Attend Inman Connect in Las Vegas July 30-August 1! Seize the moment and take control of the next era of real estate. Through immersive experiences, innovative formats and an unparalleled lineup of speakers, this gathering becomes more than just a conference, it becomes a collaborative force shaping the future of our industry. Grab your tickets now!

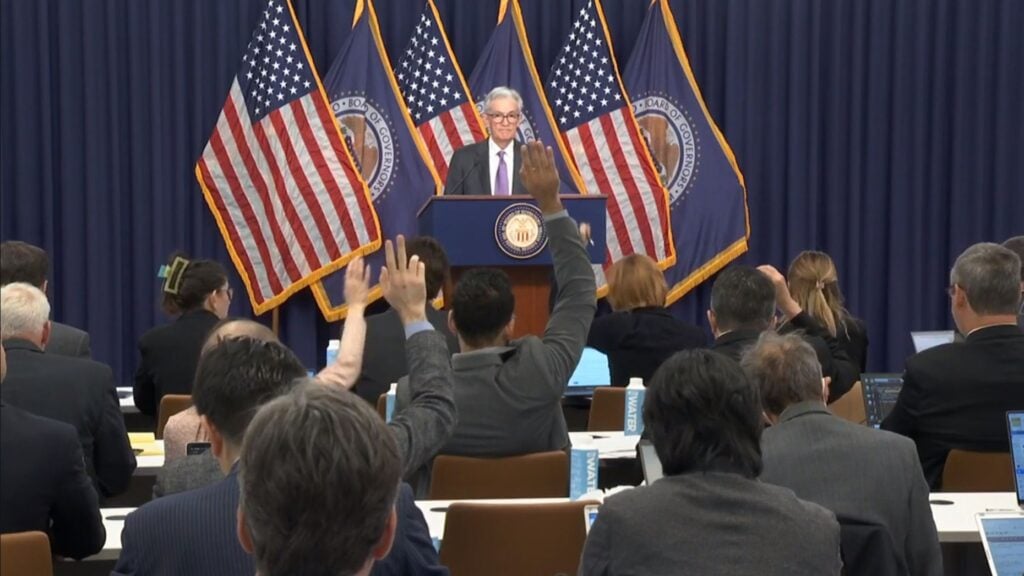

Federal Reserve policymakers left short-term interest rates unchanged on Wednesday but said they still expect to cut the federal funds rate three times this year, for a total of three-quarters of a percentage point, as previously forecast in December.

Another big news for those watching mortgage rates closely is that Fed Chairman Powell said he and his colleagues are also considering slowing the pace of “quantitative tightening,” which is reducing the central bank’s $7 trillion balance sheet surface.

In order to keep interest rates low during the epidemic, the Federal Reserve purchased $80 billion in long-term Treasury bonds and $40 billion in mortgage-backed securities (MBS) every month, swelling its balance sheet to an unprecedented $8.5 trillion.

as inflation As the epidemic begins to rage in 2022, the Fed not only begins to raise interest rates federal funds rate Its current target is 5.25% to 5.5%, but it has begun reducing its balance sheet by allowing up to $35 billion in maturing MBS and $60 billion in Treasury transfers per month.

The Fed’s quantitative tightening policies have helped prop up mortgage rates, preventing them from falling further than they have since peaking last year. Since the Fed is no longer competing in the market to buy government debt or mortgages, investors can demand higher returns.

“What we’re looking at is slowing the runoff,” Powell said. “There’s not a lot of liquidity in MBS right now, but there is in Treasuries, and we’re talking about slowing down,” Powell said. “I don’t want to give you a specific number because we haven’t made a deal or a decision yet. But here it is This idea.”

In terms of timing, Powell would only say that the slowdown would occur “fairly soon.” I don’t want to be more specific, but you get my point. “

Rather than actively selling Treasuries and mortgage-backed securities, the Fed passively rolled these investments off its balance sheet by not replacing maturing assets.

But in recent months, this passive approach has only allowed the Fed to reduce MBS’s balance sheet by about $15 billion per month. Mortgage rates remain so high that few homeowners have the incentive to refinance their existing loans.

Fed shrinks $7 trillion balance sheet

Source: Federal Reserve System Board of Governors, Federal Reserve Bank of St. Louis.

In a speech on March 1, Federal Reserve Governor Christopher Waller expressed disappointment at the slow pace of MBS reductions and expressed hope to see the Fed reduce its $2.4 trillion MBS holdings to zero.

But meeting the Fed’s $35 billion monthly MBS rollover target will require it to abandon its passive strategy and start selling mortgages, which could push mortgage rates higher. Last fall, real estate industry groups urged Fed policymakers to publicly commit to not selling MBS.

“Our long-term goal is to restore a balance sheet that consists primarily of U.S. Treasuries,” Powell said, acknowledging that he hopes to eventually unwind most of the Fed’s holdings of MBS.

But “it’s not urgent now,” and in the long run, a gradual slowdown in the pace of quantitative tightening may help the Fed make greater progress in reducing its balance sheet and avoid that kind of damage. Money Market Experience in 2019He said.

“It’s kind of ironic that by slowing down, you can go further, but that’s the idea,” Powell said. “The idea is that with a smoother transition, you have a much lower risk of liquidity problems that could develop into a shock and potentially cause you to stop the process prematurely.”

The 10-year Treasury yield briefly surged to 4.32% after the release. statement Fed policymakers said they “do not believe it would be appropriate to cut short-term interest rates” unless they have “greater confidence that inflation can sustainably approach 2%.”

But as investors digested the “dot plot” in the latest report, the 10-year Treasury yield, a barometer of mortgage rates, quickly fell back to 4.27%. Economic Forecast Summary That shows policymakers still expect three interest rate cuts this year.

Tracked futures market CME Group Fed Watch Tool On Wednesday, the probability that the Federal Reserve would cut interest rates in June was 74%, and investors predicted a 43% probability that the Fed would cut interest rates four or more times before the end of the year.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note to clients that the firm’s forecasters still expect five rate cuts this year starting in June, totaling 1.25 percentage points.

Ian Shepherdson

“We are encouraged by policymakers’ decision to stick with three rate cuts this year and forecast core inflation to slow significantly over the remainder of the year,” Shepherdson wrote. “We now want to hear from Chairman Powell, “These decisions reflect growing signs of economic weakness, as seen in recent retail sales data, a sharp decline in hiring intentions … and a host of indicators pointing to an increase in layoffs in the spring.”

In forecasts released Tuesday, Fannie Mae economists said they don’t expect mortgage rates to fall below 6% this year or next, and that a recent spike in mortgage rates could weaken an expected rebound in home sales in 2024 intensity.

Get Inman’s mortgage newsletter delivered straight to your inbox. A weekly digest of all the biggest news in mortgages and settlements around the world is published every Wednesday. Click here to subscribe.

Email Matt Carter