Pixel fitting

investment thesis

Generating additional income that you can use to cover monthly expenses or reinvest (benefiting from the compounding effect) is one of the main advantages of following a dividend income investing approach.

Newest The Dividend Income Accelerator portfolio includes acquisitions such as the Cohen & Steers Quality Income Realty Fund (NYSE:NYSE:RQI). I believe this fund will be a great addition to our portfolio as it not only helps us increase our diversification (the real estate sector has increased its share of the overall portfolio from 5.71% to 12.25%); .Significantly increase its weighted average dividend yield.

Cohen & Steers Quality Income Realty Fund currently pays a dividend yield (TTM) of 8.16%.This portfolio’s weighted average dividend yield (TTM) improved due to inclusion in the Dividend Income Accelerator Portfolio down from 4.30% to 4.73% (this calculation excludes the Schwab Short-Term U.S. Treasury Bond ETF). After adding this, the 5-year weighted average dividend growth rate (CAGR) is 7.56%.

These numbers highlight the portfolio’s strong ability to combine dividend income with dividend growth, thereby achieving the key objectives of our investment strategy.

In this article, I’ll go into more detail about why I believe the Cohen & Steers Quality Income Real Estate Fund has become an important part of our portfolio. I’ll also dive deeper into the fund’s largest holdings.

Before we delve into the details of the Cohen & Steers Prime Income Real Estate Fund, let’s review the key features of our dividend portfolio for those of you who are not yet familiar with dividend portfolios.

Dividend Income Accelerator Portfolio

Dividend Income Accelerator Portfolio The goal is to generate income through dividend payments and raise this capital annually. Among other things, the goal is to achieve attractive total returns with a lower level of risk when investing over the long term.

The Dividend Income Accelerator portfolio will achieve a lower risk level due to its broad diversification across industries and industries and the inclusion of lower beta companies.

You can find the characteristics of the Dividend Income Accelerator portfolio below:

- Attractive Weighted Average Dividend Yield (TTM)

- Attractive 5-year weighted average dividend growth rate (CAGR)

- Volatility is relatively low

- Risk level is relatively low

- Provide attractive expected returns in the form of expected compound annual returns

- Asset class diversification

- Industrial Diversification

- Industrial diversification

- Diversification of countries

- Suitability of Buy and Hold

Cohen & Steers Prime Income Real Estate Fund

The chart below shows the Cohen & Steers Quality Income Realty Fund’s top ten holdings:

Source: Seeking Alpha

Let me briefly introduce the fund’s five largest holdings below:

american tower

American Tower (NYSE: AMT) is one of the world’s largest real estate investment trusts. The company operates within the telecommunications tower real estate investment trust industry.

With a 10.15% stake, American Tower is by far the largest holding in the Cohen & Steers Quality Income Realty Fund. Today, American Tower pays shareholders a dividend yield (FWD) of 3.33%, and the company’s 5-year dividend growth rate (CAGR) is an impressive 15.41%.

prelude

Founded in 1983 in San Francisco, Prologis (NYSE: PLD) is one of the global leaders in logistics real estate. The company currently represents 6.79% of Cohen & Steers Quality Income Realty Fund. It pays a dividend yield (FWD) of 2.98%.

well tower

Welltower (NYSE: WELL) is a healthcare real estate investment trust company founded in 1970. Today, the company has 533 employees.

Welltower is the third-largest position in the Cohen & Steers Quality Income Realty Fund, accounting for 5.95%.

