Mario Tama

My recent coverage of one of my favorite stocks, Altria Group, Inc. (NYSE:MO) was more than three months ago in December 2023.I rate the stock a Buy and urge investors to buy on weakness Moves by peer British American Tobacco plc (BTI). Since then, the stock has returned about 9%, compared with the market return of 12%. As much as I like the stock, if someone had told me when I wrote my last article that Altria stock would outperform the S&P 500 in the first quarter of 2024, I probably would have laughed at them. However, that’s exactly how Altria stock is performing as the first quarter of 2024 comes to a close. Altria shares are up nearly 9% (excluding dividends) compared with the market’s 7% year-to-date gain.

it’s no secret MO stock has significantly underperformed the market over the past year and even decade. However, the stock still has a loyal following and investors (myself included), as you can see in the comment stream of almost any news or article about Altria Group on Seeking Alpha. The reason is pretty simple: reliable and growing dividends. So despite the disappointing price action, many investors (myself included again) are still holding on to the stock, and that’s likely to continue as long as the company continues to pay a generous and growing dividend.

The company can blame the macro environment and itself for the stock’s poor performance over the past few years. First, the “risk appetite, free money” macro environment favors riskier assets rather than reliable but slow-growing stocks like Altria. Second, the company’s repeated “escalation” efforts with companies like Juul and Cronos haven’t done itself any favors.

So what triggered the stock’s recent reversal? Well, the same two factors mentioned above: macro environment and company actions.

After setting records in 2023, the market has continued the same momentum in 2024, hitting new highs every week (and even every day).However, from a macro perspective, there are plenty of reasons to pay attention to the stock market economic recession Concerns mount, inflation data remains about to get hotter Sometimes beyond expectations. Against this backdrop, one can easily make the case that value and dividend stocks are more popular than risk stocks, and in hindsight, it’s no surprise that Altria stock has risen for seven consecutive trading days.

Altria, for its part, has made some right moves recently. The company posted fourth-quarter results that were in line with expectations and also announced a new $1 billion buyback program. Shortly thereafter, during an investor conference, Altria reiterated its 2024 guidance. However, I think the most positive news was released by the company a few days ago. declare Reduce its stake in Anheuser-Busch InBev (BUD) and use the proceeds to bolster its buyback program.

I tend to view stock buybacks with suspicion, especially among tech companies that use buybacks solely to offset dilution. Additionally, I’m skeptical of buyback programs that don’t have a clear end date. However, each of Altria’s buyback programs typically has an end date and isn’t known for dilution. Let’s assess the financial impact of the recently announced $2.4 billion buyback program, which is expected to be executed by December 31, 2024.

- To be extremely conservative, assume Altria repurchases these shares at the current 52-week high price of $48. This means the company can use the $2.4 billion to easily exit 50 million shares.

- Altria currently pays an annual dividend of $3.92 per share, which means the company (and shareholders) are saving at least $200 million annually through this buyback program alone. To reiterate, Altria just pulled off a masterstroke (albeit arguably a little late) by giving up BUD’s 1.35% yield to avoid paying a nearly 9% yield on its own stock.

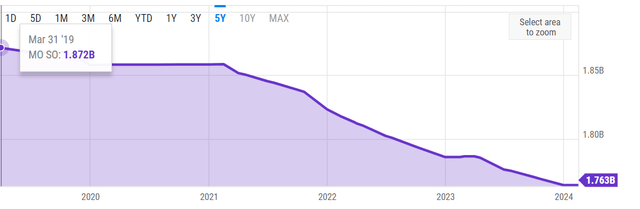

- Another way to understand the size of this new buyback program is to look at the chart below. Over the past five years, Altria has retired only about 6% of its outstanding shares. This buyback alone (approximately 3 quarters) will eliminate nearly 3% of outstanding shares.

- Finally, with shares outstanding decreasing by 3%, Altria’s earnings per share are likely to rise. How many? Let’s find out through some reasonable assumptions. I acknowledge that a variety of factors come into play, including, but not limited to, potential dilution, expected earnings, and timing of buybacks.

- Using the 1.763 billion shares outstanding at the end of the most recent quarter and the midpoint of forward guidance (discussed below), Altria expects net income for fiscal 2024 to be $9 billion. If 200 million shares were retired based on the above calculation, Altria’s earnings per share could jump to $5.76. That’s calculated by dividing $9 billion in net income by the 1.563 billion shares expected to be outstanding at the end of the new $2.4 billion buyback program.

