Chip Somodevilla/Getty Images News

Wall Street’s benchmark S&P 500 surged about 1% to a record high after the Federal Reserve and Chairman Jay Powell sent new signals on the path of interest rates. 2024. While the latest FOMC forecast highlights a slight shift in the interest rate dot plot at the extreme (with expectations for more than 3 rate cuts weakening in favor of a more solid consensus), all else being equal, this should appear slightly bearish, but Surprisingly it is worth noting that the overall response to this update from market participants has been very welcoming. I think that against this backdrop, market participants’ bullish reaction to the latest changes in the Fed’s forecasts makes sense.In my view, the market should stop focusing on the path of interest rates as the primary focus of the Fed’s contribution to the market – at this point, the arrival of lower rates Interest rates are only a matter of time. What investors should pay more attention to and celebrate is that the Federal Reserve has successfully restored support for financial asset prices at a time when the market has faced significant stress.

Arguably, what makes the threat of a recession in 2022-2023 so dire is the recognition that the Fed is unlikely or unwilling to be a source of economic support. In fact, with Powell and his team fully committed to restoring price stability, the Fed has effectively distanced itself from the possibility of using any dovish monetary policy tools. But with inflation trending around 3% year-over-year and interest rates above 5%, the Fed is once again looking like a well-recovered 800-pound gorilla, ready to step in during times of recession/market stress, Withstand any economic downturn. An “abnormal” threat to the U.S. economy. We know from past observations that the Fed’s tools will be very efficient and effective in this regard. This implicit “put option” from the Fed should be more valuable to investors than whether interest rates are at 4.5% or 4.0% at the end of 2024.

Given that already bullish sentiment is now also supported by implicit expectations for Fed puts, I reiterate my thesis that the S&P 500 is expected to trade at 5,400 by the end of 2024.

An update on FOMC forecasts

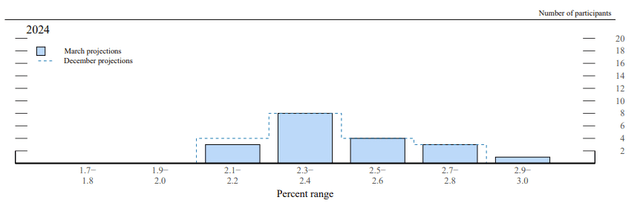

On March 20, Federal Open Market Committee (FOMC) participants released their views. Latest economic forecasts In 2024 and beyond, a clear dovish shift in policy took the market by surprise. As a key observation, I highlight that the group has broadly confirmed its inflation forecast for the end of 2024, although year-to-date 2024 inflation numbers are higher than expected. Federal Open Market Committee (FOMC) members’ collective expectations continue to remain within the 2.3-2.4% year-over-year range.

FOMC Forecast – March 2024

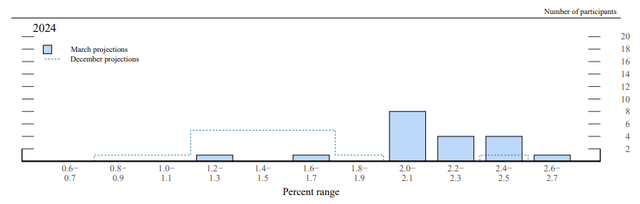

In addition to the positive inflation forecast, the Fed also surprised GDP growth. Notably, the forecast has been revised upwards significantly, with annual growth now expected to be around 2.0-2.5%, up from the December forecast of 1.2-1.7%.

