Luza Studio

follow up

I am writing this article as a follow-up to my last article about HUT 8 Corp (NASDAQ:HUT) (TSX:HUT:CA) Published on Seeking Alpha on December 11, 2023.

Since then, HUT has undergone many changes:

- back HUT merged with U.S. Bitcoin Company (USBTC) on November 30, 2023, and obtained court approval for its “horse bidding” on January 8, 2024.

- On January 11, 2024, J Capital Research released short report Concerns about merging with USBTC were expressed.Shortly thereafter, on February 2, 2024, Marathon (MARA) announced that it would stop Hosting Services Agreement with HUT.This may have resulted in Step down Chief Executive Officer appointed on February 7, 2024.

- However, not all changes are negative. HUT still has access to Coinbase (COIN) line of credit on the 12th January 2024.It can also sign a trade Partnering with Ionic Digital on February 1, 2024, could bring them $81.5 million in revenue over 4 years.

During this period, Bitcoin (BTC-USD) prices increased by more than 71%, while HUT shares fell by more than 13%. In this article, I will discuss my actions and related reasons, as well as my plans for HUT.

Compare BTC price to HUT share price (Yahoo Finance)

my actions and reasons

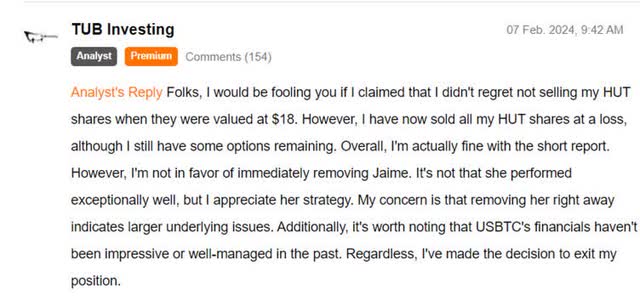

In the comments to my previous article, on February 7, 2024, I already stated that I had sold all HUT shares, leaving only options.

Seeking Alpha

This drastic operation was prompted by the following reasons.

CEO replaced

One of the main reasons I originally invested in HUT was their strong balance sheet, generation of fiat income, and diversified strategic approach to mining and holding BTC, and leveraging their cryptocurrency expertise to expand beyond mining. That direction appears to be taking shape under former CEO Jaime Leverton. While the emergence of more details has a negative impact on the USBTC merger, I believe the combined company still retains synergy potential. I’m particularly interested in HUT becoming the “exclusive operator” of the Celsius Mining fleet and receiving an annual management fee of $15 million (net of fees) for five years.

However, Leverton’s sudden resignation as CEO on February 7, 2024, without clear reasons, prompted me to reassess my position. Frankly, the brief report itself does not worry me unduly, but it seems to me that the way Leverton’s sacking was handled was poorly managed and raises governance issues. We are just two months away from the Bitcoin halving event, which has historically been associated with rising share prices for mining companies. The board could have kept Leverton through that incident before parting ways. Additionally, the silence on the reasons for changing the CEO ahead of such an important event raised a number of red flags for me. As an investor, transparency is crucial.

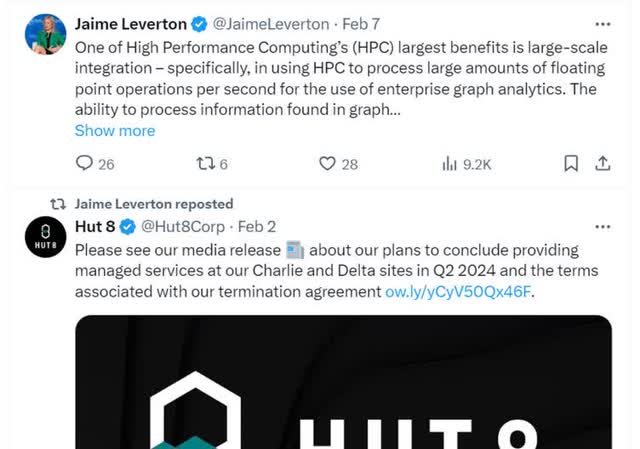

Leverton actively publishes information about HUT and its work in high-performance computing X Just from February 2 to February 7, 2024, the change in CEO also surprised her.

Jaime Leverton X Account (X)

In my opinion, these actions lead me to conclude that my original bullish thesis may no longer hold true, suggesting that I should exit my position.

new CEO

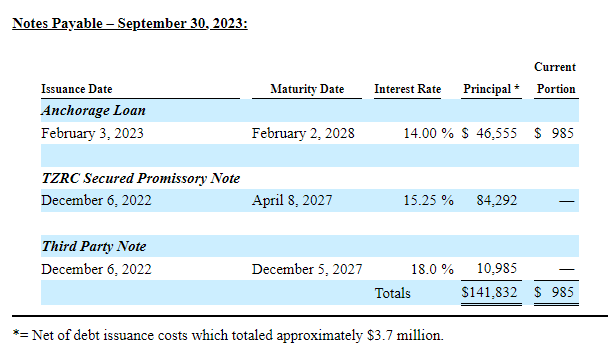

I have two concerns about the appointment of new CEO Asher Genoot. Before the merger, Genoot was the co-founder and president of USBTC, which was not doing well at the time. A review of USBTC’s financial reports revealed that the company is highly leveraged, with a debt-to-equity ratio of 6.13 times. Furthermore, the interest rates on these loans ranged from 14% to 18%, leading to losses and an unsustainable capital structure.

