The window for rate cuts may be closing.

On the eve of the Fed’s two-day policy meeting, Wall Street forecaster Jim Bianco believes the central bank may remain on hold until next year.

“I don’t think the Fed is going to change policy in the summer of an election year,” the Bianco Research president told CNBC’s “Fast Money” on Monday. “If they don’t pull the trigger by June, it won’t be until November at the earliest.” (Or) December — if the data proves it. And right now, the data doesn’t prove it.”

Bianco said the economy would have to weaken significantly if Fed Chairman Jerome Powell were to cut interest rates this spring.

“The economy is so strong right now,” he said. “It was in the ‘unlandable phase,’ as we call it. It was not a Boeing aircraft. No parts fell from it, it just continued to move at about 2.5 to 3 percent speed.”

This week’s Federal Reserve meeting comes almost exactly two years after policymakers began raising interest rates.

“It looks like inflation may bottom out, around 3%,” he said. “It’s not 2 (percent) and the Fed has made it clear they need confidence to get to 2 (percent). But we’re not getting that.”

It looks like Wall Street may have taken notice.this CME FedWatch Tool Expectations for a quarter-percentage point rate cut in June fell below 50%, Monday showed.

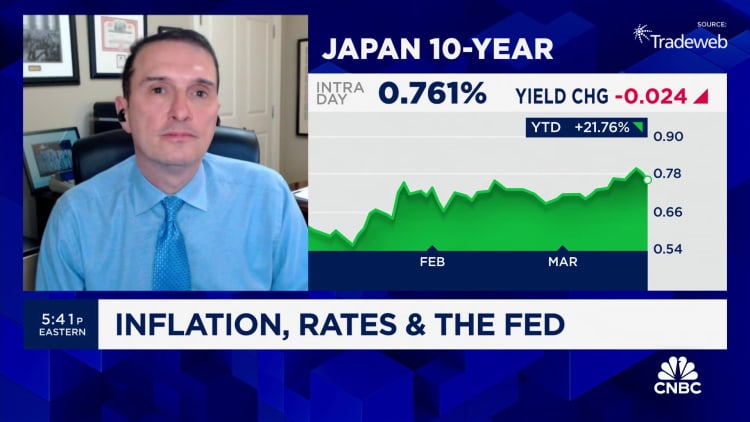

Additionally, U.S. Treasury yields are climbing.benchmark 10-Year Treasury Bond Yield The yield is at 4.328%, its highest level in a month and is approaching a four-month high.

“They might even go higher,” Bianco added. “That will be the reality of inflation.”

In January, Bianco told Fast Money that the 10-year Treasury yield would hit 5.5% this year. This is a level not seen since May 2001.

He remains confident that this backdrop will keep yields trending higher.

“I don’t think that’s the consensus in the market,” Bianco said. “When we were at 5% growth in October, we forecast the economy would grow at 3%, and it would be well positioned to handle that level of interest rates.”

Disclaimer