Priori 1

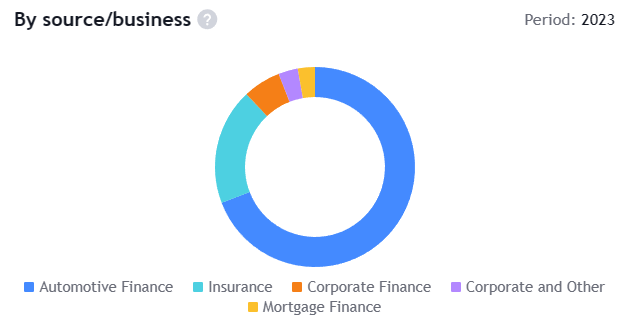

Woori Financial (NYSE: Allies) is the dominant player in auto lending; this is their core business. In addition to selling auto insurance, their goal is to generate net interest income from auto loans. 88% of revenue from these two verticals, while the remainder consists of sources such as mortgages and corporate finance, which still represent only a small portion of Ally’s business. In this analysis, I’ll detail Ally’s financial performance and explain how the rate hike regime affects its volumes and key metrics. In addition to discussing the stock’s direction, I also compare it to its major competitors and outline its potential risks and prospects to arrive at a Buy rating.

New York Fed 2023 Fed

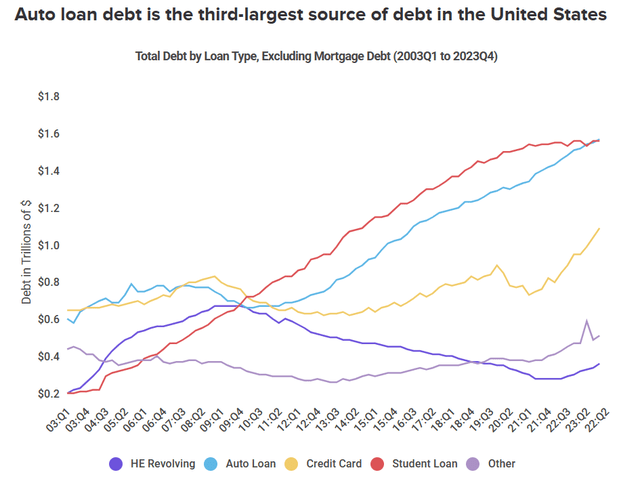

So, let’s first take a brief look at the U.S. auto loan industry.To give you context, automatically Loans are the third largest type of debt for American households after mortgages and student loans. 2022, 88% of new car purchases 40% of used car purchases are financed, the average loan per new car is $40,290, and there is currently $1.6 trillion in outstanding debt.

politician

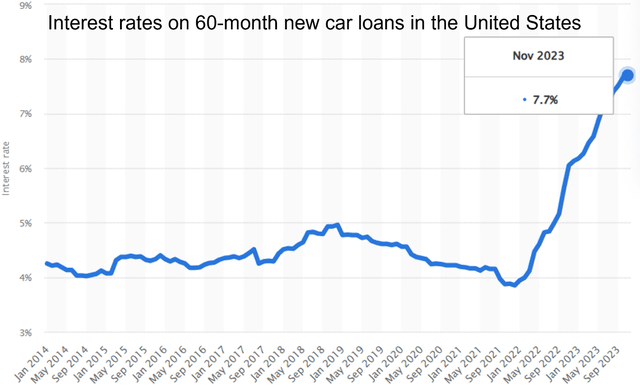

As you might expect, the industry is facing varying periods of high interest rates, ceteris paribus, which is a disincentive for customers to borrow. This is even more true when we factor in high-priced non-perishable items. As shown in the chart above, the average interest rate paid on a new car over 5 years is 7.7%, with the lowest in 2021 being 3.9%. So, if someone takes out a 5-year loan to buy a car worth $50,000, the monthly payment would now be $1,007. Not long ago, it cost $919.

trading view

Many of you may have heard of Ally’s high-yield savings account, which is currently offering a handsome yield Annualized 4.35%, and how it compares to accounts like SoFi (SOFI), Wealthfront, or UFB Direct.Or I heard that although they are a digital bank, they offer free ATM withdrawals. If you withdraw money from a non-partnered ATM system, they compensate You can get up to $10 per month. Well, since its IPO, Ally has changed its financing strategy and begun seeking higher deposits from retail customers. Maybe that’s why many people are aware of their online banking services. But what is certain is that their core business is still mainly focused on car loans, which has continued for decades since the company was founded in 1939. As of its last earnings report, the company reported more than 22,000 partnerships with car dealers, which allowed them to earn 13.8% in profits. By 2023, there will be 1 million loan applications from customers.

