Philip Thurston/E+, Getty Images

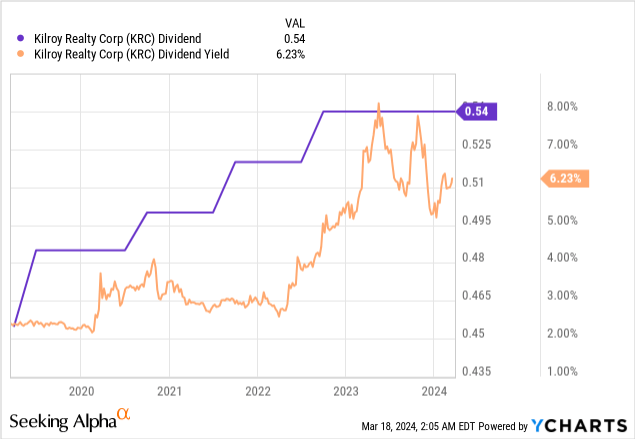

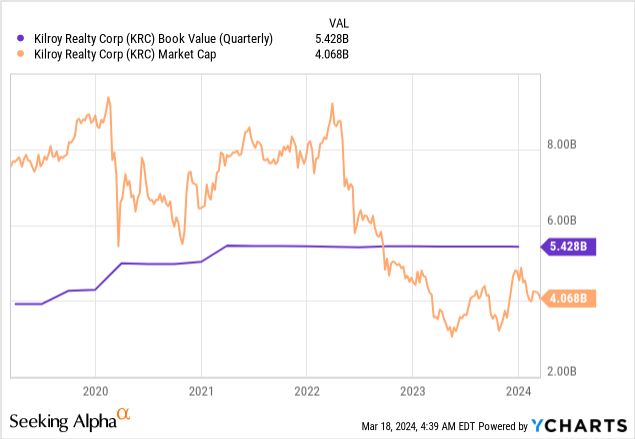

Kilroy Real Estate (NYSE:KRC) finally announced a quarterly cash dividend of $0.54 per share, the same as the previous quarter, with an annualized dividend rate of $2.16 per share and a dividend yield of 6.2%. KRC’s dividend has formed an oasis of relative calm All around is a desert of chaos. Equity Office REITs have been characterized by massive dividend suspensions and cuts since the Fed began fighting inflation. Risks are heightened as office properties face a new working-from-home reality that has left some buildings vacant and pushed up national vacancy rates. It was 18% in January, up 130 basis points KRC’s stable dividend history is attractive compared to this time last year, and its 6.2% yield is high relative to pre-pandemic averages.

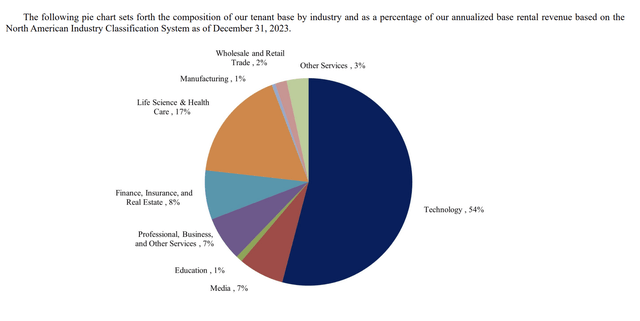

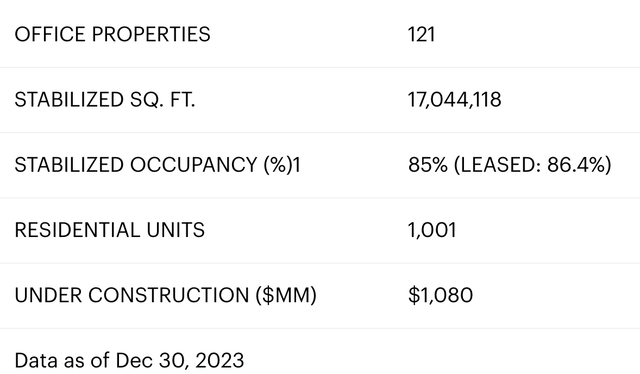

What’s in the portfolio?Internally managed REIT owned Office 121 characteristic As of the end of the fourth quarter of fiscal 2023, square footage was stable at 17,044,118 square feet.Occupancy rate was 85%, down 100 basis points from the same period last year 86% The rental rate in the third quarter was 86.4%.The REIT also owns 1,001 residential units in 3 properties and owns 92.8% Average occupancy rate through 2023.

