Twalak

investment thesis

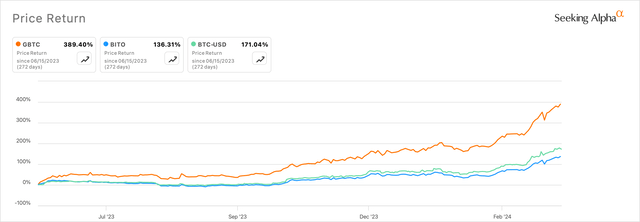

Last August, Grayscale Investments, the sponsor of Grayscale Bitcoin TrustNYSE: GBTC)fund, Won landmark case against SEC They work to convert previously held stocks into ETFs. In the expectation of investors, Investment companies and hedge funds allocate funds to GBTC, The fund benefits from rapid price appreciation compared to the underlying fund’s asset, Bitcoin (BTC-USD),As shown below. I also added the ProShares Bitcoin Strategy ETF (small), another peer of GBTC, below.

GBTC has outperformed Bitcoin and other similar currencies over the past 272 days (on the chart)

Unfortunately for GBTC, the craze for Bitcoin ETFs has created an opportunity for other asset managers to launch their own ETFs. The case that Grayscale won last year set a precedent for asset management companies to simultaneously launch their own ETFs, as GBTC submitted its own ETF Your own modifications convert the previous fund structure into that of an ETF.

The current payout profile of the GBTC fund does not attract my current recommendation of a Buy rating.But, that Sponsor’s most recent submissions Indicates some effort to reduce costs. The impact of the filing is unclear at this time and I rate the fund a Hold.

About GBTC and its sponsor Grayscale Investments

The assets of the GBTC Fund are sponsored and managed by Grayscale Investments, a Stanford-based asset management company focused on investing in digital assets such as cryptocurrencies. Grayscale prides itself on being the largest cryptocurrency-focused asset management firm in the world.

The company pioneered the concept of digital asset funds, providing investors with the opportunity to invest in digital assets through its funds. While GBTC is one of the funds that offers investors the opportunity to invest in Bitcoin, the company also has other products that offer investors access to products based on Ethereum (OTCQX: ETHE ), Litecoin (OTCQX: LTCN), Solana (OTCQB: GSOL ) investment opportunities in other digital assets) ETC.

Through GBTC, Grayscale offers investors the opportunity to gain exposure to Bitcoin without having to do any of the work that comes with actually owning Bitcoin, which I will detail in the section below. This is a pure Bitcoin ETF that contains Bitcoin as the only fund asset. The Bitcoin tokens that make up the Fund’s assets are held in custody by Coinbase (COIN), the Sponsor’s digital asset custodian.The fund primarily uses CoinDesk to track Bitcoin prices, thereby achieving its investment objective of providing exposure to Bitcoin. Bitcoin price index.

Peer comparison

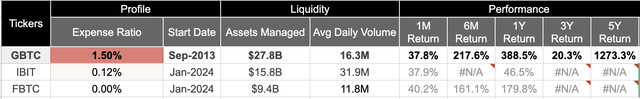

In addition to GBTC, there are several ETFs that have flooded the market with their own funds. While GBTC is the largest and oldest Bitcoin ETF, a number of Bitcoin ETFs have been launched since the beginning of the year, as shown below.

GBTC fund compared to 2 largest peers (exist)

An apples-to-apples comparison of the above ETFs is difficult due to the lack of operating history in this space. Yes, GBTC is currently the market leader in assets under management. But those assets have declined by $10 billion, which I’ll cover in a later chapter.

The only other key difference is the relatively hefty fees Grayscale charges to manage the GBTC ETF assets. For every $100 invested in GBTC, investors will lose $1.50. All other ETFs typically charge investors fees, and generally speaking, these fees tend to be within the general range of what investors would typically expect when investing in an ETF.

GBTC fund structure history

The purpose of adding this section here is to provide investors with background information on why GBTC charges higher fees due to its history.

When GBTC initially launched the fund in 2013, the fund structure was similar to a closed-end fund (CEF). As I noted before, the fund’s goal remains the same, which is to provide exposure to Bitcoin.

However, through a CEF, investors are locked into the fund. Grayscale is also initially keeping its fees at 2%. The appeal of GBTC’s previous fund structure was that owning a Bitcoin Trust would allow investors to remain invested in Bitcoin without having to do the operations required to own Bitcoin, as I noted before. Investors who are bullish on Bitcoin but want to use existing trading setups and apps can allocate funds to GBTC without having to access a cryptocurrency trading account, digital wallet, etc.

