NanoStockk/iStock via Getty Images

introduce

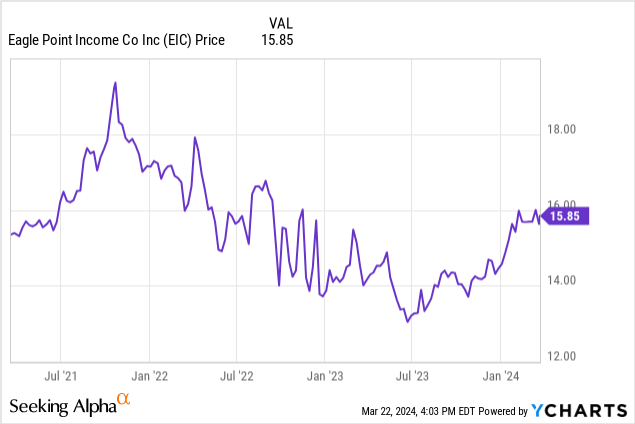

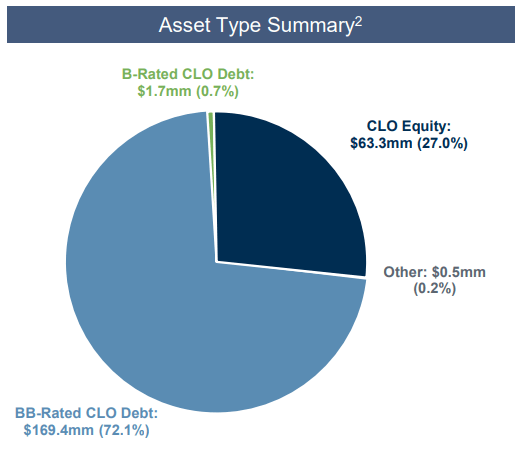

Eagle Point Income (NYSE:EIC) is an investment firm focused on CLO debt, and as explained in a previous article, Steven Bavaria is an authority in the field and I highly recommend you read some His old articles.this October 2022 Article Might be 18 months old, but still a good explanation of how you should think about CLO debt. I have a long position in EIC’s common stock but a larger position in the 2026 maturity preferred stock (NYSE:EICA) The yield to maturity is very attractive given the extra layer of safety.

Very strong fourth quarter results set the tone

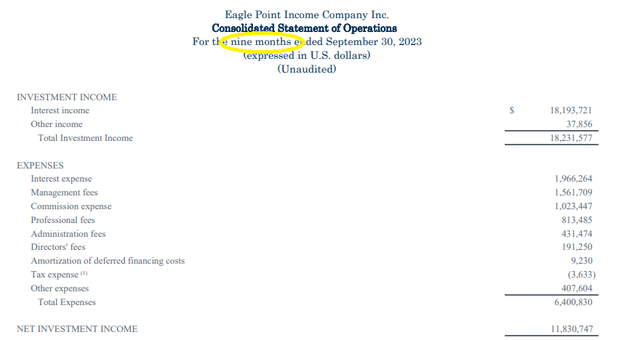

Unfortunately, EIC did not release detailed fourth-quarter results.However, by combining fiscal year 2023 results with 9M 2023 Reportwe were able to calculate fourth quarter performance.

Kai Tak Investors relation

As shown below, Eagle Point Income reported total investment income of $26.75 million and net investment income of $17.4 million for the full fiscal year 2023.

Kai Tak Investment Investor Relations

This compares to net investment income of $11.83 million as of the end of the third quarter, meaning NII for the final quarter of the year was an impressive $5.55 million.Taking into account the average Fourth quarter share count was 10.26 million sharescalculated based on the level of net investment income, the basic income is 0.54 per share.

Kai Tak Investment Investor Relations

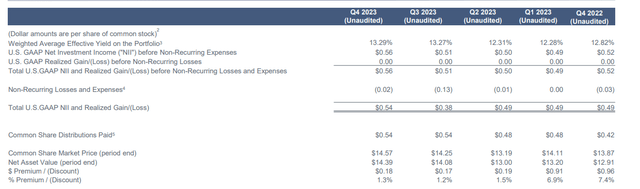

This is supported by the quarterly summary overview provided by Eagle Point, where you can see that total NII and realized earnings before non-recurring items were $0.56/share and after non-recurring items were $0.54.

