gap

Overview

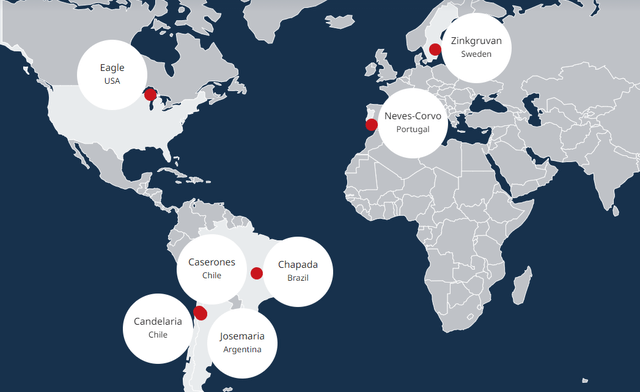

Lundin Mining (OTCPK:LUNMF) (TSX:LUN:CA) is a Canadian base metal mining company with relatively diversified businesses. Production mines are located in Chile, Brazil, the United States, Portugal and Sweden, as well as the Josemaria development in Argentina.The stock is listed in Canada and Sweden, and Reporting currency is USD.

Figure 1 – Source: Company website

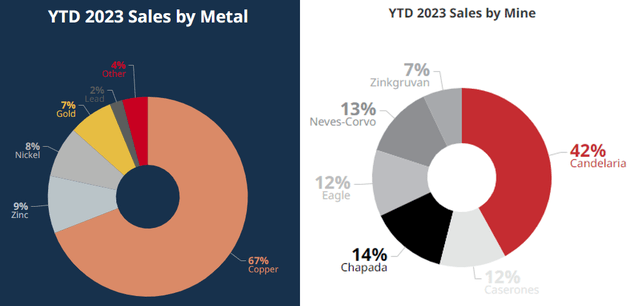

The company generates most of its revenue from copper production, but also produces larger amounts of zinc, nickel and gold, as well as smaller amounts of other metals. By mining area, 54% of revenue in 2023 will come from Chile, and the other 14% will come from Brazil. As a result, nearly 70% of the company’s revenue comes from South America, with an even higher percentage of copper revenue.

Figure 2 – Source: Company website

finance

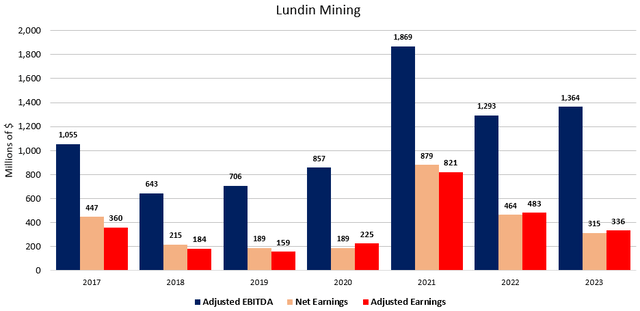

Lundin Mining is an impressive mining company It has been producing stable earnings for many years. 2021 has been a particularly good year due to rising commodity prices, but we can see in the chart below that the company has produced pretty decent earnings even in years when commodity prices have been less accommodating. Adjusted EBITDA in 2023 is $1.364 billion, and adjusted earnings are $336 million.

Figure 3 – Source: Lundin Mining Quarterly Report

The company pays dividends every quarter. Based on the latest stock price, the dividend rate is 2.7%. Annual dividends distributed to shareholders are approximately $200 million in capital distributions.

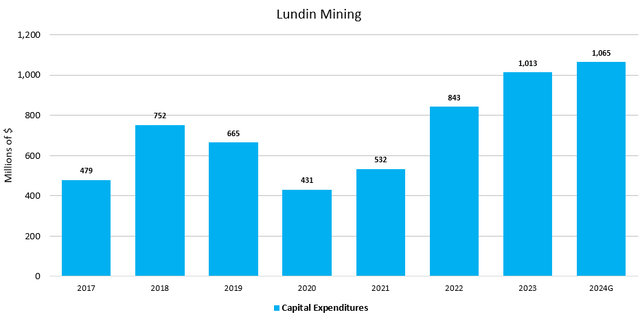

Figure 4 – Source: Lundin Mining Quarterly Report

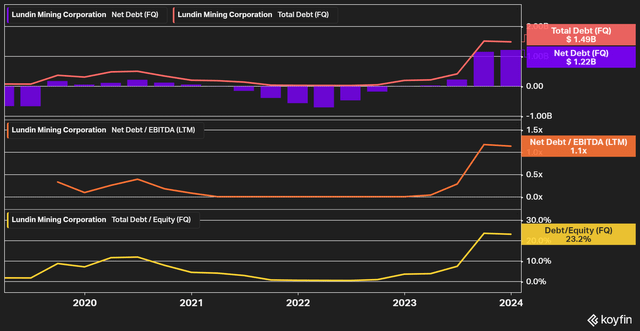

It has also made some significant capital investments over the past few years, with 2024 capex guidance at $1.065 billion. Some of the company’s capital investments come from earnings, but we also see increased financial leverage. The current debt-to-equity ratio is 0.23 and net debt to EBITDA over the last 12 months was 1.1. These are far from extreme levels, but higher financial leverage puts the company at greater risk if we see a correction in copper prices in the future.

