Kanchit Kirisuchalal

Written by Nick Ackerman and co-produced by Stanford University chemists.

Cohen & Steers Real Estate Opportunities and Income Fund (NYSE:RLTY) trades at attractive prices in the real estate sector and its valuations are attractive.real estate When interest rates and yields rise, the investment trusts and preferred stocks in which RLTY invests take a big hit. This causes borrowing rates to rise, which is one of the main ways REITs grow.

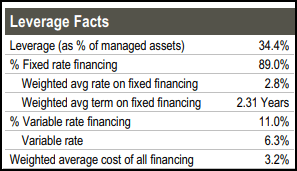

Likewise, RLTY is a leveraged closed-end fund that pays borrowings based on floating interest rates. As a result, the fund’s own borrowing costs have also increased. However, a significant portion of its borrowings are hedged through interest rate swaps.

With interest rates expected to be cut later this year, risk-free Treasury rates are also likely to fall, which should bode well RLTY’s REIT and preferred portfolio holdings. RLTY’s borrowings remain largely fixed for the next two years, which should give them plenty of time to see rates fall significantly from where they are now – at least according to the latest forecasts and expectations.

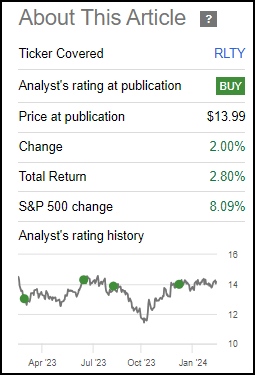

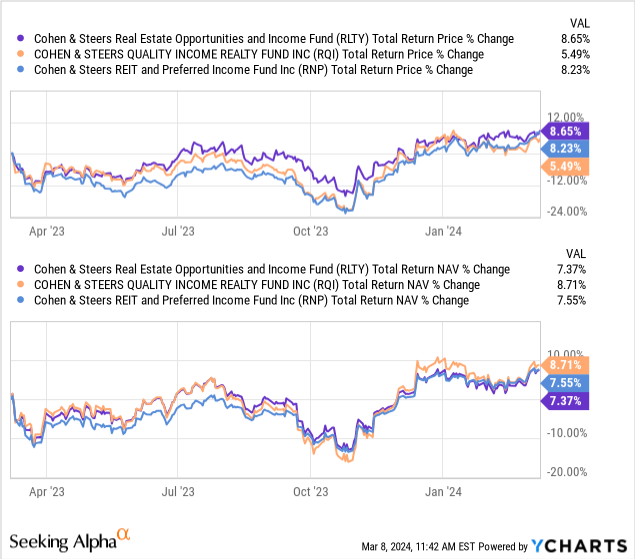

The fund’s total returns haven’t changed much since our last update. were essentially flat, while the S&P 500 continued to move higher.

RLTY performance since last update (Seeking Alpha)

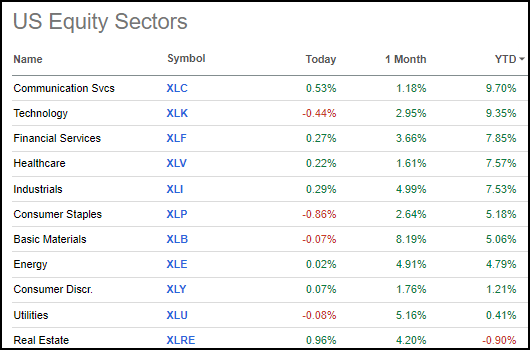

As of this writing, real estate is the only sector in decline so far in 2024. Utilities have also jumped on the bandwagon, but it looks like these companies have been able to move into positive territory recently. So it’s not surprising to see RLTY essentially flat during this period.

Year-to-date industry performance as of March 8 (Seeking Alpha)

RLTY basics

- 1-year Z-score: 0.39

- Discount: -11.50%

- Distribution yield: 9.32%

- Expense ratio: 1.74%

- Leverage ratio: 35.42%

- Assets under management: $415 million

- Structure: Term (expected liquidation date February 23, 2034)

RLTY investment objectives It is “current high income”. The second goal is “capital appreciation”. To achieve this goal, the fund will “invest at least 80% of its assets under management in (i) real estate-related investments, and (ii) preferred stocks and other income securities.” This is pretty simple, in line with Cohen & Steers’ other focus Very similar to real estate funds.