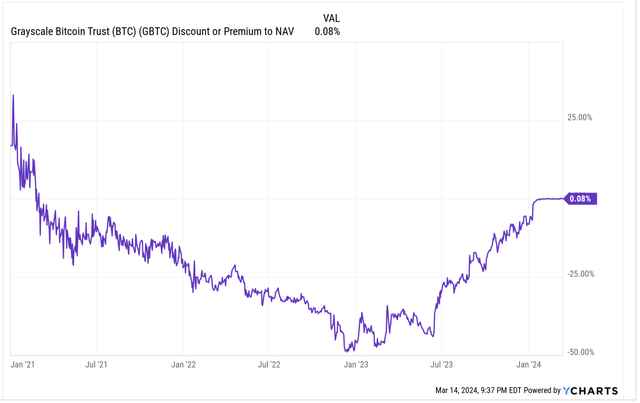

The CEF fund structure also means that the price of the trust’s shares will deviate from their net asset value and fluctuate between a premium or a discount to their net asset value, as shown below.

GBTC is trading slightly above NAV (y chart)

It can also be seen that after converting to an ETF, GBTC trades more or less in line with its NAV.

What measures is GBTC taking to mitigate high ETF fees?

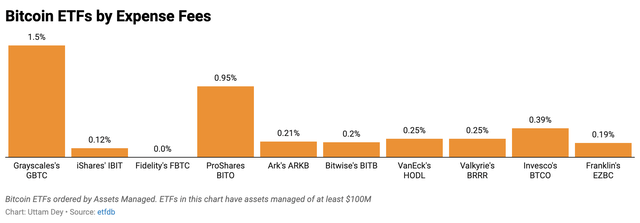

So far, GBTC has not really benefited from the SEC lawsuit it won last year. As I mentioned before, competition has quickly become fierce and existing players in the ETF space have begun to offer low-cost alternatives.

GBTC has the highest fees of any large Bitcoin ETF (ETF filing)

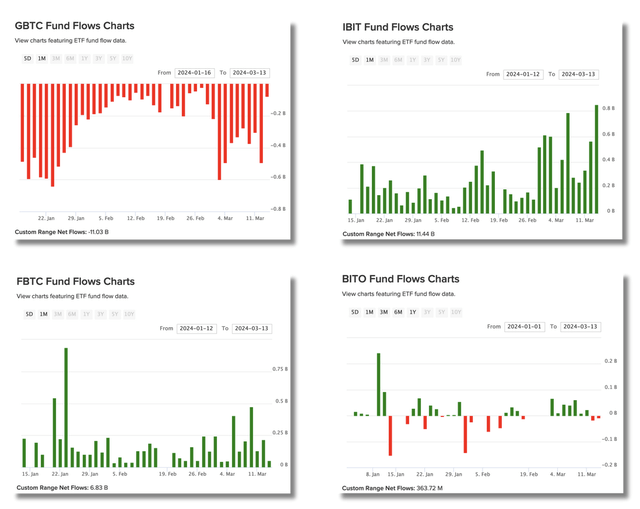

Competition has also become fierce, with many asset managers waiving fees for a period of time.For example, Fidelity has Completely waive its fees For investors to allocate funds to FBTC funds. This fee is waived until August this year. Other companies, such as iShares’ IBIT, Ark’s ARKB, Bitwise’s BITB and Invesco’s BTCO, have also said they are waiving fees. The promotions have certainly had an impact on GBTC, which has seen outflows from its funds since the start of the year, while its peers have benefited from their respective launches. This can be seen in the fund flow chart below, with GBTC outflows of approximately $11 billion.

Since the beginning of this year, GBTC is the only Bitcoin ETF to have experienced outflows of more than $10 billion this year. (etfdb)

This environment is expected to have an impact on GBTC for some time until promotions stabilize.

Now, GBTC sponsor Grayscale recently filed for a mini Bitcoin ETF under the BTC ticker, which should lower fees. The sponsor will use part of GBTC’s assets to launch the new BTC Bitcoin ETF. By using a portion of the fund’s existing assets, existing shareholders of GBTC will gain ownership of the new BTC fund. As can be seen from the filing, this new “spin-off” ETF will not have any tax implications for GBTC investors.In fact, grayscale State your own advantages The newly split BTC ETF is as follows:

We believe this will be positive for existing GBTC shareholders, who should benefit from lower blending fees (covering ownership of GBTC and BTC shares) while maintaining the same Bitcoin exposure.

While the idea of launching cheaper ETFs is not new, the impact on investor sentiment remains unknown in my opinion. For example, Invesco QQQ Trust (QQQ) is one of the other well-known ETFs that has launched cheaper alternatives, such as the Invesco Nasdaq 100 ETF (QQQM). The iShares MSCI Emerging Markets ETF (EEM) and the iShares Core MSCI Emerging Markets ETF (IEMG) are another example. In both cases, the more expensive parent ETFs QQQ and EEM continue to hold significant assets, at $255 billion and $18.3 billion respectively to date. Therefore, once the promotion environment of Bitcoin ETF ceases, GBTC outflows may stabilize. In fact, Grayscale’s new mini-ETF could cannibalize existing GBTC. I still expect volatility in GBTC in the short term.

