices, and also operates an ad technology platform that facilitates end-to-end in-app ad transactions from DSPs to ad exchanges to SSPs.

finance

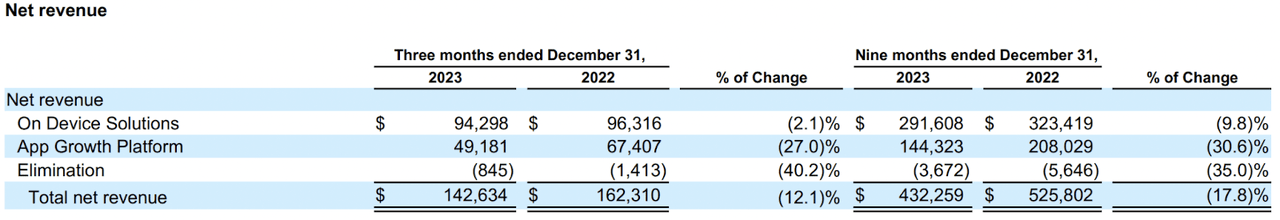

Application 24 Quarter 3 10-Q

1. Device-side solution:

APPS partners with OEMs and operators to provide advertisers with direct access to the home screens of more than 800 million devices (or users), giving them access to some of the world’s most valuable real estate in the advertising industry. In return, this creates profit opportunities for OEMs and operators.

However, past performance has been weak. For the nine months to December 2023, revenue fell 9.8% annually. The segment is largely driven by declining mobile device sales and, most notably, the unfortunate loss of one of its largest carrier partners, T-Mobile.

In past earnings calls, management has been focused on improving its equipment pipeline.In the most recent Q3 2024 earnings call, management highlighted the expansion with Motorola to cover more devices in more countries, as well as their recent focus on a shopKorean alternative app stores are expected to add 40 million devices. Additionally, management said their pipeline is “robust.”

Remember, this is still a valuable business as OEMs and operators look to monetize their hardware, while advertisers need to implement the most effective way to reach new and existing users through APPS.

2. Application growth platform:

APPS has expanded its advertising technology platform through the acquisition of Fyber, AdColony and Appreciate, enabling end-to-end advertising from DSP (advertisers purchase ad inventory) to SSP (publishers monetize ad inventory). Traditionally, DSPs and SSPs have operated independently, resulting in data silos and different fee structures. By integrating the supply chain, APPS gains complete control to enhance advertising algorithms, reduce costs for advertisers, and increase spend for publishers. However, the segment’s performance has been poor.

For the nine months ended December 2023, revenue was down year-over-year due to weaker demand and the impact of the consolidation and exit of certain legacy AdColony platforms and lines of business (which APPS describes as a single DT exchange) to modernize the ad tech platform. 30%.

According to its Q3 and Q2 2024 earnings calls, as part of this process, APPS has chosen not to migrate long-tail publishers (i.e. publishers that do not generate significant revenue and have lower profit margins) from the legacy AdColony platform, So that they can focus their resources on established publishers with higher profit margins. The new platform is designed to enable smarter trading of ad space, increase profits and provide clients with a better return on advertising investment. However, this resulted in short-term revenue losses and additional expenses incurred as a result of having to maintain current legacy systems and migrate to new platforms.

Since the unit’s performance since the acquisition has fallen short of expectations, shareholders should carefully monitor its future growth.

SingleTap – When does growth become “substantial”?

Launched in 2021SingleTap (ST) is a technology independently developed by APPS. Its biggest value proposition is to help advertisers increase conversion rates by installing apps with one click. The goal of becoming an important growth driver has not yet been achieved.

Not long ago, in Q1 2024, analyst Dan Day mentioned that management was “cautious” about STMicroelectronics’ path to material revenue generation, and CEO Bill Stone ) responded that they continue to be “excited” to embed it in “millions” of devices, citing that several publishers are working on a large social media platform – possibly Meta, but they can’t reveal this information. Management has reiterated multiple times in past earnings calls that it will take time for ST to generate material revenue.

Back in the Q2 2023 earnings call, management acknowledged that their performance was below expectations:

We do think we are at a turning point. But we want to make sure we can manage the expectations around it so we don’t get out of hand. These were all mistakes we made many years ago, going back to your reference to the dynamic installation business. So I want to make sure we don’t make the same mistakes again. So we do want to continue to focus on how we deliver on our promises and overdeliver on them. “