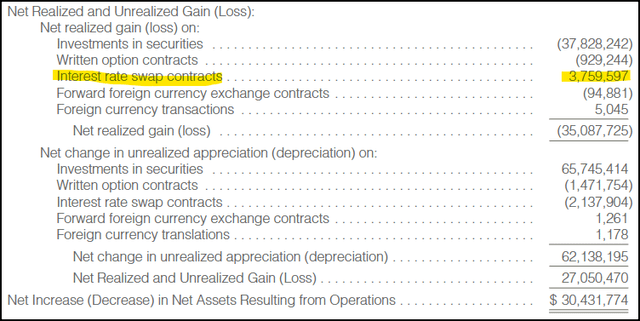

As of December 2017, RLTY’s expense ratio was 1.74% Last annual report. However, when including leverage charges, the fund’s expense ratio is 3.26%, up from 2.13% in the previous partial fiscal year. That is, it does not reflect the fund’s fixed-rate financing through interest rate swaps. Borrowing costs are still increasing, but this is more than made up for in capital gains through these swaps. For this reason, nearly 90% of the fund’s leverage is fixed.

RLTY Leverage Statistics (Cohen & Steers)

Performance – discounts remain attractive

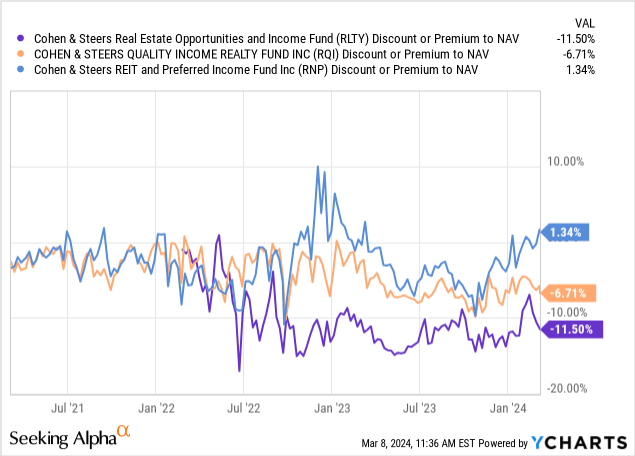

Although RLTY’s discounts are not as big as before, the current discounts are still huge. I believe it’s also quite attractive because its sister fund has a smaller discount to RLTY. In fact, discounts have turned into premiums for Cohen & Steers REIT and preferred and income funds (RNP).

Y chart

Essentially since launch or shortly after launch, RLTY has traded at a larger discount to its sister funds. The fund’s higher leverage and higher expense ratio may be to blame. There’s also no guarantee that the fund’s discount will shrink anytime soon to reach the same valuation as its sister funds. Recently, though, the fund has moved sharply higher on narrowing its discount. It reached almost the same level as the RQI discount before falling back sharply.

The fund is also a term fund with an expected termination date. Since it’s not until 2034, we still have plenty of time before it becomes a factor, but it should mean that – at some point in the future – the fund’s discount can be realized.

Furthermore, although there is considerable overlap, these funds are not identical. When we first reported on RLTY, we noted that it was an “intermediate” fund. This is because RLTY’s common and preferred portfolio split is 70/30%. RNP is about 50/50, and Cohen & Steers Quality Income Real Estate Fund (RQI) tends to be about 80/20%.

Even with these differences, the fund’s total NAV returns last year were fairly close. RLTY is the weakest, which could be the higher expense ratio at play. On the other hand, as the discount has narrowed this time, the fund’s total stock price return is still among the best.

Y chart

RLTY won’t be the only fund to benefit from the lower interest rate environment. RQI and RNP also performed well. We can already see more promising performance over the past year, with all three funds rebounding sharply from their October 2023 lows. This is a good reflection of what might happen if the risk-free rate falls.

