william porter

investment thesis

Vanguard Mega Cap ETF (NYSE:MGC) deserves a Buy rating due to its low-cost ability to capture strong returns from large-cap tech stocks, including the Big Seven.Furthermore, MGC can achieve this quality while offering the most diverse product offerings compared to similar large players The fund also saw relatively lowest volatility and highest dividend yields. While large-cap IT stocks have enjoyed high returns recently, some of them are in danger of becoming overvalued. Therefore, MGC is a large-cap ETF that also includes some diversification to hold the broader market during pullbacks of the “Big Seven.”

Fund Profiles and ETF Comparisons

MGC is a passively managed ETF designed to Track the CRSP US Large Cap Index. Since its inception in 2007, the fund has held 213 stocks and has $5.42B in assets under management. MGC has the largest share in the information technology sector (39.00%), followed by consumer discretionary (14.50%) and healthcare (12.40%).go through By most definitions, megacap stocks have Valuation exceeds $200B. While large-cap stocks are also present in non-U.S. markets, MGC and Compare ETFs exclusively capture domestic holdings. Using the $200B definition of mega-cap stocks, MGC also includes large holdings of large-cap stocks, so is not exactly a “mega-cap stock.”

For comparison purposes, other funds we examined include iShares S&P 100 ETF (OEF), Invesco S&P 500 Top 50 ETF (XLG), and Vanguard Mega Cap Growth ETF (MGK).Open Education Fund Track the S&P 100 Index Therefore, we strive to provide investors with 100 large-cap domestic stocks. XLG is made by The 50 largest companies in the S&P 500 Index. Therefore, it is less polymorphic than MGC and OEF. MGK passive tracking CRSP U.S. Large Cap Growth Index. It is less diversified than MGC and has a heavier weighting to large-cap growth stocks, with a 58.70% weighting to the Information Technology industry.

Performance, expense ratio and dividend yield

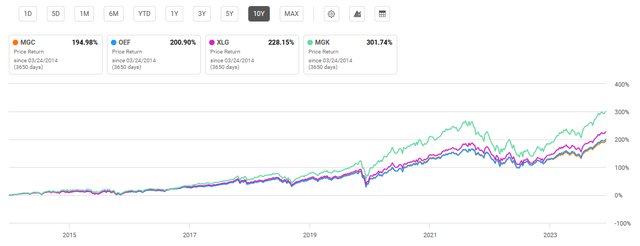

MGC’s 10-year average annual return is 13.16%. In comparison, OEF’s 10-year average return is 12.48%, XLG’s 10-year average annual return is 14.29%, and MGK’s 10-year average annual return is 15.61%. For reference, the S&P 500’s 10-year average return is about 12.7%.

10-Year Total Price Return: MGC vs. Large Cap ETFs Comparison (Seeking Alpha)

Vanguard is known for offering low-cost funds. MGC is no exception, with the lowest expense ratio among its peers at 0.07%. This expense ratio correlates with MGC’s sister growth fund, MGK. MGC also has the highest dividend yield at 1.22%, and its dividend growth rate is also noteworthy, with a 5-year compound annual growth rate of 4.14%.

Expense Ratio, AUM and Dividend Yield Comparison

|

MGC |

Open Education Fund |

XLG |

National Security Council |

|

|

expense ratio |

0.07% |

0.20% |

0.20% |

0.07% |

|

AUM |

$5.42B |

$11.75B |

$4.04B |

$18.66B |

|

short term dividend |

1.22% |

1.07% |

0.85% |

0.45% |

|

Dividend Growth 5-Year CAGR |

4.14% |

2.65% |

-1.08% |

5.11% |

Source: Seeking Alpha, 03/21/24

MGC Holdings and its competitive advantages

With 213 holdings, MGC is the most diversified large-cap fund. It also has the lowest combined weighting among its top 10 holdings at 37.88%. As mentioned before, MGC contains a large number of holdings that do not meet the generally accepted $200B “mega-cap” threshold and are therefore considered large-cap stocks.