USBTC debt financing interest rate (Cabin 10K)

Replacing Leverton with the same man who ran the financially troubled USBTC does not convince me that he is in a better position to lead HUT. Additionally, reports (1,2 and 3) suggested that Leverton was fired shortly after the short-selling report.but short report Mainly criticizing USBTC as a bad acquisition and claiming that its management team (including Genoot) has a track record of failed startups. So simply replacing one allegedly problematic person with another does not inspire confidence in me that the HUT is better managed.

In hindsight, Asher’s interviews conducted after he became CEO of HUT did not provide a compelling vision or strategy to differentiate his approach. This only fuels my doubts about whether replacing Leverton was the right decision. So this further strengthens my view that I should sell the position.

Potential changes in strategy

The appointment of a new CEO could signal a shift in strategy for the company.according to RedditSome long-term HUT investors expressed dissatisfaction with the former CEO’s efforts to diversify business income. These investors would rather she focus on expanding the mining fleet. Therefore, the appointment of a new CEO could lead to a possible re-direction of the company towards prioritizing mining machine purchases, just to appease these shareholders.

However, adopting this “go with the flow” approach of developing mining business is not in line with my investment philosophy. In my opinion, blindly accumulating more rigs does not differentiate a mining company from its peers, and there may be better options and greater efficiencies.

This leadership change created uncertainty about the future direction of HUT, which ultimately impacted my analysis and final decision to exit the investment.

i may be wrong

Even though I have exited my position at HUT, the company still has the potential to exceed my expectations.

New CEO focuses on improving efficiency

Some investors were frustrated with HUT’s previous mining operations due to the relatively low efficiency of Bitcoin production. The company’s cost of mining per Bitcoin has consistently been among the higher among industry metrics.this Drumheller Facilities In particular, BTC mining output has been underperforming and the current CEO has shut it down.

Therefore, relocating mining equipment to locations where power and operating costs are more competitive appears to be a prudent strategic decision. As the difficulty of the BTC network increases, improving efficiency at the facility level will be important to remain competitive.

Overall, adjustments to mining infrastructure based on cost considerations and productivity analysis demonstrate a focus on maximizing shareholder value through efficient operations. This could be the start of a better cabin.

HODLing strategies will benefit from the halving event

It is worth noting that HUT employs a HODLing strategy where they hold a bunch of mined BTC on their balance sheet for the long term. Although they have been selling BTC and reducing their stack, the company still holds over 9,000 BTC as of recent disclosure.

If the upcoming halving event on April 24, 2024 triggers another bullish price reaction for BTC, it is reasonable to assume that the BTC price could surge to over $100,000 per coin. If that price target is achieved, HUT’s HODL position alone will be valued at more than $900 million.

This compares extremely favorably to HUT’s current market capitalization of $634 million. Even under a conservative post-halving Bitcoin price scenario, the appreciation in its reserves could significantly exceed the company’s current share price. If BTC prices rise like in previous cycles, HUT’s valuation will have to be significantly re-rated.

my plan

Given the uncertainty about leadership and strategy, I have completely divested myself of my previous stake in HUT. Going forward, I intend to generate income by selling put options on HUT stock rather than owning the stock directly for the time being.

Selling puts allows me to benefit from volatility and time decay without taking on the full downside risk. For example, a put option with a $5 strike price on July 19, 2024 offers a premium of approximately $0.80, which equates to an attractive yield of 16%.

If these puts were to be allocated, the stock price would need to drop another 40-60% to reach $5. However, at this price, HUT’s market capitalization may still be lower than the estimated value of its holdings of over 9,000 BTC (based on the current BTC price of around $73,000 per coin). This would provide some downside protection if the stock continues to move lower in the near term.

Overall, given the uncertainty the company currently faces under new leadership, selling put options is a means to participate in HUT’s potential upside while reducing risk. I can earn from the premium without taking a speculative long position in the stock.

in conclusion

Although HUT faces significant uncertainty due to a leadership change, the company’s large BTC holdings provide some downside protection. With over 9,000 BTC in reserves, it would be difficult for even an incompetent manager to mismanage the company and cause the company to go bankrupt in the short term.

Furthermore, for existing shareholders, keeping a long position in HUT stock during the upcoming BTC halving event could pay off if history repeats itself. Alternatively, shareholders can generate additional income by selling call options corresponding to their positions.

However, there remains long-term uncertainty over HUT’s strategic direction and ability to optimize operations under new management. During this transition period, they face an uphill battle to regain their efficiency advantage in an increasingly competitive mining environment.

While Bitcoin’s impending halving brings potential short-term tailwinds, ongoing concerns about leadership and execution have me leaning toward maintain Outlook Neutral Currently, there are no direct long equity holdings. Generating option fees is my preferred method.