Win McNamee

I enjoy looking for turnaround and contrarian investment opportunities. These types of opportunities have often yielded great results for me in the past.This gives me motivation to look for situations where investors might be too negative and sell Their stocks are priced below their long-term value. I think Boeing (NYSE:BA) is close to becoming a turnaround stock and a contrarian buying opportunity. I recently wrote an article about RE/MAX (MaximumRMAX) as My Best Turnaround Stock Picks for 2024. I’ve considered making Boeing a top turnaround company this year, but I think it’s premature. However, I think it makes sense for me to start buying small amounts; here’s why:

Boeing’s performance in recent weeks has been very poor, making headlines across the media.It seems like every other day or So we hear about some type of accident where a wheel falls off a Boeing plane or something else that makes flying seem less safe. These issues are unfortunate and come at very bad timing for Boeing, as the company began to be plagued by safety issues several years ago. By now, one would hope that all major safety concerns would have been resolved, but that’s clearly not the case.

Unfortunately for Boeing, it seems almost every problem makes headlines, even those that appear to be through no fault of the company. However, Boeing has been and still is under the microscope and it was an easy scapegoat. The stock has plummeted under the weight of all the negative news, which has me wondering where the bottom is and if this is a buying opportunity. I wrote a bullish article on Boeing in October 2022, when the stock was trading near its then-52-week low of around $120 per share. A few months after I wrote that article, Boeing’s stock price nearly doubled. I sold my shares after seeing Boeing stock go up, and now I’m looking for another potential dip in the stock.

Boeing has problems, but you can’t blame it all

It seems clear that many of the safety incidents in recent years are issues for which Boeing bears at least some, if not all, responsibility, but the recent level of blame may have gone too far. Recently, a Boeing 777 had a tire that came off and had to make an emergency landing in Los Angeles. Recently, another Boeing plane had to make an emergency landing due to a hydraulic system problem. It sounds like some of these problems may occur if the aircraft is not properly inspected or maintained.

In another recent incident, around 50 passengers were injured when a LATAM Airlines flight suddenly descended sharply.This was on a Boeing 787, so it seemed like a lot of people were quick to suspect some kind of issue related to design or manufacturing, but now there are reports that this could be the cause Unintentionally due to human errorwhich could mean airline staff are responsible.

An article published by CNBC on March 18, 2024 stated that multiple recent safety incidents have involved United Airlines (UAL), and the company’s CEO is currently trying to reassure passengers that they are safe. The article also pointed out that most of these flights originated or ended in San Francisco, which may indicate that United Airlines has maintenance problems. The article points out:

“All incidents are under investigation, and some aviation experts have questioned their connection to San Francisco Airport.”

According to Airfleets.net, the average age of the Boeing jets in United’s fleet is more than 16 years old, with many of the aircraft being more than 20 years old.

Boeing needs to clean house and make big changes

While some of the recent safety incidents may not be entirely Boeing’s fault, I think it’s time for a cleanup to show that safety issues are taken seriously and restore confidence. The latest round of safety concerns has prompted a new investigation into Boeing, and they really need to show a sense of responsibility and have a new safety culture. I believe some firings are normal and will happen. Announcements about new top executives could provide a relief rally for the stock. Dave Calhoun Chief executive since 2020, he is viewed by many as the man who should “fix” Boeing. I wouldn’t be surprised if a new CEO is named in the near future.

Boeing is reportedly considering acquiring Spirit AeroSystems (SPR), which could help improve oversight of quality control and safety. This will be a big change because Spirit AeroSystems builds fuselages for Boeing and was owned by Boeing in 2005.

Large backlog and duopoly make it a great investment opportunity

While it seems like every incident is making headlines these days, it’s easy to miss the elephant in the room, the fact that Boeing recently reported Order volume hits record high and the best delivery volume in 5 years. What’s even more incredible is that Boeing’s order backlog is as high as $520 billion.That’s right, it’s over $5 trillion backlog. Boeing expects to generate approximately $89 billion in revenue by 2024, so this backlog represents many years’ worth of business for the company. In addition to its massive backlog, Boeing is part of a duopoly that is unlikely to change anytime soon, despite China’s attempts to enter the industry.

Profit Forecasts and Balance Sheets

Analysts expect Boeing to earn $3.36 per share on revenue of about $89.44 billion. However, earnings are expected to grow substantially in the coming years, with earnings per share expected to be $7.96 in 2025 and $11 per share in 2026. But those numbers appear to be a fraction of Boeing’s normal or peak profitability.

