honglouwawa

George Varantasis

Investor enthusiasm for artificial intelligence and big tech stocks drive S&P 500® It’s up more than 30% in the past 12 months. As the S&P 500 frequently hits new highs, It’s understandable if low-volatility stocks aren’t on investors’ radar.This blog will remind people of the effectiveness of this method S&P 500 Low Volatility Index Over the long term, we have been committed to delivering defensive quality and superior risk-adjusted returns. Additionally, we’ll examine the S&P 500 Low Volatility Index’s historically attractive current relative valuation, solid profitability, enhanced dividend yield, and what may have gone unnoticed relative to the S&P 500 in recent years. Significantly higher growth.

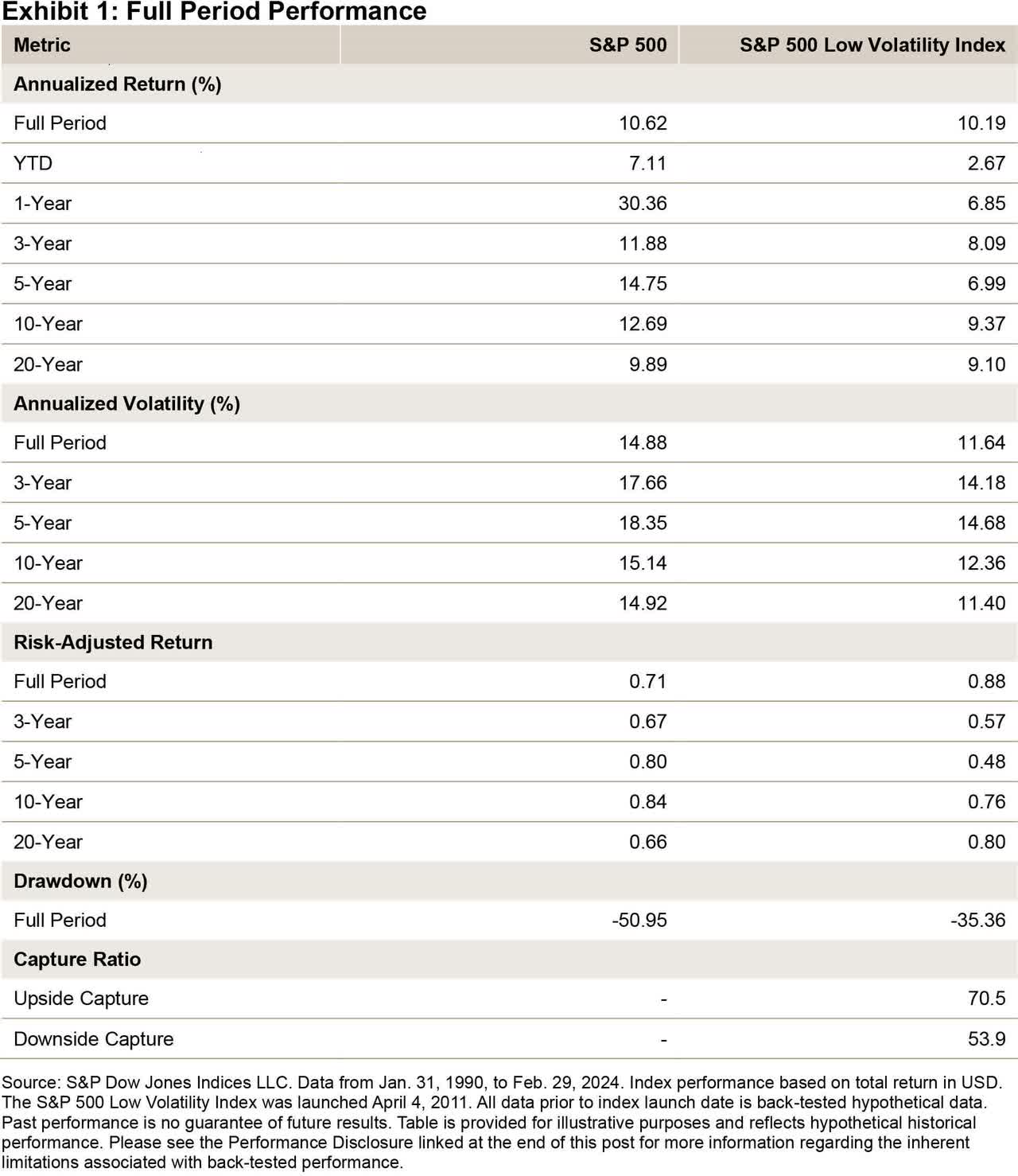

Defensive capabilities and superior risk-adjusted returns

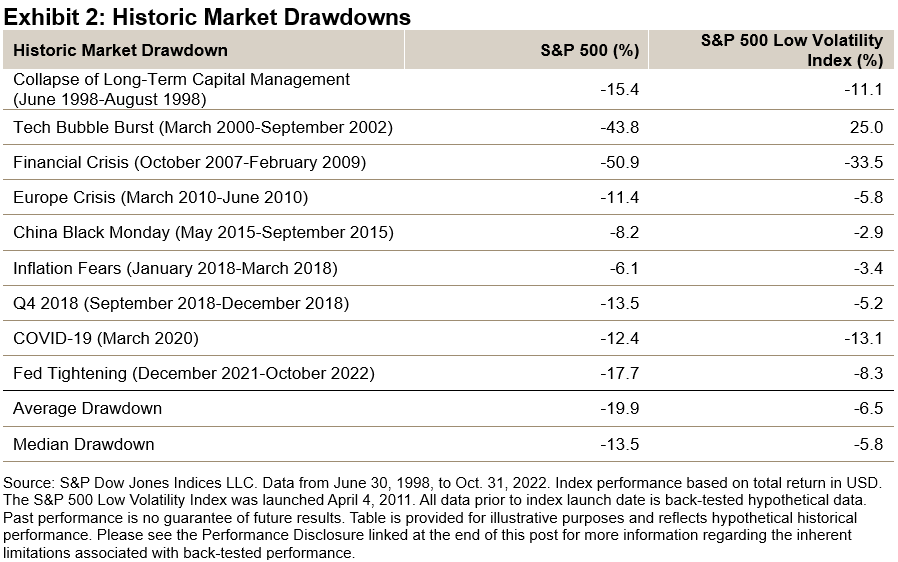

