Intuitive Surgical’s flagship da Vinci system 3alexd/E+ via Getty Images

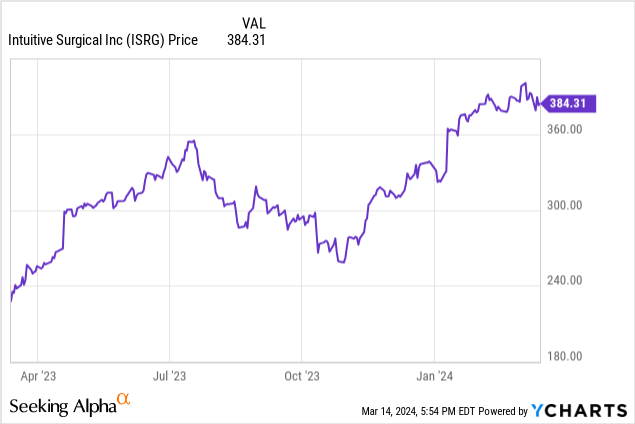

Intuitive Surgical Company (NASDAQ: ISRG) has been growing significantly over the past 12 months, up 61% since March last year. Revenue rebounds to $7.1 billion in 2023 14% annual increase This growth was driven by a 21% increase in program volume for its flagship Da Vinci system. The company’s financials are also excellent, with $5.2 billion in cash and zero debt.However, with a P/E ratio of 78.8 and EV/EBITDA of 62.4, it might look expensive, and there are some warning signs that may not justify the high price tag. I think I’m holding Intuitive Surgical at current prices, but if a pullback occurs, I’ll look to buy.

Overview

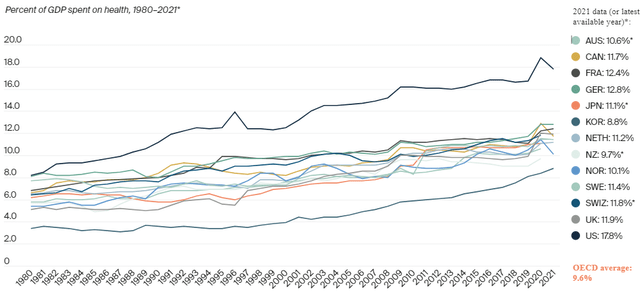

Like everything else, healthcare is being revolutionized by technology.Transforming healthcare through large-scale automation, standardization The digitization of processes will increase efficiency and reduce costs on a massive scale, and economies around the world will spend more and more. The United States is the global leader in health care spending, spending 17.8% of GDP in 2021, and all other major economies are following this trend.

Federal Funds – Health Care as % of GDP

As expenditures increase, there are tremendous capitalization opportunities for businesses, and Intuitive Surgical, Inc. is one of the companies at the forefront of this development. Their da Vinci system pioneers robot-assisted surgery, a fully unified ecosystem that combines surgical systems, learning simulations and data intelligence all in one package. The da Vinci system was the first of its kind, and Intuitive Surgical has been at the forefront since its launch.They offer hospitals more than 70 Countries with surgical equipment and command centers 80% Global market share.

In 2012 it is estimated that there 200,000 Surgery using the da Vinci system, available in 2023 2,286,000with a CAGR of 22.5%, a trend that will only continue as more types of surgeries gain approval for robotic technology, making fewer complicationsfaster recovery time and fewer scars.

recurring revenue machine

What makes Intuitive Surgical such an attractive investment is its income-generating nature.When hospitals purchased da Vinci systems, they also purchased unified ecosystem following. There is a built-in learning platform called Intuitive Learning, 24/7 maintenance and technical support, and My Intuition software, which allows access to data and artificial intelligence analysis of every surgery performed by da Vinci. There are also many single-use and surgical-specific instruments and accessories, all of which require payment.

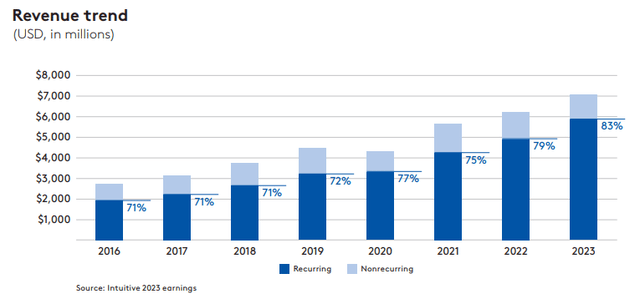

It is estimated Service Agreement Annual costs range from $80,000 to $190,000, with each procedure costing $600 to $3,500. As more systems are installed around the world, recurring revenue will increase and will account for 83% of total revenue by 2023.

Excerpted from Intuitive Surgical’s 2023 Annual Report

Revenues have grown at an average rate of 11.5% since 2014, and were on a steady upward trajectory before COVID-19 lockdowns delayed all revenue. non-essential Surgery.This growth will only continue in the future, with robot-assisted surgery expected to grow at a CAGR Will grow by 9.5% by 2030led by surgeries such as joint replacement and neurosurgery.

Zero debt and stable profits

Surprisingly, Intuitive Surgical has zero long-term debt, which means it doesn’t have to pay a lot of interest, an especially valuable quality in a high-interest rate environment. In the past 10 years, their profit margins have also been extremely stable, with annual gross profit margins ranging from 66% to 70%, and net profits always hovering around 25% of revenue every year. These solid margins are the sign of a competent management that retains and accounts for expenses, resulting in tremendous cash conversion, which we saw in 2023 free cash inflow of $1.6 billion. As mentioned above, they now have $5.22 billion in cash, so there’s no chance of bankruptcy anytime soon.

new project

With cash levels so high, Intuitive Surgical will have to put some of it to good use, and thankfully, that appears to be the case.Just received their newest Da Vinci system, Da Vinci 5 FDA clearance In the U.S.This next-generation system was 10 years in the making and features more than 150 enhancements over the current da Vinci Xi, including greater accuracy, a new 3D display and a first-of-its-kind force sensing technology. This is an important next step in their journey, and as more companies try to enter the market, Intuitive Surgical needs to show why they are the leader.However, I will be keeping an eye out for the first peer-reviewed articles on the new system to obtain the largest pool of data on robot-assisted surgery and past victories When it comes to releasing a new generation of products, it’s safe to say that Intuitive Surgical has the edge in development.

