Microcap Center

A year ago, I wrote a review of the Amplify High Income ETF (NYSE: YYY). While I like the YYY ETF’s attractive 11% forward distribution yield, I urge caution because the fund has not historically “earned” distribution returns.

with a A year on, I wanted to revisit my thesis on the YYY ETF to see if my original conclusions were correct.

Fund Introduction

The Amplify High Income ETF seeks to pay high current income through a passive portfolio invested in closed-end funds (“CEFs”). YYY’s portfolio consists of 45 CEFs selected based on their distribution yield, net asset value (“NAV”) discount and liquidity.

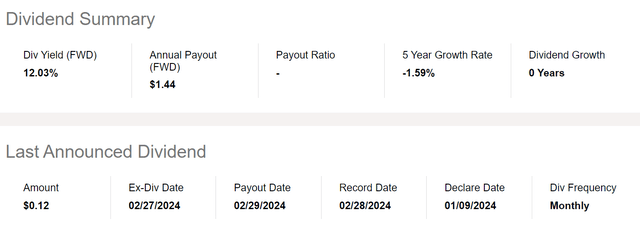

Based on its high-yield CEF portfolio, the YYY ETF itself pays an attractive distribution yield, currently set at $0.12/month or a forward yield of 12% (Figure 1).

Figure 1 – YYY Distribution Yield (Seeking Α)

Little change in portfolio allocation

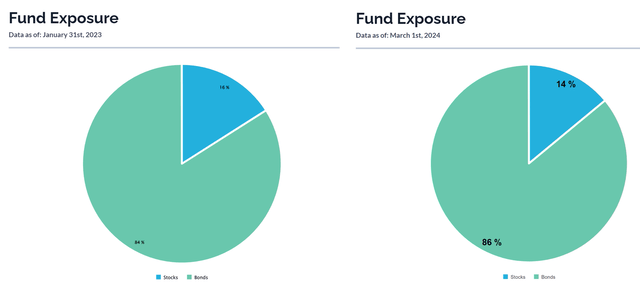

Compared with a year ago, YYY’s overall portfolio allocation is fairly stable, with 86% of the portfolio invested in bond funds as of March 1, 2024, compared with 84% as of January 31, 2023 (Figure 2 ).

Figure 2 – Fund risk exposure, March 1, 2024 and January 31, 2023 (amplifyetfs.com)

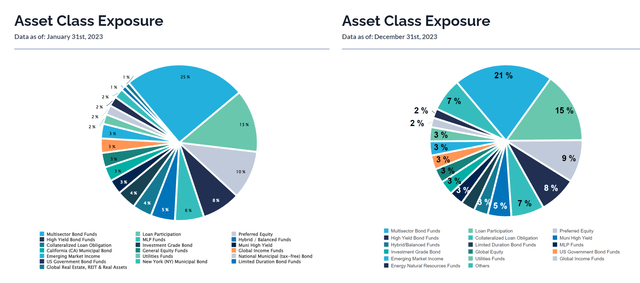

Asset class allocations are also fairly consistent, with only minor changes in individual asset class weights, such as a decrease in multi-sector bond funds from 25% to 21% and an increase in CLO funds from 4% to 7% (Figure 3).

Figure 3 – Fund asset class weights, December 31, 2023 and January 31, 2023 (amplifyetfs.com)

Strong returns in 2023

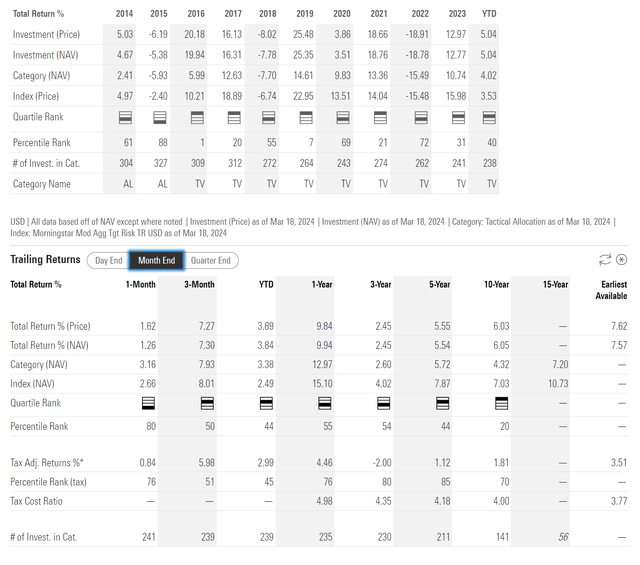

With equity markets buoyant and credit spreads tightening, it’s no surprise that the YYY ETF has performed strongly over the past year, returning 12.8% in 2023 and 5.0% year-to-date in 2024 (Figure 4).

