Igor

A little over a year ago, in mid-February 2023, I found myself analyzing Gates Industries (NYSE:GTES).For those who don’t know the company, it is a manufacturer and marketer of engineering plastics Power transmission and fluid power solutions. Most of the company’s products are sold in the aftermarket, but some are sold directly to OEMs (original equipment manufacturers). Overall, the company is doing pretty well.When I looked at the industry the company was in, how cheap the stock was, and how the company had performed in the years leading up to the original article, I found Summarize A “Buy” rating is logical.

Typically, when I assign a Buy rating, I believe the company’s stock price should outperform the market for the foreseeable future.but Unfortunately, this didn’t happen. The share price has seen some nice gains, totaling up 17.1%. But that’s less than the S&P 500’s 25.5% gain over the same time frame. In taking another look at the company, I see that there are definitely some weaknesses. It’s likely that 2024 will be worse than 2023 for the company. But when you consider how cheap the stock remains, both on an absolute basis and relative to similar companies, I think additional upside makes sense from here.

Gradual transformation

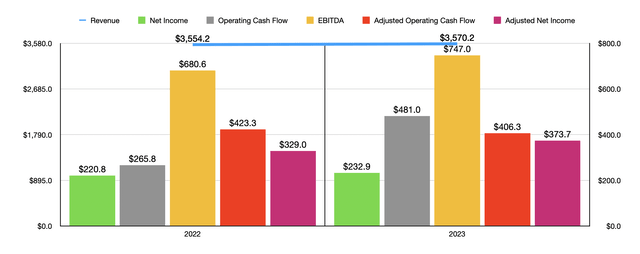

If you just look at the basic numbers for Gates Industries 2023 versus 2022, you will see a business that continues to grow. Revenue was $3.57 billion, slightly up from $3.55 billion in 2022. The sales growth was driven almost entirely by a $200.4 million gain from price increases on the company’s products. This was partially offset by lower shipments. The company also suffered an $8.9 million loss due to foreign exchange fluctuations. As a result, last year’s revenue will be slightly higher on an adjusted basis than ultimately reported.

Author – SEC EDGAR Data

The bottom line also mostly improved. Taking net profit as an example, they successfully grew from US$220.8 million in 2022 to US$232.9 million last year. While the company’s interest expense and selling, general and administrative costs increased, these costs were offset by improved margins in terms of gross margin. This increased from 35.1% to 38.1% of sales. Management said this was due to lower sales, foreign exchange fluctuations, lower freight costs and other reasons. Even if we make some adjustments for that, net income would increase from $329 million to $373.7 million.

Other profit indicators generally follow suit. For example, operating cash flow jumped from $265.8 million to $481 million. However, if we adjust for changes in working capital, our funding will decrease from $423.3 million to $406.3 million. Another important metric to keep an eye on is EBITDA. It improved year over year, climbing from $680.6 million to $747 million. For the most part, it all looks positive. But if we just look at the latest available data, things do start to change. This data covers the final quarter of fiscal year 2023.

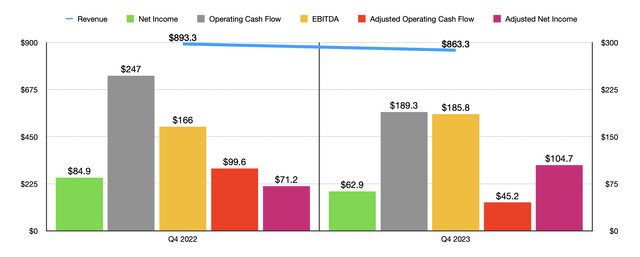

Author – SEC EDGAR Data

In the picture above you can see exactly what I’m talking about. Revenue for the quarter totaled $863.3 million. That was 3.4% lower than the $893.3 million in the same period a year ago. Management said the revenue decline was due to weakness in certain product categories such as personal mobility and diversified industrials. Management attributes this to weakness in the end markets served by these categories themselves. Fortunately, this pain was partially offset by strength in the automotive category. It’s not surprising that the auto industry has been a bright spot for the company, given that supply chain issues have eased and inflationary pressures are waning.

The pain of the final quarter wasn’t limited to revenue. Net profit also declined, from $84.9 million to $62.9 million. Although the company’s gross profit margin surged from 34.7% to 39.1%. However, the company was negatively impacted by a 3% rise in selling, general and administrative costs, plus $35.3 million in operating expenses and other charges from $25 million in earnings in last year’s final quarter to $10.3 million in expenses this year. Year. Fortunately, if we make certain adjustments, our revenue will increase from $71.2 million to $104.7 million. But that doesn’t stop other profitability indicators from taking a hit. Operating cash flow fell to $189.3 million from $247 million, and adjusted cash flow fell to $45.2 million from $99.6 million. The only other profitability metric that performs well is EBITDA. It managed to grow from $166 million to $185.8 million.

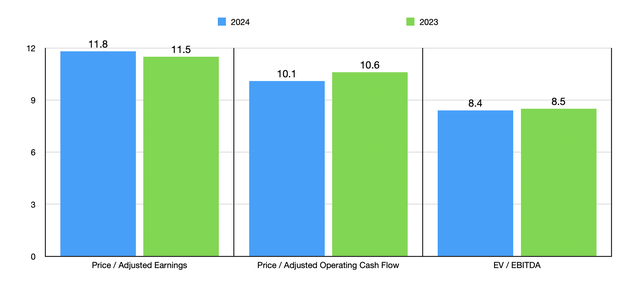

Now that 2023 is over, it’s important to start looking to the future.What’s cool is that management offers some guide This year. They expect the weakness to continue, with revenue falling 3% this year. Although they did say the increase could be as high as 1%. So we’ll have to wait and see. Earnings per share range from $1.28 to $1.43, and the midpoint of net income should be $362.5 million. The company also gave guidance indicating operating cash flow should be at least $426.2 million. Finally, EBITDA is expected to be between $725 million and $785 million. The midpoint will be $755 million.

Author – SEC EDGAR Data

With these estimates, the company can be easily valued. As the chart above shows, using two of the three estimates, the stock does look cheaper in the longer term. The stock is not only attractively priced on an absolute basis, but it’s also relatively cheap compared to its peers. In the chart below, you can see how the stock is priced compared to five similar businesses. On a price-to-earnings basis, two of these five companies end up cheaper than it. Using a combination of the price and operating cash flow method and the EV and EBITDA method, this number drops to one of five.

| company | price/yield | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| Gates Industries | 11.5 | 10.6 | 8.5 |

| ATS Corporation (ATS) | 30.0 | 45.7 | 14.3 |

| Moller Industries (MLI) | 9.8 | 8.8 | 5.2 |

| Franklin Electric Company (FELE) | 24.6 | 15.0 | 15.4 |

| John Bean Technologies (JBT) | 5.4 | 44.4 | 12.4 |

| Albany International(AIN) | 26.8 | 20.1 | 12.7 |

take away

From what I hear, this may not be the best year for Gates Industries, but the market does seem to be overreacting to that reality. Shares have seen decent upside, but considering how cheap the stock is, upside should be greater than what has been achieved. This leads me to maintain a Buy rating on the company today, despite the opportunity to make easy money.