popovaphoto/iStock via Getty Images

I’m placing a purchase Ratings for Hanesbrands Inc. (NYSE:HBI) mainly because HBI looks more likely to turn around its Champion brand’s business operations because “Champion Performance Improvement Plan“If HBI can successfully turn around Champion and stop spending hundreds of millions of dollars on brand revitalization initiatives, HBI will likely become profitable. Hanes gave a time frame of fall and winter 2024 to start seeing the full results if Hanes can succeed. Achieve that and get the company back on track with just 2.0% annual revenue growth, and I believe you’ll see a per-share value of about $6.79.

Management also announced that it is studying the possibility of a sale Brands can repay their debts. In this case, I think HBI stock is worth at least $6.52.

About Hanesbrands Company

Founded in 1901, Hanes is headquartered in Winston-Salem, North Carolina. I suspect you’ll find many Americans who don’t know about this iconic American clothing brand. When you mention the company Hanesbrands to the average American, some of the products they might think of are underwear, socks, plain T-shirts, and maybe underwear vests. In addition to this, the company also offers more products and owns brands such as Playtex, Bras N Things, Wonderbra, Maidenform, JMS Just My Size, Champion, etc., and has a licensing agreement with Polo Ralph Lauren.

HBI Champion Brand Questions

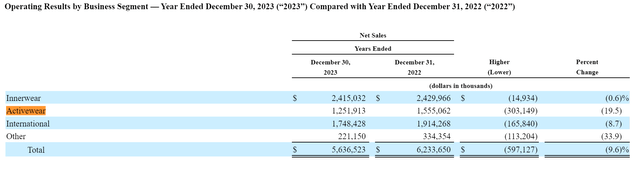

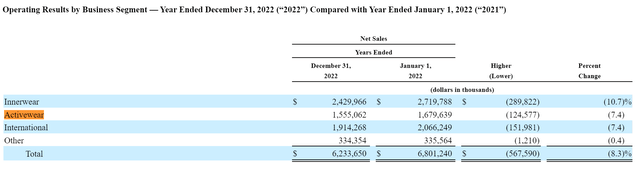

Champion’s net sales in HBI’s most recent quarter fell 23%, and HBI’s activewear category, in which Champion plays a significant role, saw net sales decline 19.5% in 2023. In 2022, HBI’s activewear segment saw net sales decline 7%. Net sales decreased by percentage.

HBI 2023 Operating Performance of Each Business Segment (HBI 2023 10-K) HBI 2022 Operating Performance of Each Business Segment (HBI 2022 10-K)

In order to revive Champion Hanes, Hanes has and will continue to invest a lot of money into the brand. During HBI’s most recent earnings call, CEO Stephen Bratspies noted that Hanes continues to “Actively implement our Champion performance improvement plan to strengthen the Champion brand and position Champion for long-term profitable growth.Bratspies also pointed out that the sharp decline in net sales revenue was due to HBI’s performance enhancement plan, and he expects the downward pressure on Champion’s net sales data to continue into the first quarter of 2024.

A considerable amount of money was spent to implement this performance plan of Champion Hans. $60 million has been spent in 2022 and $116 million in 2023, for a total of $176 million spent so far to revive Champion. Hanes stated in their 2023 10-K that they intend to spend an additional $70 million in 2024 to continue their Champion enhancement program.

All added up, Hanes said, the plan is to spend $246 million to revitalize Champion. During HBI’s recent earnings call, management was indeed excited about the launch of Champion’s fall/winter collection and hoped it would usher in a major turning point for the brand. However, even after injecting so much money into Champion, management is currently keeping the door open to a potential sale of the brand.

Possible sale of championship

Hanes hired the help of Goldman Sachs & Co. and Evercore to find “strategic alternatives” for the company’s Champion brand. These alternatives include the possibility of selling the company and using the proceeds to pay down debt. Hanes actually set the deadline for the first round of bids to end in February of this year. Companies including Authentic Brands Group and G-III have expressed interest in acquiring Champion. Hanes is rumored to have set the minimum bid at $1.4 billion, and could get more if management decides to sell.

Hanes managed to pay off $500 million in debt last year. They expect to repay another $300 million or more of debt this year. That $1.4 billion could easily help Hanes recoup a chunk of its $3.77 billion in outstanding debt, helping Hanes lower its annual interest expense (which will hit $278 million in 2023).

