Anchiy/E+ via Getty Images

generalize

The following is my report on Life Time Group Holdings (NYSE:LTH), I recommend a Buy rating as I believe the fundamentals are actually improving and this article is intended to provide my latest view on the business as well as in stock. Despite the lower growth outlook, I reiterate my Buy rating on LTH as the upside remains attractive given the way the stock is trading, even with modest growth and multiple assumptions. LTH’s fundamental operating indicators and growth indicators lead me to believe that low-digit growth is possible in the near term, and that LTH could surprise to the upside if macro conditions recover earlier and stronger than expected.

investment thesis

LTH reported that total revenue in the fourth quarter of 2023 increased 18.2% annually to $558.8 million, above market expectations of $556.7 million and within the previous guidance range of $555 to $565 million.The company also reported that Adjusted EBITDA was $137.7 million, above the consensus of $134.2 million and the previous guidance range of $131 to $135 million. Total revenue for the year was $2.216 billion, up 21.6% year over year and about 140 basis points below my model assumptions. While this was lower than expected, I think the overall strength of the business remains healthy (although I must admit that growth won’t be as strong as I previously expected (more on that below). On the positive side, key fundamental indicators continue to point to medium-term growth going forward) The healthy growth of low-income teenagers. In the fourth quarter of 2023, the total number of members continued to grow by 4.9%, reaching 815,000, of which center members increased by 5.2% year-on-year to 763,000. Plus the average center revenue per center member (ACRPM) year-on-year Growth of 11.1% to US$711 pushed center revenue to increase by 18.2% year-on-year to US$546.1 million. This impressive growth trend seems to have continued into fiscal 2024. Management mentioned that fiscal 2024 will be a good start, Noting that this year has been the strongest year ever in terms of member engagement, traffic and retention, I think this is proof that LTH’s product is resonating with members (remember, LTH managed to grow ACRPM by 11%) members quantity increased by 5%).

While momentum is strong, I think the market is increasingly concerned about slower growth, which can be inferred from the guidance for Q1 2024 and fiscal 2024. Management expects fiscal 2024 revenue of $246 to $2.5 billion, implying growth of about 12%, and the midpoint of revenue in the first quarter of 2024 is $590 million, implying growth of about 15%. With LTH still benefiting from the club realignment, I think the first season of ’24 is achievable. However, management noted that this tailwind should start to diminish over time, and that they are in the final 10% of a realignment. With this new information, I think LTH will have a hard time maintaining my previous 20% growth forecast, as revenue growth after FY24 will rely more heavily on organic growth (opening new centers, attracting more members, and finding ways to drive pricing growth) ), as comparable growth at mature stores will return to historical levels after rebalancing for tapering earnings (low-single-digit percentage growth).

That said, if LTH can continue to drive up average revenue per member (ARPM), it’s not impossible to pull growth back to mid- to high-percentage levels. Management has communicated this as well; they point to the strength in average dues while emphasizing that membership counts are increasingly less relevant. This is critical for investors to note and model ahead of time, as slower membership growth is by design. LTH has implemented a waitlist to limit overcrowding, which will help maintain the experience and reduce attrition, which I think will help members justify paying more. That seems to be the case for LTH so far, and I believe LTH should be able to continue to grow ARPM at least the expected 3% to 4%, and possibly higher as it continues to penetrate more affluent areas. For example, the average monthly membership cost is about $234, which is 15% less than a regular membership red bank Monthly fee. So while the growth outlook is lower, I think low to mid-teens growth prospects are certainly possible (~4% pricing growth + 4% historical average center growth + similar membership growth as before) 5%). covid 2019 fiscal year levels).

Additionally, another positive for LTH is that management continues to expect positive free cash flow in the second quarter of 2024, which I think will greatly enhance investor confidence in LTH’s ability to reduce leverage. This is one of the areas I pointed out earlier where I expect leverage to trend toward the management target of 3x EBITDA. I believe this is on track as we reach the midpoint of fiscal 2024. Assuming net debt levels remain unchanged from the current level of $1.937 billion, EBITDA guidance is $595 to $610 million, implying year-end leverage of 3.2x. I think LTH has the potential to lower this ratio further as it can use proceeds from the sale-leaseback transaction (mentioned in the 2023 Q4 conference call) to pay down debt to reach its targeted year-end leverage level. Looking longer term, when LTH starts generating more cash, using it to pay down debt will always be an option.

Valuation

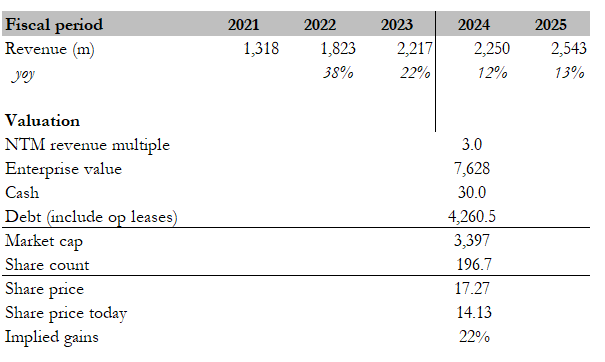

Calculate yourself

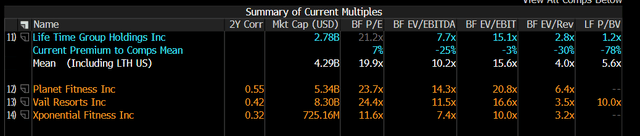

Based on my model, my LTH price target is $17.27. I know some readers may find it strange that my price targets have changed significantly relative to the previous model, but please note that this is considering a much lower growth outlook (given new information) and the sector has been re-downgraded . My new model assumptions are: (1) LTH will achieve low double-digit growth in FY24/25, with FY24 at management’s guidance of 12% and FY25 at my 13% Minimum growth expectations are tracked. I say lowest because if LTH can penetrate the luxury market better than expected, growth could easily reach the mid-to-high range, as Red Bank indicates ARPU is already 15% higher than current ARPM. It also depends on how quickly LTH opens its centers. Assume interest rates are cut in the second half of 2024 and the macro environment improves. Lower capital costs coupled with rising consumer discretionary income should support LTH’s easier pipeline growth. (2) LTH trades at 3x NTM revenue multiple. This is double my previous expectations due to: (1) lower peer group trading volume due to a weak consumer spending environment; and (2) lower growth prospects. However, it should provide some support to the valuation due to a better free cash flow and leverage profile. LTH currently trades at 2.8 times expected revenue, which I think already signals a weak growth outlook. As LTH indicates leverage will decline in FY2024, I expect valuations to increase slightly to the lower end of peers’ trading levels.

Burundi

risk

I guess the risk here is that LTH growth slows to much lower than expected, which would send a message to the market that LTH faces one or all of the following problems: (1) Continued difficulty in raising prices, suggesting that price increases are capped. High prices can go; (2) Difficulties in opening new centers or attracting new members indicate that potential demand is still poor or the market has reached a certain degree of saturation point.

in conclusion

All in all, despite the downgraded growth outlook, I maintain a Buy rating on LTH. While fiscal 2024 revenue growth is expected to slow into the mid-teens, I think the upside remains attractive. Considering strong underlying metrics like member engagement and ARPU growth, achieving low teen growth shouldn’t be a problem. LTH’s ability to continue driving up ARPU also provides upside potential. The main risk is a significant slowdown in growth, which could indicate pricing constraints or market saturation.