Afternoon pictures

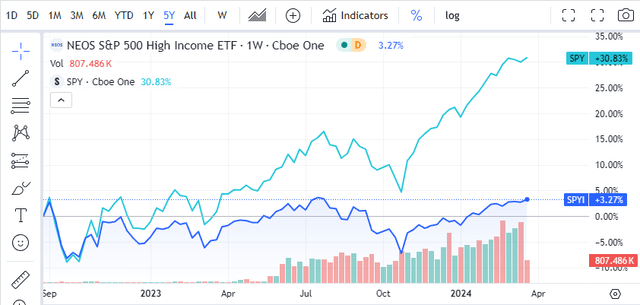

Neos S&P 500 High Income ETF (BATS:SPYI) has received widespread attention from investors, with its assets under management (AUM) growing from $314.37 million on September 20, 2023 to $946.55 million in the past 6 months.share Up 2.87% since September 20, 2023, AUM has essentially tripled. I added SPYI to the Dividend Harvesting Portfolio series on Seeking Alpha (Can be read here) Last year, I was pleasantly surprised by how well it performed. I think the Neos team has created a solid product that achieves its investment goals. I think the market will move higher in 2024, and if we rebound strongly at the end of the year, investing in SPYI should allow me to participate in the rise while generating ongoing income. As shown in the figure below, SPYI It does not copy the behavior of the market, but it follows the trend to a certain extent. If you’re looking for an instrument that delivers pure capital appreciation during a bull market, SPYI isn’t necessarily a product you’ll be interested in.If you wish to take the work out of the equation and invest in funds that are actively managed by implementing a unique approach option overlay strategy In order to generate monthly income and gain some appreciation, then SPYI is probably something that should be looked into further. I plan to add more positions before the summer.

Seeking Alpha

Following my previous article on SPYI

My last article about SPYI was published on September 20, 2023 (can be read here), and since then, SPYI’s popularity has increased significantly. SPYI’s market share increased by 2.93%, and its total assets under management tripled. From an appreciation perspective, SPYI lagged the S&P 500’s 15.64% appreciation, but when distribution gains are taken into account, SPYI’s total return was 8.23%. In my September article, I discussed the overall strategy implemented by NEOS and why I am a fan of the ETF. Now that we have more economic data and people seem to be more interested in SPYI, I wanted to revisit my investment thesis and discuss why I think it is a solid income investment.

Seeking Alpha

Risks to my investment thesis in SPYI

When it comes to SPYI, I believe there are risks to my investment thesis and there are risks to individual investors. I don’t think anyone should invest solely based on a review on one of the major financial news networks or an article they read online. Personally, one of the biggest risks is not understanding an investment or doing enough due diligence. Anyone interested in SPYI shouldn’t just look at the yield;read through prospectus and learn about investment products. Whether it’s individual stocks or ETFs, the main risk is not understanding what you’re investing in. From an actual investment perspective, the amount of income generated from a distribution is not guaranteed. If option fees soften, then monthly distribution income will decline. Although SPYI invests in companies within the S&P 500 Index, its shortcomings are not mitigated and price fluctuations will be determined by the market. SPYI can trend downward during periods of volatility. Because SPYI uses an options strategy with multiple components to generate income and capture some upside appreciation depending on market direction, there’s also an opportunity cost involved. This can lead to poor investor performance.

SPYI is closing the gap between traditional covered call ETFs and the S&P 500

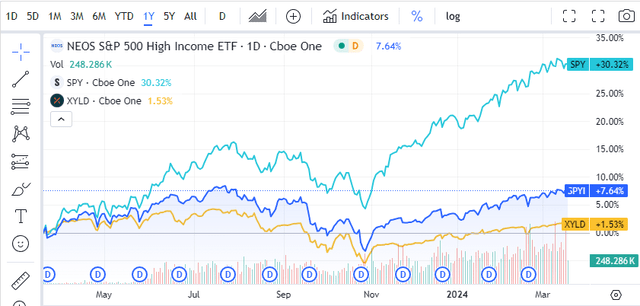

Investors focused on generating income often have different goals than those trying to generate capital appreciation. That doesn’t mean there can’t be a hybrid solution to bridge the gap between the two. GlobalX The Global There is no right way to invest, and everyone’s investment strategy is unique and their overall goals are different. XYLD True to its roots, monthly income is generated by selling funded calls, but its overall upside is limited.