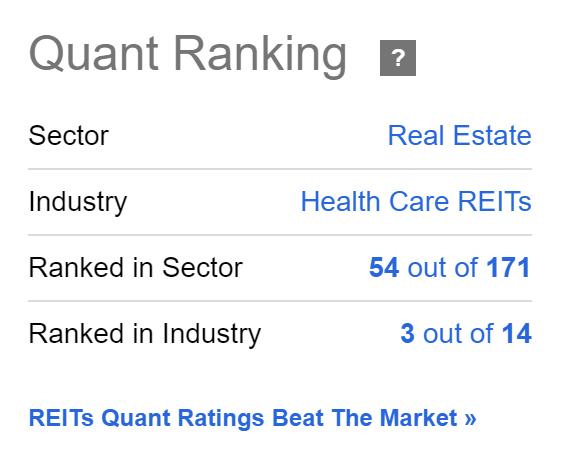

Welltower currently ranks No. 3 in the Healthcare REIT industry and No. 54 in the Real Estate industry, according to Seeking Alpha Quant rankings. These positions underscore the company’s strong competitive position.

Source: Seeking Alpha

Simon Property Group

Simon Property Group (NYSE: SPG) was founded in 1960 and is headquartered in Indianapolis. At the company’s current share price, its dividend yield (FWD) is 5.02%. The company’s current P/AFFO (FWD) ratio is 14.20, which is just below the industry median of 14.60.

Simon Property Group currently holds 4.93% of the Cohen & Steers Quality Income Realty Fund, ranking fourth.

invitation home

Invitation Homes (NYSE: INVH) is a Dallas-based single-family residential real estate investment trust. The company currently has 1,555 employees. The company pays a dividend yield (FWD) of 3.21% and a dividend yield of 59.89%, showing there is room for dividend growth in the coming years.

Invitation Homes has a share of 4.65%, ranking fifth in the Cohen & Steers Quality Income Realty Fund.

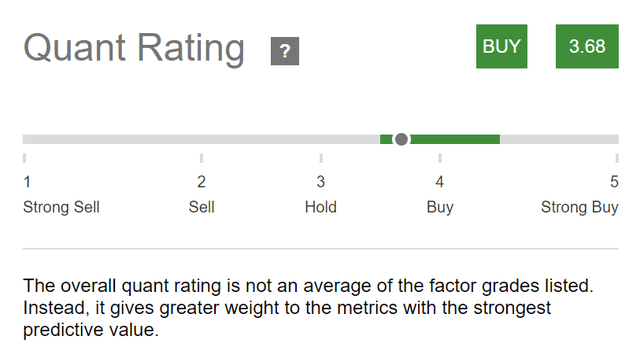

The company is currently a Buy according to Seeking Alpha Quant Ratings, further enhancing the appeal of the Cohen & Steers Quality Income Realty Fund.

Source: Seeking Alpha

Why the Cohen & Steers Quality Income Realty Fund aligns with the Dividend Income Accelerator Portfolio’s investing approach, and why you should also consider adding this fund to your dividend portfolio

The Cohen & Steers Quality Income Realty Fund currently pays a dividend yield (TTM) of 8.16%, which is highly consistent with the income-generating investment approach of the Dividend Income Accelerator Portfolio. The fund’s inclusion helps increase the weighted average dividend yield (TTM) of our dividend portfolio.

It’s further worth highlighting that the fund invests in 203 different holdings, which clearly demonstrates its broad diversification and low risk levels. This is again consistent with our investment approach to the dividend portfolio.

In addition, among the 203 stocks held by the fund, only three (American Tower, Prologis and Welltower) accounted for more than 5%, further highlighting its increased diversification and reduced risk level.

The fund’s reduced risk level is further underlined by the credit ratings of its three largest positions: American Tower has a Baa3 credit rating from Moody’s, and Prologis and Welltower have Baa1 ratings from the same agency.

After investing $400 in the Cohen & Steers Quality Income Realty Fund, investors will benefit from the Dividend Income Accelerator Portfolio

The addition of the Cohen & Steers Quality Income Realty Fund to the Dividend Income Accelerator portfolio increased the weighted average dividend yield (TTM) from 4.30% to 4.73%. This figure suggests that the portfolio is now more suitable for dividend income investors looking to generate significant income through dividend payments.

After including the fund, the portfolio’s five-year weighted average dividend growth rate (CAGR) is 7.56%.

Since the latest addition, the financial sector’s share of the overall portfolio has fallen from 29.57% to 27.49%. This shows that our portfolio is becoming more diversified and our overall risk level is lower.