Both REITs and preferred stocks in RLTY portfolios will benefit from lower Treasury rates as they once again become more attractive income options. As borrowing costs should fall, the Fed cutting its own target rate will see more growth opportunities emerge for underlying REITs, and investors in particular who currently pay floating rates should see some immediate relief.

Of course, this means that these funds are also exposed to the opposite risk. If interest rates need to rise or risk-free rates start to surge again, we could see RLTY and its sister funds fall. Since these are leveraged funds, the decline will be greater. On the bright side, since RLTY already has the widest range of discounts, the likelihood of further significant discount expansion is likely to be fairly slim. If the RNP moves back into discount territory, it looks set to face its biggest drawdown.

Distribution – Attractive 9.32% monthly distribution

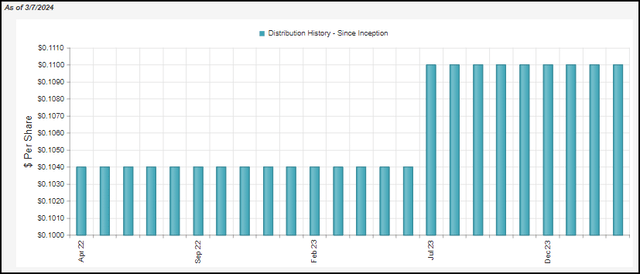

They increased allocations last year despite facing tougher conditions for the fund’s underlying portfolio. It was allocated from $0.1040 to $0.11 per month, which is still the current level they maintain.

RLTY distribution history (CEFConnect)

This allocation increase really doesn’t seem to make sense, but our NAV allocation rate is 8.25%. So, in my opinion, we’re definitely not in red flag territory based on this ratio.

Real estate investment trusts and preferred stocks that perform well in the future will also play an important role in the fund’s allocations. That’s because, like most stock-focused funds, they will rely on capital gains to fund their distributions. For RLTY, last year’s NII coverage was only 15.73%. In some cases, the NII coverage of RQI reaches 21.9%.

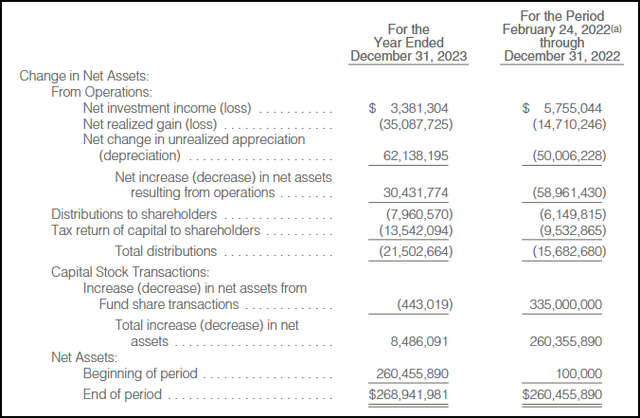

RLTY Annual Report (Cohen & Steers)

Although 2022 is a partial period for the fund, NII for that period was $0.40 per share, which has now fallen to $0.20. This reflects some changes in investment portfolios, but an important factor is rising borrowing costs. However, as we noted above, where it makes up for this is in getting some gains from interest rate swaps.

RLTY Realized/Unrealized Gain/Loss (Cohen & Steers (Author’s Note))

We can also see above that the NAV increased during the year due to unrealized appreciation in the portfolio. That was more than enough to offset the losses managers realized throughout the year.

This is an important note, as such a move would result in a return of the capital characteristics of the distribution.

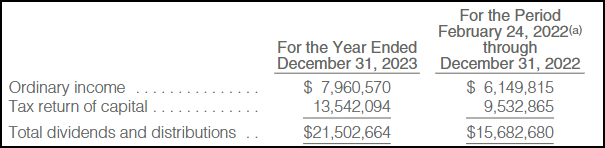

RLTY Distribution Tax Classification (Cohen & Steers)

This is what we outlined previously about RLTY and its sister funds RQI and RNP. These funds have been around longer and have more embedded capital gains that can be relied upon to realize capital gains. For RLTY, they launched in 2022 when the market was plunging and never got the chance to see those unrealized gains actually materialize. Instead, they simply took on a host of realized and unrealized losses. They still had nearly $52 million in carryforward losses at the end of 2023. This can be used to offset future realized gains and preserve returns on capital allocations for years to come.