Figure 4 – YYY Historical Returns (morningstar.com)

Distribution yield still exceeds long-term returns

However, even with its outperformance in 2023, the YYY ETF’s distribution yield is still lower than its earnings, with average annual returns of just 2.5%/5.5%/6.1% in 3/5/10 as of February 29, 2024 .

I believe my main concerns about the YYY ETF remain valid, as it continues to pay a distribution yield that far exceeds its long-term average return. As I wrote in my last article, funds that fail to earn distributions are known as “return of principal” funds, which feature net asset values being liquidated to fund their distributions.

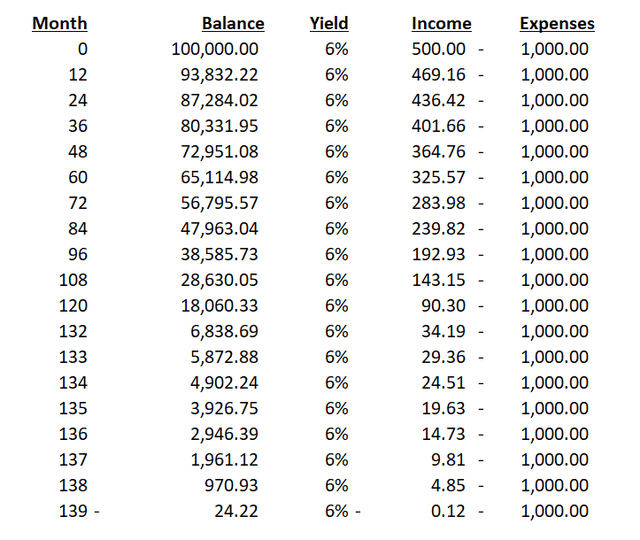

To understand where this might go wrong, consider a real-life example. Assume that John Doe has a retirement portfolio of $100,000 invested in securities that earn an annual interest rate of 6% (similar to YYY’s income over the past 10 years). However, John’s fixed monthly expenses are $1,000 (or 12% per year upon inception, similar to YYY’s fixed monthly allocation of $0.12).

Although John has ample retirement savings to cover any one month’s overspending, if John doesn’t increase returns or cut expenses, his capital will be depleted at an increasing rate over time. In this simple example, John’s savings will be exhausted in approximately 11.5 years (Figure 5).

Figure 5 – Hypothetical example (created by the author)

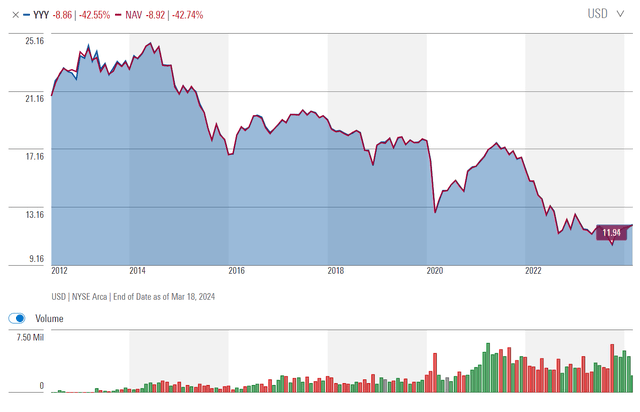

In fact, we can see that YYY’s NAV has declined 43% since inception as the fund continues to pay out more than it earns (Figure 6). While not as drastic as my simple example above, the concern is still valid.

Figure 6 – YYY Historical Net Asset Value (morningstar.com)

Think CEFS instead of YYY

Investors interested in earning high current income from a diversified CEF portfolio might consider the Saba Closed-End Fund ETF (CEFS) instead of the YYY ETF.