At the same time, the proportion of the real estate industry in the overall investment portfolio increased from 5.71% to 12.25%.

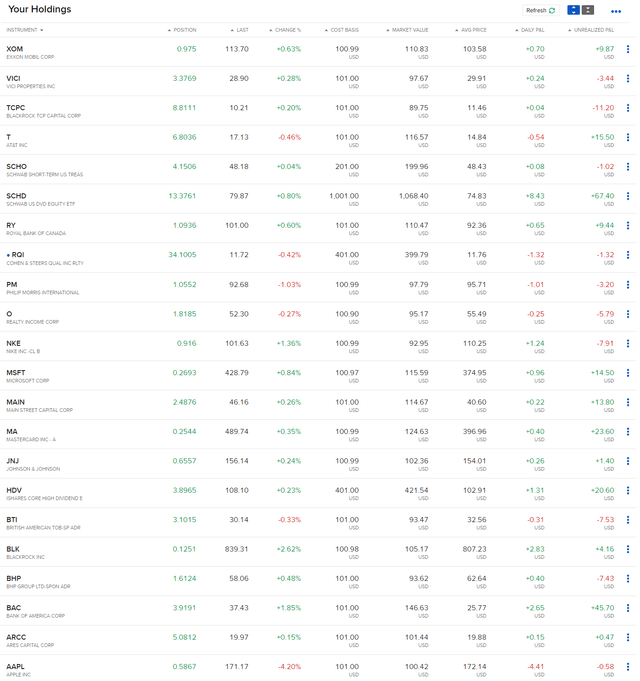

The chart below shows the positions in this dividend portfolio.

Source: Interactive Brokers

risk factors

Before investing in the Cohen & Steers Prime Income Real Estate Fund, it is important to evaluate the various factors that highlight the fund’s higher risk profile.

The fund’s 24M beta is 1.36, which indicates increased volatility compared to the overall market.

It is also worth noting that the top ten holdings of the fund account for 50.77% of the overall investment portfolio. Although the fund has a total of 203 holdings, the concentration risk is high.

It’s worth mentioning that the expense ratio is a whopping 2.21%, which you should consider before deciding to invest in the fund.

In addition to this, it is worth mentioning that the Cohen & Steers Quality Income Realty Fund uses leverage as part of its investment strategy, a practice that increases the volatility of the fund and therefore acts as an additional risk factor for investors.

in conclusion

By including the Cohen & Steers Prime Income Real Estate Fund in the Dividend Income Accelerator portfolio, we significantly increased the portfolio’s weighted average dividend yield (TTM).

With the fund’s high dividend yield (TTM) of 8.16%, we have successfully increased the portfolio’s weighted average dividend yield (TTM) from 4.30% to 4.73%.

It is further worth highlighting that we have increased the diversification of our investment portfolio, reducing the proportion of the financial sector from 29.57% to 27.49%. At the same time, the proportion of the real estate industry has increased significantly, from 5.71% to 12.25%.

As a result of the merger of the funds, I believe the portfolio is now better able to generate income through dividends, which is one of its primary objectives. Therefore, I believe the fund is strategically important.

The portfolio is now even more suitable for investors seeking to generate additional income through dividend payments while implementing an investment approach with reduced risk levels, which offers a high likelihood of positive investment results.

If you decide to include the Cohen & Steers Quality Income Realty Fund in your own dividend portfolio, I recommend investing less than 10% of your overall portfolio in this fund.

While this fund can be an important strategic component of your portfolio due to its higher potential to generate income through dividend payments, it also carries a higher level of risk, as discussed in the risk section of this analysis.

The author has something to say: Thank you for reading!I’d love to hear your opinion on my choice Cohen & Steers Prime Income Real Estate Fund Serves as the latest acquisition in the Dividend Income Accelerator portfolio. Please feel free to share any thoughts on your current portfolio composition. I’d love to hear any recommendations on companies that fit their investing style!