Chart 2 shows the continued downside protection for the S&P 500 Low Index The VIX was provided during historic market declines. It has outperformed during all retracements shown, with the exception of the COVID-19 retracement, when it underperformed by 0.7% over the month. During this period, the S&P 500 Index returned an average of -19.9%, while the S&P 500 Low Volatility Index returned an average of -6.5%. Notably, during the tech bubble burst, the S&P 500 fell 43.8%, while the S&P 500 Low Volatility Index rose 25.0%, outperforming 68.8%.

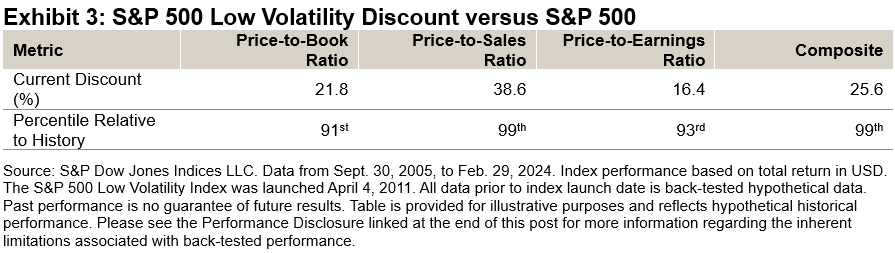

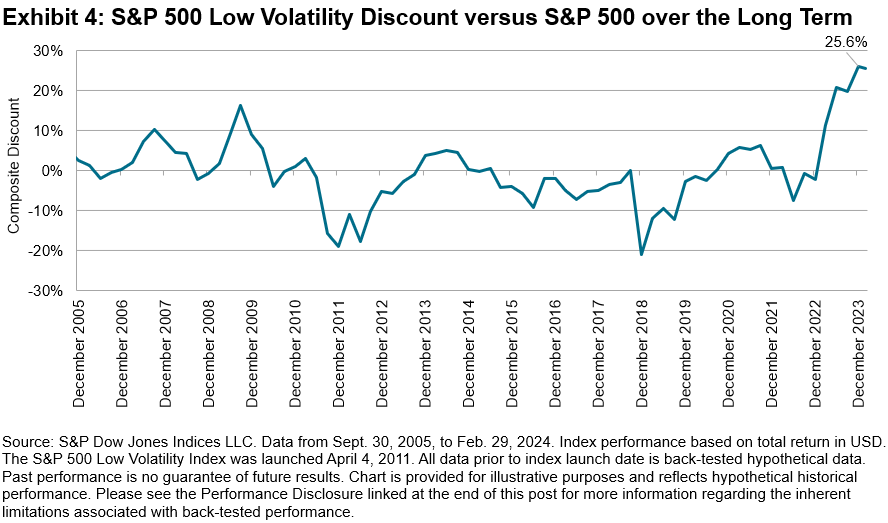

S&P 500 Low Volatility Current Valuation in the 99th Percentile of Cheap Relative to the S&P 500

Exhibits 3 and 4 show the S&P 500 Low Volatility Index’s current historically attractive valuation discount relative to the S&P 500 Index. On a composite basis (i.e., the simple average of the three indicators), the S&P 500 Low Volatility Index is currently trading at 21.8%, 38.6%, 16.4%, and 25.6% respectively. As shown in Tables 3 and 4, a 25.6% composite discount since September 2005 puts the index in the 99th percentile of cheap relative to the S&P 500.