Ally 2023 Fourth Quarter Financial Report

In the chart above, you can see how funding conditions have positively changed customer deposit weights since the IPO. Although this mix consolidated a few years ago, it is still quite high and is generally a more attractive funding situation for banks. Technically, customer deposits have zero duration because they can be withdrawn at almost any time. Nonetheless, they are considered one of the most stable sources of funding.

There are no free lunches in finance. Customers deposit funds into Ally’s savings accounts because they are attracted by the high rate of return. This of course makes financing more expensive, and even more so if interest rates rise.As for comparing Chase Pay 0.01%but Ally and other neobanks have the advantage of operating entirely digitally, reducing real estate rent and personnel.

(Source: Author’s edit | Data: Seeking Alpha)

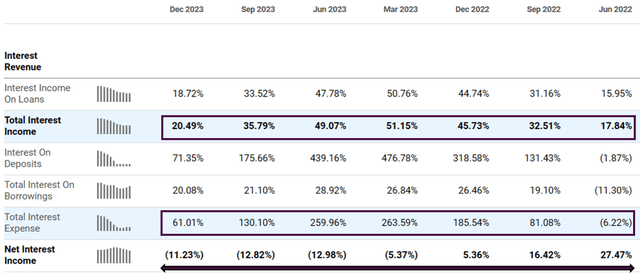

Taking a deeper look at Ally’s interest income, we can see that at the beginning of the rising interest rate environment, total interest income (TII) began a period of growth, mainly due to rising loan rates and increased customer deposits attracted by competitive interest rates. Still, Ally now has to pay higher compensation to savers, so total interest expense (TIE) is also starting to rise. Excluding the results, the expense component has regrettably grown better than the revenue component, causing net interest income (NII) to decline over the past four quarters.

The table doesn’t illustrate this because it’s based on percentages, but the absolute NNI for the fourth quarter of 2023 and the second quarter of 2022 (when rates begin to rise throughout the period) are $1,344 billion and $1,587 billion, respectively. It fell -15.3% during this rate hike period. In terms of net interest margin (NIM), we can see that the company has not improved since this measurement period. The net interest margin in the second quarter of 2022 was 4.04%, while the net interest margin in the fourth quarter of 2023 was 3.17%. Therefore, we can conclude that the company’s net interest margin profitability and margin expansion did not benefit during this rate hike.

(Source: Author’s compilation | Data: Corporate Finance)

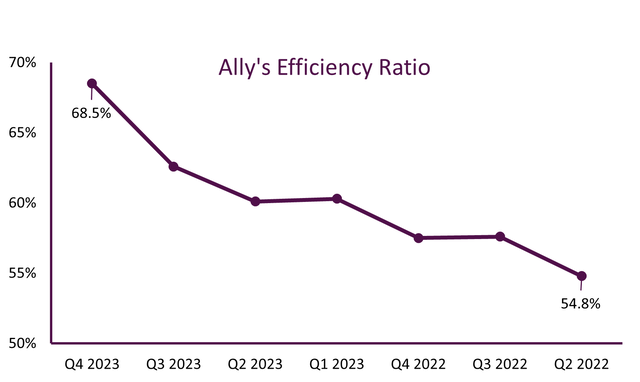

Another key ratio that banks need to watch is the efficiency ratio, which is the formula for non-interest expenses (real estate, wages, etc.) divided by interest and non-interest income less provision losses. Therefore, the lower the ratio, the better. Unfortunately for Ally, this ratio has been widening since the first rate hike in 2022. Again, consistent with NNI, the efficiency ratio was affected, rising from 54.8% to 68.5%, equivalent to a 25% increase over six quarters.

|

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

Income before loan losses |

2,289M |

2,180M |

2,279M |

2,326M |

2,441M |

2,254M |

2,295M |

|

Loan loss reserves |

587M |

508M |

427M |

446M |

490M |

438M |

304M |

|

regulations/income |

25.6% |

23.3% |

18.7% |

19.2% |

20.1% |

19.4% |

13.2% |

(Source: Author’s compilation | Data: Corporate Finance)

Finally, the provision-to-revenue ratio has also worsened quarter-on-quarter. This suggests that for every additional dollar of revenue, the company is setting aside a higher amount of capital because they believe more defaults will occur. Well, that makes sense, since higher interest rates offer zero benefit when refinancing an old loan, other than increasing the term during hard times, and even then, the extension of the loan would have to be significantly longer to reduce the per- monthly installments. Especially as interest rates move significantly.

