Solar eclipse images

biowax (NASDAQ: BIOX) is an agricultural supply company with a strong position in adjuvants and expansion into the seed genetics and biopesticides markets.

I have had a Hold rating on BIOX since April 2021, Latest Articles exist December 2023. I’ve always been skeptical of Bioceres due to its debt structure, certain aspects of its governance, and its price.

In this article, I review the 2Q24 and 1H24 results the company released last month. I analyze the reasons for HB4’s massive year-over-year pipeline quarterly revenue growth and soft development, and warn against news about the company’s debt.

I maintain a Hold rating, especially since the company currently has higher debt maturities and a lack of clarity.

Paper abstract

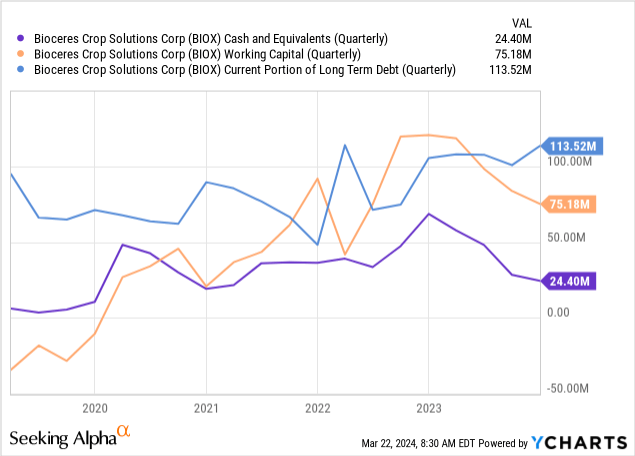

My argument against Bioceres is that the company has multiple products with growth potential but is mishandling that growth Debt and dilution.

The company is best known for commercializing (not inventing or owning) the drought-resistant HB4 genetic trait in wheat and soybeans. This is the first drought-resistant trait in soybeans and wheat, and the world’s first genetically modified wheat variety.

It should be noted that Bioceres does not own the core intellectual property rights in these products. It must pay royalties to the Argentine Scientific Institute and Holding Company (Bioceres PLC), the owner of the technology.

The company has also acquired other agritech companies, such as cultivated protein developer Moolec (MLEC) and bio-based pesticide developer Marrone (formerly MBII).

Neither HB4 nor other developments turned a profit. These are growth markets that require investment in R&D and commercialization.

The company’s profit engine is Argentina’s Rizobacter, a leader in more traditional adjuvants and crop protection products. This business unit can only be analyzed with 20-F data every year, but the growth rate is not large.

The problem is that, in an effort to accelerate growth, companies have invested too much in these new technologies, increasing debt and diluting company shareholders.

Additionally, the company has been poor at communicating key issues to minority shareholders. These include a royalty plan with Bioceres PLC, failure to report information on Rizobacter on a quarterly basis, and failure to clearly report its debt maturities and refinancing plans.