MGC’s top 10 holdings and comparative large-cap ETFs

|

MGC – 213 holdings |

OEF – 101 holdings |

XLG – 55 shares |

MGK – 82 holdings |

|

MSFT – 8.47% |

MSFT – 10.48% |

MSFT – 12.48% |

MSFT – 14.60% |

|

Apple – 7.36% |

Apple – 8.52% |

Apple – 10.15% |

Apple – 12.69% |

|

NVDA – 5.11% |

NVDA – 7.39% |

NVDA – 8.79% |

Amazon – 7.63% |

|

Amazon – 4.53% |

Amazon – 5.39% |

Amazon – 6.42% |

NVDA – 7.30% |

|

Yuan – 3.00% |

Yuan – 3.70% |

Yuan – 4.40% |

Yuan – 5.32% |

|

Google – 2.24% |

Google – 2.94% |

Google – 3.50% |

Google – 3.81% |

|

BRK.B – 1.92% |

BRK.B – 2.51% |

BRK.B – 2.99% |

Google – 3.16% |

|

Google – 1.89% |

Google – 2.48% |

Google – 2.95% |

LLY – 3.16% |

|

LLY – 1.77% |

LLY – 2.06% |

LLY – 2.45% |

Tesla – 2.67% |

|

AVGO – 1.59% |

JPMorgan Chase – 1.88% |

JPMorgan Chase – 2.24% |

V – 2.20% |

Source: Multiple, compiled by the author on March 21, 24

MGC has several key advantages over its large-cap fund peers. While large-cap stocks have historically outperformed the S&P 500 and the “Big Seven” have posted strong returns, some of these stocks are highly valued. Because MGC offers the greatest diversification among funds in its category and contains significant holdings in large-cap stocks, the fund is likely to serve investors well in the event of a sharp pullback in large-cap, tech stocks.

Is the current mega-cap overpriced?

To answer whether MGC deserves a Buy rating, one should first answer whether large-cap tech stocks are currently overpriced. Upon closer examination, the argument can be made that some large-cap tech stocks are fairly valued, while others are overvalued. For example, looking at Apple Inc (AAPL), we see that its P/E ratio is 5.7% below the industry median. Furthermore, AAPL’s P/E ratio is in line with its 5-year average. Microsoft Corporation (MSFT) has a price-to-earnings ratio of 38.45, which is slightly higher than its industry.

|

Microsoft Corporation |

AAPL |

NVDA |

Amazon |

Mehta |

|

Tesla |

|

|

P/E ratio GAAP TTM |

38.45 |

27.83 |

75.75 |

61.43 |

34:00 |

25.64 |

40.85 |

|

% difference from industry |

+30.17% |

-5.75% |

+156.49% |

+244.68% |

+76.04% |

+32.78% |

+129.21% |

Source: Information compiled by the author from Seeking Alpha, March 21, 2024

However, there are also “seven heroes” stocks with higher valuations. Amazon.com Inc. (AMZN) has a price-to-earnings ratio of 61.43, which is 244% higher than the industry median. NVIDIA Corporation (NVDA) has a price-to-earnings ratio of 75.75, which is 156% higher than the industry median. While NVDA has delivered a price return of 255% over the past year and the megacap stock’s P/E ratio is well above its industry, it’s still below its 5-year average. Finally, Tesla Inc (TSLA) has a forward P/E ratio of 76.04, which is 356% higher than the industry median. While the AI boom has delivered strong earnings, one has to question whether we are approaching a bubble with prices rising so much over the past year.

How does it compare to the megacapitalizations of history?