Allies and Credit Acceptance

For valuation, I tried to compare Ally to pure-play auto loan players. Credit Acceptance Corporation (CACC) is easily the best public company to compare to Ally, and its market capitalization is at a comparable level. Medallion Financial Corp. (MFIN) and Consumer Portfolio Services (CPSS) are consistent with the fact that they are pure-play auto loan players, but their market caps are significantly lower and are considered micro-caps. While there are always trade-offs in comparisons, I won’t include them in this analysis and will just stick with comparing Allies directly to Credit Acceptance as a one-to-one game.

(Source: Author’s edit | Data: Seeking Alpha) (Source: Author’s edit | Data: Seeking Alpha)

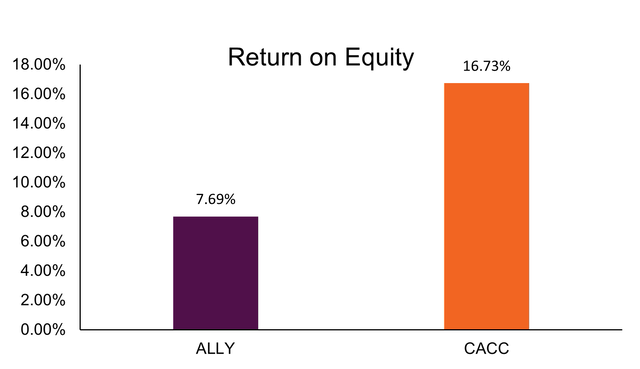

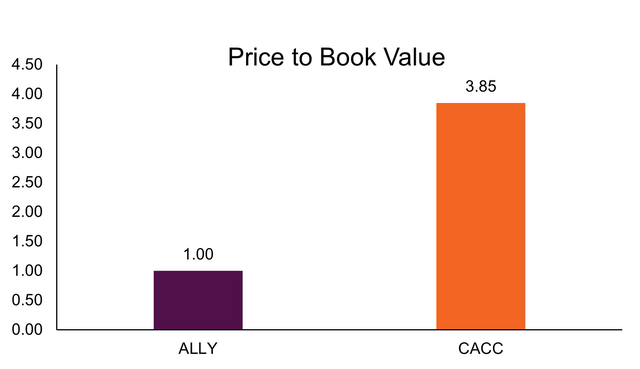

I want to compare based on the above three metrics.

- As a business, Credit Acceptance’s (ROE) is 2 times that of Ally.

- Still, using ROE to justify the multiple, CACC’s book price is almost 4 times that of Ally, suggesting that CACC stock doesn’t offer a more attractive multiple.

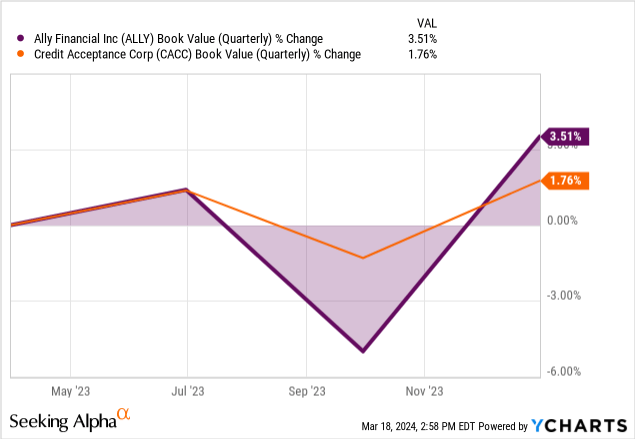

- Additionally, Ally’s equity grew faster than CACC last year, despite its higher volatility.

Seeking Alpha

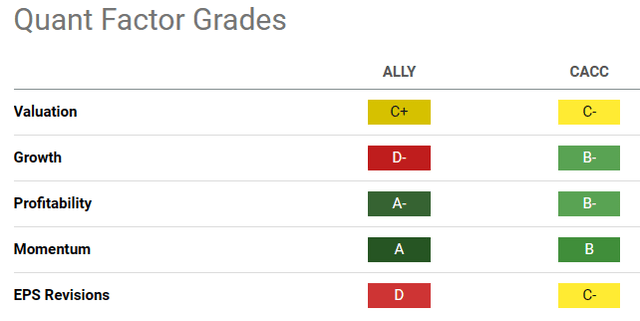

Checking Seeking Alpha’s quantitative ratings, Ally outperforms CACC in all categories except growth and EPS revisions. There’s only a small difference in the latter, and it’s also prudent to note that Wall Street analysts have paid far more attention to Ally than to CACC over the past three months. 21 analysts versus 3 analysts, a huge difference. Now digging into the growth ratings, to be honest, CACC does do better than Ally, but that’s mostly a 2023 thing, Ally’s NII growth is terrible at -10.65%, while CACC is only down slightly at -2.03%. However, if you look at previous years, Ally showed significantly higher growth numbers.

