Jeremy Poland

frontera energy corp. (OTCPK:FECCF) is a company with a solid business. But the business has effectively been “put on hold” so that the company can capitalize on its situation in Guyana.Therefore, the stock may trade based on the outlook for Guyana rather than a business that already generates revenue and cash flow.Since management really had nothing to add in the latest report telephone conference and earnings reports, the stock is likely to continue trading at current levels until an announcement is made. Even so, the stock is unlikely to see a major financial coup during the current “strategic replacement” process that management has initiated for the Guyana project. This makes the future here highly speculative and highly unsuitable for the average investor.

Review of the situation in Guyana

Some points from the previous article require Raised again and then updated.

During the Q3 conference call, the following questions elicited some confusion and inconsistent answers:

Sarah Constantine

OK Yeah, so I think the first question that everyone is asking right now is what happened with the Santonia assessment during the June press release when you said that Santonia had 210 feet of hydrocarbon-bearing sand , now we see 40 in Wei? This is the first question.

There was some confusion among management about this specific issue, and the information subsequently provided was somewhat inconsistent. This strongly suggests a lack of experience in handling this situation.

Now the latest conference call basically indicates that the process has begun and some introductions have been made. And then of course there’s the “no further update” comment. For a potentially game-changing situation, in management terms, the whole process has been less than reassuring, to say the least.

Suriname input

ExxonMobil (XOM) and TotalEnergies (TTE) both have discoveries in the Suriname region. Suriname is under great pressure The two companies combined their projects to provide a reasonable level of resources to justify the development. Apparently, both companies have their own projects, but have so far not shown sufficient resources to justify production.

Frontera is in a similar situation, having done very little drilling but made discoveries.

Comparing partnership with ExxonMobil

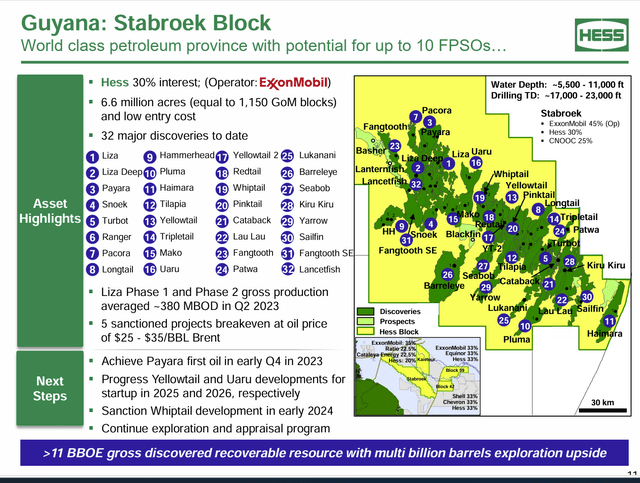

ExxonMobil, the operator partnered with Hess (HES), had more wells and made new discoveries before the company proposed spending money to build the first platform.

Hess Corporation Guyana Partnership Overview (Hess Corporation Briefing, September 7, 2023)

as As shown above, when there is no supporting infrastructure nearby, a significant amount of activity is required to justify development. The first oil production occurred in 2019, when about half of the discoveries listed above were on the slide. But that’s a lot more than Frontera’s money. There are 2 successful wells in Frontera. That’s not enough to justify the billions of dollars needed to produce oil.

Guyana Conclusion

Whenever such a young player gets involved with a “big boy”, the big boy tends to take a tough stance. This will have an impact on the company’s stock price until the company can prove that it can overcome the difficulties.

Another consideration is that I reported that CEO John Hess repeatedly asked over the years why the market did not react to these findings. The answer is always the same. No one is interested until the cash flow starts. Now, of course, Hess has an offer Acquired by Chevron (CVX). But the proposal didn’t arrive until multiple platforms were working together, with multiple platforms in different stages of development. In short, Hess can now point to significant cash inflows in the near future.

Frontera is a far cry from Hess’s situation, and the risk of extreme dilution is huge. This scenario may not actually be a game-changer in the next few years, since actual oil production may still be several years away if it does occur. Management only has two successful wells and virtually no backup plan in place if the current process doesn’t satisfy them.

This is a very small company operating in a high cost area. The platforms used by ExxonMobil partners to produce oil currently cost more than $10 billion. The typical cost of a well in a lease is about $30 million. A company of Frontera’s size does not have the resources to undertake such a project. Hess is considered a small company and has kept about $2 billion in cash on its balance sheet over the years “just in case.” Now that several FPSOs are finally in production, Hess is reducing credit lines.

But Frontera was unable to obtain such credit because of its size. Bidders know this. This makes this company a very dangerous proposition.

The company also controls CGX Energy (OTCPK:CGXEF), which has no revenue and therefore cannot fund the project. Neither stock will do well until the future becomes clearer. In this case, CGX Energy shareholders are in an even worse position because the company has no revenue.

Other business

Management releases reports for the rest of the business, which makes sense. The problem is that the market isn’t paying attention to it because management is keeping the market’s attention on what’s going on in Guyana.

Stock price trend

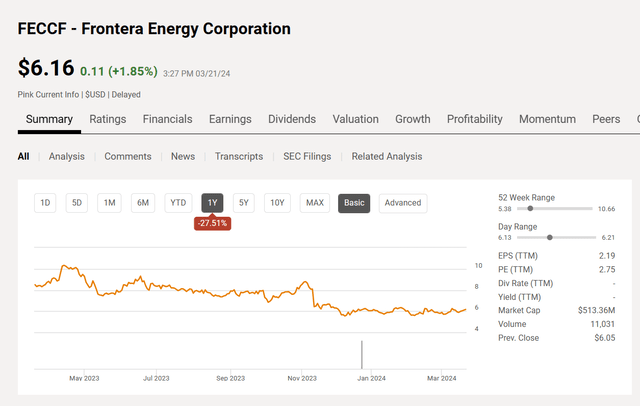

The share price will see no progress until something decisive happens in the “game-changing” situation in Guyana. There is adversity in holding stocks and waiting for “game-changing” news in a positive direction. But that doesn’t mean it won’t happen.

What it really means is that management with little experience in the oil and gas industry is “learning on the fly.” Therefore, any investment here must be considered a lottery, and the possibility of losing your principal is very high.

Frontera Energy Corporation Common Stock Price History and Key Valuation Metrics (Seeking Alpha website March 21, 2024)

As shown above, the share price has not performed well since the announcement of “strategic alternatives” to Guyana Leasing in the third quarter. The last article was a “selling” article. I still don’t see a reason to put money into this idea.

Exactly how one can predict the future of the share price when management seems to be learning as this project progresses is anyone’s guess. This means it is not an investment. Frankly I don’t know what it is.

To me, this is a classic situation to avoid. At best, it’s just for coffee money, with no hope of getting your money back. I follow other companies that are very good at mitigating offshore risk. Although Hess was acquired, many other companies remained. I would watch and get out the popcorn. I wish management all the best because they need a fair amount of luck.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.