The outlook for Bitcoin and its impact on Bitcoin ETFs

The outlook for Bitcoin is changing rapidly, causing Bitcoin’s value to fluctuate. In the rapidly evolving landscape of Bitcoin ETFs and their underlying asset, Bitcoin, not every event is as significant as the Bitcoin halving. This is a critical time for the Bitcoin supply and is important for maintaining the Bitcoin network of participants, including Bitcoin holders and miners, and Bitcoin network validators who are unlocked by processing transactions on the Bitcoin network. The reward for survival. These halving events are designed to reduce the number of newly issued Bitcoins.according to Recent research published by Coinbasethe halving event will “Reducing total Bitcoin issuance from approximately 900 Bitcoins per day (representing an annual issuance rate of 1.8%) to approximately 450 Bitcoins per day (or 0.9%).”

I have also added a table below indicating how the halving event affects the total Bitcoin supply.

|

Bitcoin halving date |

Rewards per block |

new issue |

Bitcoin total supply |

|

November 18, 2012 |

25.0 Bitcoin |

9.6% |

10.5 million Bitcoins |

|

July 9, 2016 |

2.5 Bitcoin |

3.8% |

15.75 Bitcoin |

|

May 11, 2020 |

6.25 Bitcoin |

1.8% |

18.37 million Bitcoins |

|

April 20, 2024** |

3.125 Bitcoin |

0.9% |

19.68 million Bitcoins |

Source: Coinbase, ** is estimated date

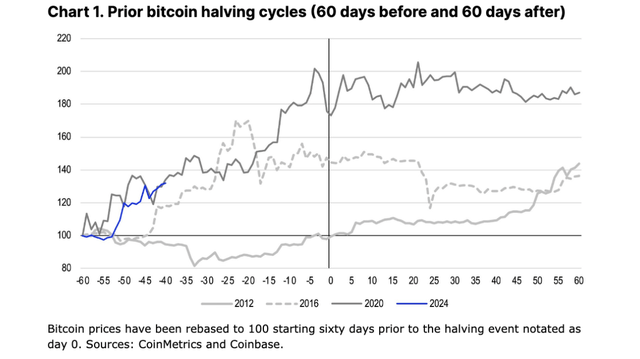

These halving events will not occur for four years, but the first effects of the halvings can already be observed above as the total supply of Bitcoin introduced into the network slows. I’ve also added a chart from the study below that shows how previous cycles affected Bitcoin prices before and after the event.

Bitcoin price, starting 60 days before the halving event (marked day 0 above) (Coin Library)

While history doesn’t repeat itself, it often is strikingly similar. There is also limited history to work with in this case, but it seems to me that the price of Bitcoin will be significantly affected by themes such as interest rates, inflation, and macroeconomic growth that have an impact on global liquidity and ultimately Impact on Bitcoin and Bitcoin ETFs. Given the bullish outlook for all three themes this year, I believe Bitcoin’s long-term outlook is positive.

Other factors and some risks that investors should be aware of

If you look back at my past coverage of ETFs, I also try to find fair value ranges for ETFs. However, this will be difficult to do with Bitcoin ETFs, whose underlying assets are highly volatile, as Bitcoin is still making progress towards mass adoption. My personal approach is to cost average my way into Bitcoin. Once the goal is achieved, I plan to rebalance allocations to achieve the goal.

So far, GBTC has benefited from the price appreciation of the fund’s underlying asset, Bitcoin. Therefore, the impact of outflows has not really impacted the ETF’s share price, and the ETF continues to trade close to NAV, as discussed in the previous section.

Grayscale’s BTC ETF product is still receiving the necessary regulatory approvals from the SEC. I expect this proposal to be approved and, once approved, will create additional headwinds for GBTC.

What remains unknown in Grayscale’s new filing is the quantifiable benefits investors will see from the new BTC product, both for existing GBTC fund investors and new investors. Grayscale hasn’t indicated what the blending fee will look like, so it’s still uncertain, although I expect it to be in the 0.25%–0.5% range like peers.

take away

GBTC currently appears to have a number of factors that could create headwinds for the fund. The fund’s only driver is price appreciation of the underlying Bitcoin asset. However, GBTC will face pressure from inflows as its peers offer cheaper alternatives, some of which are even temporarily waiving fees. In addition, once Grayscale’s mini BTC fund is approved and launched, it is expected to put greater pressure on GBTC in the short term.