Second Quarter 2024 Results

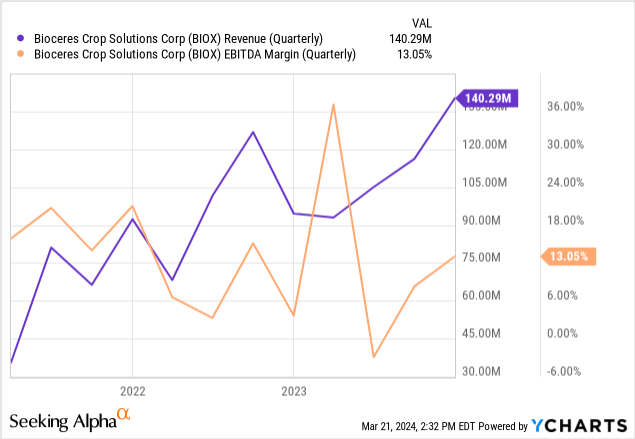

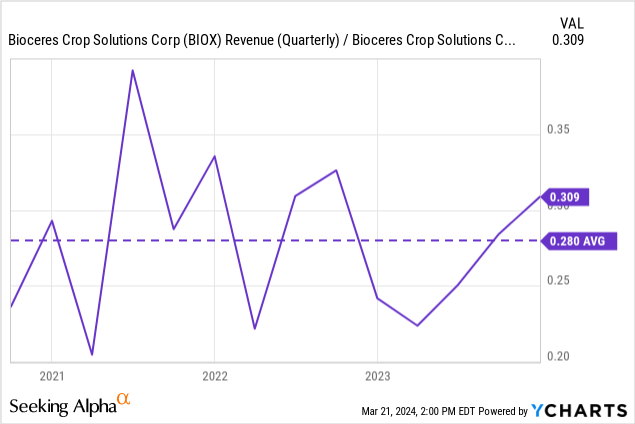

Expected revenue recovery: Bioceres posted good year-over-year quarterly comparisons, growing 50% in the quarter (16% in 1H 2024 and 16% in 1H 2023). This recovery is expected given that the company suffered a setback in the first half of 2023 due to one of the worst droughts in history in Argentina’s core market. This affects the purchase of Rizobacter crop protection and nutritional products.

well run Leverage: On the other hand, the company’s cost structure is stable, with total operating expenses of US$75 million despite revenue growth. This helps with profitability indicators. It also demonstrates some positive aspects of the company’s business model in terms of high-margin incremental growth. Overall, operating profit at the end of the quarter was $16 million, of which $7 million was deducted from interest on debt, leaving approximately $9 million in pre-tax profit or $6 million in net income (using a normalized tax rate). Seasonally, the second quarter was a strong quarter for the company as Rizobacter sells crop protection and nutrition products to farmers in its core markets of Argentina and Brazil.

Argentine peso depreciates: The company also reported $8 million in income taxes. Compared with pre-tax profits of $9 million, that seems excessive. The reason is that the depreciation of the Argentine peso has led to an increase in the peso value of certain assets, which cannot yet be offset through inflation accounting. The result is that the deferred tax should be reversed in future quarters.

soft development

Comments were also made on the softer aspects of the business during the Q2 2024 quarterly earnings call.

HB4 “Growth” through Inventory: As I commented in my latest article, the seed segment is growing rapidly, with an annual growth rate of 80% in the second quarter of 2024. This segment contains the sales of the HB4 wheat variety. HB4 soybeans will be commercialized starting in fiscal year 2025 and are currently only in the breeding program.

However, it is difficult to grasp how much of this growth comes from actual market penetration, as Q1 and Q2 2024 showed a large amount of wheat sales as stocks and should not be classified as a seed product. Rather than selling HB4 seeds to farmers, Bioceres sells some of its unused seed stock to the food chain just like farmers do, but at much lower margins.

Last year, the seed division had sales of $29 million and a gross profit margin of 55%. This year’s sales were $54 million and a gross profit margin of 34%. Assuming that $29 million is still sold at a 55% margin (management noted on the earnings call that HB4’s margins were flat or rising as a product rather than as inventory), the remaining $24 million in revenue would have a margin of around 10% , the average level of food commodities. This suggests that most of the improvement came from inventory sales, rather than packaged sales.

business frontier: During the conference call, management also brought up the commercial side of progress on patents, approvals and production volumes. These developments will not immediately impact sales, but they will provide insight into the progress of the business plan.

Patent protection for HB4 soybean products has been extended to 2042 through a staggered patent. HB4 soybeans are approved in multiple Asian economies, including Australia, New Zealand and Malaysia, and have covered 80% of Asia’s export destinations in Latin America. Finally, the new HB4 wheat varieties (second and third generation) have yields comparable to other commercial varieties in high-yield environments (and higher than commercial varieties in low-yield environments).