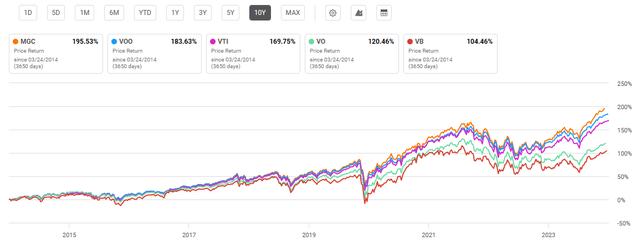

Another factor for MGC to consider is how large-cap funds compare to the overall market or even small- and mid-cap funds. Over the past 10 years, MGC has outperformed Vanguard peer funds, including Vanguard S&P 500 ETF (VOO), Vanguard Total Stock Market ETF (VTI), Vanguard Mid-Cap ETF (VO) and Vanguard Small-Cap ETF (VB). While prior performance is no guarantee of future performance, large-cap funds have generally outperformed the market over the past decade.

Long-Term Performance Comparison: Vanguard Mega-Cap, S&P 500, Total Market, Mid-Cap, and Small-Cap Funds (Seeking Alpha)

MGC’s unique qualities

A third consideration is that MGC provides investors with strong exposure to the “Big Seven” while also providing the greatest diversification during a major tech pullback. If there’s a major correction in tech stocks, MGK, XLG and even OEF will see bigger losses based on their holding weights. We’ve seen examples in history of popular stocks falling. For example, the “Nifty Fifty” was popular in the 1960s and 1970s and consisted of reliably buying and holding “blue chip” stocks.However, the group of companies sees value dropped by 60% between 1973 and 1975.Another example, of course, is the popular dot-com bubble, when the Nasdaq Decline 76.8% from 2000 to 2002.

Using beta as an implicit measure of volatility, we can measure the underlying volatility of each mega fund examined. Compared to the Dow Jones US Stock Market Total Index, MGC has a beta of 0.98. In comparison, OEF’s 3-year beta is 1.01 and MGK’s beta is 1.19. So while the “Big Seven” may still deliver strong, consistent returns, MGC offers a slightly lower-risk option than the other funds reviewed while still capturing the majority of mega-cap gains.

Valuation and risks to investors

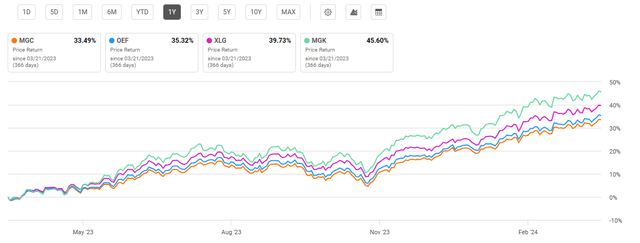

At the time of writing, MGC’s current price is $186.83. The price was near the top of the 52-week range of $136.64 to $187.68. MGC and all large-cap funds compared have outperformed the S&P 500 over the past year. As discussed, this is largely due to the performance of the “Big Seven,” which currently account for approximately 30% of the S&P 500’s market capitalization.The number of stocks with such low concentration Not since at least 1980.

One-year performance: MGC and large-cap ETFs compared (Seeking Alpha)

Because of these big tech returns and the mix of holdings in each fund, MGC has the most attractive valuation metrics among the peer funds reviewed. For example, MGC has the lowest price-to-earnings ratio at 27.89. In addition, using the price-to-book ratio as another valuation indicator, MGC is also the most attractive, with a value of 5.00, which is the lowest among its peers.

Valuation Metrics for MGC vs. Peer Mega Funds

|

MGC |

Open Education Fund |

XLG |

National Security Council |

|

|

P/E ratio |

27.89 |

26.97 |

29.70 |

38.30 |

|

price to book ratio |

5.00 |

5.25 |

5.93 |

10.80 |

Data source: Compiled by the author based on multiple sources, March 21, 2024

concluding summary

MGC presents an attractive combination of large-cap concentration and large-cap diversification. History has shown sharp recessions, including the Nifty Fifty and the dot-com bubble. While the artificial intelligence boom is delivering strong returns, adjustments to the “Big Seven” will hit OEF, XLG, and MGK particularly hard. Historically, MGC’s beta has implied lower volatility, and its current price-to-earnings and price-to-book ratios are more attractive than similar funds. Finally, MGC has a low expense ratio and the highest dividend yield among its large-cap ETF peers.