Afternoon pictures

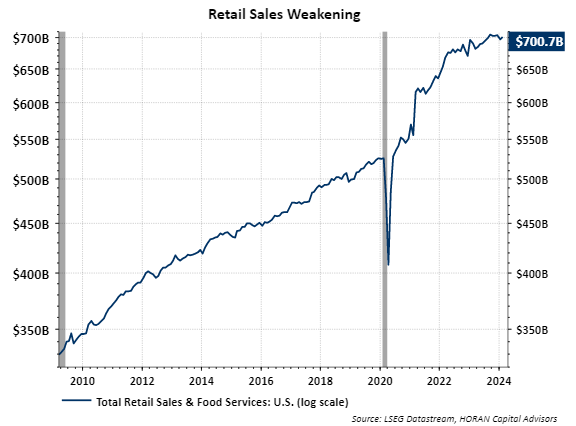

Consumer or individual spending accounts for nearly 70% of U.S. GDP, so it is important to assess the overall health of consumers.Overall retail sales levels have stagnated since September last year, although they have declined slightly Last week’s retail sales report rose, but the reported sales number was lower than expected.

Some of the weakness may be attributed to consumers largely content with deferring spending due to the pandemic and a weakening housing market due to rising mortgage rates. Areas where sales were weaker compared with the end of last year included building materials, furniture and home stores and gas station sales.

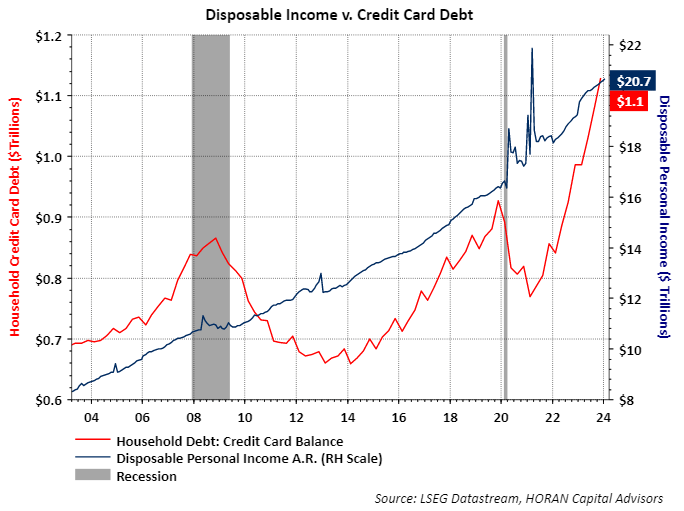

One area of concern for consumers is their credit card debt exposure.Credit card balances have increased significantly since the end of the pandemic As shown in the red line below. The chart also includes disposable income levels, which have increased, but at a slower pace than credit card balances.

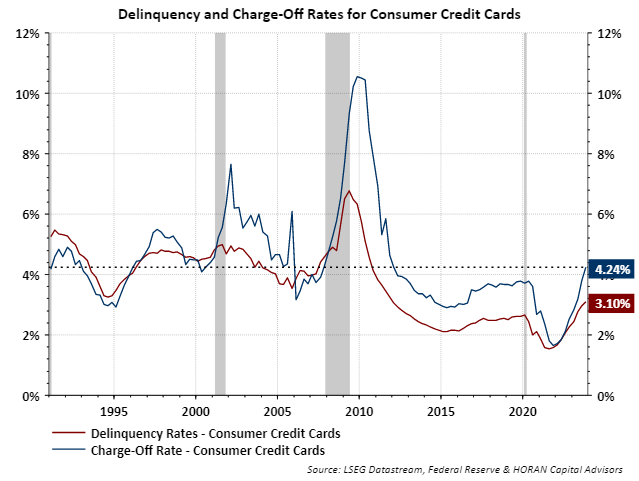

Higher levels of credit card debt appear to be causing repayment problems. Charge-offs and delinquencies on credit card debt are increasing and have reached levels seen at the start of previous recessions.

