Machimina 29

The central bank kept short-term interest rates steady at this week’s Federal Reserve meeting and reiterated its hope for three rate cuts in 2024.With interest rates expected to normalize in the second half of this year, I think Mortgage REITs and the like Ellington Residential Mortgage Real Estate Investment Trust (New York Stock Exchange: Earn) could make a comeback and become a more attractive income investment for passive income investors.

The mortgage trust’s dividend payment metrics already improved in the fourth quarter, with Ellington Homes paying out a cumulative dividend payment of $0.24 per share, adjusted distributable earnings and lower short-term interest rates pointing to interest rate dependence on mortgages. Repricing potential. Backing Securities.

As dividend payout metrics improve, a dividend cut becomes much less likely. Therefore, my stock classification for Ellington Homes remains a Buy.

My rating history

I have a I have a long position in Ellington Residential Mortgage REIT, which I established after the mortgage trust cut its dividend by 20% in June 2022.

The trust has since paid a steady monthly dividend of $0.08 per share, and Ellington Residential’s payment metrics improved in the fourth quarter of 2023, which is the main reason I maintain my current Buy stock classification.

I think the trust’s monthly dividend is sustainable, and with the Fed expected to adjust interest rates in the second half of the year, Ellington Residential’s payout metrics may even gradually improve in 2024.

Mortgage-backed securities-focused portfolios and re-rating catalysts

Ellington Residential is structured as a mortgage real estate investment trust that specializes in the acquisition, investment and management of residential mortgage-backed securities and other real estate-related assets.

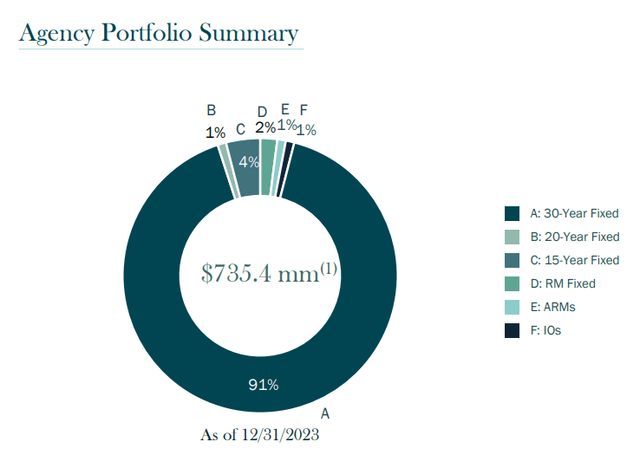

As of December 31, 2023, Ellington Residential’s investment portfolio had a fair value of $735.4 million and consisted primarily of 30-year fixed-rate mortgage-backed securities. The trust’s investments also include mortgage debt, but agency residential mortgage-backed securities are the trust’s primary source of income.

Lower short-term interest rates are a catalyst for repricing of mortgage-backed securities, as their value tends to rise in a falling interest rate environment.

Portfolio summary (Ellington Uptown)

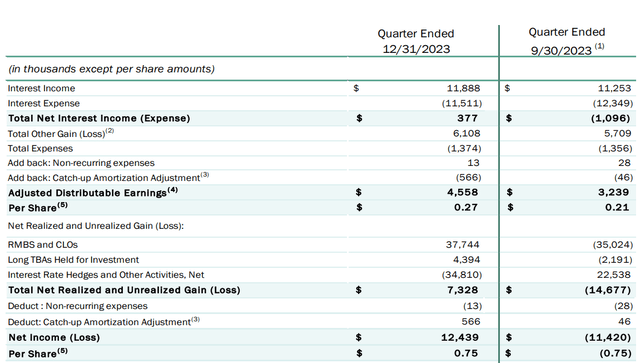

The rate cut is likely to lower the mortgage trust’s interest expense, which amounted to $11.5 million in the fourth quarter, thereby boosting Ellington Residential’s net interest income.

and Three interest rate cuts are coming With a portfolio dominated by interest rate-dependent mortgage-backed securities through 2024, Ellington Residential’s earnings outlook has improved significantly in the past few months.

Profit Outlook (Ellington Uptown)

Ellington Residential’s dividend rate drops below 100% in 4Q23, dividend likely to be sustainable

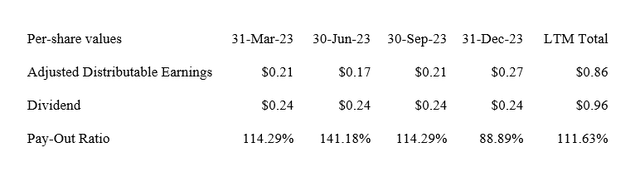

Ellington Residential’s adjusted distributable earnings exceeded dividends in the fourth quarter, the first and only quarter in 2023 where the payout ratio fell below 100%.

As a result, payments conditions have improved significantly and upcoming short-term interest rate cuts from the central bank should also boost mortgage trust spreads.

The trust’s trailing twelve month dividend payout ratio was 111.6%, so Ellington Residential still has considerable dividend risk, although this risk appears to have declined compared to the mortgage trust’s previous quarters.

With three interest rate cuts coming in 2024, I don’t expect Ellington Residential to cut its dividend payments significantly.

dividend (The author created the table using trust information)

Ellington Residential’s 7% NAV discount is attractive

Annaly Capital Management (NLY) and AGNC Investment Corporation (AGNC)The two largest mortgage real estate investment trusts in the United States have gradually returned to premium valuations, mainly due to the re-rating triggered by the central bank in December 2023 indicating that it was willing to consider cutting interest rates in 2024.

Ellington Residential is currently selling at a 7% discount to GAAP book value ($7.32 as of 4Q23), while Annaly Capital Management and AGNC Investment are selling at a small premium to book value. I put Ellington Residential’s intrinsic value at $7.32 because mortgage REITs are required to report their underlying assets at fair value.

The reason NLY and AGNC are priced higher than Ellington Residential on price-to-book ratios is that they are the largest mortgage trusts with long-term dividend records and large agency-focused portfolios of mortgage-backed securities poised to benefit from lower short-term profits Profit from it. interest rate.

Why investing in an Ellington home can be disappointing

So far, it looks like Ellington Residential will achieve a looser operating environment in 2024 than last year. Dividend risk has declined as short-term interest rates are about to fall and the trust’s payout ratio has shown an improving trend.

So even in the third quarter (when the payout ratio is over 114%), a dividend cut is much less likely.Delay in interest rate cuts may be related to continued rate cuts rising inflationmay be the reason why an investment thesis may not work as expected.

my conclusion

The main reason I don’t think Ellington Residential will cut its dividend in 2024 is that the payout ratio fell below 100% in the fourth quarter and Jerome Powell stuck to his previous talk of three rate cuts in 2024, This could be a repricing catalyst for the trust’s underlying MBS portfolio.

The central bank did not touch short-term rates at its March meeting, but Jerome Powell’s comments were very popular in the mortgage trust industry, which relies heavily on expensive short-term debt.

I think the 7% discount to NAV further improves the risk/reward relationship. purchase.