In 2018, Boeing’s profits were slightly more than $16 per share The stock peaked at around $450 per share in early 2019. I think Boeing can and will return to profits around $16 a share; in fact, I believe the company will earn around $20 a share due to price appreciation over the next few years, which could take the stock back to $400 a share USD to USD 450 range. However, for that to happen, a lot of things have to go right (or at least not as many things continue to go wrong), and that may take time.

Looking at the balance sheet, Boeing currently has about $54 billion in debt and nearly $16 billion in cash. With revenue and profits expected to grow significantly in the coming years, Boeing should be able to pay down its debt. With a stronger balance sheet, Boeing may be able to resume paying its dividend, which was suspended in 2020. Before suspending payment, Boeing Quarterly Dividend A little over $2 per share. Restoring the dividend could be a strong upside catalyst for the stock, as it could allow dividend-focused ETFs and mutual funds to buy the stock.

chart

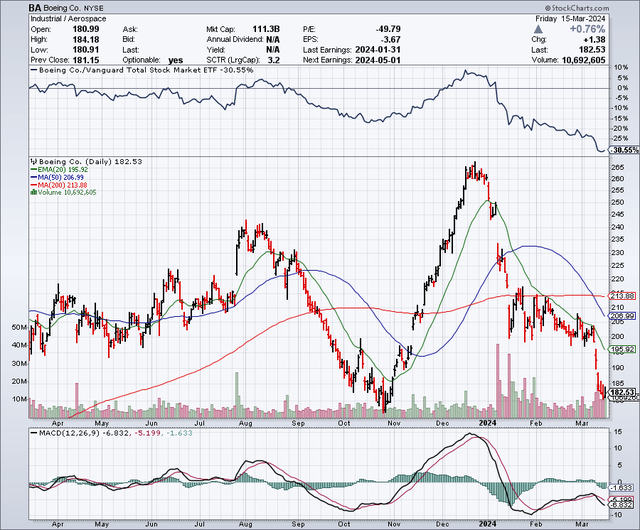

As the chart below shows, Boeing shares fell sharply in November, hitting the $170 level, but have since surged, trading near $270 a few months ago. The stock recently plunged again to around $180. That’s not far from the November 2023 bottom at $170 per share. Given this chart pattern, Boeing stock is likely at or near a bottom now. I wouldn’t be surprised if the stock bottoms at $170 again (like it did in November), and if so, this could create a very bullish double bottom on the chart.

StockCharts.com

What I like about Boeing

Despite some unfortunate issues over the past few years, Boeing has a reputation for being the airplane that saved the world in past wars, and for a plane as legendary as the 747, it remains America’s airplane. President’s choice. The company has made progress over the past few years in resolving some security issues, and the current issues are solvable. It has a massive backlog. There’s been a lot of bad news lately, but it doesn’t seem like it’s all down to Boeing. There’s a lot of good news on the horizon, including new management, continued strong demand, resolution of safety issues, and possibly learning that Boeing isn’t to blame for all accidents. In the future, Boeing may resume its dividend and post record profits.

What I don’t like about Boeing (potential downside risks)

There may be more bad news to come, which means overall risks remain high. However, at some point, the bad news is priced in and may even be exceeded, meaning the stock may stop falling on negative news. The company will be under scrutiny as some new security issues arise, which could be a good thing, but could also mean a delay in financial performance. However, shares are now much lower, which gives investors a greater margin of safety. I don’t like that there seems to be no accountability since everyone still seems to be working for this company and maybe shouldn’t be. If a new catastrophic event or severe recession occurs, this stock could retest the lows from the last time I wrote this article, around $120.

My investment strategy

I’m not an eager buyer of this stock right now, but I’m watching it every day, and at current levels and further weakness, I’m willing to buy for a very small amount. However, I would like the stock to test its 52-week low of around $176 per share before adding more purchases. I expect more bad news will hit Boeing’s headlines regarding regulatory and legal issues, so that may provide a better buying opportunity. A year from now, things may be looking up for Boeing, and investors may start to look forward to better days. I believe Boeing stock can reach my 12-month price target of $250, and over the long term I think if the stock returns to earnings levels closer to $20 per share, it can trade around $400 per share again trade. However, this may take several years.

In short

Boeing has problems it can solve, and I believe it will eventually solve them. I think you have to get over some of the hysteria that seems to exist because Boeing can be blamed for everything. Despite the recent headlines, Boeing has made progress and if you focus on the next few years, it should continue to enjoy its duopoly position and continue to add to its large backlog. I think it’s possible to resume the dividend and earn around $20 per share in the future. Now, it’s like a bumpy flight, you may not feel comfortable taking the flight or buying stocks, but for the most part, you’ll probably get there and be glad you took the risk.

No warranties or representations are made. Hawkinvest is not a registered investment adviser and does not provide specific investment advice. This information is for reference only. You should always consult a financial advisor.