Meanwhile, net asset value rose last year. The fund’s total net asset value return in 2023 is more than 12%. Therefore, it is better to draw attention to the NAV distribution coverage rather than the tax characteristics. Of course, taxes are very important. However, they are more important for the tax consequences and the impact they have when you file your taxes. They are generally not a good sign when trying to understand distribution range.

That’s one of the other things that I’ve seen when reporting on RLTY, so I think it’s important to continue to outline and show what’s going on in terms of tax characteristics. This could be another reason why RLTY trades at a larger discount relative to its sister funds, but it doesn’t seem to be an appropriate reason. ROC distributions are actually very beneficial because they are not taxed in the year they are received; instead, they reduce the investor’s cost basis. This means no taxes are due until the position is sold.

RLTY’s portfolio

The fund’s common equity and preferred/fixed income holdings are 70/30%, which is only a slight change from the fund’s 67/33% weighting in our previous update. In total, they listed 175 positions for the fund, which was only a slight increase from the previous 173 holdings.

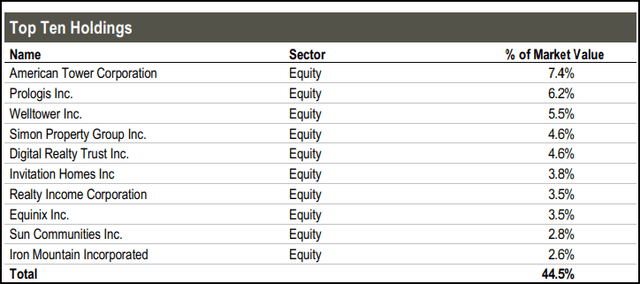

Another common feature is that, in addition to seemingly holding a large number of stocks, RLTY has a fairly concentrated portfolio within the top ten.Newest Top ten accounts Accounting for 44.5% of the fund’s total assets, a slight increase from the previous 42%.

RLTY Top Ten Holdings (Cohen & Steers)

This comes not only from RLTY, but also from its sister funds RQI and RNP. In fact, the top ten holdings of these three funds also have a lot of overlap. All three funds have the same managers, so it’s clear they have some confidence in these names. The higher the fund’s common equity position, the higher the concentration appears to be, with 50.6% for the top ten RQIs and 31.6% for RNPs.

Generally speaking, the names are also fairly consistent. American Tower Company (AMT) has been a consistent name among the fund’s top holdings since its inception. It is also a frequent visitor to sister funds.

Sun Communities (SUI) and Iron Mountain (IRM) are the only new names in the top 10 since our last report. Mid-America Apartment Communities (MAA) and SBA Communications Corp (SBAC) dropped out of the top 10. However, both names are still included in the fund’s total holdings list. The reason is simply that their percentage weighting in the fund has declined.

in conclusion

RLTY is the youngest closed-end fund product launched by real estate specialist Cohen & Steers. This is also one of their more attractive funds in terms of valuation. The fund got off to a rocky start when it launched in early 2022, with its shares falling quickly as the Federal Reserve sharply raised interest rates. They made the situation worse by significantly increasing the leverage of the fund upon launch, which is one of the negatives I see with this fund. Additionally, CEFs often go on deep discounts a year or so after they launch – this is also the case with RLTY. As a result, the fund suffered a double whammy shortly after its launch.

That said, those who wait until the end of 2022 to take a position at RLTY are seeing a very different story. The returns have been impressive and the future of this fund remains quite bright. Interest rates are expected to fall over the next few years, which bodes well for the fund in a few different ways. This includes its own borrowing costs starting to fall and fixed rates starting to fall. It should also help its real estate investment trust holdings, as they benefit from lower borrowing costs. If we are able to narrow the discount further, this could also be another potential catalyst for better positive total share price results in the future.