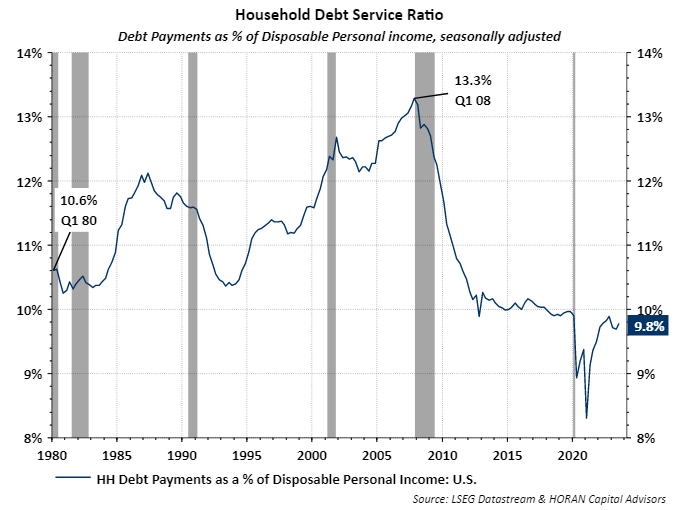

Like much of the post-pandemic economic data, credit card data appears to be at odds with consumer income levels. The rise in credit card delinquency and charge-off rates comes as household debt service rates remain low. The chart below shows debt payments as a percentage of personal disposable income near a record low of 9.8%.

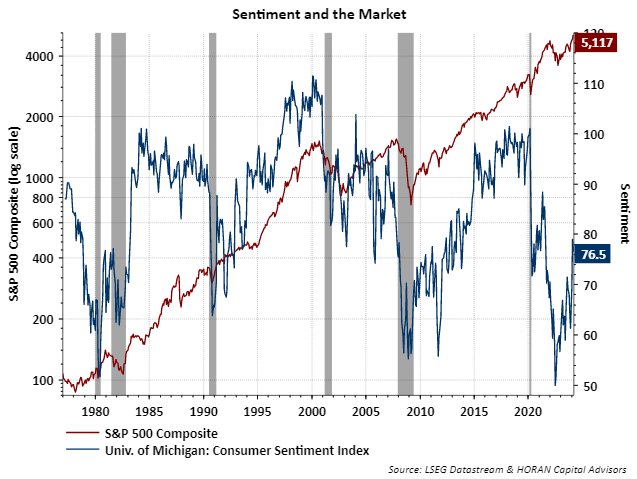

Finally, the Michigan Consumer Confidence Index is well above its June 2022 low. So while revolving credit debt appears to be weakening, consumers say their confidence in the economy has improved.

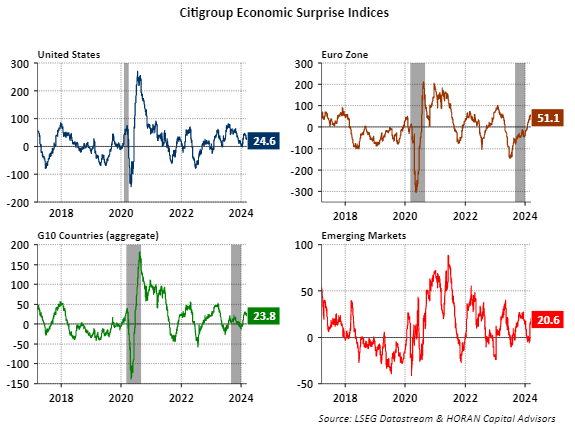

Since consumers make up a large portion of the economy or gross domestic product, rising charge-off and delinquency rates on credit card debt could be the canary in the coal mine, signaling some economic headwinds ahead. Right now, overall economic data is better than expected, not just in the U.S. but globally. Maintaining a focus on consumer health will become important over time.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.