PressureUA

at last, alphabet inc. Also known as Google (NASDAQ: Google, NASDAQ: Google) investors received some good news last week.according to a Bloomberg reportsApple (AAPL) is in licensing talks with the search giant Its Gemini LLM (Large Language Model) provides support for iPhone AI functions.

In response, Google’s stock price posted one of its highest single-day gains in months. The news was seen as clear evidence of Google’s superiority in the LL.M. space, at a time when it seems to be disappointing investors at every opportunity.

While this is clearly a positive development, it remains to be seen whether and in what form this partnership comes to fruition.

Let’s take a deeper look at the search giant’s prospects and try to understand why it remains an undervalued company among the big tech companies.

Background and investment conflicts

I’ve been covering Alphabet on Seeking Alpha Since March 2023. Despite maintaining a Buy rating during this period, most of my articles have focused on criticizing the company.Specifically, its unwilling turn the situation around, its lack of efficiencyand it is consistent with Execution failed.

I think this largely reflects the conflict that many Google investors face.

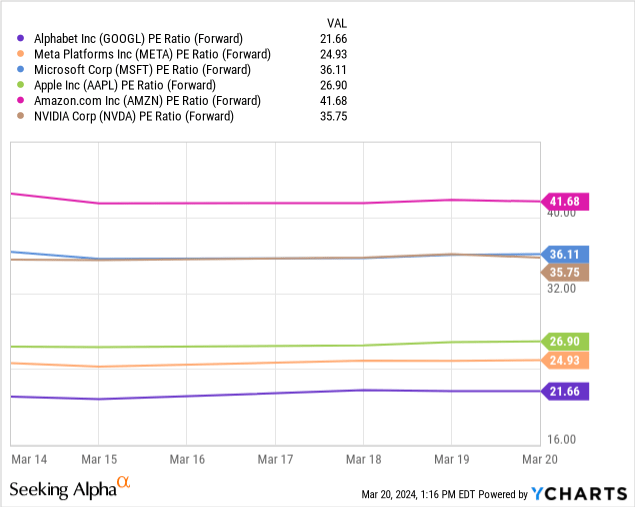

On the one hand, the company trades at the market’s average price-to-earnings ratio, the cheapest among the big tech companies, and it still owns some of the strongest businesses in the world.

Alphabet, on the other hand, is cheap for a reason. After continued underperformance, investors viewed its management as poor compared to other big tech companies. Even in artificial intelligence, where Google is supposed to be a leader, the company doesn’t seem to have a clear strategy. Additionally, Alphabet has not engaged in radical efficiency restructuring so far.

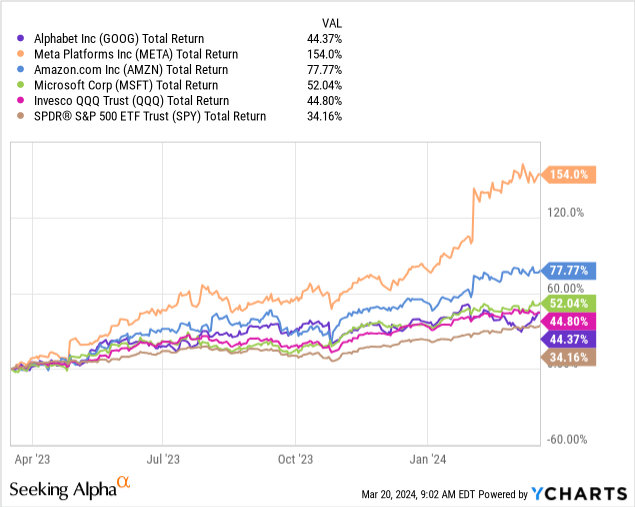

Not surprisingly, Alphabet’s stock price lagged other big tech companies last year, matching only the Nasdaq 100 Index (QQQ).

Still, investors are torn between a high-quality business with a wide moat and relatively low valuation and the fact that the business is currently underperforming.

That’s why recent Apple news has generated so much enthusiasm.

Apple in talks to license Gemini models

It has been three days since Bloomberg broke the news that Apple and Google were negotiating for the iPhone manufacturer to grant Gemini LLM license.