Kai Tak Investment Investor Relations

With the common shares still trading at a (small) premium to NAV as of the end of 2023, it wouldn’t be surprising to see the company continue to issue new shares. There were just under 11 million shares outstanding at the end of 2023, meaning EIC issued just over 1 million shares in the final quarter of 2023.

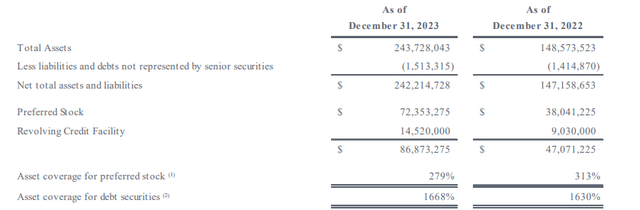

This immediately reduces my concerns about asset coverage in the term preferred stock. These asset coverage ratios must be at least 200% at any given time, and in my previous article I’ve mentioned that despite seeing the company issue additional preferred securities, I didn’t expect Eagle Point Income to come close to 200% coverage. This has now been confirmed in the annual financial performance, with asset coverage at the end of last year of approximately 279%.

Kai Tak Investment Investor Relations

This proportion will also continue to increase. EIC disclosed that it sold an additional 1.18 million shares of common stock between January 1 and February 21, resulting in total net proceeds of $17.4 million (net of $0.4 million in commissions). It is expected that, assuming all other parameters remain unchanged, the preferred stock asset coverage ratio will slowly climb again to 300%. I expect EIC will continue to issue new shares and the preferred stock will become safer with each common share issued. At the end of February, EIC’s common stock was trading at A premium of nearly 6% to NAV/shares.

Eagle Point Income currently pays Monthly dividend $0.20 common stock, but as interest rates in financial markets begin to fall, I expect monthly dividend payments to decrease as well. This is completely normal considering that CLO debt has traditionally had a floating interest rate. Fortunately, EIC still sees good opportunities in the secondary market, as it deployed cash at a 17% yield in the final quarter.

I’m still overweightEICA

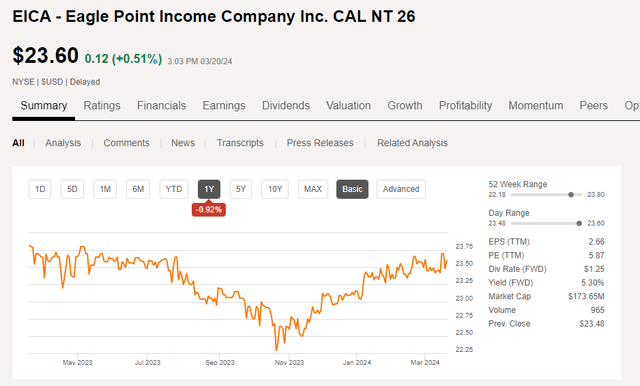

One of the largest positions in my fixed income portfolio is the 2026 preferred stock offering from Eagle Point Income. The preferred shares have a mandatory repayment date of October 2026, are redeemable from October 30 this year, and trade under the ticker symbol (EICA). Although they are classified as liabilities due to mandatory redemption dates, they are not baby bonds as some incorrectly suggest. This is an important distinction because interest payments and (preferred) dividend payments often have different tax treatment, especially for non-U.S. investors. To be clear: EICA pays monthly preferred stock dividends and is subject to applicable dividend tax rules.

Seeking Alpha

EICA Securities pays an annualized payment of $1.25 per preferred share annually, divided into 12 equal monthly payments, for a monthly payment of just over $0.104. These preferred shares are redeemable at their principal value of $25 at any given moment, but what makes this offering even more attractive is that EIC has until October 30, 2026 to redeem these preferred shares. One of the main reasons I like EICA more importantly is that the preferred stock also enjoys the benefit of a required minimum asset coverage level of 200%, which adds an interesting layer of protection.

The current expected yield to maturity for EICA term preferred stocks is about 7.5-7.6%, which I think is very attractive for a security with a remaining maturity of two years and seven months.

investment thesis

I have a small long position in Eagle Point Income’s common stock, but a sizable position in Eagle Point’s 2026 periodic preferred stock. I think the common and preferred shares are still a “buy,” although I’m somewhat reluctant to pay a single-digit premium over the common’s current NAV. That being said, EIC has performed quite well and I think management is making the right decision to continue issuing new shares as this will protect the balance sheet (and make the preferred stock safer).

I’m long in both. Common stocks are a buy on dips and 2026 preferred stocks are a buy at current levels.