Unstated debt risks

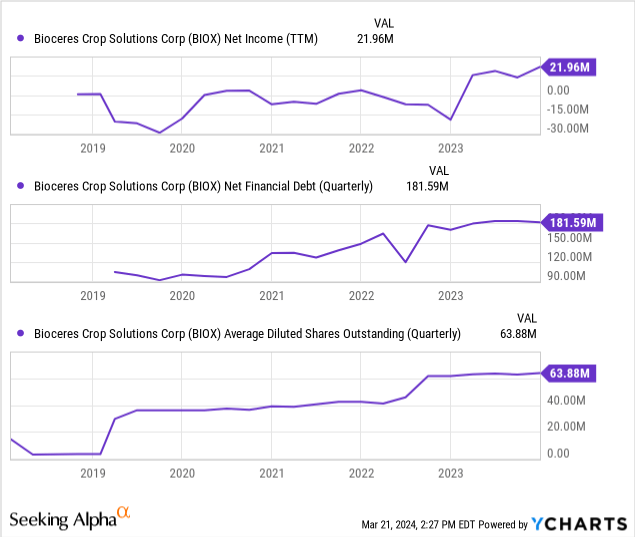

Bioceres (again) not mentioned releaseand there was no mention of the earnings call, regarding upcoming debt payments, which can be read as $113 million from the current borrowing account, with only $25 million in cash.

The company doesn’t even publish the expiration schedule for these obligations on its website quarterly financials statement. The company’s 20-F shows some information (not presented in a single table by convention) that the company faces at least $45 million in bond maturities this year, but $52 million in borrowings remains unexplained. The company didn’t even mention whether it had a credit facility and what its features would be. We know that most borrowings are denominated in dollars, not pesos.

As I mentioned in my last article, this is another sign of a lack of clear communication with shareholders on key topics such as current liquidity needs.

Valuation and Rating

I wouldn’t consider a company to be exposed to liquidity risk in the short term, and that’s unclear when communicating on such an important topic. Investors hope for the best in such situations.

Potential negative solutions to the current debt problem are to refinance at higher interest rates (Bioceres currently has a cost of debt of 7%, but recently its cost of financing has exceeded 14%, as mentioned in my previous article) and by raising Equity dilutes shareholders’ equity.

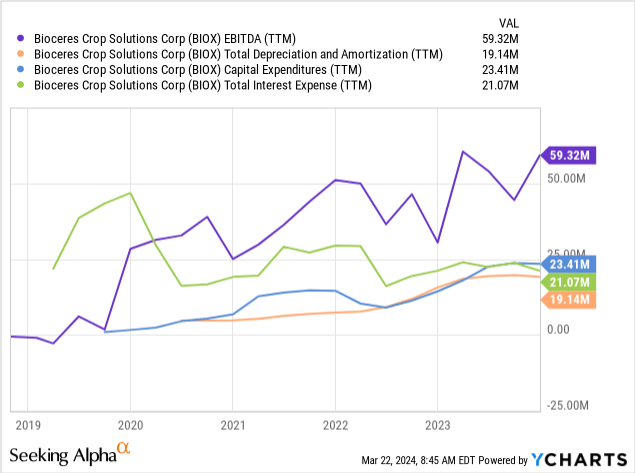

As you can see below, EBIT is already around $40 million (EBITDA less D&A or capital expenditures), and annual EBIT is about $20 million (EBIT less total interest expense) .

To these, we need to apply an income tax rate of 30% to obtain a NOPAT of $35 million and a net profit of $14 million. For a market cap of $800 million (P/E ratio of 57x) and EV of $1 billion (EV/NOPAT of 35x), these values are too small.

Despite the Marrone acquisition, EBITDA trends have been quite subdued over the past two years. Bioceres isn’t yet a coming-of-age story, but it’s still treated as one. For this reason, I don’t think it’s an opportunity at this price.