Alexander Zhilenkova

MicroStrategy (NASDAQ: MSTR) is the largest corporate owner of Bitcoin, and the investment firm has benefited greatly from the rise in Bitcoin prices over the past few months.The company also just raised another $604 million in convertible notes Get more Bitcoins. MicroStrategy also has a subscription business through which it provides business intelligence solutions to the enterprise market. While the company’s approach to acquiring and owning Bitcoin is unique, I don’t think MicroStrategy has a specific competitive advantage, and investors interested in cryptocurrencies may just want to own Bitcoin outright. MicroStrategy’s share price is also fundamentally decoupled from the price of Bitcoin, suggesting investors are dealing with a bubble!

MicroStrategy is a Bitcoin broker

MicroStrategy is an investment company focused on Bitcoin, with a software intelligence business that provides analytical services to enterprise customers. and data services. In its core analytics business, MicroStrategy uses artificial intelligence to help companies make better and more cost-effective decisions.

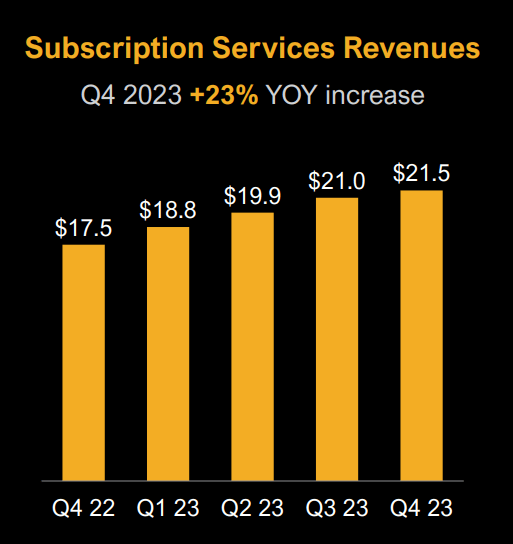

MicroStrategy’s business intelligence services target the enterprise market and are monetized through a subscription model. The company generates an average of $20 million in subscription service revenue per quarter through its software product suite, and revenue growth in this area is expected to be around 20%.

micro strategy

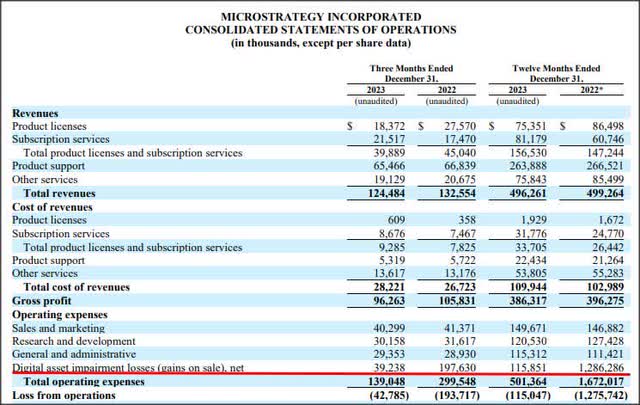

MicroStrategy is profitable on a gross profit basis, but the company’s large holdings of Bitcoin are marked-to-market and could introduce significant volatility to the company’s income statement. In the most recent quarter for which it reported financial data (Q4’23), MicroStrategy had a gross profit of $96.3 million and an operating loss of $42.8 million.

micro strategy

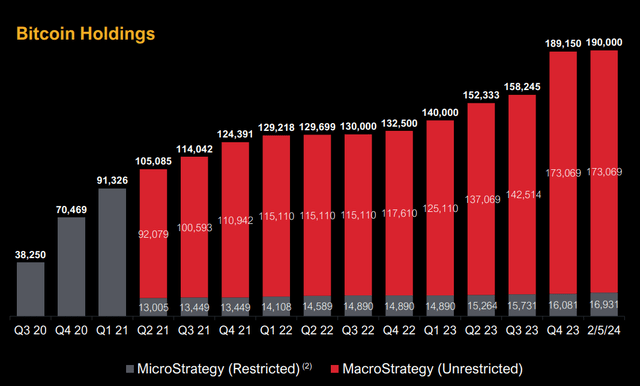

MicroStrategy is not known for its subscription enterprise analytics business but for its penchant for aggressively acquiring Bitcoin, often funded through convertible bonds.According to the latest report from MicroStrategy Investor introductionAs of February 5, 2024, the investment firm held 190,000 Bitcoins at an average price of $31,224/BTC, implying a cost base of $5.93B. Bitcoin is currently trading at 62k, and the company is sitting on $5.84B in unrealized gains (excluding March Bitcoin purchases related to a new convertible bond issuance).

micro strategy

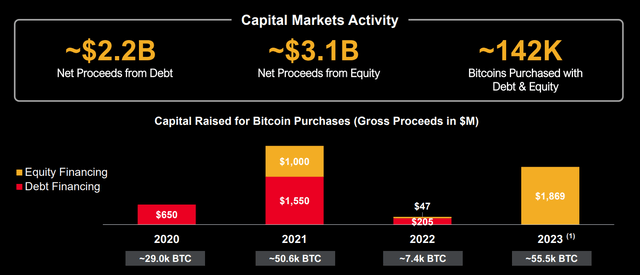

The company is using excess cash from its software subscription business as well as equity and debt financing to gain firepower to increase its Bitcoin holdings. Since February 5, 2024, MicroStrategy has made a series of additional convertible bond transactions to acquire more Bitcoin near all-time highs.