MO issued shares (YCharts.com)

| Current shares outstanding | 1,763,000,000.00 |

| forward earnings per share | $5.11 |

| The total profit | $9,008,930,000.00 USD |

| new shares | 1,563,000,000.00 |

| Earnings per share | $5.76 |

| Earnings per share difference | $0.65 |

| Earnings per share growth | 12.80% |

Still cheap, lucrative, and getting stronger

The yield is nearly 9%, which is still above the stock’s forward P/E ratio and still beats the already high levels easily. five-year average The yield is 7.75%. Speaking of forward P/E ratios, along with the BUD announcement, Altria also raised its fiscal 2024 guidance to $5.05 to $5.17 per share.If we use the midpoint of that guidance range of $5.11, Altria stock’s forward P/E ratio is 8.58, compared with the S&P 500’s P/E ratio of trading As of this writing, its multiple is close to 28.

If yields remain this high, there’s reason to worry whether Altria stock is viewed by the market as having a junk yield. fair enough. You may recall that Altria recently adjusted its dividend growth target from 80% of earnings to mid-single-digit dividend growth. Does this put the payout ratio in danger territory? Not quite. Based on the current dividend of $3.92 per share and the median earnings per share of $5.11 per share, Altria’s payout ratio is about 76%, well below what the company has promised and delivered for decades. The 80% dividend payout target stated in the past.

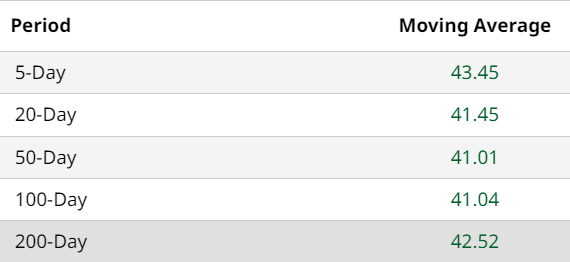

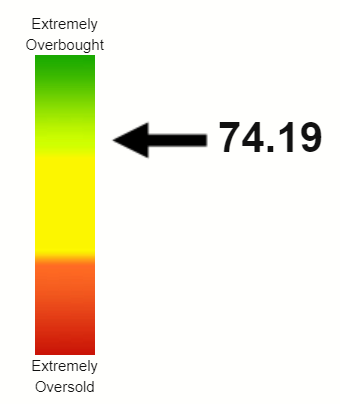

Finally, given the stock’s recent strength, it’s no surprise that Altria’s technical indicators look great this time around. The stock is well above all common moving averages, with the 200-day moving average just 3% below the current market price. That means the stock is on the verge of finding strong technical support if things take a turn for the worse from here. However, with a relative strength index (RSI) of 74, I expect Altria stock to remain strong in the short to medium term, with the market softening as the ex-dividend date approaches (March 22), with two consecutive weeks of losses.

MO moving average (barchart.com) Altria RSI (Stockrsi.com)

Risks and Conclusions

While I strongly believe that Altria stock could perform strongly in the short to medium term given the above thesis that it remains undervalued, there are some viable risks to be aware of. The Fed could surprise us all and deliver more (and deeper) rate cuts than expected in 2024, which would spur risk-on stocks and hinder stocks like Altria. While Altria has pricing power to offset at least some of the effects of inflation and sells sticky products, a weak consumer outlook is never a good thing for any consumer products company.

What is the fair value of Altria stock? Do I have an exit strategy? As long as the dividends keep coming in (and increase every year at the promised rate), I will almost always hold this stock. However, that doesn’t mean I never plan to prune. The only time I sold a lot of Altria stock was around 2016/2017, when extremely low interest rates caused stocks like Altria and Realty Income Corporation (O) to skyrocket. I remember both names were yielding less than 4% when I sold them to lock in multi-year dividends on capital gains (some tax-free). Even if Altria shares were now back to their dizzying heights of around $75, the stock would still yield well above 5% as the dividend rises from 61 cents per quarter now to 98 cents per quarter. In other words, Altria has a lot of room to go before it gets close to my cut zone, and I’m happy to hold the stock at least in the $60 zone before considering a cut. At $60, the stock still yields 6.50%, and its forward P/E ratio is 11.74 times based on fiscal 2024 midpoint guidance of $5.11 per share.

All in all, I always recommend buying shares of good companies during times of weakness. On a different note, Altria stock is fundamentally and technically strong and deserves a “Strong Buy” upgrade. I believe the macro environment, the stock’s undervaluation, and the company’s renewed focus on increasing shareholder value make Altria stock a buy here.