Kilroy Realty Fiscal Year 2023 Form 10-K

KRC’s office portfolio is built from quality Class A properties, mostly located in the West Coast markets of San Diego, Los Angeles and the San Francisco Bay Area. Technology tenants accounted for 54% of annualized base rent, with life sciences and healthcare accounting for the second largest component of rent at 17%. KRC’s buildings are carefully designed and constructed to be sustainable and efficient. However, despite less pressure on Class A offices, KRC still experienced relocations, leading to lower occupancy and suppressing rental income and FFO.

Kilroy Properties

Revenue, FFO and Dividend Coverage

KRC’s fourth-quarter revenue was US$269.02 million, down 5.4% from the same period last year due to rising office vacancy rates. It also missed consensus by $15.47 million. Fourth-quarter FFO was more optimistic, at $129.3 million, or about $1.08 per share, 3 cents higher than market expectations. Crucially, fourth-quarter FFO meant quarterly dividend distribution coverage reached 200%. Additionally, the REIT projects full-year 2024 FFO of $4.10 to $4.25 per share, covering 194% of the midpoint dividend in that range. Despite the uncertain growth outlook, the dividend appears to be safe. However, KRC Chief Financial Officer Eliot Trencher expressed some uncertainty about this during the fourth-quarter earnings call and stated that the board needs to make a judgment on whether the current dividend level is appropriate and whether it needs to be adjusted upward or downward. It’s also a boilerplate statement about dividends on earnings calls.

KRC’s recent history of consistent dividend increases eliminates the possibility of a rate cut, as strong coverage and an upcoming Fed rate cut will improve the FFO outlook. KRC’s leasing momentum was also strong, with 590,000 square feet of leases signed in the fourth quarter. This was the highest quarterly leasing volume since 2019, with GAAP and cash rents in the stabilized portfolio growing 21.7% and 1.6%, respectively. The company leased 1.3 million square feet throughout 2023, with an average lease term of about six years.

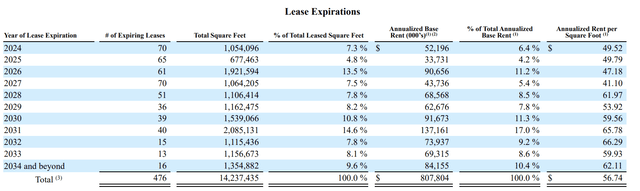

Lease maturities and debt maturities

Kilroy Realty Fiscal Year 2023 Form 10-K

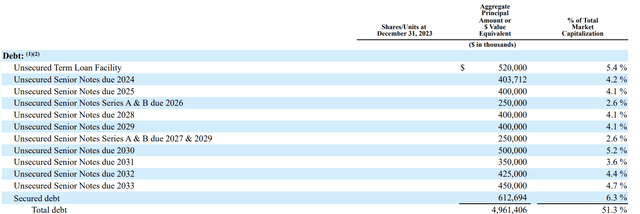

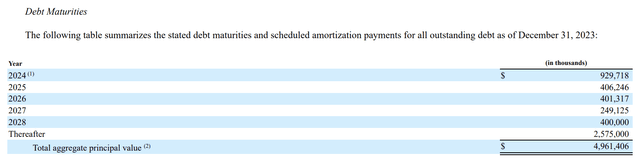

KRC’s lease expiration schedule is not bad, with 6.4% of total annual base rent due in 2024 and another 4.2% due in 2025. Current leasing momentum is good, and while KRC’s vacancy rate may decline, the current lease expiration schedule should allow for continued leasing momentum for the REIT to keep occupancy at healthy levels. As of the end of the fourth quarter, KRC held $4.96 billion in total debt, including $403 million in unsecured notes due in 2024.

Kilroy Realty Fiscal Year 2023 Form 10-K

The REIT’s $520 million unsecured term loan also matures this year, but can be extended for up to two years. As of the end of the fourth quarter, KRC held $2.2 billion in available liquidity, half of which came from cash and marketable securities and the other half from its existing credit facilities. The real estate investment trust plans to spend $200 million to $300 million on its development in 2024.

Kilroy Realty Fiscal Year 2023 Form 10-K

KRC’s high dividend coverage makes this REIT one of the most attractive office REITs.At the same time, the Fed is increasingly leaning toward cutting the federal funds rate, with the CME FedWatch tool putting the likelihood of no rate cut before the end of 2024 at a low level 1.24%. I may buy a position in KRC later this month, with the REIT trading at 8.3x below the midpoint of its 2024 FFO range.