FactoryTh/iStock via Getty Images

introduce

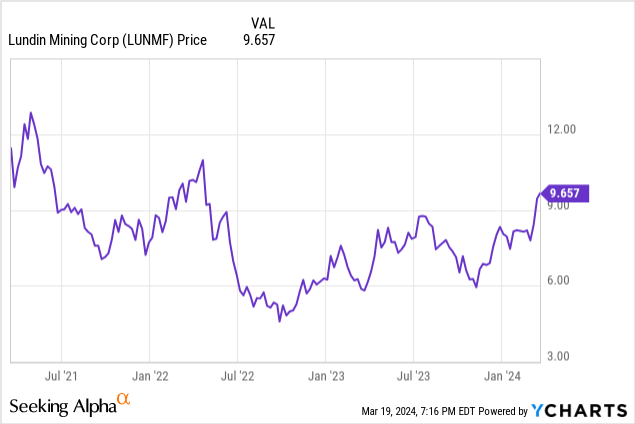

I have been following Lundin Mining (TSX:LUN:CA) (OTCPK:LUNMF) for several years now as I consider it one of the best managed copper companies.The Lundin family has one Well-known in the commodities sector (mostly known for its hard rock mining companies and projects, but the energy sector is also highly regarded). Its mines are spread across the world, helping to spread and reduce geopolitical risks. Since most mines have quite a long remaining life, I still think Lundin Mining Provide good exposure to copper prices.

A closer look at the 2023 results

In 2023, Lundin Mining was due to acquire Holds a stake in the large Caserones mine, due to be completed in summer 2023.Production in the fourth quarter was Even more impressive is the 103,000 tons of copper This is apparently also a quarterly record for the company.

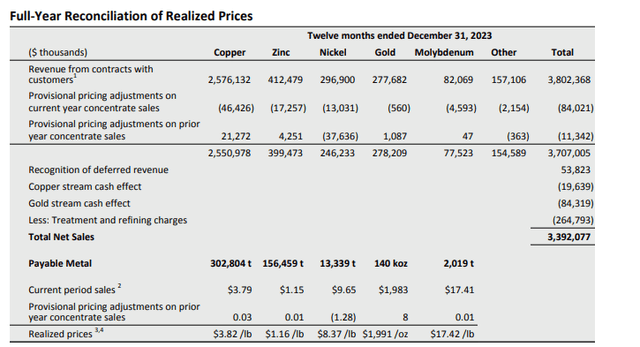

Lundin Mining Investor Relations

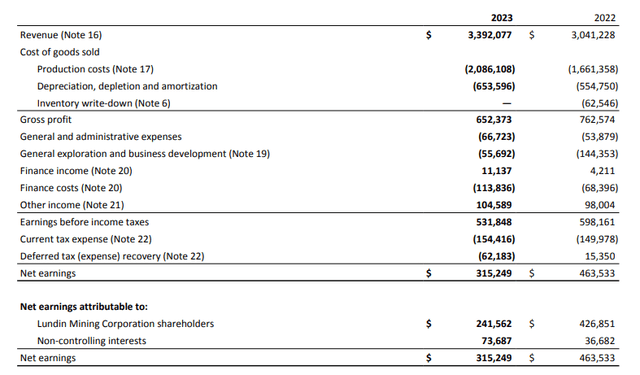

Strong copper production leads to total revenue of $3.4B in 2023, based on average Realized price was $3.82 per pound Copper, as shown above. The company’s revenue gross profit was $652 million, down from the prior year due to higher operating expenses and depreciation and amortization expenses. Having said that, Lundin Mining spent significantly less cash on exploration and business development expenses, and although total interest expense increased, pre-tax income fell by more than 10%, which is good considering volatile metal prices and higher costs. is a good result. Interest Expenses.

Lundin Mining Investor Relations

The bottom line showed net profit of $315 million, of which $242 million was attributed to Lundin Mining shareholders. The result was earnings per share of $0.31.

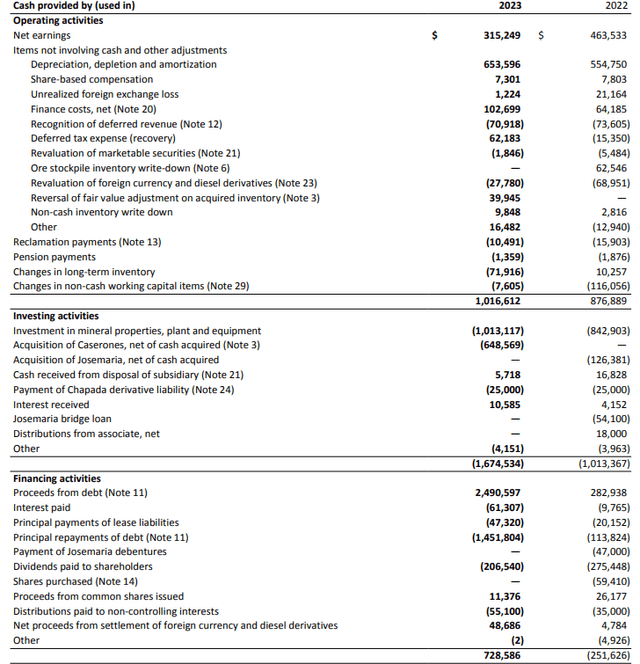

Looking at the cash flow results, the company reported total operating cash flow of $1.02B, but this includes an $80M investment in the working capital position and excludes $108M of interest and lease payments. In addition, we should also exclude the $55 million in cash payments to non-controlling interests, since we are clearly primarily interested in Lundin’s performance.