The NEOS team developed a strategy where they invest in companies within the S&P 500 index just like XYLD, but their selection strategy takes a 2-legged approach. at 1Yingshi NEOS captures the premium by selling covered calls in its portfolio. near earth object system Utilize this premium to pay monthly distributions while doing 2ND One leg of its options coverage strategy. at 2ND NEOS buys call options on the S&P 500 Index with residual premium to unlock some of its upside potential. When a covered call is sold on a position, the entity selling the covered call is selling the right to purchase its stock at a specific price on a specific date. If the stock appreciates beyond that price, the entity entering into the contract is not entitled to any upside beyond the price agreed upon in the contract. By purchasing call options with residual premium, SPYI allows its investors to participate in some of the upside if the market rebounds.

As the chart below shows, the SPDR S&P 500 Trust (SPY) is up 30.25% over the past year. XYLD, a straight covered call ETF, has gained 1.53% in that period while paying a distribution of $3.94, or a capital gain of 9.91% on shares trading at $39.77 on March 20, 2023. SPYI, on the other hand, was able to generate a return of 7.64% over the same period while paying investors $5.83 in distribution earnings, or a capital gain rate of 12.5%, as the stock traded at $46.63 on March 20, 2023. According to the data, SPYI is able to generate more alpha than traditional covered call ETFs because 2ND Its options cover part of the strategy, but during uptrends it often still underperforms the market as some of the upside is somewhat constrained.

Seeking Alpha

I think the market will move higher in 2024 and SPYI can continue to bridge the gap and generate significant revenue with some appreciation

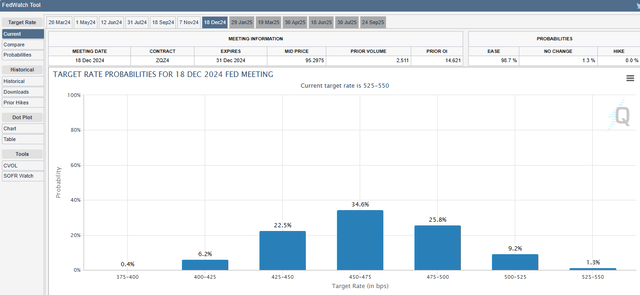

Goldman Sachs (GS) added S&P 500 Index Target 5,200 by end of 2024, while Bank of America (BAC) raises target S&P 500 Index to 5,400. Today, the S&P 500 is trading around 5,170, up about 8.42% year-to-date. It will be interesting to see what Fed Chairman Powell says at this month’s FOMC meeting and the tone regarding interest rates.this CME Group It is estimated that there is an 89.5% chance that interest rates will fall below 5% in 2024, with the federal funds rate most likely to be between 450 and 475 basis points. If the Fed starts cutting interest rates, I think we will see the market move higher as the cost of capital falls and companies are more likely to expand.

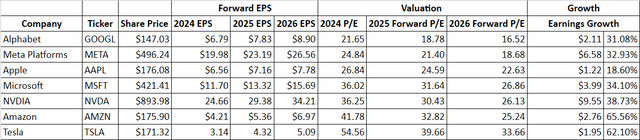

CME Group

Below I have compiled Magnificent 7’s forward profit forecast based on Seeing Alpha. Magnificent 7’s current average price-to-earnings ratio is 34.59 times its 2024 price-to-earnings ratio. In the next two years, the average profit growth rate of these companies is expected to be 40.44%. Based on 2026 earnings, Magnificent 7’s price-to-earnings ratio is 24.25 times. I think this is a sign that companies and individuals will be spending more money across the economy in the coming years, and if that’s true, I would expect earnings per share to increase in the broad market over the next few years. If this happens, I think it will be good for SPYI since it owns all the companies in the S&P and generally follows the market direction.

Steven Fiorillo, “Searching Alpha”

in conclusion

I believe we are entering a multi-year bull market led by big tech companies. If the Fed begins a rate-cutting cycle in the coming months, I think more companies will expect higher profits, which could lead to further upgrades on Wall Street and an increase in S&P targets. If this happens, I think SPYI will follow the market higher while continuing to generate monthly income through its covered call overlay strategy. SPYI can be a hybrid fund that allows income investors to achieve their original investment objectives while providing a vehicle for some added value. I am bullish on the market and SPYI in 2024.