The company has raised billions of dollars to buy Bitcoin over the past few years and made two other capital markets transactions in March through the issuance of convertible senior notes: The company issued a total of 1.4B to acquire Bitcoin U.S. dollar convertible bonds.most recent transactions is a $604 million convertible senior notes offering with a maturity date of 2031 (transaction closes on March 19, 2024).

micro strategy

While MicroStrategy is the largest corporate owner of Bitcoin, I don’t see any specific need or advantage for investors to own the cryptocurrency or benefit from its growing adoption through a corporate structure like MicroStrategy. Additionally, MicroStrategy’s subscription business provides some cash for purchasing Bitcoin assets, but doesn’t have any real relevance or value for investors who want exposure to the world’s largest digital cryptocurrency.

Investors looking for exposure to Bitcoin can buy directly through cryptocurrency exchanges such as Coinbase (COIN) or purchase spot-traded Bitcoin-focused ETFs such as Fidelity Wise Origin Bitcoin ETF (FBTC)… with a management fee of 0.25 % (currently abandoned). For investors looking for a more diverse bet on the crypto economy, it might make sense to invest in Coinbase stock: A Crypto Play With A Catalyst.

MicroStrategy stock price is frothy

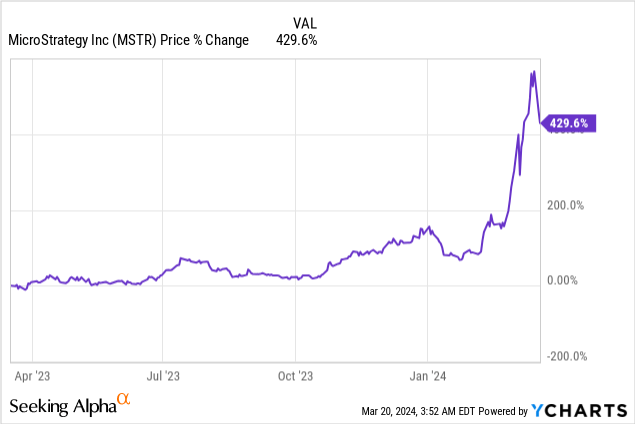

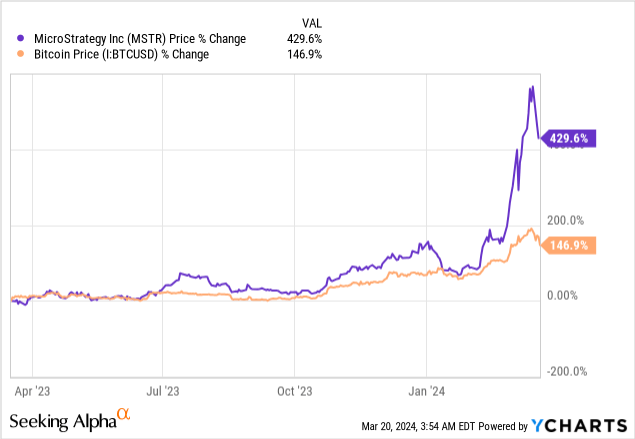

MicroStrategy’s stock price has soared recently, driven largely by Bitcoin’s climb to an all-time high and associated investor enthusiasm. However, the rise in MicroStrategy’s stock price is decoupled from the rise in Bitcoin prices in 2024, indicating that investors currently generally overestimate the value of this investment company.

MicroStrategy’s stock price surged 430% last year, while Bitcoin’s price rose only 147%. Since MicroStrategy owns Bitcoin directly (and has no leveraged products), there is no reason for MicroStrategy’s stock price to rise at 2.9 times the price of Bitcoin.

Based on a price of approximately $62k/BTC, the company’s 190k Bitcoins (the latest reported BTC amount) are currently worth $11.8B. The enterprise software business generates ~$500M in annual revenue, and if we assign a very generous P/E ratio of 10x to the business, it could be worth as much as $5.0B (for example, Salesforce (CRM) sells for 8x revenue). Collectively, MicroStrategy’s Bitcoin holdings and the company’s enterprise analytics business could be worth as much as $16.8B (fair value market cap). The current market capitalization is approximately $24.0B, which means that even without a potential correction in Bitcoin price, there is the potential for a significant 30% downside. Therefore, with approximately 17 million shares outstanding, my fair value estimate is $990 (based on the current BTC price of $62,000).

MicroStrategy Risks

Holding so much Bitcoin on the balance sheet creates unique concentration risks. Due to the lack of diversification and active investment in Bitcoin, MicroStrategy is essentially a proxy for Bitcoin investments, and a subscription business no longer makes that sense. As a result, MicroStrategy’s stock is likely to be highly volatile in the future, potentially exposing investors to dramatic changes in valuation.

final thoughts

Bitcoin is the largest holding in my portfolio, and I am generally positive about cryptocurrencies. However, I don’t think there is any clear advantage for investors looking to hold Bitcoin through the MicroStrategy corporate structure. Investors who like and appreciate Bitcoin’s place in the decentralized financial system can own Bitcoin directly or invest through ETFs, which are more cost-effective, easier, and simpler. MicroStrategy shares have also risen much more recently than the price of Bitcoin itself, suggesting the market is overpriced for the company’s Bitcoin earnings. With no clear competitive advantage and Bitcoin holdings being overvalued, I think this is a bubble and I see an unattractive risk profile.