Figure 5 – Source: Koyfin

Having said that, there are no liquidity concerns in the short term. Working capital at the end of 2023 was $581 million, with $150 million remaining on the company’s revolving credit facility.

reserves

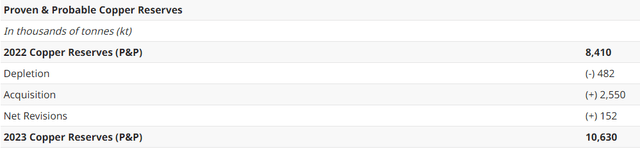

In early February, Lundin Mining Reserve updates provided, overall proven and probable copper reserves increased by 26% on a 100% basis. Much of the growth will naturally come from the acquisition of Caserones. Regardless, the average mine life of these copper reserves is very good, and I also think it’s reasonable to assume there will be some additional reserve growth from exploration over the next few years.

Figure 6 – Source: Company Press Release

Guidance and Valuation

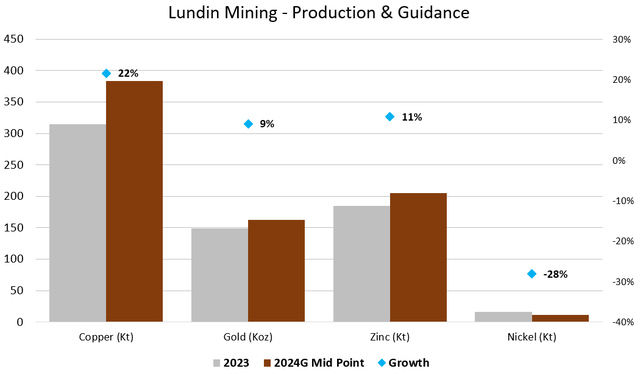

Production guidance for 2024 is very positive, with copper, zinc and gold production expected to increase compared to 2023. The growth in copper production following the acquisition of Caserones has been particularly impressive. Nickel production is expected to decline significantly, but the overall impact of this decline on total revenue will be minimal. Cost guidance for 2024 is also very competitive.

From 2025 onwards, production is expected to be more stable or possibly slightly lower, but this will also depend more on the timing of various near-term growth projects.

Figure 7 – Source: Data from Lundin Mining Demonstration

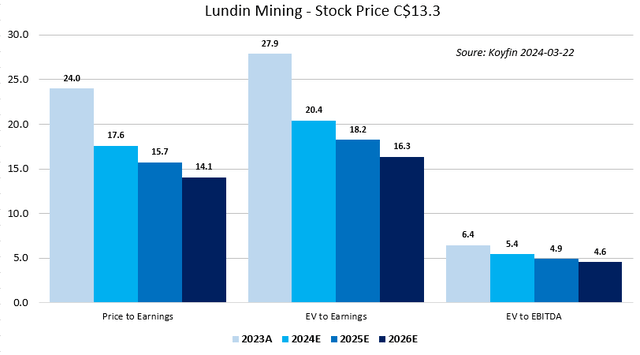

If we use the latest stock price, net debt, and share count from Q4 2023, the company has a market cap of $7.6B and an enterprise value of $8.8B. The following estimates are from Koyfin, and despite strong copper prices, we haven’t seen many upward revisions recently. Therefore, if current copper prices continue, estimates may be slightly conservative.

Figure 8 – Source: Koyfin

Based on the latest estimates, we expect a P/E ratio of around 20 in 2024, with the P/E ratio expected to decline slightly over the next few years. It’s not too expensive, but it’s far from cheap either.

in conclusion

While there’s a lot to like about Lundin Mining, there are also some risks to consider. Increased financial leverage and a higher capital expenditure budget for 2024 mean the company is more dependent on higher copper prices than some peers or the company has been in the past. As a result, downside protection has been reduced recently.

Chile and Argentina have relatively high exposures and will increase even more when the Josemaria project comes online in a few years. There is no doubt that there will be synergies from operating several neighboring mines, which could put downward pressure on operating costs. However, concentrated risk exposure also means that regional geopolitical risks may have a more significant impact on the company.

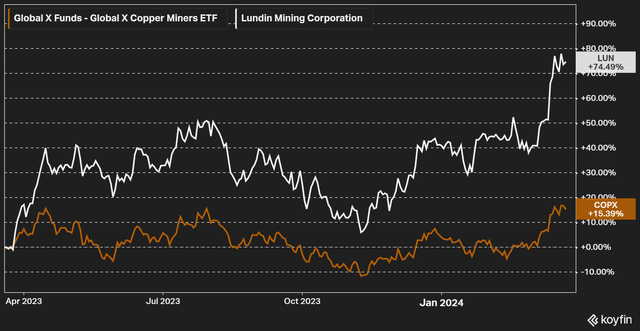

Figure 9 – Source: Koyfin

Overall, I think Lundin Mining is a quality copper mining company that has managed to grow production profitably over the years. In terms of valuation, I think the company is fairly valued after last year’s strong share price performance, so I’m neutral on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.