Lundin Mining Investor Relations

This resulted in adjusted operating cash flow of $933 million and total capital expenditures of $1 billion. You might think that the company’s free cash flow is clearly negative, and while that’s correct, there’s more going on here than meets the eye.

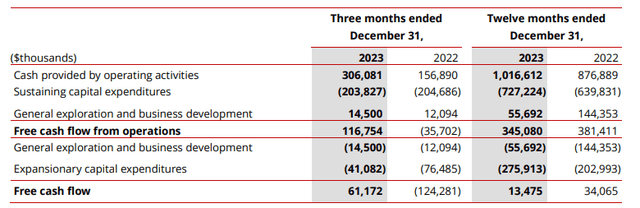

First, there are important differences between maintenance and growth capital expenditures. Furthermore, with the Caserones acquisition only closing in mid-2023, the full-year results don’t really provide a good overview. Fortunately, the company also provided a breakdown of operating free cash flow, which, according to the company’s own calculations, was about $117 million in the final quarter of 2023.

Lundin Mining Investor Relations

While that sounds great, keep in mind that this is “operating” free cash flow, which excludes interest payments, lease payments and non-controlling interest payments. Once these factors are included, company-level net free cash flow may be only half or slightly less than half the reported free cash flow results.

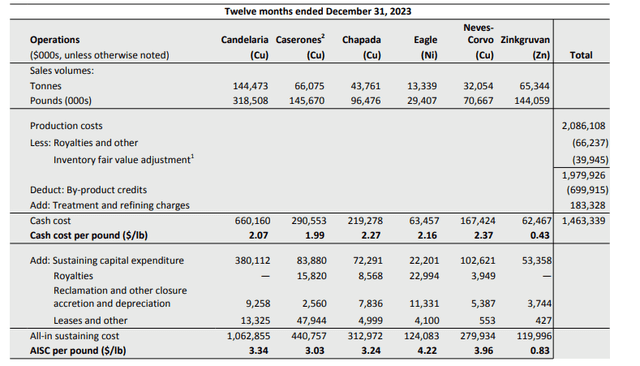

That sounds pretty low, which is a correct assumption. Unfortunately, this is due to the higher production costs of copper. While C1 cash costs are quite reasonable (approximately $2/lb for the two largest mines), there is considerable sustaining capex factor, with FY23 AISC per pound for Candelaria and Caserones respectively. pounds $3.34 and $3.03.

Lundin Mining Investor Relations

This also explains why Lundin Mining should be considered an interesting call on copper prices. The average rise in copper prices from $3.82 to $4.00 was only 5%. But AISC’s profits will increase from $0.60 per pound (rounded) at the largest mines to $0.80 per pound, an increase of 33%.

2024 Guidance and Why Copper Prices Matter

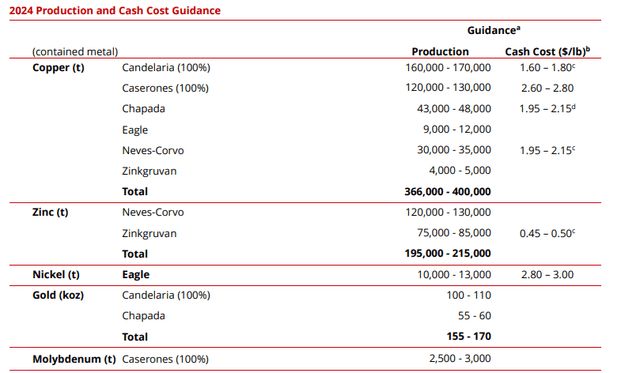

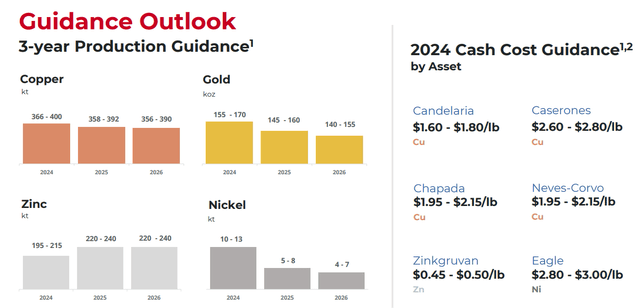

Lundin Mining has apparently also issued guidance for the current fiscal year. The company expects copper production to total 366,000-400,000 tons this year, and average production costs should be quite competitive in the current pricing environment. Keep in mind that despite the company only owning 80% and 51% of the shares respectively, it reported production guidance of 100% for Candelaria and Caserones.

Lundin Mining Investor Relations

The company does have the option to acquire an additional 19% stake in the Caserones mine for $350 million in cash. Exercising this option will increase annual attributable copper production by approximately 25,000 tonnes.

Lundin also provides three-year outlook. While copper production will remain relatively stable, total gold production is likely to decrease by about 5-10%, while nickel production will also decrease, with output expected to decrease by about 50% over the next two years.

Lundin Mining Investor Relations

Zinc production, on the other hand, is expected to increase by more than 10% to approximately 500 million pounds per year. Although zinc prices have been quite weak recently, lower TC/RC charges suggest the zinc market is getting stronger as smelters struggle to find enough feedstock for smelting.

investment thesis

Although Lundin Mining has significant gold and zinc production, I still view it primarily as a copper company and an interesting way to be exposed to stronger copper prices.Lundin Mining is definitely not cheap right now because The current number of shares is close to 775 million shares Resulting in a market capitalization of approximately $7.5B. Fortunately, even after acquiring the Caserones stake, the balance sheet remains strong, with net financial debt (excluding lease liabilities) of approximately $840 million.

I currently no longer hold a position in Lundin Mining, but I believe the company remains one of the more attractive opportunities to increase my exposure to copper prices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.