FOMC Forecast – March 2024

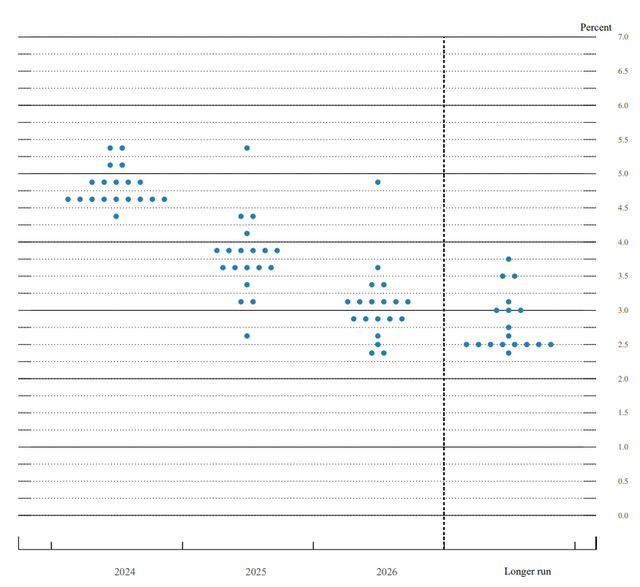

In an environment of rising economic growth and declining inflation, the Federal Open Market Committee maintained its interest rate outlook for 2024 and called for a 75 basis point interest rate cut.

FOMC Forecast – March 2024

Overall, the FOMC forecasts are very consistent with my expectations leading up to the meeting, and I think calls for 3 rate cuts should continue:

Looking at the latest FOMC version scheduled for release on Wednesday the 20th, I expect the Fed’s 2024 core PCE forecast may rise from 2.4% to around 2.5-2.7%, as recent inflation has proven to be more troublesome than expected . However, I still believe the call for three interest rate cuts will continueas the Fed may point to the impact of recent seasonal factors.

Look beyond the FOMC noise and keep an eye on Fed puts

While the FOMC’s forecasts for the U.S. economic and monetary policy outlook remain important inputs into investors’ asset allocation decisions, I believe it is time for markets to look beyond interest rates as the primary driver of investor sentiment. Investors should accept that FOMC decisions often result in immediate, short-lived market reactions that obscure underlying economic fundamentals. Additionally, investors should recognize that FOMC communications and decision-making, while important, are only one part of the broader economic picture. If you only focus on FOMC updates and short-term market fluctuations, you may miss deeper, more structural economic drivers, such as the emerging use cases of GenAI in productivity growth, and the broader technological potential and value creation of new business models.

However, one of the most obvious and powerful market drivers that investors may overlook when focusing on interest rate moves has to do with monetary policy itself, namely the central bank’s success in reinstating the Fed’s put options. The term “Federal Reserve put option” refers to the belief among investors and traders that the Federal Reserve will intervene in the market by adjusting monetary policy during a sharp market decline or financial distress. The concept is similar to a put option in investing, where the holder has the right but not the obligation to sell the security at a predetermined price to protect against a price decline. This expectation may influence investor behavior, as belief in a “Fed put” may lead to higher risk-taking, assuming the Fed will help cushion the market from any significant losses. In this case, the “Federal Reserve put” is not an official policy or strategy of the Federal Reserve. Rather, it developed over time as a result of the Fed’s historical actions during times of financial crisis or market turmoil. For example, during both the financial crisis of 2007-2008 and the COVID-19 market sell-off in early 2020, the Fed took significant actions to stabilize the economy and the financial markets by slashing interest rates and buying various financial assets through open market Operations. Interestingly, the S&P 500’s lowest trading price during the coronavirus sell-off coincided with the Fed announcing plans to support the market.

To this extent, concerns about the threat of a recession in 2022-2023 are largely driven by the recognition that the Fed may not be able or willing to provide economic support as it has in the past. This shift is mainly due to the fact that the Fed led by Powell and others prioritized restoring price stability over stimulating the economy, thereby abandoning the possibility of implementing dovish monetary policies traditionally used to respond to economic recessions. However, with inflation holding steady at around 3% annually and interest rates above 5%, the Fed has once again become the silent guarantor of market prices, ready to intervene in times of recession or market turmoil.

Important points for investors

Beyond the March Federal Open Market Committee (FOMC) forecast, investors should focus less on the specific timing of a rate cut (which seems inevitable) and more on the Fed’s new role as a financial backer during major market distress. status. This change in sentiment is critical, especially given concerns about a recession in 2022-2023, fueled by doubts about the Fed’s willingness to support the economy. However, with inflation stabilizing and interest rates above 5%, the Fed should be in a very good position to offer investors implicit Fed put options. Overall, as past financial crisis events have demonstrated, the importance of the Fed’s implicit support or “Fed put” to investors cannot be overstated. With market sentiment already upbeat and confidence in the Fed’s protective measures increasing, I think the S&P 500 is expected to trade at 5,400 by the end of 2024.