RHJ

I have recently written about precious metals more generally on Seeking Alpha and thought it would be worthwhile to look at a specific commodity such as palladium in more detail.As a key component of automotive catalytic converters, palladium benefits from strict emissions regulations Driving demand, especially with the shift to gasoline engines, which are more efficient than platinum. Additionally, its rarity, combined with supply constraints primarily from Russia and South Africa, creates the potential for price appreciation amid geopolitical tensions and mining challenges. As technologies such as clean energy fuel cells advance, demand for palladium is likely to surge, providing a hedge against inflation and currency devaluation.

To that end, the abrdn Physical Palladium Equity ETF (NYSE: Pall) is a great ETF to use as part of a commodities portfolio allocation if you own palladium. PALL is an exchange traded The fund seeks to reflect the performance of physical palladium prices less trust fees. The fund provides investors with a cost-effective and convenient way to invest in palladium with an interest rate of only 0.60%.

The ETF is backed by physical palladium held in vaults in London, UK, and Zurich, Switzerland. PALL’s holdings are entirely in physical palladium. Therefore, the value of the fund is directly related to the price of palladium. This setup gives investors direct exposure to palladium’s price movements, making PALL a potentially attractive investment for those seeking exposure to this specific commodity.

This is where palladium is particularly interesting. China’s economic growth is crucial to global palladium demand, largely due to its status as the world’s largest consumer of the metal, while its massive auto industry relies heavily on palladium to make catalytic converters. As China implements stricter vehicle emissions policies, such as the CHINA 6 standards, demand for palladium has intensified, with demand increasing tenfold between 2001 and 2020. However, China’s domestic palladium reserves are limited and require a large amount of imports, accounting for nearly 89%. % of its palladium supply comes primarily from geopolitical hot spots such as Russia, highlighting the importance of China’s economic trajectory to the palladium market and potential vulnerability to supply disruptions.

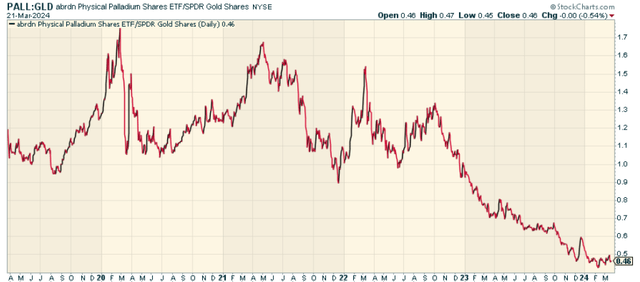

China has been performing poorly on the economic stage, but if China recovers and accelerates again, it could pull palladium. This means that a new multi-year cycle may emerge in favor of palladium based on improvements in China’s own economic cycle. When we look at how poorly palladium has performed over the past few years, China can be blamed for the weakness.

stockcharts.com

Peer comparison

Comparing PALL to other similar ETFs can provide valuable insights. Other ETFs in the precious metals space include SPDR Gold Shares (GLD) and iShares Silver Trust (SLV). However, these funds track the price of gold and silver respectively, which makes them fundamentally different from PALL. PALL’s key differentiating factor is its focus on palladium, a metal that has seen increasing demand over the years. This unique focus could make PALL an attractive investment for those seeking to understand palladium price movements.

PALL is still in a downtrend relative to GLD, but may be bottoming, suggesting it may actually start outperforming gold soon.

stockcharts.com

Pros and cons of investing in PALL

Like any investment, Pall has its own pros and cons.

advantage

-

Contact palladium: Pall provides direct price exposure to palladium, a precious metal with increasing demand due to its use in a variety of industrial applications.

-

Hedging against inflation: Like other precious metals, palladium can act as a hedge against inflation. Therefore, PALL may provide protection during times of economic uncertainty.

-

physical support: PALL is backed by physical palladium, providing investors with a level of security.

shortcoming

-

Industry dependence: The price of palladium depends largely on its industrial applications, particularly in the automotive sector. Any significant changes in these industries could affect Pall.

-

geopolitical risks: A large portion of the world’s palladium supply comes from Russia and South Africa. Any geopolitical issues in these regions could disrupt palladium supply and thus impact PALL.

-

No dividend: As a commodity ETF, PALL does not pay dividends. For income-focused investors, this can be a disadvantage.

Conclusion: To invest or not to invest?

In summary, investing in the abrdn Physical Palladium Stock ETF provides a unique opportunity to understand where palladium prices are headed. I think it could start to catch up with gold, and any green shoots from China could provide upside momentum.