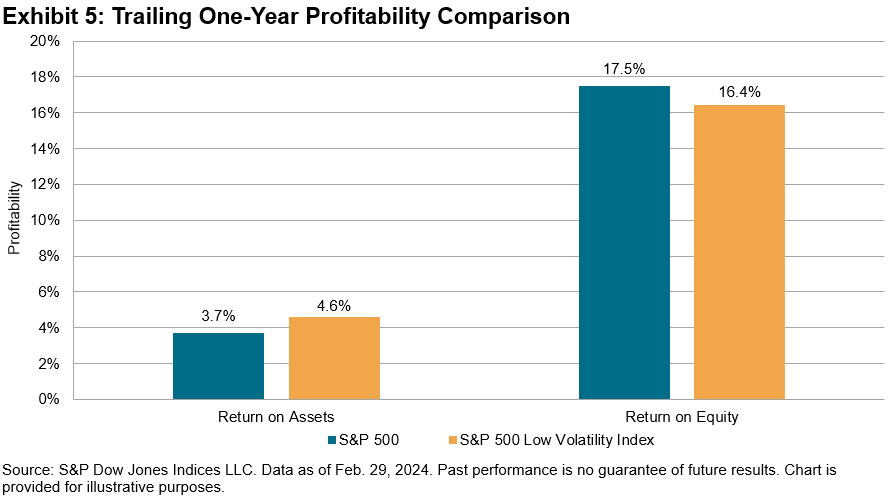

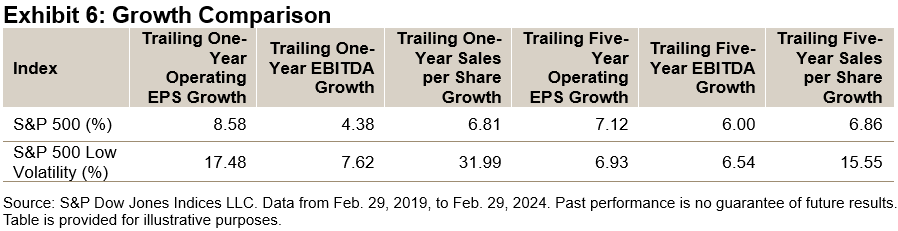

Chart 5 compares return on assets and return on equity for each index, while chart 6 compares growth indicators over the past year and five years. Notably, the S&P 500 Low Volatility Index has been in line with the S&P 500 from a profitability perspective over the past 12 months, and earnings and sales growth have also improved significantly over the past one and five-year periods. .

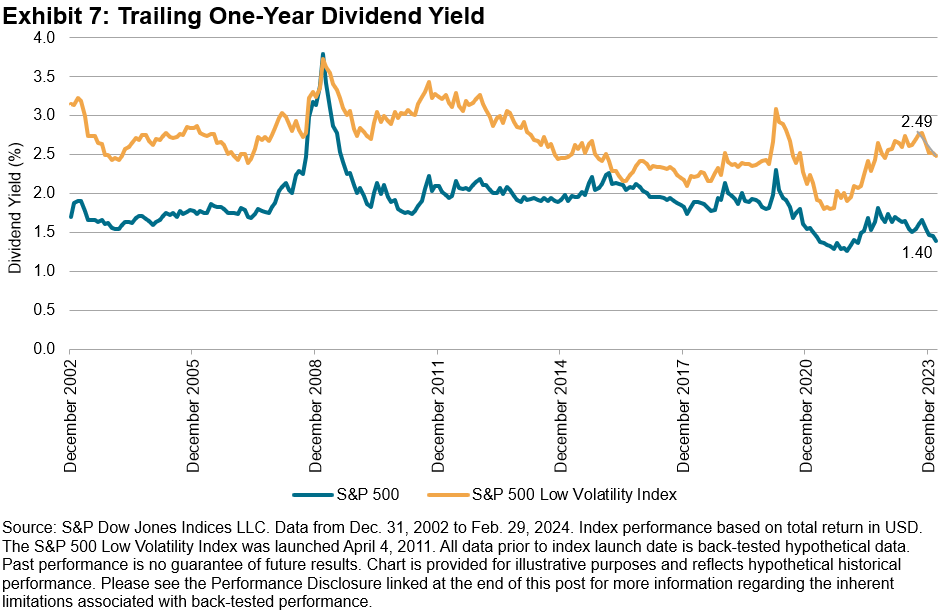

As shown in Exhibit 7, the S&P 500 Low Volatility Index generally has a higher dividend yield than the S&P 500 Index over the long term. Recently, however, the dividend yield spread widened significantly to 1.09% as the S&P 500 Low Volatility Index yielded 2.49% compared to the S&P 500 Index’s yield of 1.40%. The current dividend yield spread is in the 87th percentile since December 2002.

in conclusion

Over the long term, the S&P 500 Low Volatility Index has historically provided investors with superior risk-adjusted returns relative to the S&P 500 Index. Although recent performance has lagged the S&P 500, it is the S&P 500 Low Volatility Index that has shown similar profitability and significantly higher growth compared to the S&P 500. For market participants who are hesitant about high valuation multiples but want solid fundamental performance and improved dividend yields, the S&P 500 Low Volatility Index may be an option worth considering.

Reveal: Copyright © 2024 S&P Dow Jones Indices LLC, a subsidiary of S&P Global. all rights reserved. This material may be reproduced with the prior written consent of S&P Dow Jones Indices.For more information about S&P Dow Jones Indices, visit S&P Dow Jones Indices.For complete terms of use and disclosures, please visit www.spdji.com/terms-of-use.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.