Intuitive Surgical is also using its massive cash reserves to expand its presence in the healthcare technology industry through Intuitive Ventures. The group’s own venture capital fund, with $250 million under management, supports independent initiatives in the direct and adjacent areas of minimally invasive care, with nine new startups in its portfolio. NyosisKela Health, a leader in robotic-assisted dentistry and an advanced surgical AI platform, are some noteworthy assets in the portfolio. This is a big step in the right direction, expanding and diversifying their global presence in the healthcare space.

risk

It’s clear that Intuitive Surgical is a great company with nearly monopoly Rapidly expanding growth markets and superior financial management. However, this does not come without a cost. With a price-to-earnings ratio of 78.8 and an EV/EBITDA of 62.4, it’s extremely expensive compared to other products in the robotic-assisted surgery space.Some notable vendors with systems on the market include Stryker (SYK), Medtronic (MDT), Boston Scientific Corporation (BSX) and Abbott Laboratories (ABT).

| company | ISRG | SYK | multidisciplinary treatment | BSX | ABT |

| P/E ratio | 78.8 | 42.7 | 25.3 | 61.9 | 35.6 |

| Enterprise value/interest, tax, depreciation and advance profit | 62.4 | 27.5 | 14.8 | 29.4 | 20.0 |

Valuations are taken from the SA Valuations page.

Importantly, Intuitive Surgical only sells robotic-assisted surgical systems and their accompanying products, while the other companies have broader product catalogs, so this valuation may be justified as they currently sell more robotic surgical systems than the other four All merged. However, I think this puts them at higher risk, especially given how market dynamics are changing right now.

Competitors seize market share

The biggest risk to high valuations is market share. When the Da Vinci System was released in 2000, Intuitive Surgical was the first company on the scene and has been at the forefront ever since.However, most of their original patent The past few years have expired, which could cause some trouble for the competitive advantage they’ve long enjoyed.When the great investor Warren Buffett talks about competitive advantage, the key words he uses are durable, So how durable is Intuitive Surgical?

Medtronic (MDT) is one of the major emerging players challenging the da Vinci system.Their Hugo RAS has regulatory approvals in Europe, Canada and Asia and is in progress Clinical Trials In the U.S. When looking at peer-reviewed articles comparing the Hugo RAS to the Da Vinci system, some very interesting results were discovered.First, in every comparison, there were no significant differences in functionality between the two systems, see here, here and here.Leading robotic surgeon Alex Mottrie says Hugo RAS could more suitable Because it has four independent arms, and is therefore used for general surgery than the Da Vinci, the open console is a big advantage because it allows other surgical staff in the room to see what the surgeon is seeing, This allows for dialogue and improved surgery.

One preconceived notion against implementing Hugo RAS is that most surgeons trained in robotics have been primarily Leonardo-trained, meaning that retraining on Hugo RAS is impractical. However, the da Vinci-savvy surgeon seemed to have little problem switching to the Hugo RAS – think of it like switching from a PlayStation controller to an Xbox controller, a bit of getting used to, but ultimately the same process. Moultrie believes that in the future large surgery centers will be able to use a variety of different machines, ultimately depending on the type of surgery each surgeon prefers.

The fact that the Hugo RAS performs as well as the Da Vinci is significant, with a reported efficiency of 25% cheaper Than Da Vinci.One of the biggest complaints about robot-assisted surgery is justifying the price and cost-effectiveness, which is why it has been performed in many places outside the U.S. Slow adoption technology. Cheaper systems with the same performance will capture Intuitive Surgical’s future market share, and Medtronic already has strong ties in Europe.Medtronic isn’t the only one competitors More cost-effective systems on the market mean less revenue for Intuitive Surgical. This threat to market share is the main reason I can’t justify such a high valuation right now.

Next-generation systems that impact the bottom line

Of course, Intuitive Surgical won’t let competitors take away all market share. The next generation system da Vinci X is their answer to all their competitors and it will be interesting to see how it performs. If the system is truly revolutionary and ahead of the current generation, it will solidify their position as the best manufacturer of robotic surgical systems and I can totally justify the high valuation, but that’s not something we won’t know for at least a year things.

One thing we know is that the rollout of the new system will have an impact on company finances.Chief Financial Officer Jamie Samath said operating margins could improve under pressure This is expected to be achieved in 2024 due to the upcoming launch of Da Vinci 5. On top of this, Intuitive Surgical’s R&D costs have been steadily increasing since 2015, rising from 8.3% of revenue to 14.0% last year due to new competition. I think this is a continued trend going forward as they need to make sure they still have the best product on the market. This is the second reason I’m tired of high valuations, because if operating margins take a bigger hit than expected, the stock will fall.

final thoughts

Overall, Intuitive Surgical is a great, revolutionary company with amazing products that will benefit millions of people. They are the market leader in a rapidly growing market and have been for a long time. Unfortunately, the market has priced it in and it looks too expensive to me. The next few years will be crucial in determining whether they remain the best in the market, and it seems to me that the stock has priced in all the upside without accounting for any potential risks.However, if there is a sharp correction general marketthis will be the first one I add to my portfolio.