Spain/E+ via Getty Images

generalize

Readers can find my previous reports through this link. My previous rating was Hold as I believed in National Vision Holdings (Nasdaq: Eyes) long-term growth prospects are uncertain.My idea is to wait for the growth of the results to normalize Before I turn bullish. I’m adjusting my rating to Buy as I’m optimistic about management’s ability to guide business growth and margins back to normal levels. The guidance for FY24 and FY25 is very positive, and as long as it continues to execute like it did in Q4’23, I think the stock price will continue to trend upward.

Finance/Valuation

EYE’s 4Q23 net income increased 8% year-on-year to US$506.4 million, higher than the market consensus of US$499.8 million. The growth was driven by a 5.7% increase in comparable store sales, driven by higher transactions and tickets. Gross profit margin decreased 139 basis points year-on-year to 51.2% due to rising optometrist-related costs Decreases in certain components of service revenue offset growth in exam revenue and lower product costs. that is, adjectives. EBITDA grew 48.4% year over year to $23.9 million, adjusted. EBITDA margin increased 128 basis points year-on-year to 4.7%.

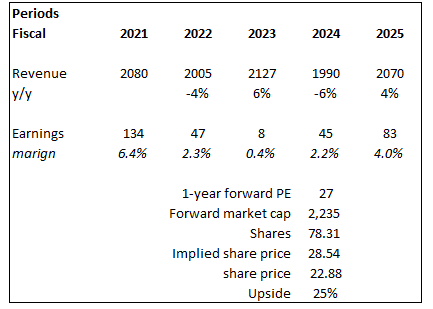

Based on the author’s own mathematical calculations

Based on my view of the business, EYE should be able to grow -6% in FY2024 (guidance) and return to 4% growth in FY2025 (mid-single-digit comparable sales growth guidance).I have raised our FY24 growth assumptions by 100 basis points to reflect the implementation of pricing increases, which should cushion Walmart deals. Reflecting expected improvements after stores transition to America’s Best banner, as well as a better macro environment (which should improve discretionary spending). I note that my 4% growth forecast for fiscal 2025 is conservative as it does not assume any significant store growth contribution and growth is at the lower end of fiscal 2025 guidance (assuming mid-single digits of 4% to 6% ). I also increased my fiscal 2025 margin assumptions by 100 basis points to reflect my optimism about management’s ability to drive further margin improvements through store digitization (more remote capabilities), increased productivity ( lowering labor costs), and by transforming a low unit economics eyewear world brand into America’s best brand. EYE’s current 2-year expected price-to-earnings ratio is 27 times. Considering that fiscal year 2024 is still a sluggish year for profits (still affected by Walmart’s trading losses in the first half of 2024), EYE is valued based on fiscal year 2025 data. Seems more appropriate.

Comment

The evidence I’m waiting for seems to be showing up nicely in the income statement, and management’s guidance for fiscal 2024 is a real confidence booster. Fiscal 2024 guidance includes comparable store sales growth of 2% to 4%, which suggests demand relative to FY23 given that comparable store sales grew 2.9% in fiscal 2023 (with no deterioration in unit economics following the termination of the Walmart deal) Already stable. There are several encouraging signs that EYE can move beyond this guidance. First, management’s comments about improvements in February trends from last quarter were very encouraging given the severe weather the U.S. is facing. Second, the lower end of FY24 guidance assumes weak demand and no improvement in eyewear world trends, which I think will improve as I expect the macro environment to improve in 2H24 (i.e. consumers have more discretionary income) and as the with America’s Best expansion banner. For the latter, management expects to rebrand 20 California Eyeglass World stores to America’s Best by the end of the first quarter of 2024. Considering that California Optical World stores are performing below the chain average and that the store transformation plan appears to be primarily focused on improving store economics and overall profitability, I think this transformation will have a positive impact on the bottom line. On the growth side, given the underperforming stores, this should drive higher sales (changing store branding should also re-engage the attention of consumers who don’t visit the Eyeglass World brand). On the bottom line, the switch will drive margin expansion as it is expected to lower field overhead expenses, reduce travel expenses, better leverage national advertising spend, and improve optometrist deployment. Finally, EYE has implemented non-headline price increases and cost saving initiatives, which means the hard comparison in 1H24 (due to Walmart’s loss) will be cushioned.

Overall, I’m very optimistic about this fiscal 2024 guidance, and it did help improve sentiment on the stock – shares were up 10% after the earnings release. How EYE executes going forward will be a key driver of the share price, as it will further bolster confidence that management’s target of mid-single digit (MSD) comparable sales growth for FY25 is achievable. From what I’ve seen, execution seems to be going well, and the two areas that really highlight this are its technical capabilities and the successful implementation of its business improvement plans. On the technology front, EYE has now equipped more than 500 of the best U.S. stores with remote eye exam capabilities, and the impact on the business is clear, with EYE achieving 5.7% comparable sales growth in the fourth quarter of 2023. In terms of business improvement initiatives, key to track is how EYE manages its labor costs despite the pressure of a shortage of optometrists. The implementation of teleeye exams effectively solves this problem by providing optometrists with greater flexibility. This, in turn, will continue to help EYE improve employee recruitment, retention and productivity metrics, leading to same-store and profitable sales growth. I think it’s important to emphasize that these investments are still in the early stages of development; for example, only 5% of eye exams are performed remotely. So I think there’s a lot of room for EYE to continue to drive growth and productivity in that regard.

Going forward, I believe all EYE has to do is continue to execute on what they are doing now, drive margin expansion and productivity, and continue their store digitization plans. If management can continue to make progress in restoring stability to same-store growth and lifting margins into the mid-single-digit range, I think the stock will do well.

Risks and Conclusions

Downside risks include weaker-than-expected execution leading to lower-than-expected top-line growth due to management’s failure to continue rolling out remote eye exam capabilities in stores or converting expected numbers, leading to weaker comparable store growth. Shop America’s Best Flag. This will impact EYE’s argument that it can continue to drive improvements in the business in the short term.

I recommend a Buy rating on EYE as I am more confident in management’s ability to deliver on its FY24/25 guidance. Recent results have been encouraging, with EYE reporting comparable sales growth of 5.7%. Additionally, fiscal 2024 guidance points to stable demand and potential upside. Their execution of technology initiatives continues to be strong, particularly with distal eye exams, which I think is a key driver of growth and productivity. All in all, EYE appears to be well-positioned to deliver mid-single-digit comparable sales growth and margin expansion in the near to medium term, which, if realized, should drive the stock price higher.