Therefore, based on quantitative ratings and valuation ratios commonly used by banks, I believe Ally’s valuation is better than CACC’s.

stock trend

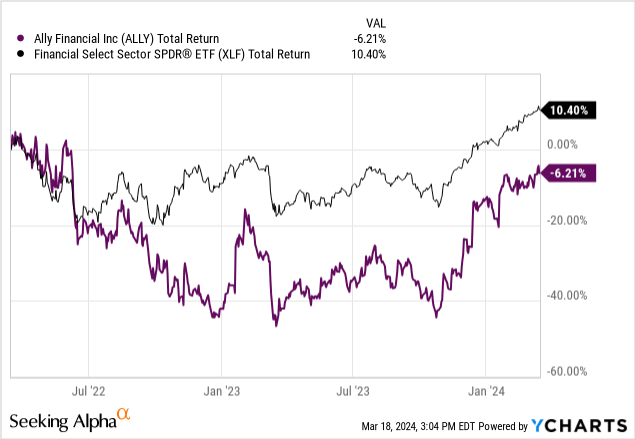

Now let’s compare Ally’s performance to the Financials Sector ETF (XLF). Results vary significantly depending on the lookback period of the analysis. For example, since the rate hikes began, the stock has underperformed its natural benchmark by -16.6%. Still, from a total return perspective, the stock has outperformed Financials ETFs by 41.1% over the last year and by 16.9% over the past six months.

|

ally |

45 |

the difference |

|

|

6M |

34.6% |

17.7% |

16.9% |

|

1 year |

70.0% |

28.9% |

41.1% |

|

Interest rate hike begins |

-6.2% |

10.4% |

-16.6% |

(Source: Compiled by the author | Data: YCharts)

Appearance

Finally, although the regime period affected the company in getting better financial returns, they are in a cyclical business and rising interest rates did have an impact on them. Since the inception of this monetary policy regime, all indicators such as efficiency ratios, net interest income and margins, and revenue reserves have been on the red side. Fortunately, the rate hikes appear to be over, as the Fed has kept rates at the same level since September 2023. Yes! People are debating whether they’re going to start cutting rates earlier this year or later this year, whether it’s going to be three cuts or six cuts, but ultimately, the fact is, we’re getting closer to that happening, unless, of course, things develop. That said, cheaper financing will help spur auto loan originations, especially for customers with high credit scores.

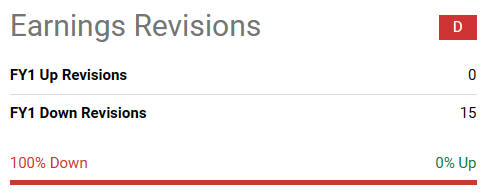

Seeking Alpha

One important aspect that caught my attention is the company’s poor earnings revisions. There have been 15 revisions in fiscal 2024, all of them downward. However, this may be an industry issue as CACC also has a Moderate Earnings Revision Rating.

risk

(Source: Author’s edit | Data: Seeking Alpha)

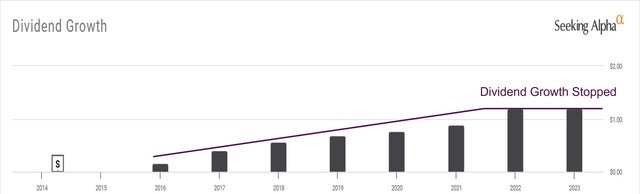

Ally has made great corporate moves for investors, such as spending $3.46 billion on stock repurchases since June 2021, and has been able to diversify its funding sources into more stable sources of financing like retail deposits. Although dividend growth has increased year by year since 2016, in 2023, due to the impact of the macro environment, dividend growth has stopped and the dividend payout ratio has remained at around 40%. This ratio is still sustainable, considering Ally’s previous distributions topped out at a payout ratio of 26.41%. But a key risk here is the company’s inability to grow net profit, which could lead to a dividend cut.

Another risk could be easing monetary policy in response to weak economic conditions. From these perspectives, the cure for lower interest rates may be worse than the disease itself, as delinquency rates would rise and consumers’ propensity to purchase nonperishable goods would decline. Additionally, as interest rates fall, higher deposit betas can become a funding problem, as savers begin to save less, spend more, or simply move assets to other banks.

in conclusion

When investing, you need a telescope to predict events. That’s why I have a Buy rating on this cyclical company. Yes, financial results were weak, largely due to the macro environment. But my bet is that rate hikes are over and any rate cut by the Fed will be a win, whether they do it in June or a few months later. If the deposit beta decline eventually materializes, the company can continue to enjoy its acquired funding position and achieve a higher net carry trade. What’s more, many people with good credit don’t find it attractive to get a car loan at existing loan rates.