If the deal goes through, it would be a strong demonstration of Google’s superiority in artificial intelligence compared to other open source LLMs like OpenAI and Llama.

In terms of financial impact, however, it’s hard to say as terms of the deal are still unknown.

As we all know, Google and Apple have established a long-term partnership in the search field, in which Google pay Apple has invested heavily in becoming Safari’s default search engine.

Interestingly, in this case, most experts believe Apple will pay Google to use its model, but that’s not as obvious as one might think.

Having said that, it is important to stress that no agreement has been officially announced and no negotiations have been confirmed. In addition, the same news also stated that Apple is also negotiating with OpenAI.

In my view, Google’s stock price is rising not necessarily because investors priced in the potential gains from the deal, but because investors understand Google is cheap and they want to take advantage of what the current valuation has to offer ahead of a potential turnaround. Selective for profit or actual development.

Google’s competitive positioning shows weakness

Google is the world’s number one search engine, and its market share has been hovering around the world. Low nineties Almost ten years. Likewise, Gmail remains the most popular email platform and YouTube is the most viewed streaming platform and one of the most popular social media apps in the world.

That’s all well and good, but investors should care about how Google turns this popularity into revenue. Of course, Google does this primarily through advertising and cloud services.

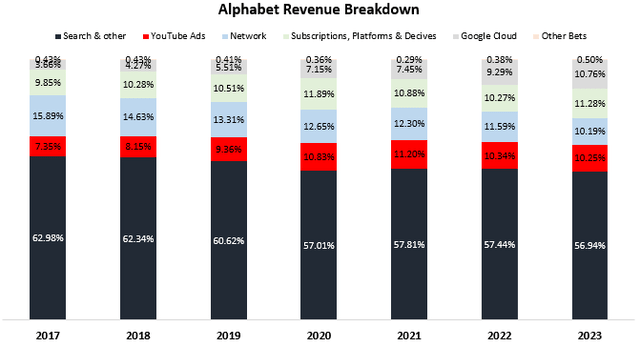

Created by the author using data from Alphabet’s financial reports.

According to Alphabet’s 10-K data, more than 75% of the company’s revenue in 2023 will come from online advertising. That’s about $240 billion, which is exactly the same as Google search and other, YouTube advertising and Google Network revenue combined.

In 2023, the combined growth rate of these three categories is 6%. In comparison, Meta Platform’s (META) ad revenue grew 16% during this period, and Amazon’s (AMZN) growth was faster, at 24%.

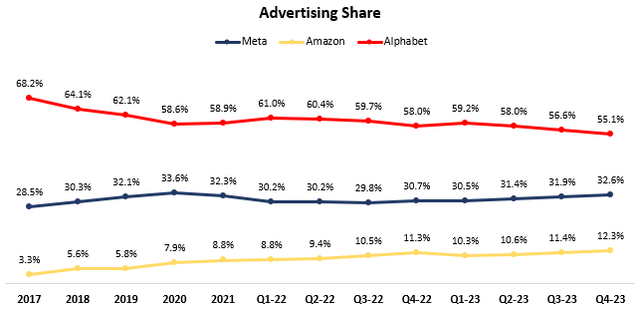

Created and calculated by the author using data from the company’s financial reports.

As we’ve seen, Alphabet’s share of the online advertising space has been declining significantly, and while Meta is showing clear signs of recovery from its 2022 trough, Alphabet’s decline is only getting worse.

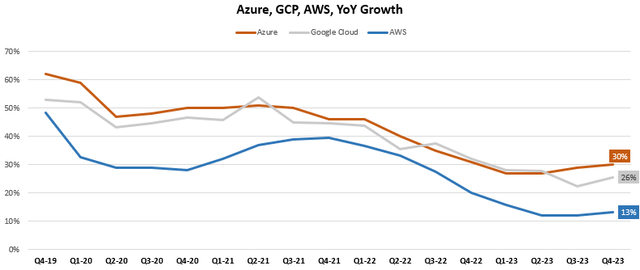

And Google Cloud, Alphabet’s second-most important business line, doesn’t fare much better than its rivals.