projected cash flow

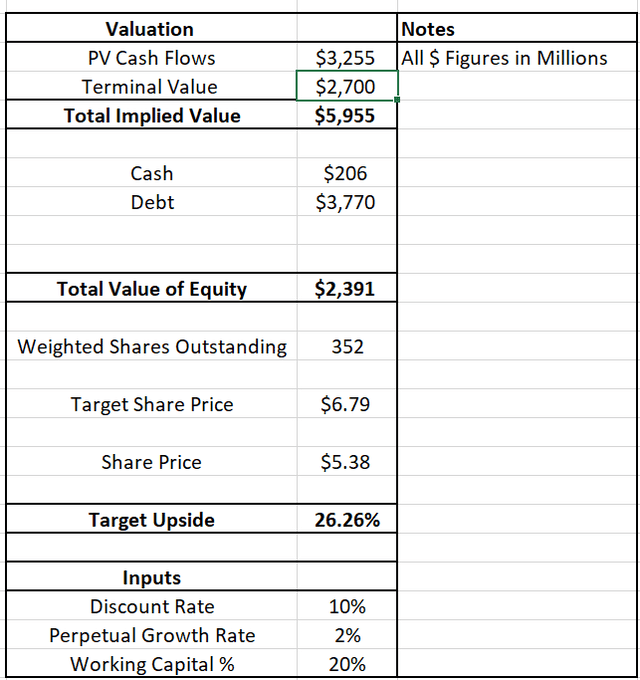

I ran several growth model discounted cash flow analysis scenarios for HBI, trying to figure out what the company’s financials would look like if it returned to modest revenue growth. For each DCF scenario, I assume a weighted average cost of capital of 10% and a working capital as a percentage of revenue of 20%. Across all DCFs, I assume HBI’s revenue will first fall a further 2.9% in 2024 (the average decline in revenue from 2019-2023). After that, I found HBI’s revenue growing at a modest rate of between 2.0% and 3.0%, depending on the specific DCF model. I also assume HBI’s EBIT margin will recover slightly to 10% of revenue. That EBIT margin is likely to be lower than what it will be if HBI becomes profitable again, as its historical EBIT margin before 2021 has hovered around 13% year after year.

When running my first DCF under these assumptions, my stock price target was $6.97 per share, representing a 26% upside from the current stock price of $5.38 per share. The DCF assumes Hanes retains its Champion brand and can guide the company back to modest revenue growth of 2.0% through its turnaround plan. This also assumes that HBI continues to pay an effective corporate tax rate of 10%.

HBI will discount cash flow if it maintains its championship brands and returns revenue growth to around 2% (Leland Roach)

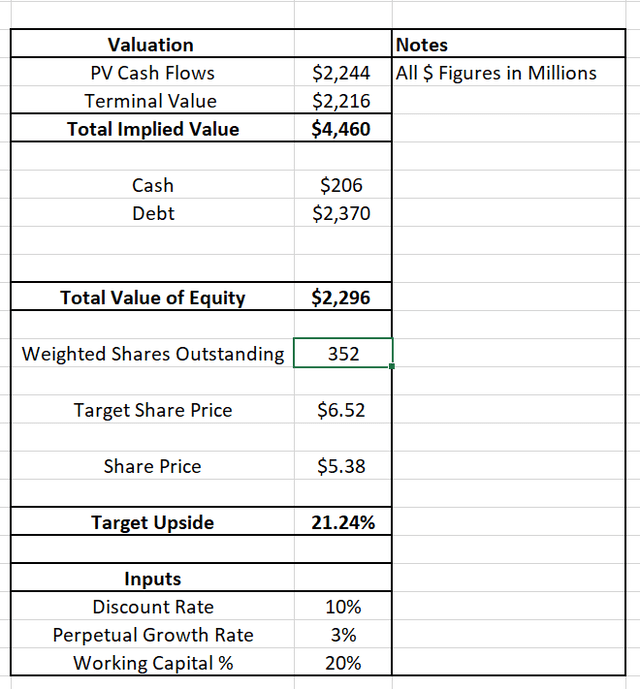

Other struggling retailers, such as Reebok, have sold at about 1x sales in recent years. Unfortunately, HBI doesn’t know exactly how much of its revenue comes from the Champion brand because it only reports revenue in three segments: lingerie, activewear, and international, but doesn’t provide many details on specific brands. Unfortunately, we can only assume revenue of 1x HBI’s starting bid for Champion, so assume Champion’s projected sales are around $1.4 billion. If we subtract this $1.4 billion from HBI’s future earnings and use the cash from the sale to pay down HBI’s $3.77 billion in debt, HBI is left with $2.37 billion worth of debt. Breaking free from Champion and not having to continue pouring money into a troubled brand will also improve Champion’s revenue growth, so I’ll increase HBI’s revenue growth to a solid 3.0%. Selling Champion would also likely increase HBI’s effective tax rate, since they would likely lose a large tax write-off on losses related to Champion, so I think Hanes will have to pay the normal 21% tax rate after selling Champion and returning to profitability.

If HBI sells Champion and returns a revenue growth rate of about 3%, HBI’s discounted cash flow (Leland Roach)

Based on my assumptions, HBI’s price target would actually drop to $6.52 per share after the Champion sale compared to our previous DCF, but would still have ample upside potential of 21%. One thing I have to mention about my DCF is that the sale of Champion will allow HBI to use more free cash flow to pay down existing debt at a higher interest rate since it won’t have to pay or pay as much for interest anymore cash. Spending cash on its championship revitalization plan. If HBI successfully sells Champion, that alone could further increase future upside potential.

risk

By far the biggest risk HBI faces is that it might not be able to sell Champion or steer the company to a profit. If Champion continues to lose money despite investing hundreds of millions of dollars, HBI stock could fall back to as low as $4.00 or even further. The excitement in the market recently has been driven largely by investors excited about the prospect of Hanes ditching a troubled brand that has dragged down earnings and stock prices since 2021. If these investors see the prospect of Champion turning over a new leaf or being sold if anyone reduces, then I fully expect them to exit their positions.

in conclusion

I think Hanesbrands Inc. is a purchase. The Buy rating is specifically based on HBI’s ability to sell its troubled Champion brand or complete its Champion Performance Enhancement Plan. If Hanes fails to do either of these, the stock could fall back to the low $4.00 range. If HBI can successfully sell Champion and deliver 3.0% revenue growth starting in 2025, I believe the stock’s fair value will be $6.52 per share. If HBI can turn around its Champion brand and generate modest revenue growth of 2.0%, I believe the stock will be worth $6.79 per share. The stock is a bit riskier than I typically think, but I think the very modest turnaround HBI has to make should be feasible.