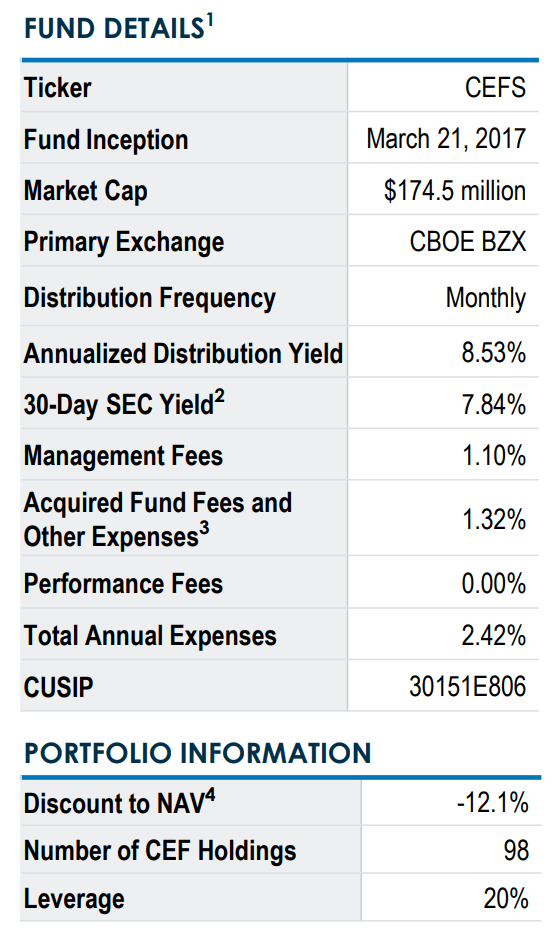

CEFS is CEF’s actively managed fund, managed by Saba Capital’s award-winning portfolio managers, with a management scale of $175 million and a distribution yield of 8.5% (Figure 7).

Figure 7 – CEFS Fund Overview (CEFS Fact Sheet)

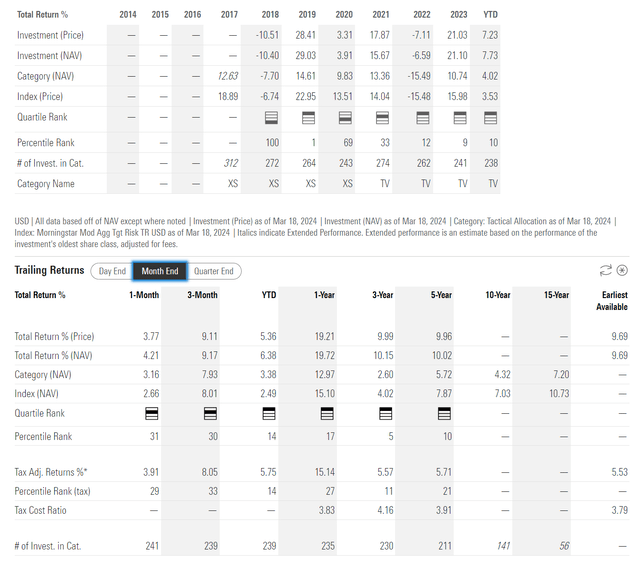

While the CEFS ETF does not offer as high a return as the YYY ETF, I believe it is more sustainable as CEFS has provided stronger historical returns, with 3-year and 5-year average annual returns of 10.2% and 10.2% respectively as of February. 10.0% on February 29, 2024 (Figure 8).

Figure 8 – CEFS historical returns (morningstar.com)

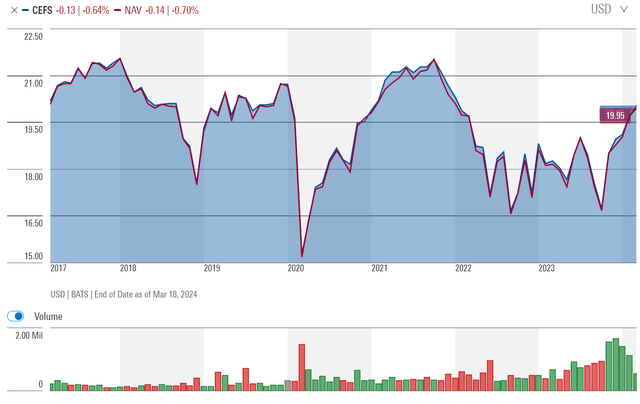

As a result, CEFS’s NAV has remained flat/stable over the long term, rather than liquidating NAV to pay its distributions (Figure 9).

Figure 9 – CEFS Historical Net Asset Value (morningstar.com)

I reviewed the CEFS ETF here.

in conclusion

Revisiting the Amplify High Income ETF, I remain concerned about the long-term sustainability of the YYY ETF distribution. While 2023 is a good year and the fund is able to earn distributions, the YYY ETF pays more than it gains in the long run.

I recommend that investors interested in a CEF portfolio approach consider the Saba Closed-End Fund ETF rather than the YYY ETF, as CEFS has consistently generated higher returns without depleting its NAV due to its more moderate distribution policy.

I remain cautious on YYY with a Hold rating.