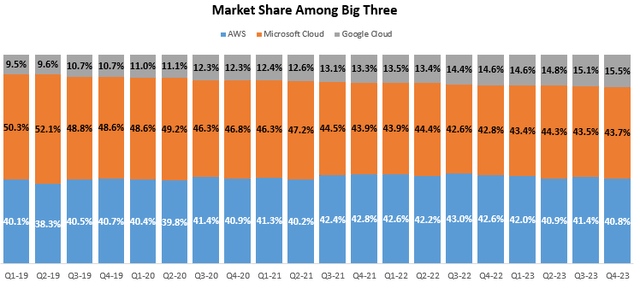

Created and calculated by the author using data from the company’s financial reports.

As of the fourth quarter of 2023, Google Cloud’s share lags far behind AWS and Microsoft Smart Cloud (MSFT), at 15.5%. Despite being much smaller and least profitable, Google’s growth still lags behind Microsoft’s.

Created and calculated by the author using data from the company’s financial reports.

Overall, we can understand why investors are worried about Google’s weakness, with nearly 90% of the company’s revenue coming from underperforming peer businesses.

Concerns about efficiency remain

In a bad year for tech stocks in 2022, many companies have undergone major transformations to become leaner and more profitable, cutting unnecessary headcount and shedding non-core operations.

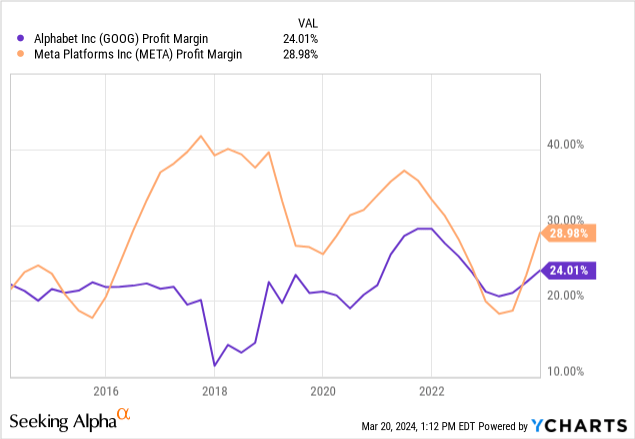

Meta is one such company, which achieved one of the most impressive turnarounds in its history through Zuckerberg’s “Year of Productivity.”

With Google’s operating profit plummeting 400 basis points in 2022, Google investors hope to see a similar situation happen with Sundar Pichai.

However, this has not happened yet.

While Meta arguably has a deeper hole to climb out of, its 10-point operating margin improvement was rightly welcomed with enthusiasm.

For Google, the lackluster improvement of 96 bps is quite disappointing.

Looking forward to 2024, Google’s margins are widely expected to improve slightly from 24.0% to 24.9%, while Meta is expected to improve from 29.0% to 32.3%.

Again, I think investors’ criticism of Google’s lack of ambition to further cut costs is legitimate.

Valuation “too good”

Personally, when I see a company that is underperforming and ineffective, I usually cross it off my list. Add to that one of the greatest innovator’s dilemmas in history, and I’m sure many investors will be put off as well.

However, Alphabet’s valuation is too attractive to give up easily.

As I write this, Alphabet’s price-to-earnings ratio is 21.6 times, well below other large tech companies.Going even further, Alphabet is currently trading in line with the S&P 500 many kinds of 21.4 times.

Furthermore, many investors, myself included, believe that Google’s business still has the potential to regain its crown, or at least close the gap with its peers.

Therefore, I still think that as long as Alphabet’s P/E ratio is the market average and well below its peers, investors would not go wrong in wanting to take advantage of this opportunity, as the company’s turnaround potential is seen as a Free “choice”. “

in conclusion

Alphabet has disappointed investors in consecutive quarters as it lags rivals in both growth and profitability.

In a vacuum, the stock performs well, but a closer look reveals that Alphabet has lagged all of its peers while delivering returns consistent with QQQ.

Recent news that Apple is considering licensing Google’s LLM has raised optimism about the company’s technological superiority amid concerns about continued disadvantage.

While it’s far from done, the news serves as a reminder to investors that they can acquire Google at an objectively lower valuation and receive its turnaround option for free.

Therefore, I reiterate my buy rating on Alphabet stock.