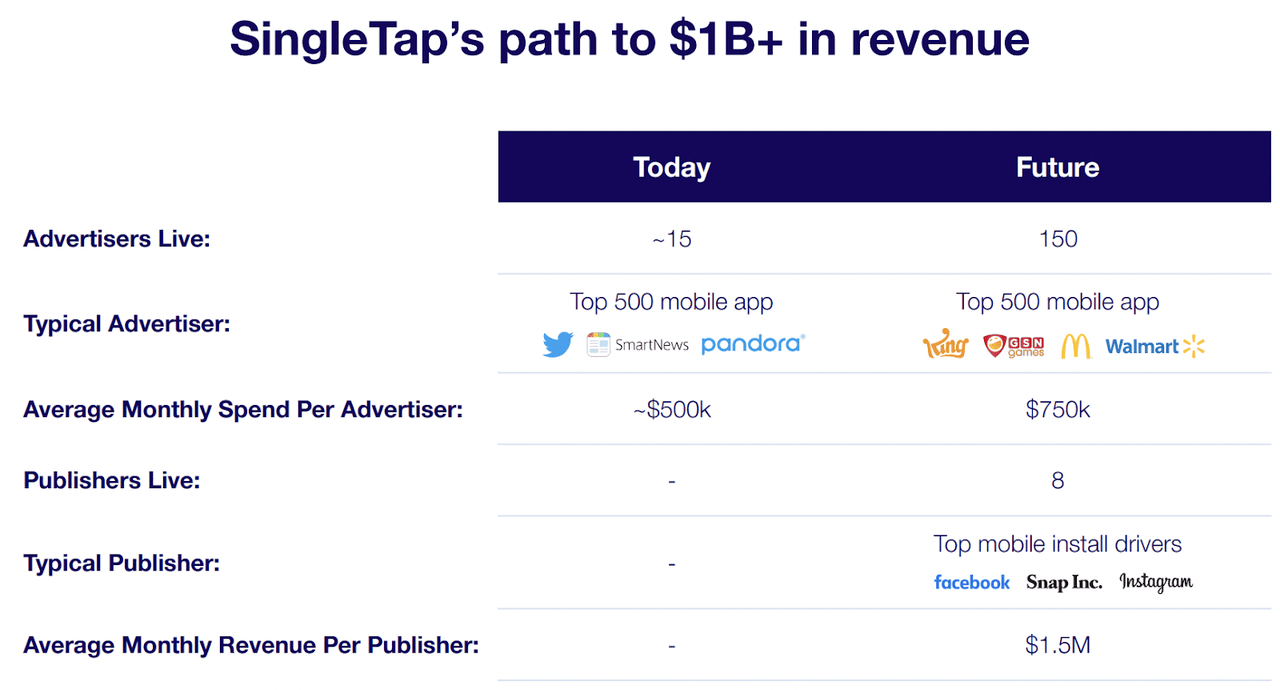

2021 Investor Day Presentation

It’s not difficult to understand when you return to China. 2021the company announced ST’s potential path to $1 billion in revenue.

To date, ST has worked with customers including Google Marketplace, Amazon, Epic, TikTok, and LinkedIn.

By doing a quick back-of-the-envelope calculation, average monthly revenue per advertiser is $1.5M x 5 advertisers x 3 months, which would generate $22.5M in quarterly recurring revenue and $90M in annual recurring revenue. This implies material growth, but it has not yet been achieved.

Analysts and investors seem to be growing impatient with ST’s growth, and I remain cautious about ST’s ability to drive substantial growth until results are reflected in the financials.

Upside – Alternative App Stores and Digital Marketplaces Act

One of the biggest advantages is APPS’ pursuit of an alternative app store.Recently, the company has made 2 strategic investments Aptod and a shop. APPS and Aptoide work together to create Game centre The company primarily serves the U.S. market and aims to reach 80 to 100 million devices by the end of 2023. APPS achieves this by working with operators and OEMs to pre-install GamesHub on user devices. One store in South Korea provides access to over 40 million devices in South Korea. Additionally, APPS will deploy SingleTap on these devices.

This pursuit is also largely due to the European Union’s Digital Markets Act (DMA), which aims to crack down on monopolies such as Apple.exist January 2024In the EU, Apple has complied with regulations by allowing third-party app stores to be installed on iOS devices, reducing commission rates for apps distributed through the App Store (from 17% to 10%), and allowing developers to choose alternative payment systems , without paying any fees. Pay extra to Apple.

I believe this will pave the way for more monopolies to open up their ecosystems in the future, thus promoting healthier competition. More importantly, APPS will benefit from these regulations.

While this is certainly good for APPS’s growth, the key thing to note is that this segment has yet to generate any substantial revenue for the company.

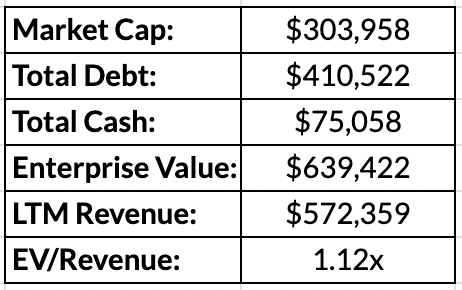

Valuation

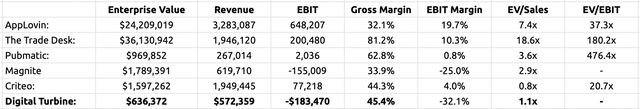

Author comments Peer evaluation

Based on relative valuation, APPS trades at a discount to its peers. But as an investor, it’s important to consider the risk versus reward trade-off. If we factor in underperformance, current valuations certainly won’t be as attractive as they look until there are clear signs of improvement.

in conclusion

Digital Turbine faced significant challenges, including a sharp drop in its share price and poor performance due to management issues including the loss of key customers and execution issues.

While their investments in alternative app stores and regulatory changes such as the EU’s Digital Markets Act do benefit APPS, the impact on revenue remains uncertain given that it’s still early days.

Given APPS’ current valuation at a discount to its peers and the ongoing challenges it faces, investors may take a cautious approach and wait for clearer signs of a turnaround before considering investing.